We Are

Finding Balance in a Bear Market

Market Overview

Unfortunately, when it comes to human behavior, nothing forces change like pain. Bear markets are certainly painful, but the silver lining is that the pain helps crystallize new market cycles as it corrects imbalances and forces investors to finally accept that the old bull market cycle is truly over. It also sets up new investment opportunities, as the repricing of risk inevitably pushes market prices below long-term value in a broader set of equities. However, investors must be patient for new opportunities to emerge, and the key in a bear market is to try to maximize adaptation by balancing short-term risks with long-term opportunity.

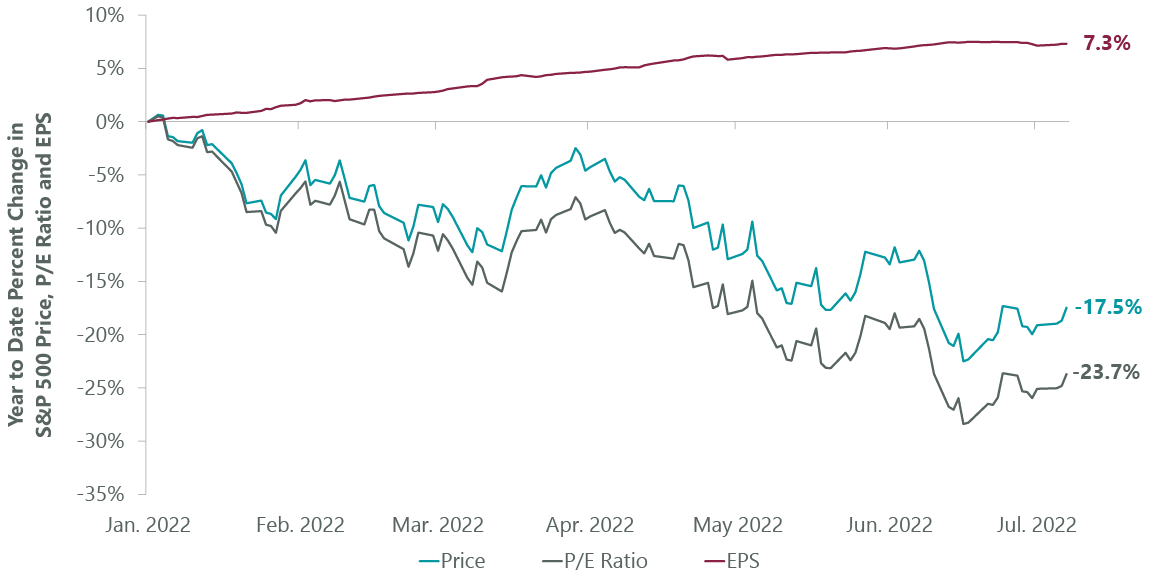

When both the year and the second quarter began, we still were not certain a bear market cleanse would be required. The market pain we did expect was that rising interest rates would pressure very high starting valuations for broad U.S. equity indexes. This has indeed happened (Exhibit 1), as the market has fallen over 20% despite earnings estimates rising over 8% year to date. As a complex adaptive system, the market is not a simple math problem to be solved. However, with the 10-year Treasury yield doubling from the start of the year, and equity risk premiums also rising, the simple math of valuation gravity was too much for markets to overcome. In addition, earnings estimates were only rising in two sectors: energy and materials, which by themselves were not enough to power the market materially higher.

Exhibit 1: While Prices Fall, Expected Earnings Rise

As of July 7, 2022. Source: Bloomberg Finance, L.P., ClearBridge Investments.

As investors, we typically avoid using the word hope, as it interferes with the ability to accept reality and impairs our capability to adapt to evolving challenges. However, we were indeed hoping that a recession could be avoided. The major pillars of the U.S. economy are broadly in good shape, including the consumer, the banking system and corporate balance sheets. More directly, with nominal economic growth at such robust levels, ironically there was room for the inflation part of growth to cool as interest rates rose, without resulting in a crash in real growth. However, with the war in Ukraine tragically grinding on, ongoing global energy shortages and wealth destruction from declining asset prices, the probability of a recession scenario has been rising to levels that require ongoing portfolio adaptation. What does this adaption entail?

- Starting Point Matters: With the portfolio valued at less than 10x earnings, a greater than 20% discount to its respective value index, we have less to fall from our starting point. We recognize that broad market earnings typically fall around 30% in a recession, but our explicit goal is to hold up better than this. The portfolio’s cyclical earnings risk is primarily in energy stocks and interest-rate-sensitive financials, where higher energy prices and higher rates are major fundamental tailwinds. In a recession, energy prices will fall and credit costs will rise. However, these stocks are already discounting a lot of this pain, and we do not expect either a collapse in energy prices or severe credit losses. After all, the major issue we face today is an energy supply shortage, and consumer and corporate balance sheets are in good shape. We are not going to see a repeat of the Global Financial Crisis (GFC) and the negative oil prices that defined the last two recessions. However, it is typical for fearful investors to round up the usual suspects from recent recessions, even though every downturn is different.

- Recession Scenario Test: Our valuation process continually estimates our investments’ absolute business value across various scenarios, including a recession. Despite not expecting the next recession to equal the GFC of 2008 in either character or magnitude, we have extensively stress tested our portfolio holdings’ business values under a GFC-like scenario. If you assume half the magnitude of the GFC, our business values would drop by roughly 15%. We think this is much more resilient than the overall market and reflects the valuation and fundamental advantages of our holdings, specifically our focus on companies with resilient free cash flow generation in both inflationary and deflationary environments. This focus has resulted in most of our holdings enjoying fortress-like balance sheets, and we expect all will make it through even a severe recession. The challenge and opportunity in a recession, however, is that prices are more volatile than business values, and forward returns would rise as market prices fall faster than business value. Right now, we are more focused on the challenge of falling prices, but the risk/reward of the portfolio is already extremely attractive, with roughly 30% downside to a full GFC scenario and well over 50% upside in a recovery.

- Recession Tactics: Given the starting valuations and fundamental strengths of our portfolio we did not have to make major changes as the bear market took hold. However, as the probability of a recession grew, we added additional defensive balance by adding positions in healthcare and regulated utilities. We also reduced some of our positions that had the highest price volatility in the portfolio. This included some of our energy names near their highs. With many defensive stocks already at valuation levels that fully reflect a recession, we refuse to invest in any name whose price is above our estimate of business value. In our view, investors are inordinately focused on the tactical considerations of price drawdowns, while in many cases ignoring the ability by businesses to compound value through the downturn – the ultimate driver of long-term equity returns. The best defense is combining resilient fundamentals with reasonable valuations. As such, we believe our positions should have a higher rate of return over a full market cycle than more traditional defensive stocks, where valuations reflect investors are paying for insurance against further tactical drawdowns. We think we have struck a good balance on defense, and will continue to adapt, if needed, as the environment evolves.

Astute readers may have noticed we stuck to conveying our observations and adaptations to the current environment, rather than offering a concrete forecast. This reflects our investment process of being probability based, diversifying the portfolio to be robust in multiple scenarios and adapting only when an event materially shifts our pre-existing probabilities. Our guess is that this bear market is already two-thirds done on price declines, but we recognize that no one knows what the future holds. We take comfort in this ambiguity, especially since investors and pundits will almost certainly get more bearish and more negative as the bear market continues. This cascading cacophony of fear will create great opportunities for long-term, valuation-disciplined investors like us. The further prices fall below a reasonable range of business values, the greater the forward returns become and the fewer hard questions about the future we must answer.

“The further prices fall, the greater the forward returns become.”

The challenge is that investors are already so depressed we may not get an additional major reset in prices. Market cycles are also moving so fast that both good and bad news are discounted with a speed that can leave human prognosticators behind. At the time of our writing, it seems growth and inflation are moderating, which may allow the Federal Reserve to reduce the aggressiveness with which it has recently raised interest rates. If so, as earnings estimates drop from slower growth, valuation multiples may start to rebound from their recent plunge. Again, even two-variable equations like multiples and earnings are hard to handicap in a complex, adaptive world moving at digital speed.

There is one other key observation we can make: when people are under stress in a bear market, they become extremely shortsighted and lose perspective on long-term changes and opportunities. Yet, as we stated earlier, bear markets are when new leadership gets cemented. Value, as a style, was leading growth before this bear market, it is leading growth in this bear market, and we think it will lead coming out of this bear market. Why? The first supporting argument is simply that value leadership is what we are currently observing. Leadership, by definition, must lead. Secondly, even with recent value leadership, value relative to growth is just in the 95th percentile of history (Exhibit 2). This puts it roughly where value bottomed when the 2000 growth equity bubble popped, which we believe is highly supportive of our view that it is still very early for this ongoing value cycle. Thirdly, as we detailed in our last commentary, energy security and transition are the big problems the world needs to solve. This challenge is at the center of the current crisis, and we need to invest massively in global power for supply to catch up with demand. Energy demand declines during a recession as prices fall down the steep supply curve, but also rebounds just as strongly when growth bottoms. Despite this structural shortage and great fundamentals, energy stocks remain the cheapest value stocks in a value market.

Exhibit 2: Value Remains Historically Undervalued

As of June 30, 2022. Source: Bloomberg Finance, L.P., ClearBridge Analysis.

Portfolio Positioning

Given that we think the ongoing bear market will crystallize, rather than end, this still-nascent value cycle, we are excited by the growing opportunities to capitalize on the next stage of this value market. With the portfolio already in great shape from a fundamental and valuation perspective, the bar for new names is relatively high. However, we continue to find new names where the risk/reward is accretive to the portfolio, or where our portfolio construction benefits from its inclusion on the defense/offense spectrum. In some cases, we are getting both.

During the quarter we added three new names and exited seven existing positions, including the following:

- We initiated a new position in Pfizer (PFE) in the health care sector. In addition to helping to balance our exposure to more cyclical sectors of the market, Pfizer’s strong windfall from its COVID-19 vaccines has swelled the company’s free cash flow to a magnitude we feel is not adequately reflected at its current valuation. The inundation of cash into Pfizer’s war chest leaves it well- positioned to buy ample assets to refill and expand its pharmaceutical pipeline. In that sense, the recent market downturn has created even greater long-term opportunities, as many biotechnology stocks are now much more attractively valued for potential acquisition. We believe that its inclusion to the portfolio provides both short-term insulation from further market pullbacks and long-term value creation opportunities.

- We exited our position in Owens Corning (OC), in the industrials sector, a manufacturer of insulation, roofing and fiberglass materials used in the home construction industry. The rapid rise in interest and mortgage rates during the quarter, combined with surging home prices, have cast a shadow over the prospects of continued expansion in the home construction industry. While the company has thus far been able to successfully pass-through increases in material input costs to its customers, a slowdown in the home construction industry could make its ability to sustain its current margins a significant challenge. As a result, we elected to exit the position in favor of other opportunities we believe have greater resilience against challenging macro factors.

- We also exited our position in Reynolds Consumer Products (REYN), in the consumer staples sector. The company’s products are heavily reliant on commodity inputs such as aluminum and resin, which have seen significant inflation-related price increases over the last few quarters. Additionally, Reynold’s focus on the premiumization of its products such as scented trash bags and reinforced aluminum foil makes them more vulnerable to a shift in consumer preferences towards generic and store-brand options as inflation continues to erode consumer purchasing power. We feel this trend is emblematic of many companies within the sector and has been a contributing factor in the challenges of finding attractively valued companies with strong pricing power within consumer staples. As a result, we elected to exit the position in favor of other opportunities we feel are better positioned to leverage current market conditions to improve fundamentals and capture market share.

Outlook

Recently, ClearBridge’s Chief Investment Officer Emeritus and Portfolio Manager Hersh Cohen remarked that we are becoming some of the “old” portfolio managers of the firm. We found this banter to be incredibly complimentary, as Hersh points out that that grey hair and survival matter in this very challenging profession. Over our tenure, we have navigated three recessions, and are staring at our fifth bear market. Despite these sometimes-painful lessons, one point has remained remarkably clear: bear markets are ultimately where new opportunities arise. We are well-positioned to observe and will act accordingly.

Portfolio Highlights

The ClearBridge All Cap Value Strategy underperformed its Russell 3000 Value Index during the second quarter. On an absolute basis, the Strategy had losses across all 11 sectors in which it was invested during the quarter. The leading detractors were the financials, industrials and information technology (IT) sectors, while the real estate sector was the top performer.

On a relative basis, overall stock selection and sector allocation effects detracted from relative performance. Specifically, stock selection in the industrials and consumer staples sectors, an overweight to the IT sector and underweight allocations to the health care and consumer staples sectors weighed on returns. Conversely, stock selection in the energy, consumer discretionary and IT sectors as well as an overweight to the energy sector benefited performance.

On an individual stock basis, the biggest contributors to absolute returns in the quarter were Murphy USA (MUSA), T-Mobile US (TMUS), AutoZone (AZO), UnitedHealth (UNH) and Suncor Energy (SU). The largest detractors from absolute returns were Signature Bank (SBNY), Six Flags Entertainment (SIX), Wells Fargo (WFC), OneMain (OMF) and American International Group (AIG).

In addition to the transactions listed above, we initiated positions in Capital One (COF) and Western Alliance Bancorp (WAL) in the financials sector. We also exited positions in NetApp (NTAP) and Vontier (VNT) in the IT sector, Curtiss-Wright (CW) and Sensata Technologies (ST) in the industrials sector and U.S. Bancorp (USB) in the financials sector.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment