Scott Olson

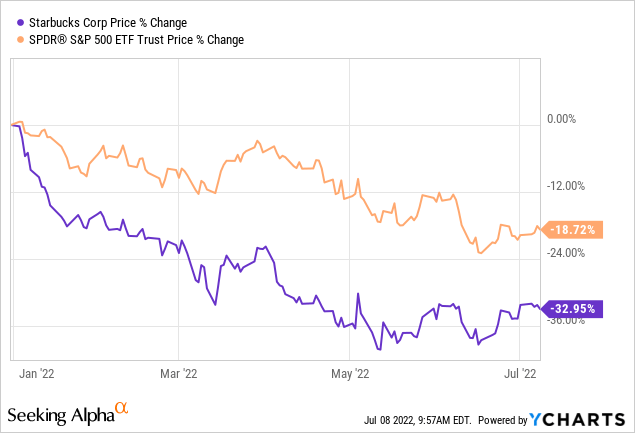

Starbucks Corporation’s (NASDAQ:SBUX) share price has dropped nearly 19% YTD due to its ongoing battles against unionization affecting its reputation. Although the company will likely fare well during a recession and has strong pricing power to combat rising inflation, supporting unions may be beneficial in regaining brand loyalty during potential downturns.

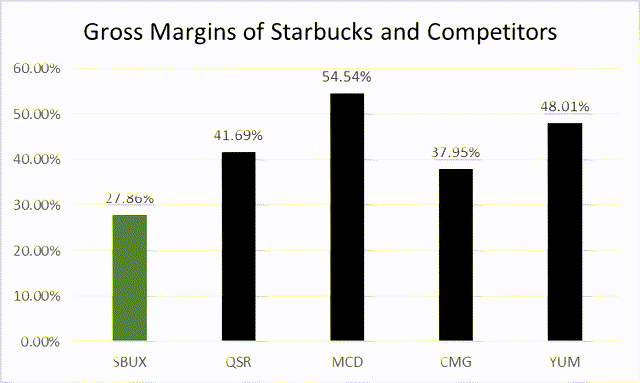

Starbucks has a poor gross margin, which could mean that the company will continue raising its prices, as it already has three times since October. However, the company has profit maximization strategies to make the most of its pricing power if need be. A possible downturn could also eliminate smaller coffee shops that are competitors to Starbucks.

The company has been pushing back against unionization, which is rupturing its reputation. Unions could cause Starbucks to pay higher labor costs, provide more benefits, and implement new strategies, but the company could control its prices to afford these costs. The company could also salvage its progressive reputation by siding with unions. Starbucks likely has a bright future in the long-run, especially if it decides to support unions. Due to all of this, as well as the current share price, I will apply a Buy rating to this undervalued stock.

Starbucks Is Reasonably Protected From Inflation

Inflation has been rising and has been directly impacting the restaurant industry. Starbucks has raised its menu prices three times since October 2021 to compensate for inflation. The company has also decided to spend less on marketing and promotional spending this year to further combat some inflationary concerns. Even though Starbucks is taking steps to fight inflation, it has a poor gross margin which is especially low when compared to some major competitors. This inferior gross margin could mean that the company will continue raising its prices in the future, possibly causing lower demand.

Gross Margins of Starbucks and Competitors (Created By Author)

Starbucks rising its prices is not all bad for the company, as it does have pricing power. Its consumers are dedicated to the company’s brand and its high quality. Customers are willing to pay a few more dollars for Starbucks in order to get a premium coffee and other menu items. Starbucks utilizes profit maximization by increasing its prices precisely to generate the most possible profit.

A Recession May Lead To Reduced Competition

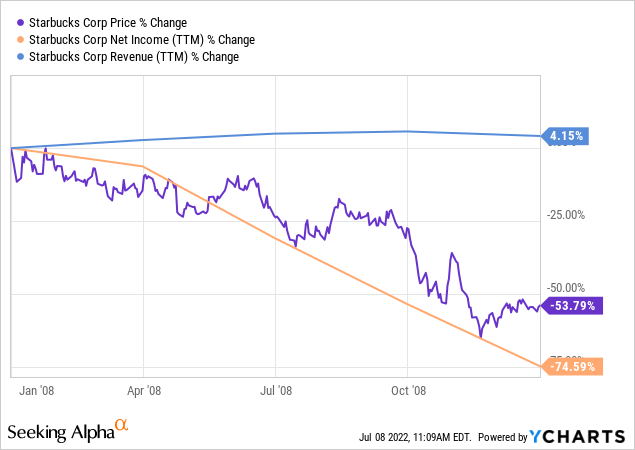

Atlanta’s Federal Reserve Bank has reported that the U.S. is likely already in a recession. A potential recession may not further develop until unemployment begins to rise, however Starbucks has historically underperformed during downturns. The company was able to increase its revenue every year since 1991, excluding 2009 and 2020 due to the impacts of those recessions. During the 2008 recession, Starbucks went through some rough times as its share price and net income percentage dropped significantly. Revenue increased in 2008 before dropping for the first time in 18 years in 2009. The company was forced to shut down around 900 of its stores in 2008 and 2009 as it failed to generate sufficient revenue.

The Great Recession brought some hard times for Starbucks. However, a potential upcoming recession could have some positives for the company. Starbucks and its major competitor, Dunkin’, have all the tools be able to survive a recession. Strong fundamentals, a plethora of cash, and lucrative earnings all help to protect these coffee giants from a possible downturn. On the other hand, smaller coffee shops that are competition to Starbucks likely do not have these tools to survive a potential recession. With much less cash and smaller revenues, these small businesses could be at risk, which would benefit Starbucks by eliminating some competitors.

The Fight Against Unions Is Negatively Impacting Starbucks’ Reputation

In December 2021, a shop in Buffalo became the first Starbucks store to become unionized. Since this historic vote, 149 total Starbucks stores have voted in favor of unions. Starbucks’ workers have described being underpaid, overworked, and having little benefits as the biggest reasons for seeking unions. The company has pushed back among the union fight, claiming it operates best when it works directly with its employees.

The onset of unionization throughout Starbucks came with issues, as the company’s price per share saw a considerably large decline after the fight began. It has faced backlash for its stance, however. Starbucks is making efforts to improve working conditions by raising its average hourly wage to $17 and by considering other benefits.

Starbucks has been risking its reputation, but the company is sticking to its fight against unions. If it continues its stance against unions, the company risks hurting its brand further and potentially losing customers. However, if the company changed its stance and began supporting unions, it could potentially incur higher labor costs, provide more benefits for workers, and other changes. But, Starbucks already pays wages above the market, which means it could utilize its previously mentioned pricing power to help afford the impacts that come with unions and at least offset the rising costs of unions. Therefore, the positives of unionizing far outweigh the negatives of not which means allowing unions may be beneficial for the company’s future.

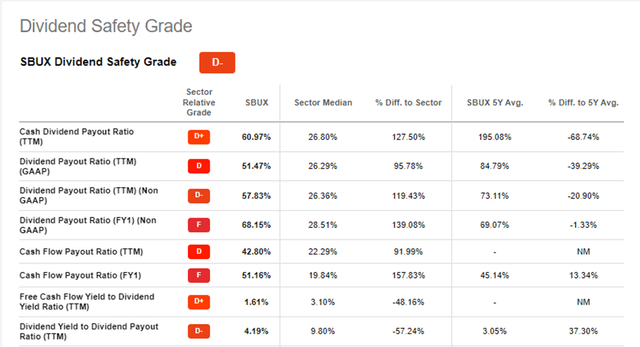

Dividends Could Soon Become Unsustainable

Costs of unionizing could potentially drive up Starbucks’ payout ratio and lead to it becoming unsustainable. The company’s cash payout ratio is already at 57.83%, which is very high. If the dividend payouts increase further, it could be troubling for dividend investors, as there is little safety regarding the dividend.

Starbucks Dividend Safety Grade (Seeking Alpha)

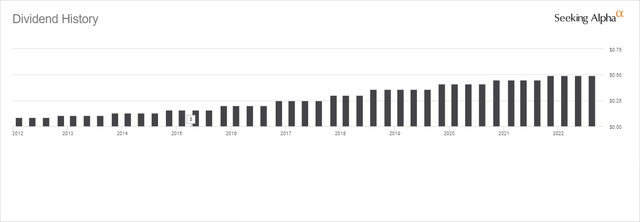

The company currently pays a $1.96 annual dividend, which equates to a 2.52% yield at the time of writing this article. This is a good dividend yield but it may be too high for the company to handle in the future. Starbucks has had 12 consecutive years of dividend growth, which could seem very attractive for dividend investors. However, the dividend payout is likely getting to be unsustainable and it seems that the company will not be able to keep this consistent dividend growth up for much longer.

Starbucks Dividend History (Seeking Alpha)

Valuation

Starbucks is underperforming the market this year, which could indicate great value at the moment. With the price down, it could be a good time to get into the stock as it seems to be undervalued.

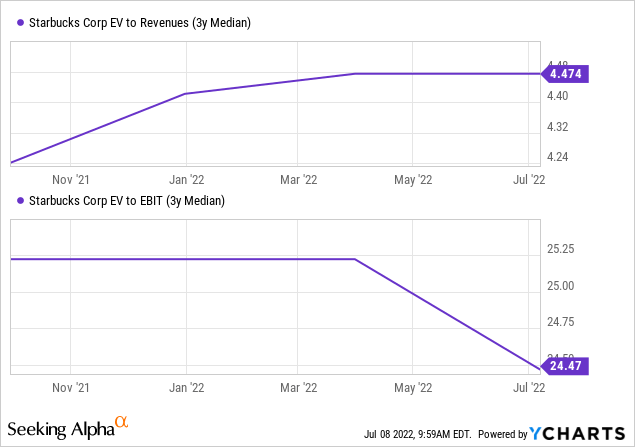

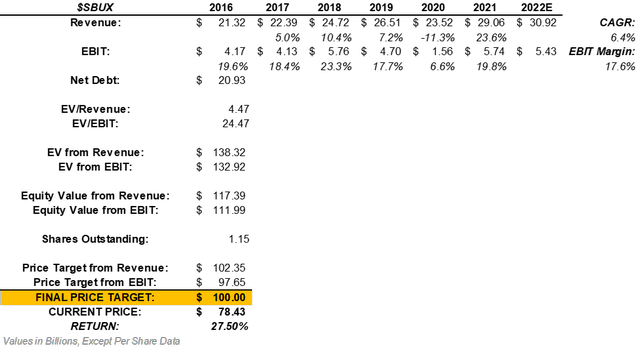

During the last 6 years, Starbucks increased its revenue from $21.32 billion to $29.06 billion. This reflects a CAGR of 6.4% which can be applied into the company’s next fiscal year. This projects the company to generate $30.92 billion in revenue in 2022. On top of that, Starbucks has seen an average EBIT margin of 17.6%. Multiplying this margin by the estimated revenue of $30.92 billion projects the company to produce $5.43 billion in EBIT in the upcoming fiscal year. After multiplying these projections by its 3-year median EV/Revenue and EV/EBIT multiples, we can come to the company’s expected enterprise value.

After adjusting the company’s estimated enterprise values for net debt, we can find Starbucks projected equity value from revenue and EBIT. Dividing the equity values by the current number of shares outstanding and averaging the price targets bring us to a final price target of $100.00. This means that SBUX stock could return an upside of 27.50%.

Valuation of SBUX Stock (Created By Author)

The Takeaway For Investors

Starbucks has pricing power to combat inflation and maximize profits. A recession could bring some trouble to the company like it did in the Great Recession, but it could also eliminate smaller competitors that take away from Starbucks’ potential. The company is also in an ongoing battle against unions as they are beginning to rise. This stance is negatively impacting the company’s brand, as the company is known to be fairly progressive. Siding with unions could be the best decision for Starbucks since it could repair its damaged reputation and be affordable if the company continues to utilize its pricing power and profit maximization strategies. Dividends are trending to be unsustainable, as Starbucks’ cash payout ratio is nearing 58%.

With all this put into mind and with the share price currently undervalued, I believe it may be smart to start adding a position to Starbucks. Therefore, I will apply a Buy rating to SBUX stock.

Be the first to comment