cokada

Investment thesis

Livent (NYSE:LTHM) continues to accelerate its own financial results, and it seems that the overall economic slowdown is not an obstacle for the company. The lithium market looks like a safe harbor against the backdrop of global challenges such as supply chain crisis, inflationary pressure, and declining demand. We remain confident and recommend to buy the stock.

Lithium has its own price cycle

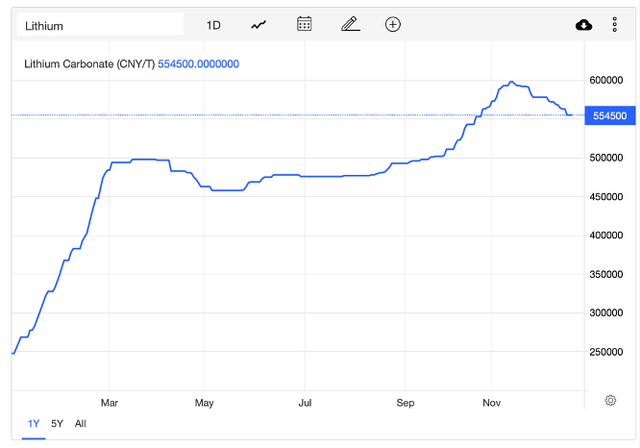

Despite the price correction in commodities amid rates increases, a strengthening dollar and the global economic slowdown, the price of lithium reached a new historical high of ~$80 thousand a ton, according to Trading Economics (below chart in CNY).

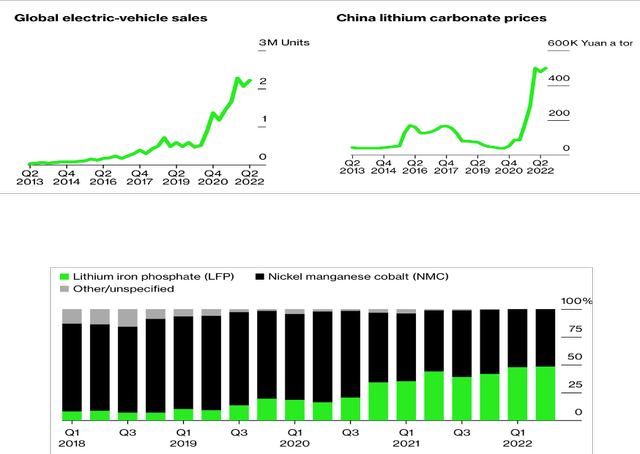

The lithium market is not yet fully prone to cyclicality, as it rests on the support from a rapidly growing demand by the EV industry and a fast deployment of lithium-iron-phosphate batteries in China, which replace batteries based on other metals, according to Bloomberg.

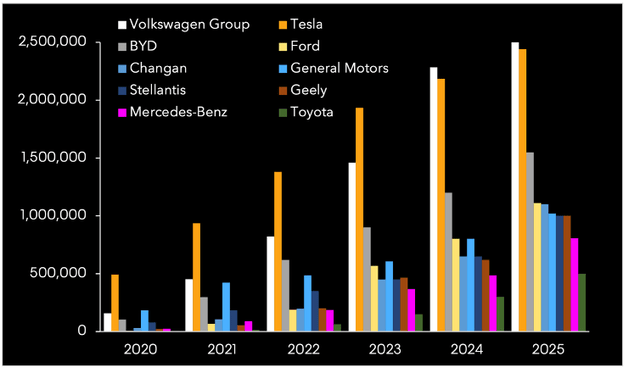

Despite an impending recession and the consumption weakness, we don’t expect demand for lithium to fall, due to the cannibalization of ICE car sales by EVs. Various producers almost every quarter announce releases of new models that push to the sidelines the familiar lineup of ICE cars, and that’s a long-term trend, according to Bloomberg.

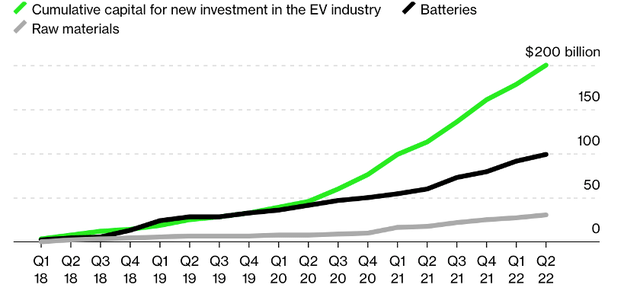

Another tailwind that helps to support lithium prices is the classic story of underinvestment. Investment in EV markedly exceeds the investment in the commodity, according to Bloomberg.

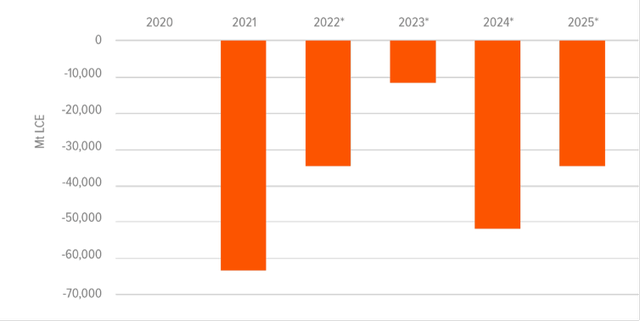

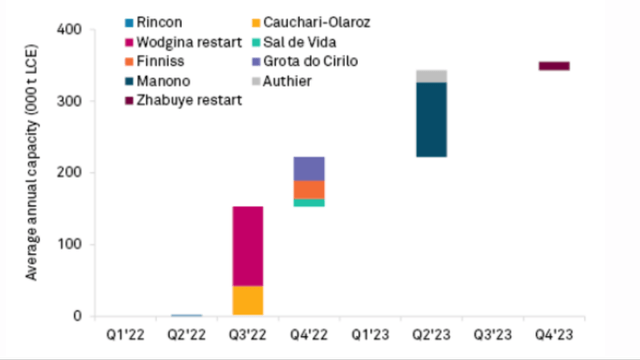

The high demand is expected to drive the shortage of lithium from 2022 to 2025, according to Global X, to average about 30 thousand tons a year. The shortage will be the lowest in 2023 due to the start of key production projects in Australia, Africa and South America.

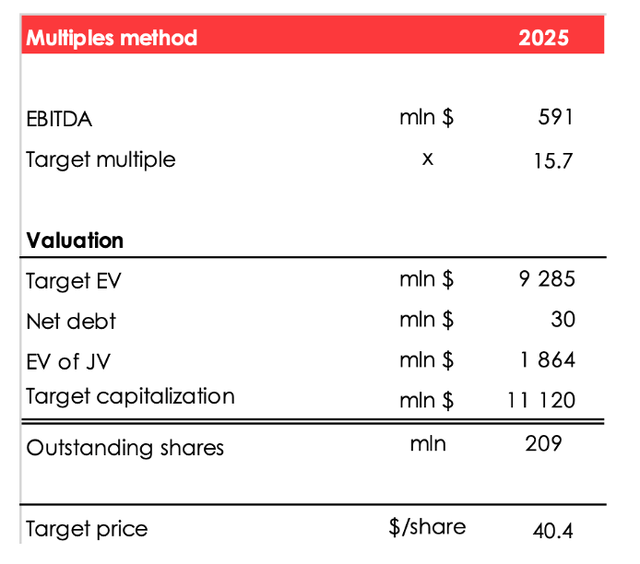

Valuation

The valuation of $40.4 was achieved through discounting the share price target for 2025 to the FTM valuation at the rate of 13% per annum. Therefore, the fair value price for the shares is $40.4. The upside is 91%. The status is BUY.

Risks

- The acceleration of reagent prices which will cut the gross profit margin.

- More severe recession than expected that will hit demand for electric vehicles as well as battery demand.

- Adoption of lithium recycling.

Conclusion

Livent is a bet on the long-term trend for the global transition to electric vehicles. The company should now benefit from prices of the commodity holding high. That will enable Livent to conclude contracts at prices that are high and beneficial for the company. We believe that the current stock price offers the best entry point for long-term investors as we think the lithium rush has not ended

Be the first to comment