koto_feja

Shares of neurology spinout Longboard Pharmaceuticals (NASDAQ:LBPH) have fallen by nearly 70% since IPO priced at $16 in March of 2021 (near the peak of the prior bubble in biotech). Share price performance is slightly negative at -4% for 2022.

Recent Q3 report got my attention as cash position of $77M puts them at close to $0 enterprise value while clinical momentum (finally) appears to be accelerating with healthy volunteer data for lead drug candidate due this quarter followed by more important results in patients with developmental and epileptic encephalopathies (DEEs) in 2H 23. Additionally, a second intriguing asset for rare neuroinflammatory indications looks to enter the clinic in the near term.

Given the above, I want to dig deeper and bring this name to the attention of my readers as we decide whether it’s a good fit for the ROTY (clinical stage) biotech portfolio.

Chart

Figure 1: LBPH weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see share price steadily fall from mid-teens to current levels in the $4 to $5 range. The stock has recently jumped above 50 day moving average and it looks like continuation is possible into the Q4 health volunteer data update. With under the radar phase 3 readout for lorcaserin in DS (dravet syndrome) expected in Q2 2023 (Longboard receives 9.5%-18.5% royalties on sales), my initial take is that investors interested in this name would do well to accumulate dips in the near term.

Overview

Founded in January 2020 with headquarters in California (22 employees), Longboard Pharmaceuticals currently sports enterprise value of ~$8M and Q3 cash position of $77M providing them operational runway into 2024. There were 17.2M shares outstanding as of November 1st.

September’s webcast at Wainwright Healthcare Conference provides an excellent overview, with CEO noting that Longboard was spun out of Arena Pharmaceuticals (bought out by Pfizer for $6.7B a year ago) in 2020 with focus on developing novel CNS-targeted assets. Company has a large G protein-coupled receptor-based (GPCR) pipeline behind it and interestingly enough, Arena (Pfizer) continues to own 23% of the company.

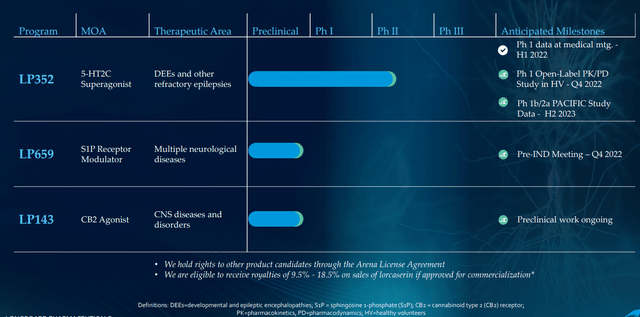

Longboard is focused primarily on two programs, 5-HT2C agonist LP352 for the treatment of seizures associated with DEEs and S1P receptor modulator LP659 with potentially broad applicability across a number of neurological indications.

Figure 2: Pipeline (Source: corporate presentation)

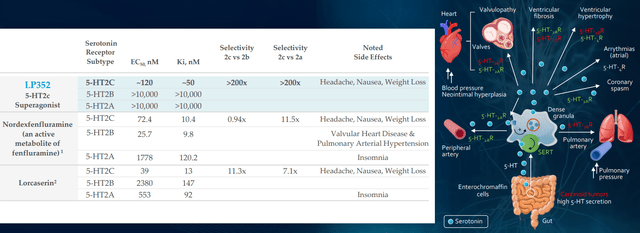

Starting with LP352, the compound is backed by real world evidence for 5-HT2C agonism showing activity across multiple types of seizures and multiple DEEs. Management believes LP352 has potential to differentiate from the competition given high selectivity to the 5-HT2C pathway versus A&B (associated with negative side effects). Additionally, LP352 is the only compound that’s been dose-optimized for DEEs and that selectivity could lead to cleaner safety profile as well as improved efficacy. Giving it as oral liquid is easiest way for these patients.

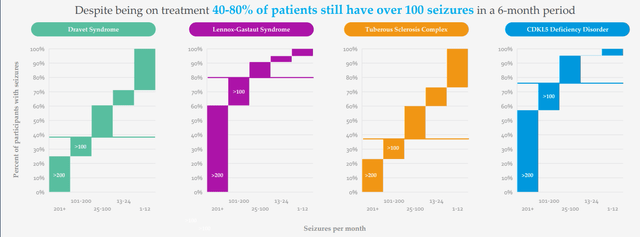

DEEs (developmental and epileptic encephalopathies) can be thought of as some form of continuous seizure disorder that continue throughout the lifetime of these children and young adults and are either syndromic or genetic (specific causal mutation). Currently there are around 25 known DEEs with higher number to be characterized in the future thanks to increased genetic testing.

Figure 3: High unmet need in DEEs as reflected in seizures per month despite multiple treatment options being available (Source: corporate presentation)

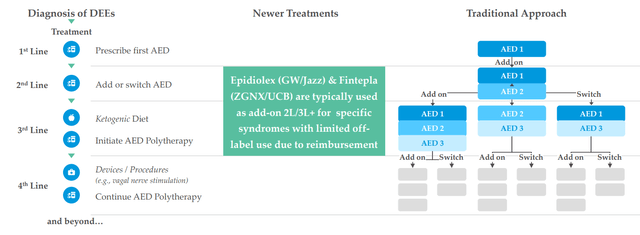

There are 20,000 Dravet patients, 50,000 LGS patients and 1,500 patients with CDKL5 (more missed and undiagnosed out there as well). They see LP352 as a potential antiepileptic treatment that could have broad usage across a number of the DEEs (why they are running a basket study). Current treatment paradigm for patients is a polytherapy approach, put on multiple AEDs (antiepileptic drugs) and various drugs are tried during course of treatment. Fintepla and Epidiolex are sometimes added in 2nd and 3rd line, and long-time readers might recall my prior Buy recommendations on companies that bought these treatments forward (Zogenix acquired by UCB for $1.9B and GW Pharmaceuticals bought out by Jazz for $7.2B). Physicians are looking for treatments that are easier to add on to standard of care and that’s why Epidiolex has had a higher launch trajectory than Fintepla, which has a black box warning. I note that this past quarter Epidiolex did $196M of sales (up 22%) and is well on its way to achieving blockbuster status soon (peak sales estimates of up to $3B).

Figure 4: DEE treatment landscape (Source: corporate presentation)

Thus, if LP352 is shown to be safe and efficacious, management believes it likewise has outsized commercial potential (could be used earlier in treatment paradigm as well as in combination with Epidiolex).

Phase 1 SAD/MAD data was exciting per management, as they’ve learned there’s no food effect (in this population timing is important to parents and caregivers). They also saw slight increases in prolactin levels (biomarker evidence for interaction with 5-HT2C receptor) at middle doses tested, allowing them to exclude lower doses as they move into clinic and to do narrower band for dose selection for the phase 1b/2a program (exclude higher levels at which no additional prolactin increase occurred).

Figure 5: Greater selectivity and specificity for LP352 should result in cleaner safety profile with fewer off-target effects (Source: corporate presentation)

Goal of the phase 1b/2a PACIFIC study is to enroll 50 patients with DEEs (broad group, not just Davet or LGS) with 40 patients on drug, 10 on placebo. In regard to screening, they will ensure patients have background history of motoric seizures (minimum 4 in initial screening period) then go into titration period (start at low dose, then can gradually increase to higher doses of 6 mg, 9mg and 12mg). The hope is that they can reach higher doses while drug is well tolerated, then stay locked in for 60 days and at the end they do a dose-titration down. Safety, tolerability and pharmacokinetics are primary endpoints, but one unusual aspect of the trial is that efficacy has been moved into primary endpoint as well (reduction in seizure frequency, looking for comparable findings across different DEEs and see how different seizure types responded). Such findings should aid them in powering pivotal phase 2/3 program in the future.

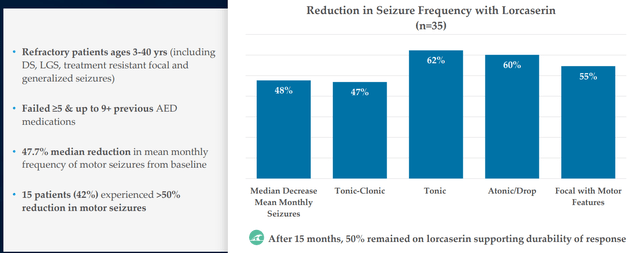

Figure 6: Efficacy in DEEs for predecessor lorcaserin partially derisks the mechanism of 5-HT2c agonism with real world evidence (Source: corporate presentation)

Goal per protocol is 10 patients with Dravet, 10 with LGS and smattering of other DEEs in the PACIFICA study (data expected 2H 22). As for bar for success, other medicines tend to circle around 30% to 50% reduction in seizure frequency (range they’d be looking for). Management’s goal is quite lofty in terms of desire to build out beyond what Fintepla has (easier to add on top of standard of care). In figure 6 above, I touch on how predecessor drug lorcaserin (originally intended for treating obesity) achieved 47% to 62% reduction in seizure frequency across various types of DEEs. Because LP352 has higher selectivity on 5-HT2C, the hope is that will translate into even higher efficacy. Aside from more common DEEs, they will also aim to treat those where nothing is available as Fintepla can’t treat them (can’t be used off label due to black box warning). As for the devil’s advocate question of whether LP352 would have a black box label because Fintepla has one, CEO responds that FDA will take a logical approach based on the data (Fintepla, lorcaserin and LP352 are very different compounds). As noted above, 352 interacts with just one of the most important receptors and healthy volunteer data indicates (so far) that black box warning would not be indicated.

They are also running a phase 1 CNS PK/PD study trying to better understand receptor interaction and this should provide more insight into mechanism of action. Fintepla’s data readout in CDKL5 deficiency is expected in 2024 and this also could provide further evidence that this mechanism of action is working (prior Dravet showed ~70% efficacy and LGS had ~35%). That drug would still have same black box and REMS program. Arena thinks it’s a problem to start with just one indication like Dravet and moving through each indication step by step, which is why they chose a basket study as a better way at drawing conclusions and opening up patient access to these compounds. They are even considering a basket design for pivotal trial, but that would require FDA sign off.

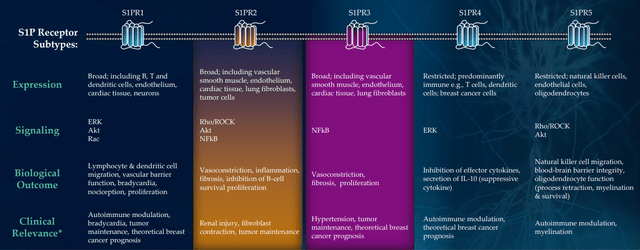

CB2 agonist LP143 is not dead and has very interesting preclinical data, but being a small company with limited resources management wisely chose to focus on initial two assets (I’m glad they are not spreading themselves too thin). IND submission for LP659 (S1P receptor modulator) remains on track for the near term (“Q4”) with phase 1 study to get underway as soon as possible after. They are still doing some translational work to determine which neurological disease makes sense as a lead indication. For context, there are already multiple S1Ps on the market for treating multiple sclerosis, but 659 has interesting differentiation including rapid onset of action and is very selective to S1P 1 & 5 (does not hit known bad actors P2 and P3).

Figure 7: High selectivity for S1PR1,5 could decrease off-target activity; S1PR2 & 3 associated with serious adverse events (Source: corporate presentation)

When I think of S1P drugs, Novartis’ Gilenya comes to mind ($3B of peak sales) and management calls LP143 the “cousin of atrasimod”, which was the cornerstone of Pfizer’s $6.7B buyout of Arena and recently aced two phase 3 trials in ulcerative colitis (also thought to have $3B+ peak sales potential). Preclinical mouse model data in MS was quite promising, but there are already 4 drugs approved for this indication which is why they are doing work in other diseases.

As for operational runway, they are guiding for cash into 2024 at this point and think they are funded through PACIFIC study (sounds like raise in Q1 is likely, in my opinion).

Select Recent Developments

In March, the company appointed Dr. Randall Kaye as the new Chief Medical Officer after Dr. Philip Perrera retired (stayed on in advisory role). Kaye served prior as CMO of Avanir Pharmaceuticals (bought out by Otsuka for $3.5B) and Axsome Therapeutics (subject of a recent writeup of mine in consideration for the Core Biotech portfolio).

Other Information

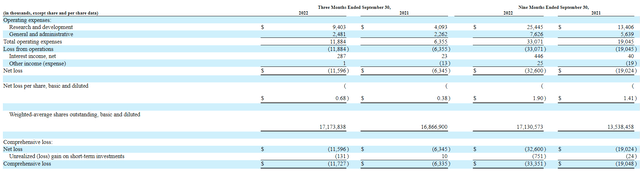

For the third quarter of 2022, the company reported cash and equivalents of $77M as contrasted to net loss of $11.6M (which nearly doubled from prior year at $6.3M). Research and development expenses rose to $9.4M, while G&A was about flat at $2.5M. Trends in growth of expenditures seem justified by progress I am seeing with the pipeline, particularly lead asset in phase 1b/2a study.

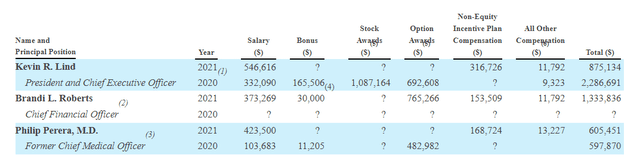

Figure 9: Executive compensation (Source: quarterly filing)

Again, the company is guiding for runway into 2024 but I still think we see a dilutive financing in the next quarter or so. Accumulated deficit since inception of just $42M speaks well in regard to management’s stewardship of the balance sheet and keeping expenditures at a reasonable level.

As for competition, Jazz Pharmaceuticals (JAZZ) Q3 commentary on Epidiolex update is helpful for context in terms of what we could see for LP352 IF it’s shown to be safe and effective (important not to get ahead of ourselves). Jazz’ management notes that Epidiolex is seeing growth driven by underlying demand and is poised to become a cornerstone of treatment for refractory seizures. Market research indicates nearly 60% of prescribers are moving Epidiolex up in the treatment algorithm (synergistic effects with Clobazam, one of the most widely used anti-seizure therapies). As Longboard’s team mentioned in prior presentation, competition from other modalities such as ASOs (antisense oligonucleotides) and gene therapy is in very early stages where promising efficacy has not been demonstrated as of yet. This makes me think of Stoke Therapeutics (STOK), which recently reported “positive” interim data for its ASO candidate STK-001 in the phase 1/2a MONARCH and ADMIRAL clinical studies across multiple doses (20mg, 30mg and 45mg). While the top of the press release highlights the 55% median reduction from baseline in convulsive seizure frequency among patients treated with 3 doses of 45mg, buried under that is a potential safety signal of increased protein in the cerebrospinal fluid that could correlated with monthly CSF dosing (27% of patients experiencing mild to moderate drug-related treatment-emergent adverse events). Likewise, non-human primate chronic toxicity studies revealed longer than expected half-life and slides (to my eyes) put a lot of effort into data mining (never a good sign). They have more higher dose (45mg and 70mg) data coming in 2023, but at those levels I am concerned about increased safety issues.

As for institutional investors of note, Arena/Pfizer owns nearly a quarter of the company with 23% stake. Cormorant Asset Management is maxed out with a 9.99% stake and Farallon Capital Management owns a 6% stake. It’s worth noting that in terms of insiders, President and CEO Kevin Lind has skin in the game and owns over 348,000 shares.

As for relevant leadership experience, President and CEO Kevin Lind served prior as EVP & CFO at Arena Pharmaceuticals. On the board of directors, we find Vincent Aurentz (prior EVP and Chief Business Officer of Arena) and Corinne Le Goff (prior Chief Commercial Officer of Moderna).

Moving on to executive compensation, cash portion of salaries looks quite reasonable for a company this size as do stock and option awards (nothing sticks out as excessive).

Figure 9: Executive compensation (Source: proxy filing)

In regard to IP, for LP352 Longboard owns exclusive worldwide license to issued and pending claims including for composition of matter (estimated expiration 2036, not taking into account term adjustment or extensions). LP659 patents including compositions of matter and methods of treatment are capable of continuing into 2029 (seems on the short end to me). Likewise, for LP143 issued and pending patent claims are capable of continuing into 2030.

As for other useful nuggets from the 10-K filing (you should always scan these in your due diligence as many companies like to sweep undesirable elements under the rug), one lesser-known detail is that Arena license agreement involves mid-single digit royalty on net sales to Arena/Pfizer.

In reference to Fintepla (fenfluramine) as providing validation for novel MOA in epilepsy (targeting 5-HT2c receptors), I note that the drug candidate was initially developed as monotherapy treatment for adult obesity as well as in combination with phentermine (fen-phen). Reports later were published documenting cases of valvular heart disease and pulmonary arterial hypertension, causing the drug to be pulled from the market in 1997. Zogenix successfully developed fenfluramine for Dravet, BUT received black box label for the aforementioned off target effects. Similarly, Arena’s 5-HT2c agonist lorcaserin provides validation for the class and was also initially developed for weight management and marketed as Belviq. It too was pulled off the market following FDA analysis of higher rate of total cancer diagnoses (not statistically significant) in the CAMELLIA-TIMI 61 clinical study (to my eyes not significant at 7.7% versus 7.1% for placebo). A follow up retrospective study in 35 refractory epilepsy patients achieved 50% reduction in mean monthly frequency of seizures in LGS patients, 43% reduction in Dravet and 23% reduction in other epilepsies (Figure 6 above). Following FDA consultation in 2020, Esai initiated a phase 3 study of lorcaserin in patients with Dravet syndrome and I reiterate that should it be successful with Q2 data, Longboard would be eligible for 9.5% to 18.5% royalties (not a small amount for a company this size).

Final Thoughts

To conclude, with market capitalization of $85M and EV of $8M, valuation of Longboard Pharmaceuticals appears exceedingly cheap compared to market opportunity and high unmet need in treating DEEs despite recently approved treatments like Fintepla or Epidiolex. Despite LP352 being an early-stage asset, significant derisking has taken place via healthy volunteer data and prior validation for MOA of 5-HT2c agonism via Fintepla’s approval in addition to lorcaserin’s proof-of-concept data. It makes sense that a highly selective compound with improved safety & tolerability profile would allow for utilizing higher doses to potentially achieve even greater efficacy.

Investors won’t have to wait long for needle moving catalysts, as phase 3 data for lorcaserin in Dravet is expected in Q2 (primary completion date of March 8th per clinical trials website). Similarly, data from the PACIFIC basket study of LP352 in multiple DEEs is expected in Q4.

For readers who are interested in the story and have done their due diligence, LBPH is a Buy and I suggest initiating a pilot position in the near term. A prudent strategy could be to purchase half of desired exposure presently, then waiting for dilution or the lorcaserin phase 3 readout before taking further action.

I wish to caution readers that trading volume for the stock is low at average daily volume of 21,000 shares (~$100,000 worth). Thus, limit orders are a must and I suggest spacing out one’s purchases over time in smaller orders.

From an ROTY perspective (focus on next 12 months), I am not currently considering this one for near-term entry given market capitalization is under our $100M limit and more importantly the stock is thinly traded with low volume causing wide bid-ask spread. That could change in the next couple quarters when needle-moving readouts are closer.

One key risk is significant dilution within the next quarter or two, considering the company has cash runway of just 1 year or so. Delays in the clinic would equally punish share price and valuation, as it would mean current cash position is inadequate to reach the PACIFIC readout. Upcoming data sets including lorcaserin phase 3 and LP352 in PACIFIC study could prove disappointing, whether from safety perspective (revealing tolerability concerns or off target toxicities) or efficacy (not high enough to show differentiation versus predecessor drugs). This for all purposes can be considered a single-drug company for the present until phase 1 data is reported for S1P receptor modulator LP659 in 2024 or so. Another devil’s advocate point is whether Pfizer will continue to own its 23% stake or sell it at some point (which could put pressure on share price as well). Again, LBPH is a small company at sub $100M market capitalization and so readers should expect increased risk and volatility here.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Be the first to comment