sarayut/iStock via Getty Images

Investment Thesis

CareTrust REIT (NYSE:CTRE) is a REIT engaged in skilled nursing, seniors housing, and other healthcare-related properties across America in 29 states. The company currently has an attractive dividend yield of 5.86% (as of 11 July 2022) and owns a fair financial track record. It benefits from its lease structure and active acquisition activities. But CTRE faces downside risks in the near term caused by the long-term care sector reform and the macroeconomic downturn.

The company will likely face headwinds in the next twelve months, and its dividend growth rate will likely slow down. As such, I am hesitant that the stock is a good buy right now, considering its current valuation, financial strength, and dividend distribution.

Financial Track Record

CTRE’s diversified portfolio comprised 227 senior long-term care facilities by the end of 2021, with 70% of the company’s rental income generated from skilled nursing facilities. The overall demand for skilled nursing services will increase due to the U.S. ageing society.

The top-line performance of CTRE has been fair over the past five years. Revenue per share expanded from $1.81 in 2017 to $1.98 in 2021 (2.27% 5-year CAGR). Even during the vulnerable time amid Covid, it could still generate stable income.

| 2017 | 2018 | 2019 | 2020 | 2021 | |

| Revenue per Share | $1.81 | $1.96 | $1.71 | $1.85 | $1.98 |

Its bottom line grew at a more rapid rate. FFO per share leaped from $0.90 in 2017 to $1.32 in 2021 (10.0% 5-year CAGR) as the company enjoyed improving margins in the same period.

| 2017 | 2018 | 2019 | 2020 | 2021 | |

| FFO per Share | $0.90 | $1.28 | $1.21 | $1.40 | $1.32 |

| Gross Margin % | 90.09 | 90.42 | 96.26 | 97.32 | 98.12 |

| Operating Margin % | 43.81 | 52.88 | 53.47 | 58.01 | 54.89 |

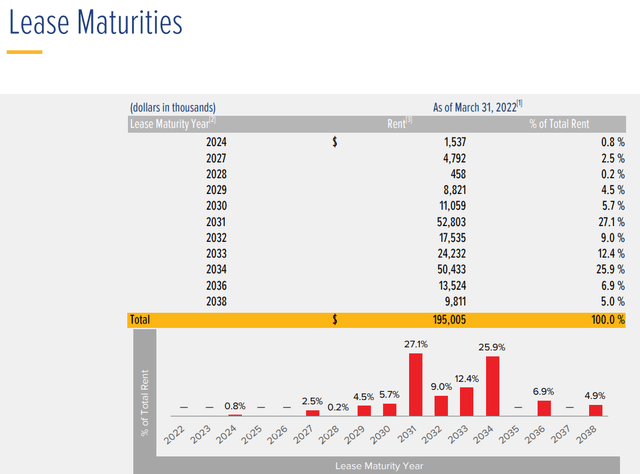

The company enjoys a stable income stream. The lease maturities of CTRE were tabled below. 99.2% of the leases will mature not before 2027, which almost guarantees sales for the company over the next five years. The most significant risk, however, will be tenants failing to make contractual payments on time. It is worth noting that in the latest earnings conference call, the company reported its planning to re-tenant or repurpose 32 assets as they have unacceptable risks financially.

Challenges Ahead

CTRE is expected to face headwinds in the NTM. Besides macro issues that a recession may soon hit, the long-term care industry also faces challenges.

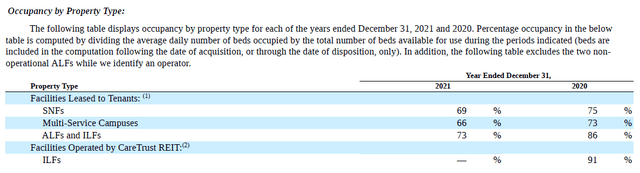

Barclays pointed out that market share losses to the home health sector would threaten the skilled nursing home industry as the former provides lower-cost services. The below table shows the occupancy level of various property types in 2020 and 2021. Occupancy rates have declined since the pandemic and are yet to recover now.

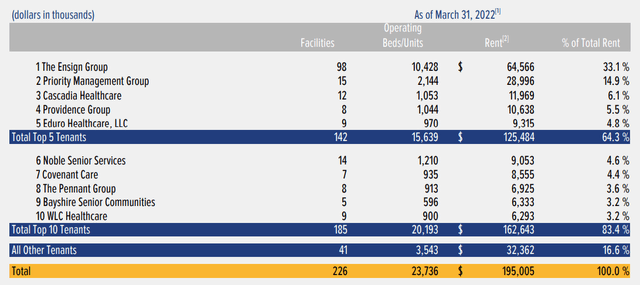

Besides, the skilled nursing home reform mostly negatively impacts the operators as policies tend to exert an additional financial burden on the nursing homes. By 2022 Q1, the top five tenants of CTRE are the Ensign Group (ENSG), Priority Management Group, Cascadia Healthcare, Providence Group and Eduro Healthcare. They are accountable for over 60% of the rental income of CTRE. So, if any of these tenants are in trouble financially, the company will be at risk of failing to receive contractual lease payment. Let’s recall that the company collected 93.2% of the contractual rent obligation in January 2022, dropping from near 100% late last year.

ENSG is the largest tenant of CTRE, contributing 33.1% of the company’s total rent. Last month, I wrote an article about the ENSG, discussing the impact of the skilled nursing home reform proposed by the Biden Harris Administration on the company. And concluded that there would be low but manageable risk. Along with ENSG’s robust balance sheet, it’s safe to say ENSG is merely possible to fail to make punctual lease payments even with the sector reform proposal.

Despite CTRE’s largest tenant being capable of making contractual lease payments, small-scaled skilled nursing homes may suffer and default eventually. The company conducted stress tests on the portfolio and identified some operators and properties that pose an unacceptable risk of default. Thus, CTRE investigates and proceeds to re-tenant or re-purpose 32 assets, representing around one-tenth of the contractual cash rent. The reallocation of properties may bring more stable and less risky income streams to the company over the long run but may affect rental income in the short term as some properties will be vacated for refurbishment.

Dividend

CTRE raised its dividend for seven consecutive years running at a solid 5-year CAGR of 8.75%. With a recent pullback, the company currently has an attractive dividend yield of 5.86% (11 July 2022). It can be easily derived that CTRE has consistent dividend growth and safety.

However, having investigated the following data, I am doubtful if the company can still grow its dividend at such an appealing level without compromising its balance sheet.

The first data I looked into is the dividend payout ratio to FFO. Since 2018, the figure has been on an increasing trend and reached 0.8 last financial year. Although 0.8 is not a prohibitively high figure, it alerted me about the company’s future dividend growth and financial health.

| 2017 | 2018 | 2019 | 2020 | 2021 |

| 0.82 | 0.64 | 0.74 | 0.71 | 0.8 |

I also noted that CTRE’s debt level is rising. Long-term debt is up 50% from 2017. Besides, its current short-term debt level ($80M) exceeds the cash and cash equivalent level ($19.9M). Investopedia suggests:

this suggests that the company may be in poor financial health and does not have enough cash to pay off its impending obligations.

So, the company will probably raise capital by issuing new debt or new stocks. The latter results in share dilution, which adversely impacts shareholders’ rights. Raising capital via stock offering seems more advantageous as rates are still escalating. Over the past five years, CTRE issued new shares in four years.

| 2017 | 2018 | 2019 | 2020 | 2021 | |

| Issuance of Shares ($M) | 170.32 | 179.88 | 195.92 | – | 22.95 |

| Market Cap ($M) | 1265.01 | 1594.94 | 1961.98 | 2111.89 | 2198.45 |

Plus, I observed that CTRE’s dividend growth rate is slowing down from 10.8% in 2018 to 6% in 2021, while the 3-year dividend CAGR (7.89%) also falls behind the 5-year dividend CAGR (8.75%). All signs point to a decelerating dividend growth rate, or the company continues to raise the payout ratio. Thus, I recommend paying closer attention to the company’s dividend distribution record, balance sheet, and stock offerings.

Valuation

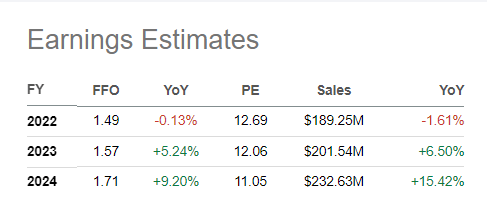

I anticipated headwinds to the industry over the NTM. As mentioned, 32 assets to be repurposed or re-tenanted represent around one-tenth of the contractual cash rent. It is expected prolonging such a process will hurt sales. Both sales and FFO are expected to stay almost flat in FY22 and then pick up in the next two years.

Seeking Alpha

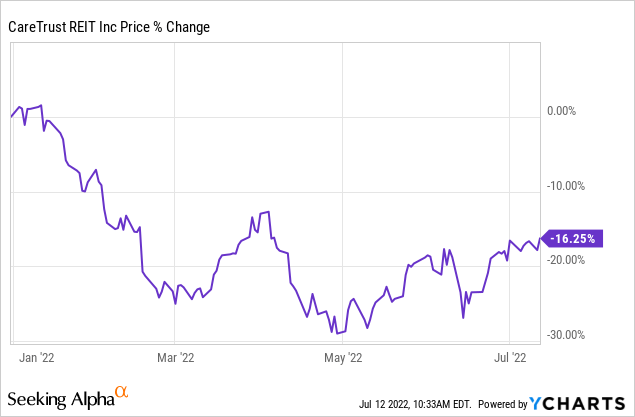

Shares of CTRE pulled back by 16% YTD and currently trading at a P/FFO of 14.74. Taking into consideration the FFO estimates and if the multiple were to revert to its mean level in the past three years (16.71), the stock would have a 13.3% potential upside. But it will not be surprising to see the market giving CTRE a lower multiple as worries may loom.

I believe the stock has returned to a fair value now. However, too many unknowns are lying ahead over the NTM, including the nursing home reform and the re-purposing and re-tenanting of the 32 assets, which have an ineligible impact on the company’s sales. Also, despite the stock offering a high dividend yield right now, its dividend growth rate is likely to decelerate. Thus, looking forward to the NTM, I will wait for a better entry point and give a “Hold” rating to CTRE.

Please kindly note that all data in this article is abstracted from the company’s conference call transcript in 2022 Q1, conference call presentation, and the Form 10-K for the financial year 2021, unless otherwise specified.

Be the first to comment