BlackSalmon

Recent data for the US economy reflect a mixed profile, but several widely followed business-cycle indicators are screaming recession.

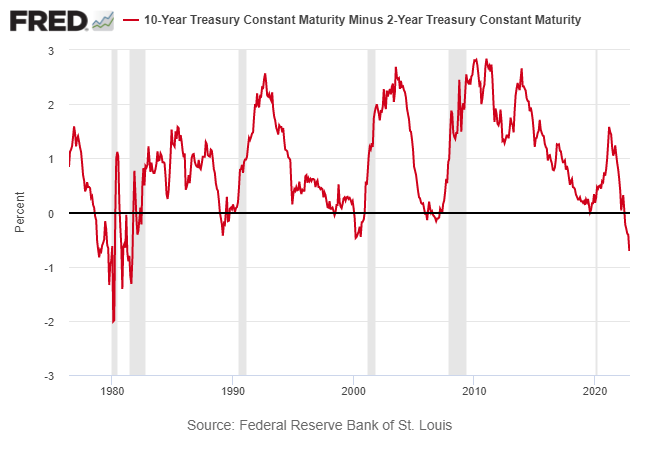

A pair of Treasury yield curves are signaling that the odds are high that a period of economic contraction is approaching. The spread for the 2- and 10-year Treasury on Wednesday (Nov. 22) edged deeper into negative terrain, slipping to -0.71 percentage points, a new four-decade low. The 3-month/10-year spread is also negative. History strongly suggests that when these yield curves are inverted, as they are now, a US recession is near.

“Historically, when you get a sustained inversion like this… it’s a very reliable indicator of a recession coming,” says Duane McAllister, a senior portfolio manager at US firm Baird Advisors.

It could be different this time, and the main source of optimism remains two pillars of US economic activity: the labor market and consumer spending. On both fronts, the latest numbers continue to point to growth.

US payrolls increased 261,000 in October, a solid gain, albeit the slowest in nearly two years. Meanwhile, retail spending picked up last month, rising 1.3% from September. Taken together, these critical indicators continue to reflect an economic expansion.

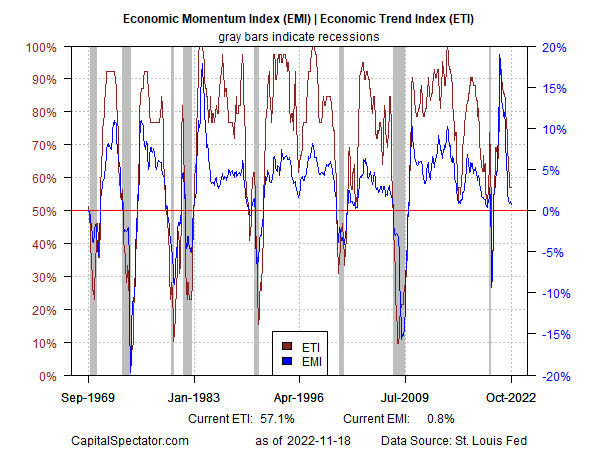

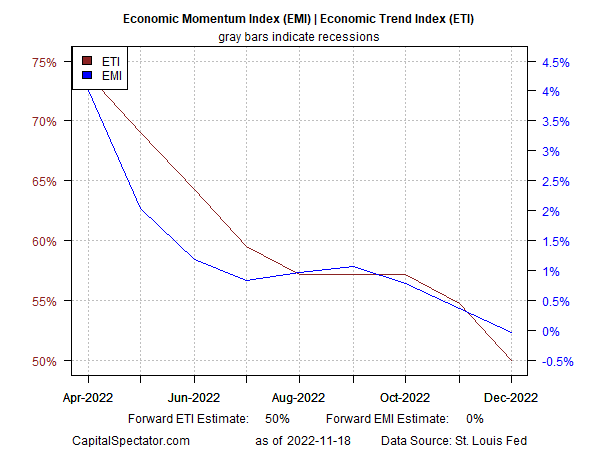

But it’s been clear for some time that growth is slowing. The deceleration has been captured in a pair of proprietary indicators published in the weekly updates of The US Business Cycle Report. In this week’s issue, the Economic Trend Indicator and Economic Momentum Indicator for October remain close to their respective tipping points that mark the start of recession.

Forward projections for ETI and EMI through December point to the possibility of flat to slightly negative economic activity.

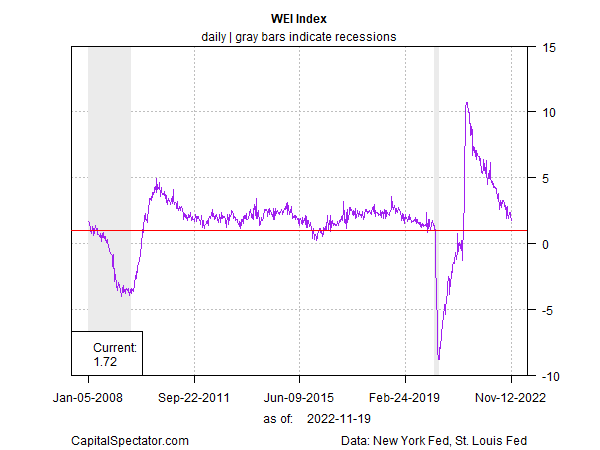

Business-cycle indicators from other sources paint a brighter picture, but only modestly. Consider the New York Fed’s Weekly Economic Index, which eased to its softest reading in a year-and-a-half. Extrapolating the recent trend suggests economic contraction will start in early 2023.

Keep in mind that the Federal Reserve is still expected to raise interest rates. The pace of hikes is projected to slow, but the effects of previous hikes and additional policy tightening will continue to strengthen economic headwinds in the months ahead.

The November and December economic numbers will be a critical test for deciding if the forces of growth succumb to contraction. For the moment, it’s too close to call in terms of timing, although the Treasury market is signaling that a new recession is near. Optimists are looking to next week’s November report on payrolls (Fri., Dec. 2) to argue otherwise.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment