Joe Raedle

Thesis

I have previously initiated coverage on Block, Inc. (NYSE:SQ) with a ‘Buy’ rating. And following a better-than-expected Q3 report, the stock quickly surged towards my price target of $63.36/share. But reflecting on Block’s strong September quarter, I am confident to double down on my bullish thesis and raise my target price to $70.49 /share – on the backdrop of EPS consensus revisions.

Although SQ stock has rebounded from YTD lows by about 20%, the company’s valuation is still down almost 80% from all-time highs.

Block’s Strong Q3

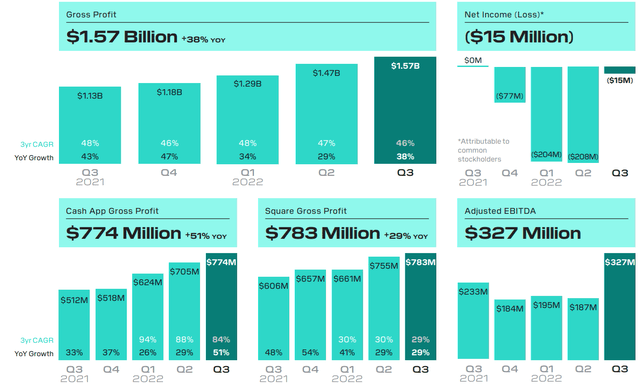

Block’s fintech ecosystem outperformed analyst consensus estimates in Q3 with regards to both revenue and profitability.

From July to end of September, Block generated total sales of $4.52 billion – as compared to $3.8 billion for the same period one year earlier (18% year-over-year growth) and consensus expectations anchored around $4.49 billion ($300 million beat). Notably, the strong performance was supported by the entire ecosystem, with transaction revenue up about 15% year over year, Subscription and services-based revenue up 72%, hardware revenue up 16% respectively, while Bitcoin revenue only contracted by about 4% year over year.

Profitability Outpaces Expectations

Block’s gross profit increased by 38% year over year, to $1.57 billion in Q3 2022. Again, the performance was supported by the entire ecosystem: Gross profit from the Cash App jumped by 51% year over year, to $774 million; and gross profit from the Square business increased 29% to $783 million.

Adjusted EPS came in almost 100% higher than what consensus had expected, at $0.42, versus expectations of $0.23.

Bitcoin Risk Manageable

Reflecting on a very challenging environment for cryptocurrency business initiatives, investors were concerned about how Block will perform during the ‘crypto winter’. In Q3, Block only accounted for about $37 million of gross profits related to Bitcoin, which implies that Jack Dorsey’s fintech ecosystem is not really dependent on profits related to the crypto industries. Moreover, impairments related to the company’s bitcoin purchases in 2020 and 2021 were only $2 million in the September quarter – and thus not really meaningful.

Still A Long-Term Growth Company

While growth for many FinTech and BigTech companies has slowed down sharply during Q3, Block managed to expand. This makes me confident to reiterate my belief – as I have written before – that Block is poised to grow at a greater than 20% CAGR through 2030.

A multi-year 20% CAGR growth would not be unreasonable. In fact, it would be anchored on the estimated 20.5% expansion of the global fintech market, which is expected to reach a size of about $700 billion by 2030. Moreover, investors should also consider that Block still has room to expand into more value-creation opportunities, as the company is focused on three priorities key priorities: (1) enabling omnichannel capabilities, (2) growing upmarket, and (3) expanding internationally.

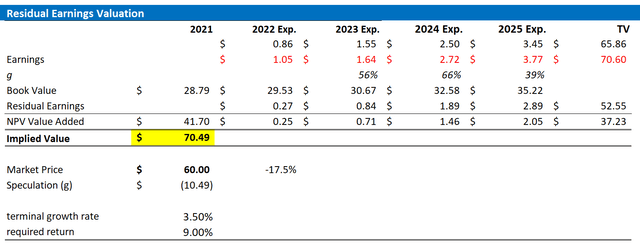

Target Price Estimation – Update

Following an unexpectedly strong Q3, I update my residual earnings model for Block to account for preliminary consensus EPS upgrades. However, I continue to anchor on a 9% cost of equity and a 3.5% terminal growth rate, which I regard as reasonable – if not conservative.

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price of $70.49, versus $63.36 prior.

Analyst Consensus Estimates; Author’s Calculation

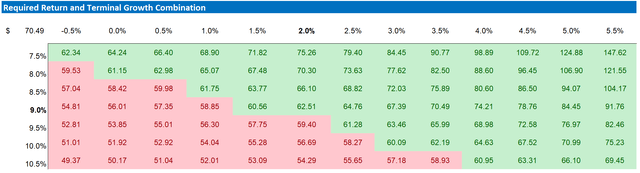

Below is also the updated sensitivity table.

Analyst Consensus Estimates; Author’s Calculation

Risks

As I see it, there has been no major risk update since I last covered SQ stock. Thus, I would like to reiterate what I have written before:

Much of Block’s value is based on growth. And judgements about growth are always connected to speculation. Accordingly, investors should consider that the company might fail (simply a function of probabilities and uncertainty) to grow at a 20% CAGR through 2030.

I would also like to point out that Block’s approximately $14 billion of combined goodwill and other intangible assets might be exposed to a write-down – if valuations in the fintech space keep falling.

Investors should also consider that much of Block’s share price volatility is driven by investor sentiment towards risk and growth assets in general. Thus, investors should expect price volatility even though Block’s business outlook remains unchanged.

Finally, rising real yields could add significant headwinds to Block’s stock price, as the higher discount rates affect the net present value of long-dated cash flows.

Conclusion

Following a strong Q3 report from Block, I am confident to reiterate my bullish thesis on SQ stock. I continue to believe that Block is poised to grow at a greater than 20% CAGR through 2030. And reflecting on Block’s current EV/Sales valuation of x2, along with attractive prospects for further profitability expansion, I don’t believe SQ is valued correctly. On the backdrop of EPS consensus upgrades, I raise my target price to $70.49 /share, from $63.36 prior.

Be the first to comment