hxdyl

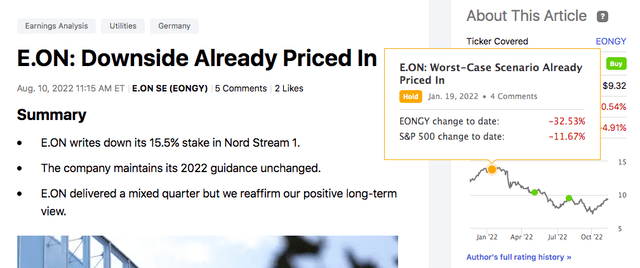

Here at the Lab, when we started to cover E.ON (OTCPK:EONGY), we were optimistic about the company’s long-term prospects and more cautious about the valuation. During the year, given E.ON’s share price developments, we decide to increase our rating target from neutral to buy with an analysis called: downside case scenario already priced in. Our buy case recap was based on 1) a compelling valuation with a juicy dividend yield, 2) transmission grid new CAPEX to drive the company’s return on equity (with higher needs for renewable capacity connections), 3) still related to point 2. We were forecasting an acceleration towards the energy transition (due to the Russian invasion), and 4) higher maintenance CAPEX given the transmission grid age.

Q3 results

All in all, Q3 results were positive. However, E.ON’s stock price declined more than 30% year-to-date and underperformed the whole sector by more than 15%. Here at the Lab, we believe that this was due to the company’s important debt (and consequently to the increase in the interest rate expenses) and also by the German retail market exposure and its reliance on Russian gas. As a reminder, E.ON has almost 20% market share in its home market.

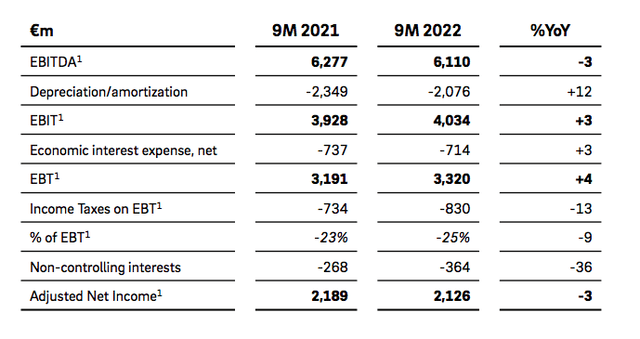

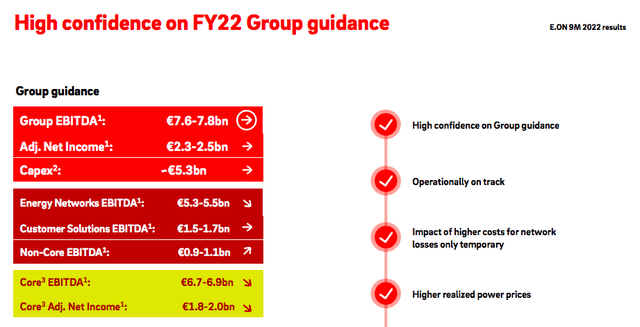

Cross-checking the VARA consensus estimate collected by the company, E.ON EBITDA and net income results were respectively 3% and 7% higher than expected. Having confirmed its 2022 guidance, the company is automatically implying that few risks are estimated in the last quarter (we will deep-dive into the conclusive paragraph later on). Looking at the company’s division, energy networks and customer solution EBITDA results were the positive outliers. Battery storage solutions and new solar panel installations were again supportive of the company’s accounts and in line with our investment thesis. On a negative but expected note, there was the absence of nuclear compensation that negatively impacted E.ON EBITDA evolution by almost €650 million.

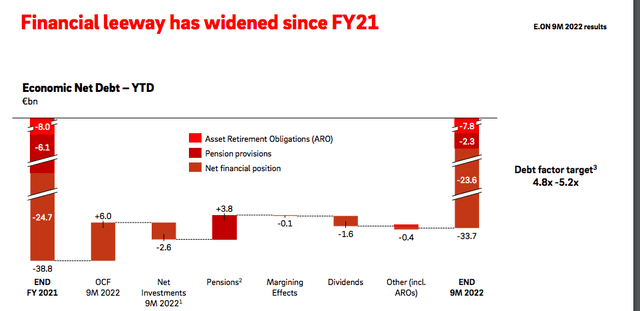

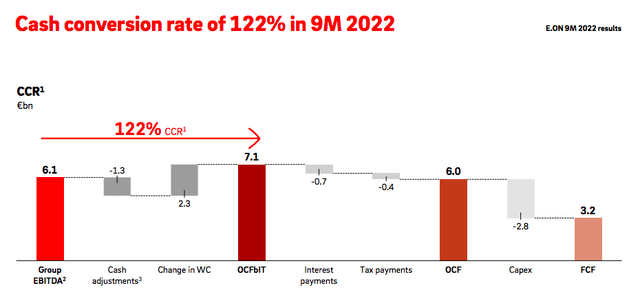

Looking at the company debt evolution, our readers might be positively surprised by the lower economic debt. However, we should note a few positive one-offs that happened during the year. First of all, higher interest rates in the UK and in Germany led to a decrease in the company’s pension provision. Secondly, important to note was also the high cash conversation cycle that recorded 122% at the nine months aggregate. €2.3 billion out of €6 billion was positive benefits from working capital and we expect that this trend will revert and negatively impact the E.ON debt evolution. Lower provision offset the higher interest costs evolution, so we decide to leave unchanged our forecast numbers.

E.ON debt evolution E.ON cash conversion rate

Conclusion and valuation

After having analyzed the Q3 results, we decide to reiterate our outperforming rating. Indeed, E.ON is a long-term pick and is currently trading at a compelling valuation with clear MACRO to MICRO advantages in the medium-long term horizon. There are clear benefits in the energy transition and despite the positive results year-to-date in the core business, the company left unchanged its 2022 guidance, so we expect some short-term turbulences in Q4. Even if there is no disclosure, we believe that E.ON is expecting an increase in bad debts, a colder winter, and higher gas & electricity spot price that cannot be shared with B2B and B2C clients. However, we are confident in the long-term view and we emphasized how the German transmission grid giant is trading at a discount compared to its closest peers with a P/E ratio of 6x versus the average European comps at 11x. Our buy rating is then confirmed.

Source: E.ON Q3 results presentation

Be the first to comment