StockPhotoAstur

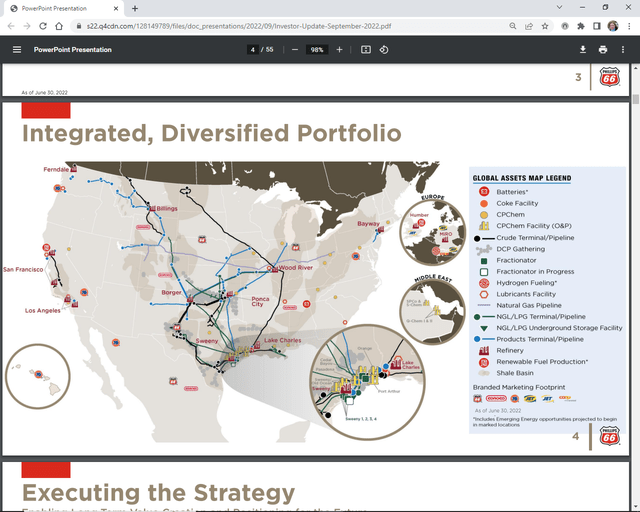

Phillips 66 (NYSE:PSX) operates and reports in four segments: a) midstream, b) oil refining, c) chemicals (50% of CPChem), and d) marketing and specialties. It owns and operates twelve refineries worldwide, including ten in the US comprising 9.4% of the country’s capacity, one of which (Rodeo in the San Francisco area) it is converting to renewable fuels.

Dividend hunters may like Phillips 66 for its 5.1% dividend. Others who trade short-term may benefit from expected strong 3Q22 earnings. In this respect, the company’s price/earnings ratio looks like a bargain.

However, for long-term growth investors—who may also want to wait out the current market slide—I suggest Phillips 66 as a “hold,” a down-rank from my prior “buy.” Oil prices may strengthen after the Biden administration finishes its extra release from the Strategic Petroleum Reserve (SPR), yet in a recession gasoline demand may flatten, a double negative. PSX has made strides toward simplifying its structure, but it still has complications via various partial ownerships of its assets.

Macro Environment

Among the many cross currents in the US are inflation (particularly Fed tightening), recession, and policies implemented ahead of the November elections, such as the extended sale of oil—another 10 million barrels through October—from the SPR. To date Phillips 66 has bought 16 million, or 7.3%, of the 218 million barrels sold.

Later factors are short-term reduced global economic demand, especially in China and Europe, and policies around the Russian-Ukraine war (PSX has 1/6 ownership in a German refinery), which affect the prices of all hydrocarbons.

For example, the UK has previously said it will stop selling gasoline- and diesel-powered vehicles by 2030—which could affect Phillips 66’s Humber refinery—yet in reaction to sky-high energy prices the new Truss administration favors offshore drilling and onshore fracking, a reversal.

Moreover, some recent estimates of global hydrocarbon demand in 2030 have increased to 107 MMBPD from 100 MMBPD.

Second Quarter 2022 Results

Phillips 66 reported superlative 2Q22 earnings of $3.2 billion, or $6.53/share, compared to earnings of $582 million in the first quarter of 2022. These results were similar for all companies in refining given the exceptional post-pandemic 2Q22 transport demand.

The company had $1.8 billion of operating cash flow ($3.6 billion excluding working capital), repaid $1.5 billion in debt, and returned $533 million to shareholders via dividends and share repurchases.

The alternative fuels market is a competitive one and PSX is spending more than $850 million to enter it.

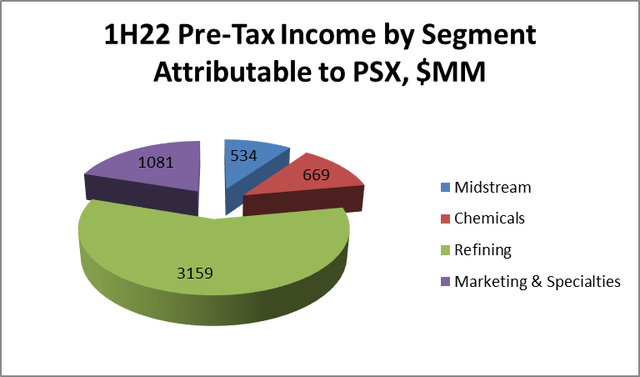

phillips66.com and Starks Energy Economics, LLC

The figure above shows pre-tax income contributions from each segment for the first half of 2022.

The company will announce 3Q22 results on November 1, 2022.

Product Demand and Refining Margins

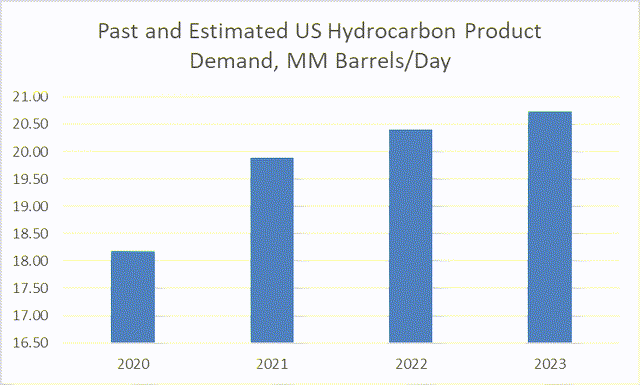

EIA and Starks Energy Economics, LLC

As shown above, the US Energy Information Administration (EIA) forecasts US consumption of hydrocarbons of 20.4 million barrels per day (BPD) for 2022 and 20.75 million BPD for 2023.

At September 23, 2022, the NYMEX oil price for November 2022 delivery is $78.74/barrel for WTI at Cushing, while Brent oil for November 2022 delivery is $86.15/barrel. Natural gas for October 2022 delivery at Henry Hub is $6.83/MMBTU.

The RBOB gasoline futures price for October 2022 is $2.38/gallon. RBOB stands for “reformulated gasoline blendstock for oxygen blending.” The heating oil futures price for October 2022 is $3.24/gallon.

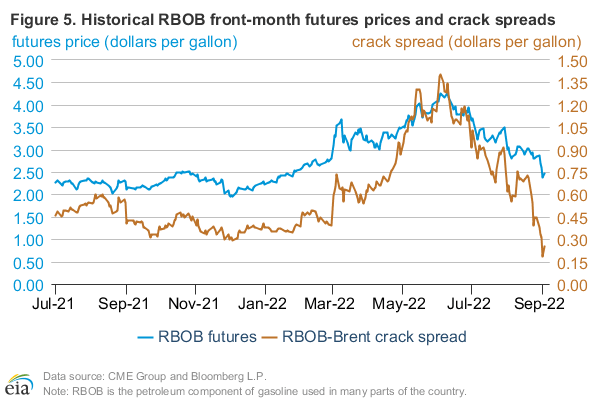

Crack spreads refer to the difference between crude oil feedstock cost (here Brent oil rather than WTI) and the value of refined products, usually gasoline, distillate (like truck diesel) or some combination of the two. As crack spreads increase, so does refining profitability.

The graph below shows the crack spread for Brent and gasoline. This spread typically declines in the fall and winter since gasoline demand is lower is less then.

EIA

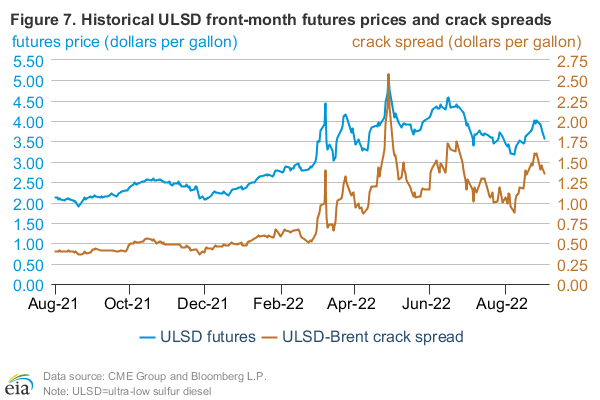

The next graph shows the crack spread for Brent and ULSD, or ultra-low sulfur diesel. It is not unusual for this to be (as 2-oil is) stronger in the winter—heating oil is a backup fuel for electric utilities in the Northeast and commercial transportation (truck diesel) stays strong. However, it is unusual for the oil-diesel crack spread to be as wide as it has been recently.

EIA

PSX has four US West Coast (USWC) refineries with over 400,000 BPD of capacity, although one is due to be closed and one is being converted to renewable fuels. (164,000 BPD of the total.) USWC gasoline crack spreads have been particularly strong recently ($60-$70/barrel). This benefits PSX and all USWC refiners.

The BP-Cenovus Toledo refinery is temporarily closed after a tragic accident and fire leading to deaths of two people and injuries to others. It is likely other PADD 2 and PADD 3 refineries, like PSX’s, would fill any supply gaps.

Hurricane season is not yet over. Should one or more hurricanes make landfall on the US Gulf Coast (USGC), refineries in the paths will close temporarily.

Refining Operations and Competitors

Phillips 66 is headquartered in Houston. Its refineries are located in all five regional PADDs (Petroleum Administration for Defense Districts), so it competes with all US refiners. Downstream-focused competitors include PBF Energy (PBF), Delek (DK), Marathon Petroleum (MPC), HF Sinclair (DINO), and Valero (VLO). Integrated companies with refineries include Exxon Mobil (XOM), BP (BP), Chevron (CVX), and Shell (SHEL).

Among its twelve refineries, the company has total crude capacity of 1.96 million BPD, which will decline to 1.84 million BPD when the San Francisco refinery is converted to renewable fuels, with commercial operations beginning in 2024. None is a mega-refinery (500,000 BPD or more): the largest are 250,000-265,000 BPD. One refinery, in which Phillips owns 18.75%, is in Germany; a second is in the U.K. Thus, Phillips’ US capacity now is 1.68 million BPD, or 9.4% of the US total of 17.9 million BPD.

In the renewable diesel segment of the renewable fuels market—primarily California—PSX faces considerable competition from more-established players, notably Valero in its Diamond Green renewable diesel joint venture with Darling Ingredients (DAR). In California, Marathon Petroleum is converting its Martinez refinery to renewable diesel in a joint venture with Neste Oyj.

Midstream, Chemicals, and Marketing

The midstream segment includes 22,000 miles of pipelines used in crude and refined products transportation, storage and processing along with the same services plus marketing for natural gas liquids and natural gas. This includes the company’s investment in DCP Midstream and its 16% interest in NOVONIX. It recently traded with Enbridge a smaller interest in Gray Oak Pipeline (from 42.23% to 6.5%) for a larger interest in DCP Midstream (28.26% to 43.31%). It has also tendered publicly for the DCP Midstream LP units it does not own.

Prior to this, the company also bought back and folded in the one-fourth interest in PSXP it didn’t own. These assets comprise pipelines, terminals, storage caverns, and rail rack facilities which were already integrated with Phillips 66 refineries.

The chemicals segment is Phillips 66’s 50% investment in Chevron Phillips Chemical (CP Chem), headquartered in The Woodlands, Texas. CP Chem owns or joint ventures in two research centers and 28 manufacturing plants located in North America and the Middle East (none in Europe) which make and market petrochemicals and plastics worldwide.

Via the marketing segment, Phillips 66 sells gasoline, diesel, aviation fuel, and renewable fuel through more 7100 retail outlets in the US and 1700 international outlets. Brands include Phillips 66, Conoco, 76, and Jet. It also sells specialty base oils and lubricants.

The diagram below shows Phillips 66’s operations.

phillips66.com

Governance

On August 31, 2022, 2.2% of floated Phillips 66 stock was shorted. A small 0.45% of the stock is held by insiders.

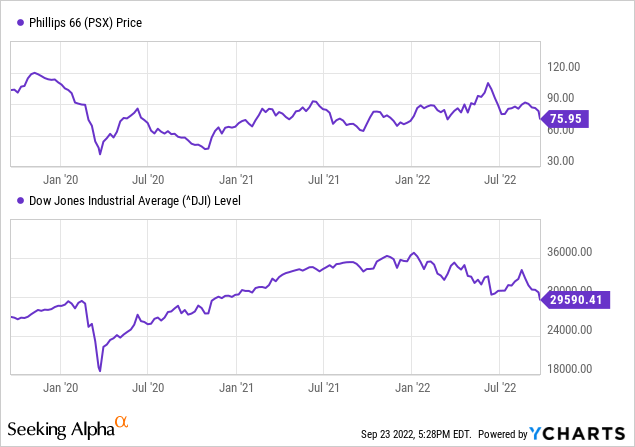

The company’s beta is 1.38, measurably above the market average. Macro factors in feedstock and product pricing combine to produce this higher-than-expected volatility, given the company’s large size.

On September 1, 2022, Institutional Shareholder Services ranked Phillips 66’s overall governance as a weak 9. Sub-scores were audit (8), board (8), shareholder rights (9), and compensation (8). On the ISS scale, 1 represents lower governance risk and 10 represents higher governance risk.

As of August 2022, Phillips 66’s ESG ratings from Sustainalytics were “medium” with a total risk score of 29 (61st percentile), similar to that of Marathon Petroleum and Valero. For PSX, the component parts are environmental risk 16.4, social 7.0, and governance 6.0. Controversy level is 3 (significant) on a scale of 0-5, with 5 as the worst.

On June 29, 2022, the five largest institutional stockholders, some of which represent index fund investments that match the overall market, were Vanguard (10.3%), Blackrock (7.9%), State Street (6.8%), Wells Fargo (3.5%), and Fidelity/FMR (2.1%).

Financial and Stock Highlights

Market capitalization is $36.56 billion at a September 23, 2022, stock closing price of $75.99/share, or 68% of the one-year target price of $111.07.

The company’s 52-week price range is $67.08-$111.28 per share, so the closing price is also 68% of the 52-week high.

Phillips 66 pays a dividend of $3.88/share for a yield of 5.1%.

Trailing twelve months’ earnings per share (EPS) is $11.80 for a price/earnings ratio of 6.4. The averages of analysts’ 2022 and 2023 EPS estimates are $16.30 and $11.66 respectively, giving a forward price-earnings ratio of 4.7 for 2022 and 6.5 for 2023.

Not surprisingly, as virtually all refiners experienced stellar second quarters, the company’s trailing twelve-month return on assets was 5.9% and return on equity was a large 25.2%.

The graph below shows the difference between the patterns for Phillips 66 stock and the Dow Jones Industrial Average during the last three years.

On June 30, 2022, PSX had $38.2 billion in liabilities, including $12.4 billion of long-term debt and $17.8 billion in current liabilities (of which $12.5 billion was accounts payable), and $62.8 billion in assets giving Phillips 66 a less-than-flexible liability-to-asset ratio of 61%.

The company’s ratio of debt to EBITDA is 1.8. The ratio of enterprise value to EBITDA is 6.9, well below the maximum of 10.0 thus suggesting a bargain.

Trailing twelve-months’ operating cash flow is $6.92 billion and levered free cash flow is $1.86 billion.

The mean analyst rating is a 2.7, or “hold,” from nineteen analysts.

Notes on Valuation and Risks

The company’s book value per share of $50.46 is two-thirds of its market price, signaling positive investor sentiment.

The biggest exposures for Phillips 66 are recessionary declining demand of gasoline and chemicals and cost inflation particularly for oil, natural gas, and gas liquids feedstocks costs. Higher oil prices may result from a decline in Russian output, tighter OPEC supplies, the Biden administration’s anti-hydrocarbon policies—as seen, for example in the EPA’s rejection of a permit for PSX’s Bluewater export terminal–and the decline in nearby supply once the US is no longer selling oil out of the Strategic Petroleum Reserve.

Recommendations for Phillips 66

With the market falling due to current and expected increases in the fed funds rate and growing evidence of US recession, many investors will be uncomfortable adding to equity positions.

Nonetheless, dividend hunters may like the company’s 5.1% dividend. The stock may see a short-term bump on good 3Q22 earnings, bargain price/earnings ratio, high winter diesel and west coast crack spreads, geographically diversified crude supply and operations, and the Biden administration’s further release of crude oil from the SPR before the election.

At present, Phillips 66 has many parts: half a chemicals company, half of two refineries, a fifth of a German refinery, one shuttered refinery and another about to be, a refinery conversion to renewable fuels, and partial ownership of DCP Midstream, among others. The alternative fuels market is a competitive one and PSX is spending more than $850 million to enter it. It also has a substantial debt load ($12.4 billion of debt and $17.8 billion of current liabilities) as of June 30, 2022.

I am changing my recommendation of PSX stock from “buy” to “hold.”

phillips66.com

Be the first to comment