Richard Drury

Favoring American shares has long been a winning strategy, but nothing lasts forever. Timing, of course, is the great mystery.

Research reports heralding the case for overweighting stocks ex-US have been circulating for years. Catalysts cited include relatively attractive valuations and stronger growth in certain overseas markets. The US juggernaut, however, persists.

The performance edge for American stocks is no longer absolute, at least so far in 2022. Hard times have arrived for equities generally. But in relative terms, it’s still not obvious that the long-running leadership for US equities has run out of road.

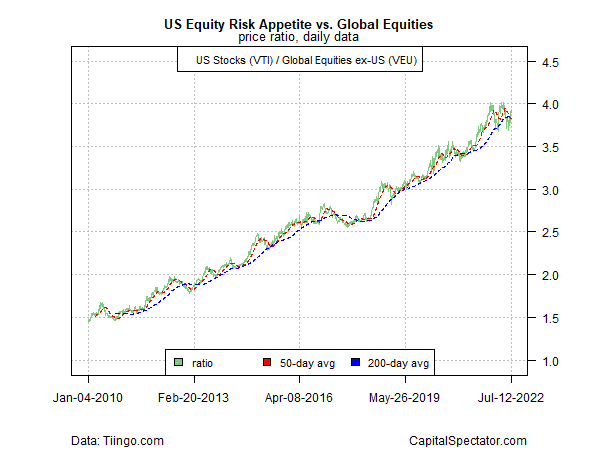

For perspective, let’s review four ETF pairs via a set of Vanguard funds, starting with the US stocks (VTI) vs. Global stocks ex-US (VEU). Although the relative strength for US shares has wobbled this year, it’s not yet clear that the long-running trend is rolling over. To be fair, the VTI:VEU trend is stuck in a range, but the jury’s still out on whether this is one more temporary pause or an early sign that US stocks are starting to decline vs. the rest of the planet’s equity markets.

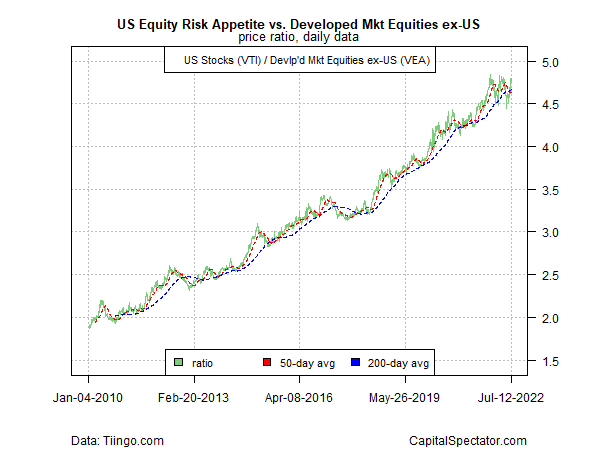

A similar profile applies to US stocks vs. shares in developed markets ex-US (VEA).

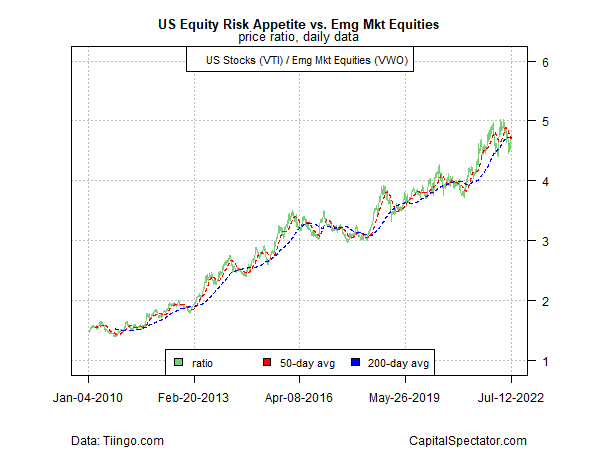

Ditto for the US vs. stocks in emerging markets (VWO).

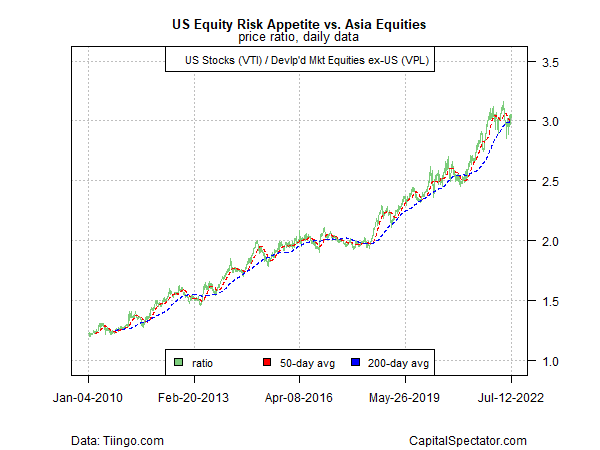

Finally, let’s focus on the US relative to Asia stocks (VPL). Here, too, it appears that the US leadership remains intact.

Blindly assuming that US stocks will always and forever outperform is assuming too much. The immediate question: Will a chaotic 2022 reshuffle the game in favor of foreign stocks? Too early to tell, but the initial takeaway is that old habits don’t appear in imminent danger of dying.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment