Eric Francis

Foreword

Dan Burrows and Kyle Woodley say in Kiplinger Investing:

The Berkshire Hathaway portfolio is a diverse set of blue chips and, increasingly, lesser-known growth bets. Here’s a look at every stock picked by Warren Buffett and his lieutenants.

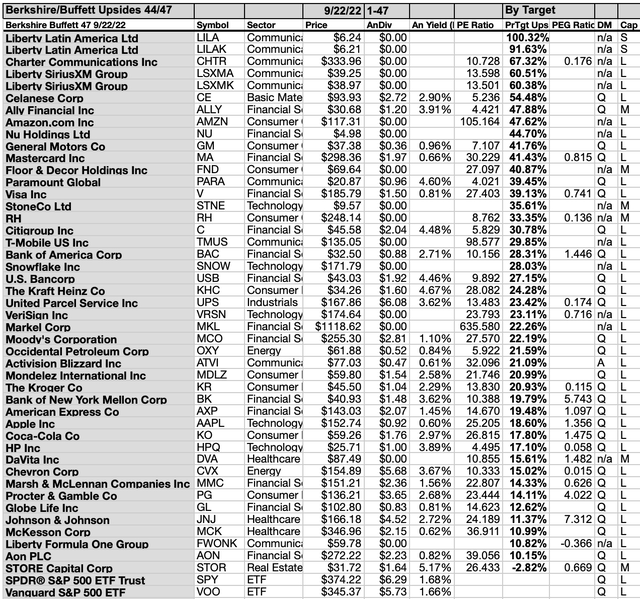

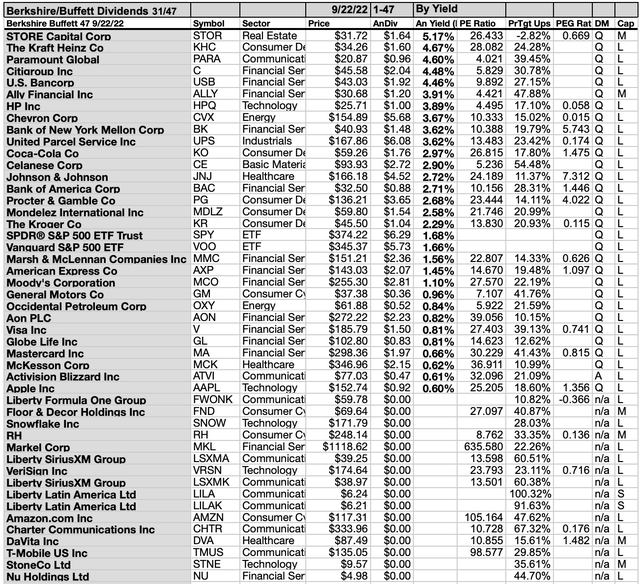

Any collection of stocks is more clearly understood when subjected to yield-based (dog catcher) analysis, this Buffett/Berkshire batch is perfect for the dogcatcher process. Here is the August 16 data for 31 dividend paying stocks in the Kiplinger-documented collection of 47 currently owned by Buffett through his Berkshire-Hathaway firm.

Another resource consulted for this article was dogsofthedow.com which also keeps an ongoing spreadsheet of the Buffett/Berkshire stocks updated quarterly per BRK SEC filings, the next of which reports in November.

A rapid market recovery after the Ides of March 2020 plunge made the possibility of owning productive dividend shares reflecting this collection less viable for first-time investors.

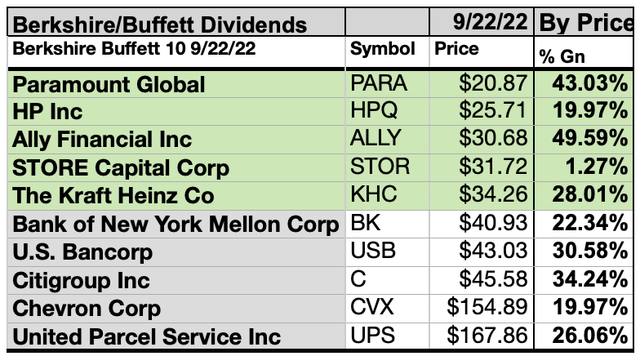

This September 2022 update shows that the following six top dogs of Berkshire stocks now live up to the dogcatcher ideal of paying annual dividends (from a $1K investment) exceeding its single share prices: STORE Capital Corporation (STOR); The Kraft Heinz Co (KHC); Paramount Global (PARA); U.S. Bancorp (USB); Ally Financial Inc (ALLY); HP Inc (HPQ).

Two more are within $3.00 or 6% of the ideal: Bank of New York Mellon (BK) at 5.96%, and Citigroup Inc (C) at 0.86%. Those are the stocks showing price decreases that would pay dividends at current payout levels from $1k invested equaling their single share prices.

To run-down the ‘safer’ dividends of those six and two more, check-out the Dividend Dog Catcher marketplace site after September 30.

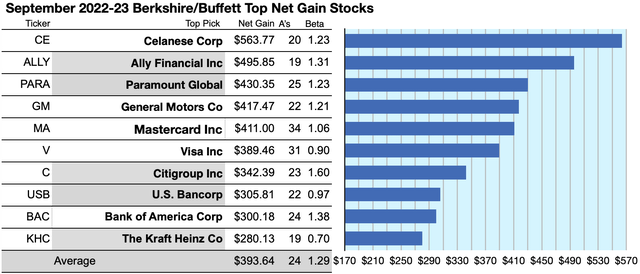

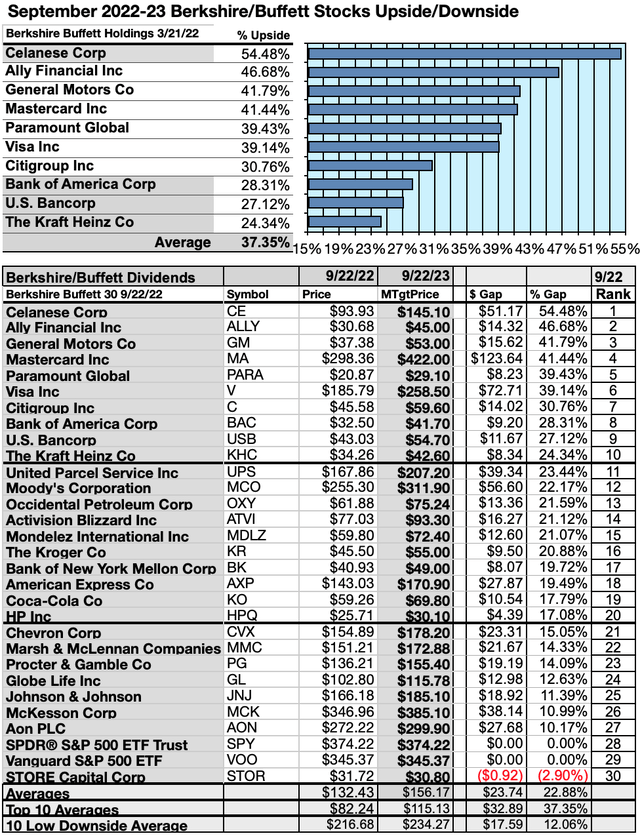

Actionable Conclusions (1-10): Analysts Estimated 28.01% To 58.28% Net Gains For Ten Top Buffett-Held Dividend Stocks Come September, 2023

Five of these ten Buffett-held top dividend stocks by yield were also among the top ten gainers for the coming year based on analyst 1-year target prices. (They are tinted gray in the chart below). Thus, this yield-based forecast for these Buffett dogs was graded by Wall St. Wizards as 50% accurate.

Estimated-dividends from $1000 invested in each of these highest-yielding stocks and their aggregate one-year analyst median target-prices, as reported by YCharts, produced the data points for the projections below. Note: one-year target prices by lone-analysts were not applied. Ten probable profit-generating trades projected to September 22, 2023 were:

Celanese Corp (CE) netted $563.77 based on the median of estimates from 20 analysts, plus dividends. The Beta number showed this estimate subject to risk/volatility 23% greater than the market as a whole.

Ally Financial Inc was projected to net $495.85, based on the median of target estimates from 19 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 31% higher than the market as a whole.

Paramount Global was projected to net $430.35 based on dividends, plus the median of target price estimates from 26 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 23% greater than the market as a whole.

General Motors Co (GM) netted $417.47 based on the median of estimates from 22 analysts, plus dividends. The Beta number showed this estimate subject to risk/volatility 21% greater than the market as a whole. Yes, GM now pays a dividend again!

Mastercard Inc (MA) was projected to net $411.00, based on the median of target price estimates from 34 analysts, plus annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 6% greater than the market as a whole.

Visa Inc (V) was projected to net $389.46 based on a median of target price estimates from 31 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 10% under the market as a whole.

Citigroup Inc was projected to net $342.39, based on the median of target price estimates from 23 analysts plus annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 60% over the market as a whole.

U.S. Bancorp was projected to net $305.81, based on a median of target price estimates from 22 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 3% under the market as a whole.

Bank of America Corp (BAC) was projected to net $300.18, based on dividends, plus the median of target price estimates from 24 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 38% greater than the market as a whole.

The Kraft Heinz Co was projected to net $280.12 based on dividends, plus the median of target price estimates from 19 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 30% under the market as a whole.

The average net gain in dividend and price was estimated at 139.36% on $10k invested as $1k in each of these ten stocks. These gain estimates were subject to average risk/volatility 29% over the market as a whole.

Source: Open source dog art from dividenddogcatcher.com

The Dividend Dogs Rule

Stocks earned the “dog” moniker by exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as “dogs.” More precisely, these are, in fact, best called, “underdogs”.

47 Buffett Holdings By Target Gains

30 Buffett Picks By Yield

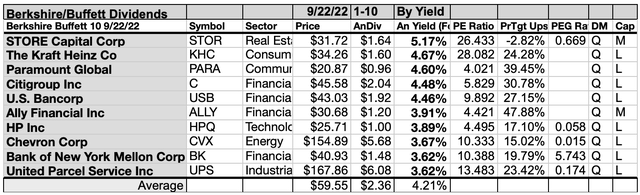

Actionable Conclusions (11-20): 10 Top Buffett-Held Stocks By Yield Are The Dogs of Berkshire-Hathaway

Top ten Buffett-held stocks selected 9/22/22 by yield represented seven of eleven Morningstar sectors.

First place went to the lone real estate company STORE Capital Corp [1]. Next, the lone consumer defensive sector representative placed second, The Kraft Heinz Co [2]. Then, the one communication services company placed third, Paramount Global [3].

Four dogs from the financial services sector, placed fourth, through sixth, and ninth: Citigroup Inc [4] U.S. Bancorp [5], Ally Financial Inc [6], and Bank of New York Mellon Corp [9].

One from the technology sector, placed seventh, HP Inc (HPQ) [7], and taking eighth was one from the energy sector, Chevron Corp (CVX) [8], and finally, the lone industrial stock placed tenth, United Parcel Service (UPS) [10], to complete the September Buffett/Berkshire top ten dividend dogs, by yield.

Actionable Conclusions: (21-30) Top-Ten September Berkshire/Buffett Dogs Showed 24.34%-54.48% Upsides, While (31) Two Showed Downsides of -2.90% to -17.83%.

To quantify top-dog rankings, analyst median price target estimates provided a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, analyst median price target estimates became another tool to dig out bargains.

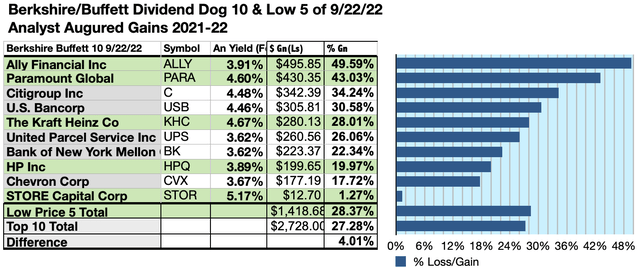

Analysts Forecast A 4.01% Advantage For 5 Highest Yield, Lowest Priced, Of 10 Top Buffett-Collected Dividend Stocks To September, 2023

Ten-top Buffett/Berkshire dividend dogs were culled by yield for this update. Yield (dividend/price) results provided by YCharts did the ranking.

As noted above, top ten Buffett-chosen dividend dogs screened 9/22/22 showing the highest dividend yields represented seven of eleven Morningstar sectors.

Actionable Conclusions: Analysts Predicted 5 Lowest-Priced Of The Top Ten Highest-Yield Buffett-Held Dogs (31) Delivering 28.37% Vs. (32) 27.28% Average Net Gains by All Ten Come September 22, 2023

$5000 invested as $1k in each of the five lowest-priced stocks in the top ten dividend Buffett-selected kennel by yield were predicted by analyst 1-year targets to deliver 4.01% more gain than $5,000 invested as $.5k in all ten. The third lowest-priced selection, Ally Financial Inc, was projected to deliver the best analyst-estimated net gain of 49.59%.

The five lowest-priced top-yield Buffett-backed dividend dogs as of September 22 were: Paramount Global; HP Inc; Ally Financial Inc; STORE Capital Corp; The Kraft Heinz Co, with prices ranging from $20.87 to $34.26.

Five higher-priced Buffett-picked dividend dogs as of September 22 were, of New York Mellon Corp; US Bancorp; Citigroup Inc; Chevron Corp; United Parcel Service, whose prices ranged from $40.93 to $167.86.

The distinction between five low-priced dividend dogs and the general field of ten reflected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of projected gains based on analyst targets added a unique element of “market sentiment” gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, since analysts are historically only 20% to 90% accurate on the direction of change and just 0% to 15% accurate on the degree of change (within 2.5%).

Afterword

If somehow you missed the suggestion of the six stocks ready for pick-up at the start of the article, here is a reprise of the list at the end:

This September 2022 update shows that the following six top dogs of Berkshire stocks now live up to the dogcatcher ideal of paying annual dividends (from a $1K investment) exceeding its single share prices: STORE Capital Group; The Kraft Heinz Co; Paramount Global; U.S. Bancorp; Ally Financial Inc; HP Inc.

Two more are within $3.00 or 6% of the ideal: Citigroup Inc at 0.86%, and Bank of New York Mellon at 5.96%. Those are the stocks showing price decreases that would pay dividends at current payout levels from $1k invested equaling their single share prices.

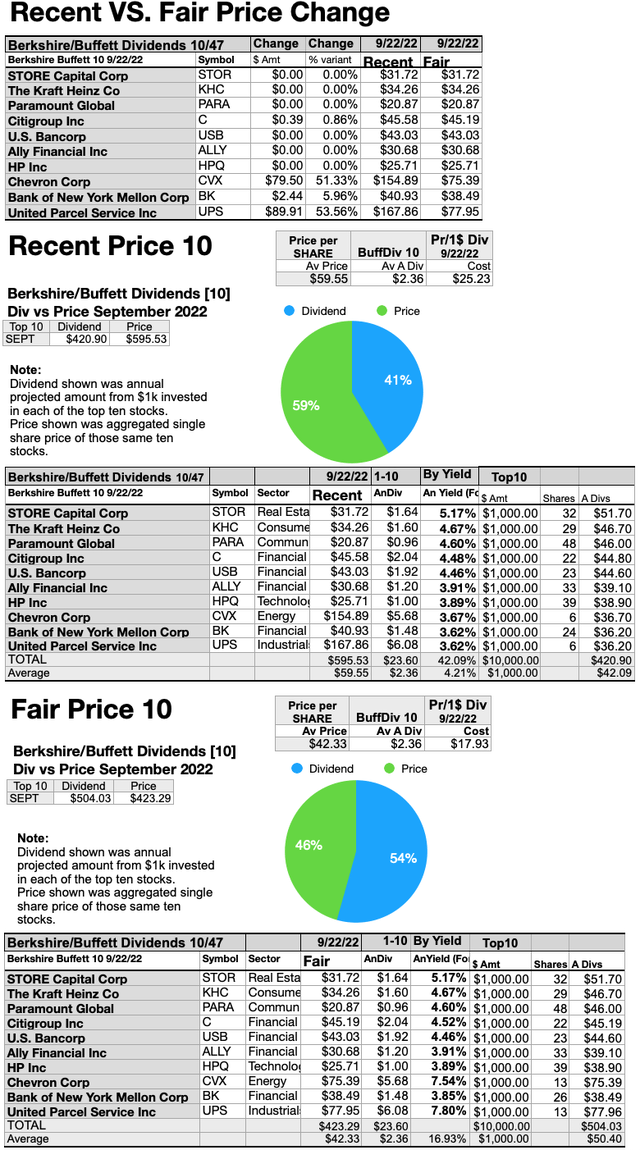

Price Drops or Dividend Increases Could Get All Ten Dogs of Buffett Back to “Fair Price” Rates For Investors

The charts above retain the recent dividend amount and adjust share price to produce a yield (from $1K invested) to equal or exceed the single share price of each stock. As you can see, this illustration shows the six fair priced dogs in the top ten (STOR, KHC, PARA, USB, ALLY, HPQ), plus four out-of- bounds-priced stocks (CVX; C; BK; UPS). The outliers need to trim prices between $0.39 and $89.91 to realize the 50/50 goal for share prices equalling dividend payouts from $10k invested.

The alternative, of course, would be for these companies raise their dividends. That, of course, is a lot to ask in these highly disrupted, dollar-flooded, understaffed, short-supplied, and inflationary times.

Market action is the key. Two more only need to drop 54% to become Buffet Ideal dividend dogs.

The net gain/loss estimates above did not factor-in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Stocks listed above were suggested only as possible reference points for your Buffett/Berkshire batch stock purchase or sale research process. These were not recommendations.

Disclaimer: This article is for informational and educational purposes only and should not be construed to constitute investment advice. Nothing contained herein shall constitute a solicitation, recommendation or endorsement to buy or sell any security. Prices and returns on equities in this article except as noted are listed without consideration of fees, commissions, taxes, penalties, or interest payable due to purchasing, holding, or selling same.

Graphs and charts were compiled by Rydlun & Co., LLC from data derived from www.indexarb; YCharts.com; finance.yahoo; analyst mean target price by YCharts. Open source dog art from dividenddogcatcher.com.

Be the first to comment