Justin Sullivan

Thesis

Apple Inc.’s (NASDAQ:AAPL) FQ4 earnings release saw many loyal Apple fans excited at the Cupertino company’s resilience while its big tech peers faltered.

However, investors who parsed its earning commentary and segment metrics would have gleaned several red flags that shouldn’t be missed. iPhone was strong as it launched its iPhone 14 series recently. Apple investors are keenly aware that its FQ4 is a seasonally strong quarter due to the timing of its iPhone launch. Hence, we wouldn’t focus too much on how FQ4 performs per se. Instead, we will discuss why we see significant headwinds into the next two quarters that Apple bulls may not have considered carefully relative to Apple’s unsustainable valuation.

We will pore through forward guidance/commentary on how Apple sees its forward outlook. The market doesn’t focus on past data/releases but on what it anticipates Apple’s forward performances could shape up.

Our analysis indicates that the post-earnings surge looks increasingly like a move to ensnare traders/Apple bulls into another trap before digesting those gains. Some investors get caught up in pre/post-earnings moves without carefully assessing the price action of their overall price structures. As a result, we maintain our conviction that AAPL’s medium-term uptrend has been lost, which we will address in the article.

We discuss why AAPL’s valuation at the current levels is unsustainable. Also, it appears to have been de-rated, which is another early warning sign that a steeper fall could be in the works for careless Apple bulls who don’t accord sufficient caution on its valuations.

Accordingly, we revise our rating on AAPL from Hold to Sell and urge investors to use the rally to cut exposure.

Where’s The Follow Through For iPhone?

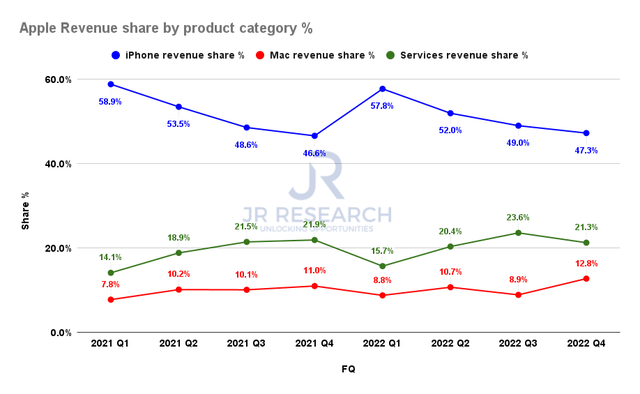

Apple revenue share by product category % (S&P Cap IQ)

Apple investors should be keenly aware that any serious discussion can never avoid the performance of its three most critical revenue drivers, as seen above.

There’s little doubt that Mac outperformed in 2022, as its revenue share surged to 12.8% in FQ4. Coupled with iPhone and Services, they accounted for 81.3% of Apple’s FQ4 revenue, down from FQ3’s 81.6%. However, it’s higher than FQ4’21’s revenue share of 79.6% when Mac accounted for 11% of revenue. Hence, we will need to address whether Mac’s outperformance in FQ4 can sustain its growth moving forward.

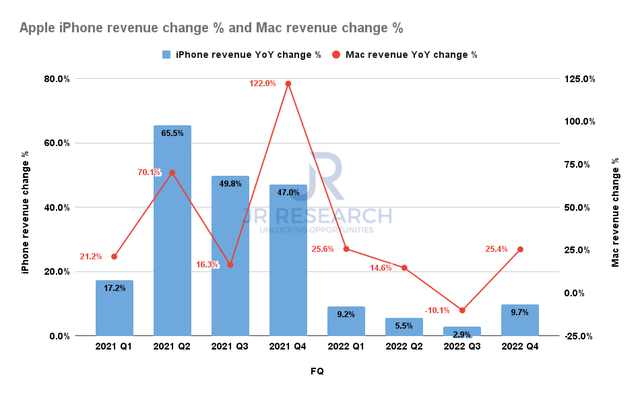

Apple iPhone revenue change % and Mac revenue change % (Company filings)

With iPhone accounting for 47.3% of FQ4’s revenue base, Apple bulls would have been heartened to know that iPhone revenue grew 9.7%. But that’s miles off last year’s 47% growth. Management attributed the strength in iPhone revenue to the upgraders and switchers, implying that it has continued to gain market share. But, we wouldn’t encourage investors to read too much into FQ4’s numbers for Apple, given its seasonal distortions.

Notably, we urge investors to consider what FQ1 could look like as Apple enters its first full quarter of iPhone 14 series sales. Management’s forward commentary (not guidance) suggests it sees “year-over-year revenue performance will decelerate during the December quarter [FQ1’23] as compared to the September quarter [FQ4’22].”

Okay, so here’s what it looks like. Apple’s FQ1’22 iPhone revenue grew by 9.2% YoY. So, iPhone 13 had a pretty solid full quarter of performance, but it still came in below FQ1’21’s 17.2% growth, as seen above.

Note that Apple’s FQ4’22 overall revenue grew by 8.1% YoY. Hence, it suggests that iPhone’s revenue growth would likely continue on a declining trend even as it gains share against its competitors. As a result, we believe it will continue to get harder for Apple to outperform.

Meanwhile, Mac’s performance is unsustainable. Apple has outperformed its Windows peers by posting a remarkable 25.4% growth in Mac revenue in FQ4. However, management’s commentary suggests that “Mac revenue to decline substantially year-over-year during the December quarter [FQ1’23].”

As a reminder, Mac delivered $10.9B in revenue for FQ1’22, up 25.6% YoY. Hence, that tailwind from Mac is presumably gone. Therefore, it suggests that Apple is not immune to the significant consumer electronics headwinds that have impacted the PC market. Apple’s commentary suggests that it sees these headwinds to continue. Supply chain sources indicate that inventory digestion in the PC channel could continue till H2’23. But that’s inventory digestion. Recovery of demand is another matter.

In a recent commentary, Bloomberg’s Mark Gurman highlighted that Apple could be ready for its MacBook launch with new M2 chips on TSMC’s (TSM) 3nm process nodes in early 2023. Therefore, Apple could be looking to juice its Mac segment in time for FQ3’s reporting. We will see how that goes, but we assess that investors shouldn’t place too much emphasis on expecting Mac to lead again in the near term.

What About Services?

Before investors get overly excited about the recent price hike in Apple’s subscriptions, Loup Ventures’ estimates indicate a 1% accretion to net income “over the next year.” Of course, Apple’s ability to boost prices is often taken for granted but is an outcome of its competitive moat built up over time. However, we wouldn’t get too excited over a 1% boost for now, as AAPL shares are priced at a marked premium.

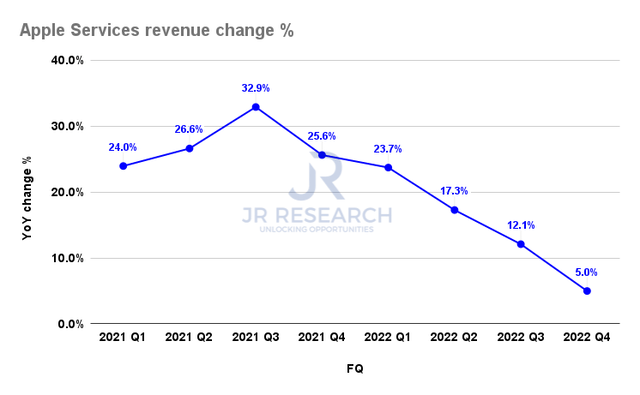

Apple services revenue change % (Company filings)

Services grew by 5% YoY in FQ4, continuing a downward trend that topped out in FQ3’21, as seen above. Hence, is it going to bottom out eventually? Nothing falls in a straight line. But maybe not in the near term.

Management’s commentary suggests that Services could continue to come under pressure due to significant macro challenges, including forex. However, we urge investors to consider forex tailwinds/headwinds as one package. For companies with substantial global exposure, it’s just part and parcel of doing business. It’s inherent in the business model. When did people complain about forex being a tailwind previously? We don’t recall if there was any.

So, Apple’s most important growth driver could be undergoing a structural slowdown even if its bottoms out subsequently. So what’s next in line? If you buy Apple for “optionality,” you can consider the following, as highlighted by Loup Ventures’s Gene Munster:

Apple has growth optionality within three potential addressable markets that I’ve talked about before. This includes health, AR, and auto. One of these three opportunities will likely come to fruition and set up the company for another decade of solid performance. – Loup Ventures

For now, we focus on what we can see. Why? AAPL is not cheap. It’s too expensive to buy just for optionality.

Is AAPL Stock A Buy, Sell, Or Hold?

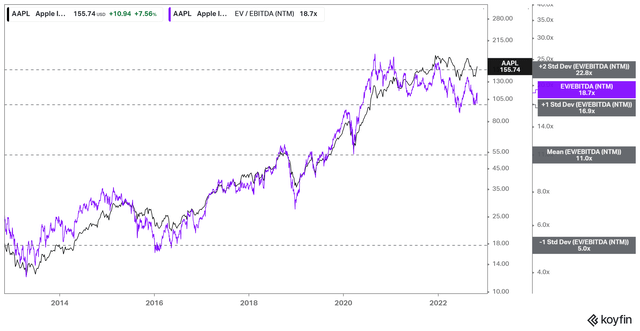

AAPL NTM EBITDA multiples valuation trend (koyfin)

AAPL last traded at an NTM EBITDA multiple of 18.7x, well above its 10Y mean of 11x. Also, note that AAPL has been unable to gain momentum above the two standard deviation zone over its 10Y mean.

Hence, the market has seemingly “refused” to follow AAPL bulls on their optimism that AAPL deserves to be rated at a significant premium against the market and its peers.

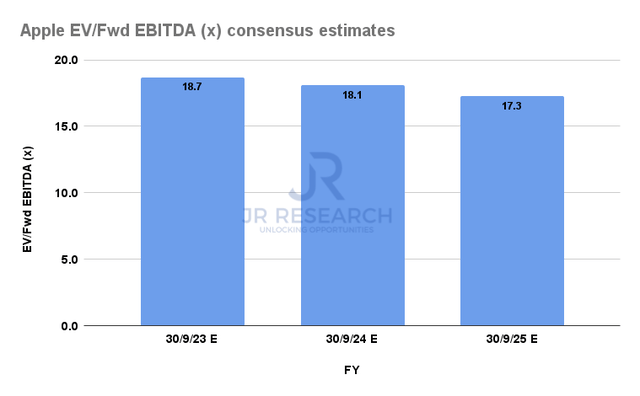

AAPL Forward EBITDA multiples consensus estimates (S&P Cap IQ)

Based on its forward EBITDA multiples through FY25, it’s clear that Apple is not a growth story. Even the bullish Street analysts don’t think Apple can generate massive profitability growth over the next three years to “bring down” its forward EBITDA multiples.

We believe the market knows that AAPL is not a growth story. And therefore, its valuation is unsustainable at the current levels.

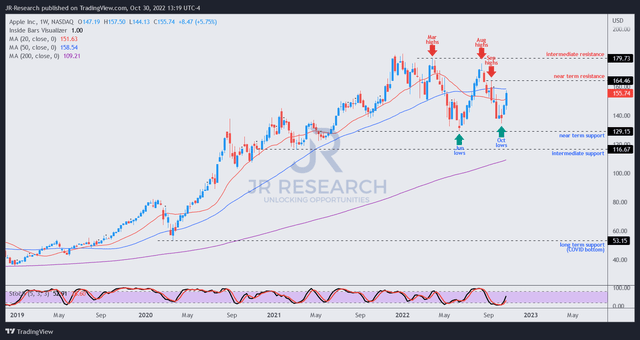

AAPL price chart (weekly) (TradingView)

Therefore, we postulate that the easy money in AAPL has already been made. If you jump on the bandwagon now, we assess that the reward-to-risk profile is highly unattractive.

Note that AAPL has already lost its medium-term bullish bias. It’s not unusual for AAPL to stage a relief rally from an oversold September bottom (yes, the rally already started three weeks ago, not last week). The critical question is where this rally could stall.

We urge investors to watch for its near-term resistance, annotated in the chart above. Hence, it doesn’t hurt to take some exposure off if you are sitting on massive gains. Given the tech bear market, there are plenty of alternatives to choose from.

As such, we revise our rating on AAPL from Hold to Sell.

Be the first to comment