Eloi_Omella

Price Action Thesis

For long-term investors who use price charts, it has been easy to marvel at NextEra Energy (NYSE:NEE) stock’s remarkable long-term uptrend.

But, its recent price structures leave us with some concerns that a deeper sell-off could be in the cards. In addition, NEE has failed to regain its medium-term bullish bias. Therefore, we believe it’s possible that NEE could be in an extended distribution phase.

Furthermore, NEE last traded at a normalized P/E well above its 5Y and 10Y averages. Therefore, the company could find it increasingly challenging to justify its growth premium if revenue or profitability growth slows down over time.

Notwithstanding, the company raised the guidance on its adjusted EPS in June, highlighting the resilience of its operating model.

We rate NEE as a Hold for now. Given its robust long-term uptrend, it’s hard to bet against NextEra. However, we believe its recent price action dynamics warrant caution. Hence, we urge investors to be patient for a better entry point.

NextEra Energy Lost Its Medium-Term Bullish Bias

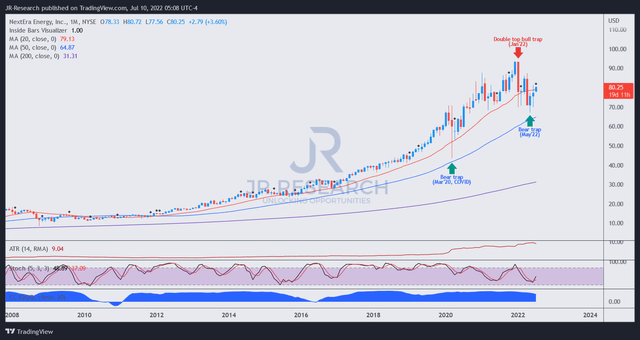

NEE price chart (monthly) (TradingView)

NEE has delivered market-beating returns for long-term investors over the past ten years. NEE handily outperformed the SPDR S&P 500 ETF (SPY) with a 5Y and 10Y total return CAGR of 20.7% and 19.93%, respectively. Therefore, long-term investors who chose to add on significant dips in its long-term trend have benefited tremendously.

Notwithstanding, a double top bull trap (significant rejection of buying momentum) formed in January 2022, which sent NEE down about 28% to its May lows. However, the menacing double top seems to be resolved by a noteworthy bear trap (significant rejection of selling momentum) in May 2022. Also, it was NEE’s first bear trap that we observed since its remarkable bear trap in March 2020. Therefore, it seems highly constructive, as the market rejected further selling decisively in May.

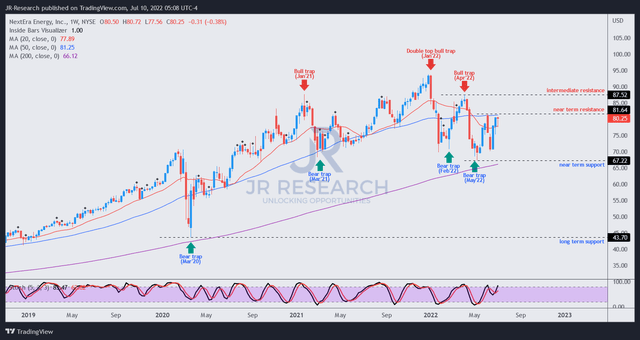

NEE price chart (weekly) (TradingView)

Moving over to its medium-term chart, we noticed that NEE had lost its bullish bias.

Investors can glean that two lower-high bull traps formed in 2022 (January’s double top and April). However, the steep sell-off triggered by the bull traps was stanched by the bear traps seen in February and May.

However, we noticed that NEE has failed to regain its upward momentum. Notably, persistent selling pressure has formed at its near-term resistance ($81.5) that has rejected further buying upside since May’s bear trap.

However, we have not observed another bull trap yet, but we cannot rule out its possibility. Therefore, it’s also plausible that the market could still be digesting the gains from January’s double top. Consequently, a steeper sell-off could follow if another lower-high bull trap forms close to its near-term resistance.

Therefore, we believe further caution is justified, as failure to regain its bullish bias is a significant warning signal for dip buyers to hold off their trigger first.

NEE’s Valuation Is Not Cheap

Furthermore, NEE last traded at an NTM normalized P/E of 33.39x. It’s well above its 5Y mean of 26.61x and its 10Y mean of 22.25x. Therefore, we believe the market could potentially digest its premium further. Investors need to consider that NEE encountered significant selling pressure when its valuation surged to more than 35x NTM P/E previously.

Is NEE Stock A Buy, Sell, Or Hold?

We rate NEE as a Hold for now.

NEE’s long-term uptrend demonstrates the market’s confidence in its underlying business model and track record of execution. However, it has failed to regain its bullish bias and is a cause for concern.

NEE continues to trade at a significant premium against its 5Y and 10Y averages. Therefore, further compression in its valuation could help NEE maintain its long-term market outperformance.

Be the first to comment