gguy44

I’ve written a few “short” articles so far this year, meaning articles about shorting a stock or stocks. Here they were in order:

- February 23 – “Why Would You Short Digital Realty Anyway?”

- April 16 – “Innovative Industrial: Short This REIT and Watch Your Savings Go Up in Smoke”

- October 21 – “Digital Realty: Chanos Big Short = Big Buying Opportunity.”

To explain what shorting a stock is, I’ll turn to IMDb, which catalogues countless movies and TV shows – who starred in them, their most notable quotes, their plot breakdowns, etc.

This includes for The Big Short, a 2015 film based off Michael Lewis’ best-selling, same-named, true-story-based book. IMDb user Jwelch5742 sums it up like this:

“In 2008, Wall Street guru Michael Burry realizes that a number of subprime home loans are in danger of defaulting. Burry bets against the housing market by throwing more than $1 billion of his investors’ money into credit default swaps.

His actions attract the attention of banker Jared Vennett, hedge-fund specialist Mark Baum, and other greedy opportunists. Together, these men make a fortune by taking full advantage of the impending economic collapse in America.”

Let me highlight the words “bets against.” Because that’s what shorting is. It’s putting money down on the belief that something – usually a stock – is going to fall.

If it does, the shorter makes money. If not, though, there’s a lot to lose.

Get Your Squeezes From Your Honey (You’ll Save a Lot of Money)

22 years ago – over a decade before The Big Short was a concept, much less a production – The Street published a piece titled “Squeeze Play: What Happens When Short-Selling Goes Bad.”

It’s something I quoted in a short-focused article of my own on August 21, and I’m going to quote it again today:

“To many investors, short sellers are evil. They try to profit from falling stock prices, preying on companies and making stocks fall even further.

“… but short sellers can also cause a stock to rise if they’re forced en masse to buy back the shares they sold short. Meet what’s called the short squeeze.

“In a short sale, an investor borrows stock from a broker and sells those shares into the market with the understanding that the shares must be bought back at a future date and returned to the broker.”

As such…

“If the stock falls, the investor buys back the stock at a cheaper price, making money on the trade. If the stock rises, the investor has two choices: Wait for the stock to come back down, leaving the short seller exposed to potentially greater losses, or buy it back and realize a loss.”

That’s why, the last time I cited those paragraphs, I added this two cents’ worth: “Really, shorting is rarely worth it. Even when it’s profitable, you’re bound to lose a lot of sleep in the process.”

That’s certainly what happened with GameStop Corp. (GME) and so many other ultimately ill-fated meme stocks, last year especially. While most of the “little guy” investors who followed the cry to (pardon my French) screw over the shorts got the short end of the stick in the end, too…

They did succeed in making “the man” lose out intensely.

Long vs. Short

In “short,” shorting a stock is playing with fire. That’s especially true of real estate investment trusts (“REITs”).

As I wrote in the previously referenced “Innovative Industrial: Short This REIT and Watch Your Savings Go Up in Smoke”:

“Let me be succinct: You should never short a REIT unless you have a rock-solid short thesis.”

Which, incidentally, almost never exists. Besides:

“Most important [of the negative factors involved in shorting] is the fact that the borrower of the stock is responsible for paying any dividends to the lenders.

“So investors who short a stock are never entitled to dividends, and that includes those [who are] short a stock on its dividend record date. Rather, short sellers owe any declared dividend payments to the shares’ lenders.”

If that doesn’t sound like fun, you’d be right. And the chances of being profitable aren’t great, either. Over my almost 12 years of writing on Seeking Alpha, I’ve never once seen a REIT get shorted by a hedge fund – the usual culprits in such schemes – successfully. Or at least successfully enough to make it worth the headaches.

Instead, there are plenty of cases where these big-wig firms ended up losing out intensely. For examples of that, I’ll refer you to another article I mentioned in the beginning: “Why Would You Short Digital Realty Anyway?”

Otherwise, going back to that “Innovative Industrial” piece one more time:

“As I said earlier, shorting REITs is not recommended, especially when you’re attempting to profit from a well-managed firm that provides tremendous transparency and rock-solid fundamentals.”

Cue three REITs that are being short sold as I write this… all of which I’m buying up.

Medical Properties Trust, Inc. (MPW)

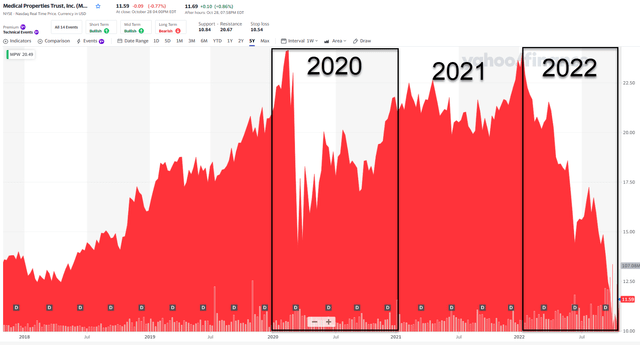

I’m sure most of you are familiar with MPW, a hospital-focused REIT that’s been appearing on Seeking Alpha and other media outlets quite a bit. Just take a look at the price action below:

As you can see, MPW hit $24 per share just before Covid-19 and then rebounded again to $24 in January 2022, and then sentiment forced shares to slide all the way back to $10.14 per share in early October.

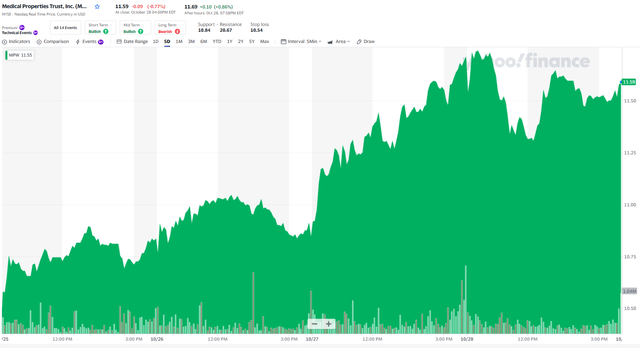

There’s no need to go into my short debunking, as I have already done so HERE and HERE. The most important thing to know about this REIT is that management delivered the goods in Q3-22, and Mr. Market was listening.

Now, let me be perfectly clear, it’s way too early to wave the victory flag, just because MPW shares were up around 11.5% last week. However, MPW gave its investors some excellent response to some of the lingering headline issues, as addressed by management last week,

“…we are seeing some positive trends over the last couple of months within the health care sector that are worth noting. Volumes have fluctuated throughout 2022, but August saw increasing volumes which have provided a good boost in revenues.”

Our operators are actively negotiating new contracts with their payers and expect to be successful in negotiating increased reimbursement rates that are even greater than CMS increases.

Our underwriting and managing of these assets are not done in a vacuum, nor on a quarter-to-quarter time span. We see the forest; we’ve seen our portfolio go through numerous cycles over the years. Hospitals have always adapted to whatever the new norm and then they do it again.

We fully expect that our (Pipeline) rents will continue to be paid and our hospitals will continue to serve their respective communities during the duration of the bankruptcy process.

The value of Steward’s Utah operations did not suddenly go away just because one particular operator faced antitrust issues.

On a weighted average basis, Steward’s EBITDARM coverage in these markets has ranged from 2.7 times for the trailing 12 months ended June 30, 2022, to in excess of three times preliminarily for a stand-alone August. With these coverages, Steward appears well able to continue paying MPT rent.

At the end of Q3-22, MPW had cash and revolver capacity of around $1.5 billion, and recently the company restated and amended its $2 billion revolving credit facility and extended its term to mature with extension options to June of 2026.

In addition to the $1.5 billion, MPW previously announced it expected proceeds in 2023’s first half from pending transactions, that is, Springstone and Yale, of up to another $650 million.

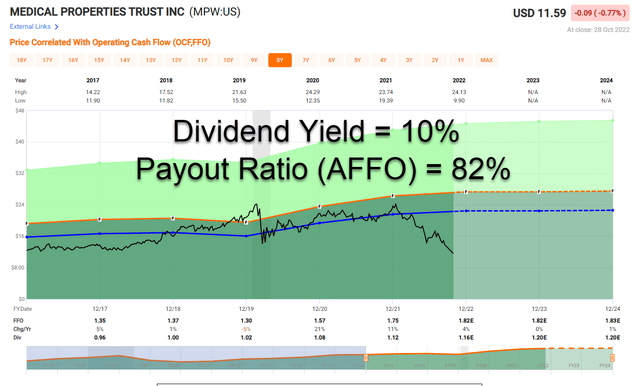

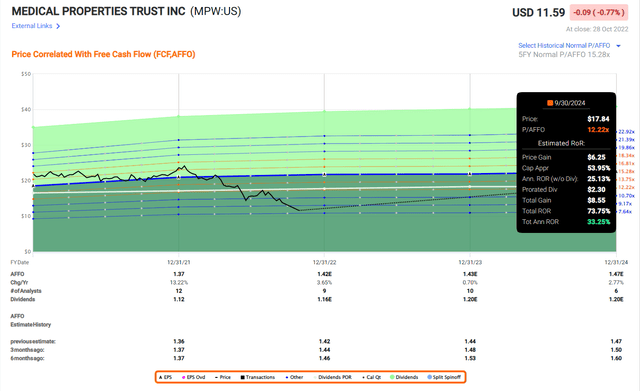

MPW generated normalized funds from operations (“FFO”) of $0.45 per diluted share in Q3-22 and refined its 2022 calendar year estimate to a range of $1.80 to $1.82 per share (narrowing the previous range to the higher end).

While MPW has obviously slowed its recent years acquisition pace, the company should still maintain solid organic growth, as the CEO told me in our one-on-one interview a few weeks ago,

“It starts with FFO growth, and we have escalators that helps us in periods of high inflation. These will be re-adjusted in January. We don’t need to acquire new assets to grow.”

iREIT’s conservative total return projection for MPW is 30% over 12-months, and we believe that it could be as high as 50%. We’ll continue to monitor the company and I plan to visit several properties when I visit Europe in a few more weeks.

Digital Realty Trust, Inc. (DLR)

DLR has also been the victim of shorts, specifically Jim Chanos, founder of Kynikos Associates, now known as Chanos & Company. He came out with his data center short thesis, and his premise of the trade was that hyperscalers (customers of DLR) are essentially the enemy.

He believes that eventually these hyperscalers will digest DLR’s core business and bring it into the cloud, and the necessity of the kind of hybrid private, public cloud, public provider won’t be there anymore. Again, I debunked this silly short thesis HERE.

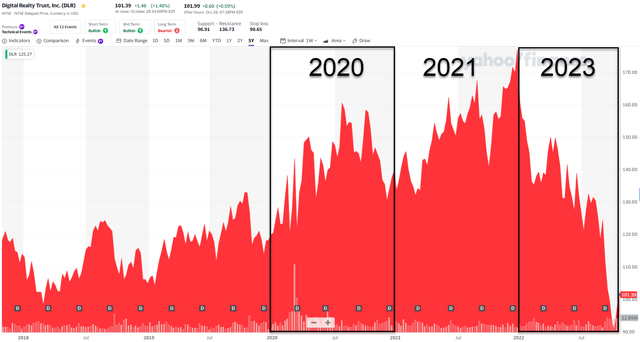

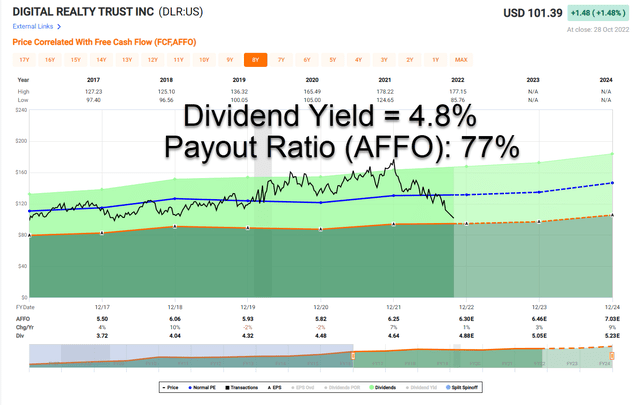

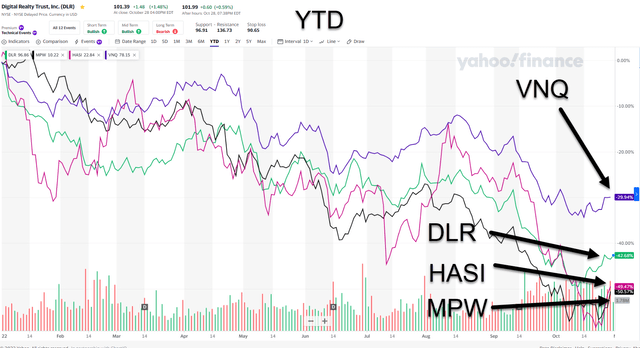

As you can see, DLR hit an all-time high of $176.87 in late December 2021, and has since fallen by over 42% in 2022, with a recent close of $101.39 per share. Keep in mind, the Vanguard Real Estate ETF (VNQ) is down around 28% YTD, so certainly rising rates have fueled the short-sellers’ fire.

Last week, DLR delivered what appeared to be solid earnings, highlighted by the following:

- A record $176 million of new bookings, making the third time in the past 4 quarters that bookings have exceeded $150 million.

- Core FFO per share was $1.67 despite stiff FX and interest rate headwinds.

- Successfully completed the acquisition of a majority interest in Teraco, a leading carrier and cloud-neutral data center and interconnection services provider in South Africa

- Sold a noncore mixed-use data center property in Dallas for $206 million.

Importantly, DLR has shifted cadence toward further insulating its portfolio from the effects of inflation through the addition of CPI-based escalators into new leases. Currently, more than 95% of the portfolio includes rent escalation clauses, and less than 20% are specifically tied to CPI, while the balance are fixed.

In DLR’s highest leasing volume quarter ever, it was able to achieve CPI-based escalators on 40% of the leases signed in the quarter, which demonstrates the resolve and DLR customers’ acknowledgment of this important factor.

Also, in Q3-22 DLR reported that its leverage ratio was 6.7x and its fixed charge coverage ratio was 5.5x. Since the last earnings call, DLR has raised or received commitments for approximately $2 billion of debt capital at an effective blended average of just over 3%.

So, with cash and forward equity outstanding totaling more than $700 million, the company has increased its current available liquidity to approximately $3 billion.

Also, in Q3-22 Core FFO per share was $.167, which includes a $0.03 benefit from a lower share count. AFFO per share was $1.50. missing consensus (of $1.58) of ~$0.06 due to impact from maintenance capex timing. The 2022 FFO per share guidance midpoint is $6.725, lowered from $6.80 to account for f/x and rate headwinds.

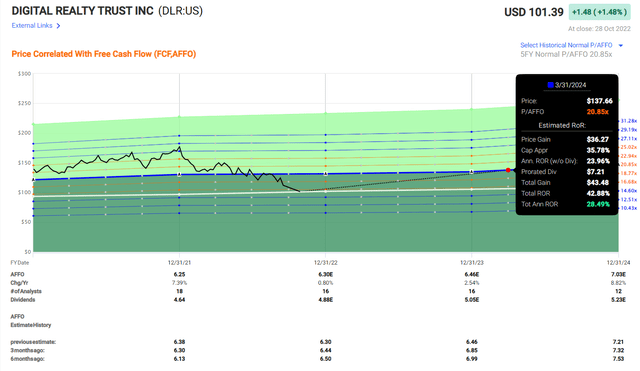

We consider DLR an attractive Buy at this time, based upon the record leasing quarter, ongoing demand strength, conservative development pipeline (that has the highest level of pre-leasing since Q2-18), and a pricing environment that has substantially improved and should soon begin to flow through (tightening supply, rising costs, strong demand and declining vacancy rates).

iREIT’s realistic total return target for the next 12 months is 25%, and given the success of the management team, we consider 30% annual returns achievable. I plan to fly to San Francisco in a few weeks to attend REIT World, and I will be visiting a few data centers while in town.

Hannon Armstrong Sustainable Infrastructure Capital, Inc. (HASI)

HASI has also been a target of shorts, and last July we provided iREIT on Alpha members with a detailed response to the Muddy Waters thesis.

As you may recall, this thesis was targeted to HASI’s cash flow projections, as Muddy Waters claimed various accounting methods and decisions are unethical and or misleading (but not illegal).

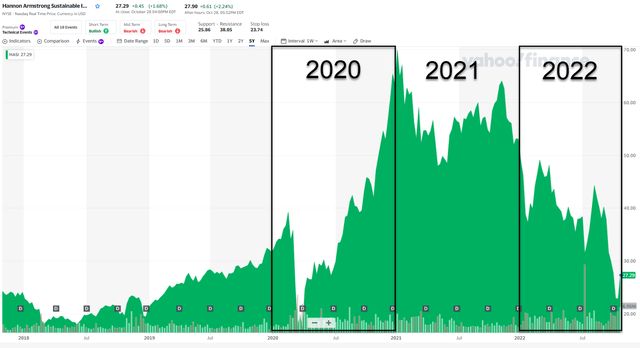

As you can see (above), HASI hit an all-time high of $69.89 per share on January 4, 2021. This was one of my best calls over the last 12 years on Seeking Alpha, as I bought shares on March 31, 2020 at $20.41 and sold at around $55 per share in late 2021.

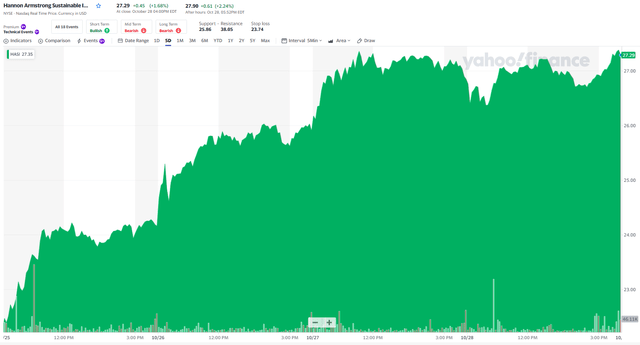

When shares began to drop in 2021, due to rising rates, I began to nibble again, and when Muddy Waters began shorting shares, my ears perked up. As you can see below, HASI shares climbed over 22% last week, and our iREIT members were happy.

A few days ago, I interviewed HASI CFO Jeff Lipson (full interview at iREIT on Alpha). Here’s what we learned:

“The Inflation Reduction Act is the most comprehensive energy policy we’ve had related to renewables in this country…So we’re very excited about it in terms of the increased volumes that will probably start a couple years from now as a result of the Act.”

We believe that prospects of the company have never been better. We’re poised to take advantage of this public policy development, and yet financial markets aren’t reflecting that. So we’re hoping that reverses itself sometime soon.

We view residential solar leases as being a very non-cyclical consumer category, however, and so this is essentially the energy to the home. It also represents a savings, particularly now as natural gas prices have risen.

…we’ve positioned ourselves that we can continue to grow without accessing the public debt markets. So that’s exactly what you want is to have enough diversity in the liquidity profile, so you’re not forced to do anything at the wrong time.

… we have many alternatives and we’re very conservative with how we manage liquidity and capital.

Our guidance right now is that our distributable EPS will grow annually by 10% to 13% through 2024, and our dividend will grow annually 5% to 8% through 2024.”

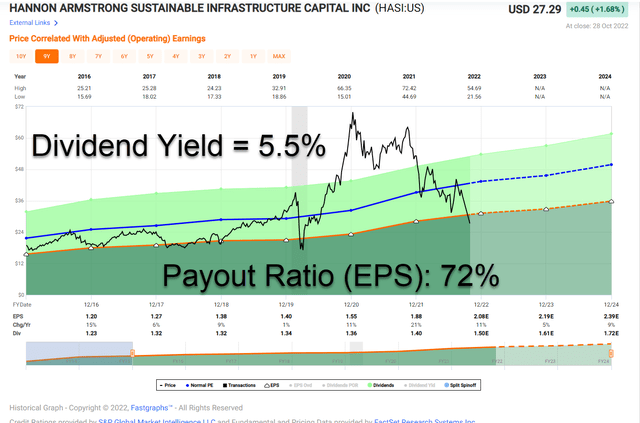

We consider HASI attractive given its extremely stable and predictable earnings growth. Much like a utility stock, HASI generate stable dividends (yield is now 5.5%) with annual growth of 10% to 13%.

Do the math?

5.5% + 10.0% = 15.5%

However, iREIT believes that HASI is capable of doing more… a lot more…

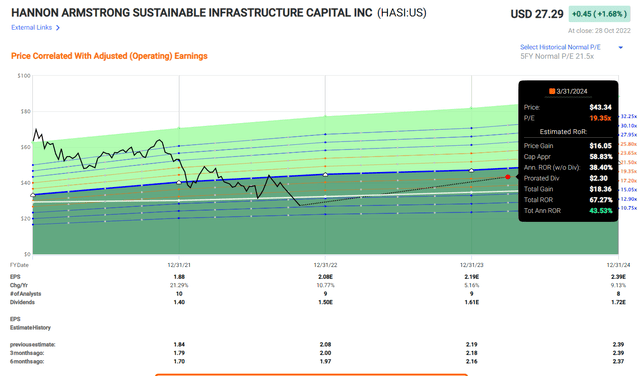

As viewed below, we believe HASI could fetch something like $40 per share by the end of 2023, which translates into annual returns of 40%+. The surge last week, in our view, is just the beginning…

A Big Bet Against The Big REIT Short

In case you missed it, there’s a common theme with all of these REIT picks, and that is that all three have solid fundamentals.

While the shorts have focused on things like lack of transparency, dishonest management, faulty accounting, overblown hyperscaler domination, and the like, iREIT has concentrated on fundamentals, combined with management interaction.

It’s true that short sellers will oftentimes raise the bar when it comes to corporate transparency and insist that companies disclose certain facts that are relevant.

In my view, this is healthy for investors, as due diligence is perhaps one of the most important pillars to becoming an intelligent investor.

For these three REITs, we have been forced to double down on our research, to make sure that the data is accurate and that the management teams can be trusted.

That’s why I took an entire day to travel to Birmingham, Alabama to meet the CEO of MPW. That’s also why I took time out of my day to connect with the CFO of HASI. And I will be meeting DLR management soon at REIT World.

A few days ago, I heard Jim Cramer literally crying on CNBC when asked about his Meta Platforms (META) bet. He said (emphasis added):

“Let me say this: I made a mistake here. I was wrong. I trusted this management team. That was ill-advised. The hubris here is extraordinary, and I apologize.”

“OK,” replied his cohost, awkwardly.

While I can certainly sympathize with my friend, Jim Cramer, I’ll end this article with just three words from President Ronald Reagan:

“Trust but Verify.”

Good luck and happy REIT Investing!

Be the first to comment