tdub303

Thesis

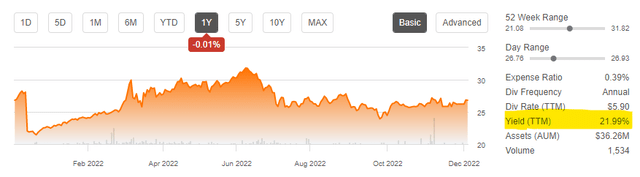

We stumbled upon this fund while browsing the commodity space, an outperformer in 2022. The iShares Commodity Curve Carry Strategy (NYSEARCA:CCRV) fund is an ETF from the iShares family. The vehicle has a small AUM of only $36 million, but sports an impressive yield:

In fact this fund has a yearly distribution only, distribution which is based on its underlying collateral pool. The fund is exposed to the “ICE BofA Commodity Enhanced Carry Total Return Index” via Total Return Swaps, and if the performance of the index is positive, it settles some of the gains via one-time distributions.

The fund has a fairly bombastic name, which led us to dig into its composition, seeking opportunities for higher returns. The “ICE BofA Commodity Enhanced Carry Total Return Index” is an index based on commodities futures. The index is just a composition of various long positions in commodity futures. There is no relative value aspect or curve arbitrage positioning here. The only redeeming factor is that the index and thus the fund, take long positions in longer maturity futures contracts, rather than the front one. As of the April Semi-Annual report, most of the underlying futures contracts had 6 to 8 months maturity profiles.

At the end of the day CCRV is not as complex as the name would suggest, nor does it take any relative value positions. All the fund does is being long commodities via longer dated futures contracts. The fund has a similar build and performance profile as the much better known Invesco DB Commodity Index Tracking ETF (DBC).

Holdings / Index Composition

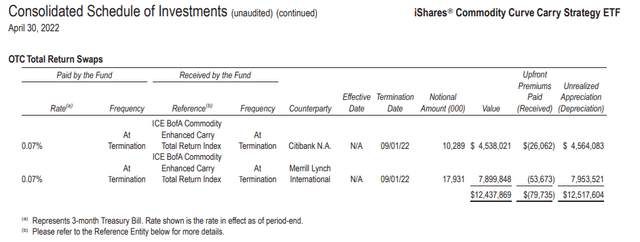

The fund takes a synthetic position in the “ICE BofA Commodity Enhanced Carry Total Return Index” via Total Return Swaps:

TRS Holdings (Semi-Annual Report)

We can see from the above excerpt from the April Semi-Annual Report that the fund has two larger total return swaps with Citibank and Merrill, where it receives the returns associated with the Index, while paying a rate of 0.07%. Please keep in mind the returns for the Index can be negative, thus the fund would be forced to disburse funds in those instances. We can also see from the above table a “Termination Date” of 09/01/22 for the swaps, meaning they will probably be rolled-over on that date after settlement is made.

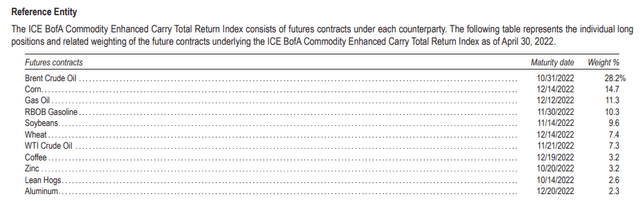

While it is a bit clearer what the ETF does, let us have a look at the Index composition:

As of April, the Index was composed of a number of commodities futures contracts, many of which were far dated ones. This means that the Index contains contracts which expire in the future, not the front end ones. As an example for Brent Crude Oil, as we can see from the table above, the futures contract held was the October 2022 one, rather than the front end June 2022 contract.

We can see a similar maturity allocation for the other commodity contracts, with most of them being 6 to 8 months out. There is no specific relative value curve positioning here (i.e. trying to monetize the shape of a certain commodities curve), just a long position in a futures contract, but out the curve.

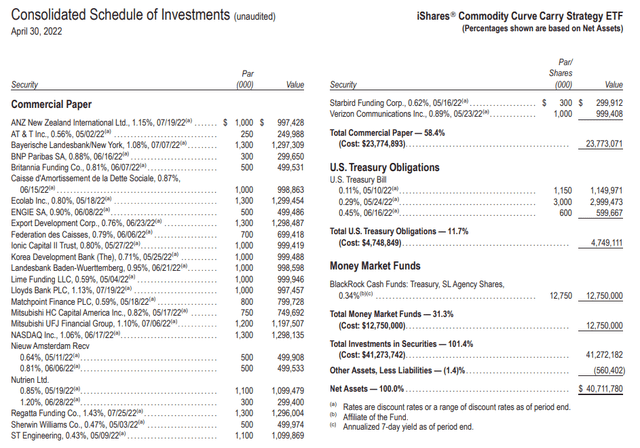

Since the ETF takes its positions via a Total Return Swap, there is no cash outlay on day 1. This translates into the fund’s assets being invested in cash like instruments:

We can see how the fund is putting its cash in commercial paper, treasuries and money market funds. This is a prevailing characteristic of funds that invest via swaps – there generally is no day 1 cash outlay, therefore the vehicle can invest its funds in short dated instruments and earn a yield.

Performance

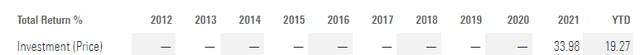

The fund has posted a very robust annual total return in the past years:

However, we can notice that the fund was started only recently, the vehicle not being present for the 2020 Covid crash.

By scouring the market, we found that the most liquid and widely used instrument in the space is Invesco DB Commodity Index Tracking ETF:

We can see that the return profile for the two funds matches quite closely. DBC is much larger with a $3 billion AUM, and has been in the market for much longer. As expected, during the Covid crisis the fund crashed, on the back of negative returns for many of the commodities futures.

Please keep in mind that these funds need the commodities futures levels to go up in order to generate a return. Flat markets result in the funds not earning anything, and thus not disbursing any returns (outside the yield gained on short term investments).

Conclusion

The iShares Commodity Curve Carry Strategy (CCRV) fund is an ETF from the iShares family. The fund is exposed to the “ICE BofA Commodity Enhanced Carry Total Return Index” via Total Return Swaps, and it pays a hefty annual dividend if the performance is positive. Despite the complex nomenclature, the index purely contains long positions in a number of commodity futures contracts, where Brent Oil has the largest weighting (over 28%). CCRV does not take any relative value commodities curve positioning. If commodity prices go up, CCRV gains. The vehicle is new in the market, having IPO-ed in 2020, and contains only $36 million in assets. The fund has a very similar return profile to the much larger and better known Invesco DB Commodity Index Tracking ETF (DBC). Retail investors should not look at the fund’s dividend yield since it is non-recurring and dependent on the performance of a basket of commodities futures. Given the lack of liquidity and outperformance, a retail investor looking to take a long position in a basket of commodities futures should have a look at the much larger and better known DBC fund instead.

Be the first to comment