Talaj

There is a restructuring going on in the world today, a restructuring that might just really change things for the near future.

This restructuring is showing itself in the recent performance of the U.S. Dollar.

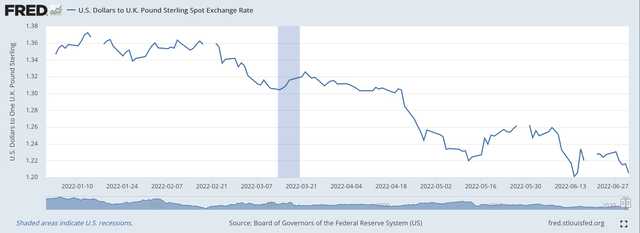

Note the recent performance of the dollar versus the British pound.

U.S. Dollar/British pound – 2022 (Federal Reserve)

Since the beginning of 2022, the value of the U.S. dollar has risen substantially against the British pound.

Great Britain is not doing so well these days.

The recent resignation of British Prime Minister Boris Johnson is evidence of the turmoil going on within the United Kingdom and the disequilibrium that England must go through in order to recover its place in the modern world.

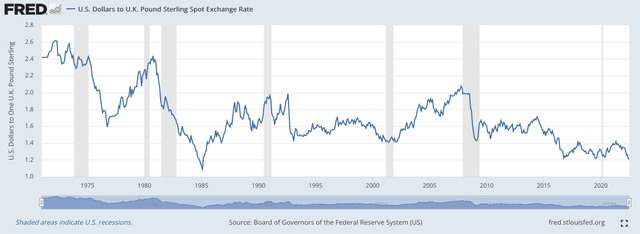

But the deterioration has been going on for a long time. Just note the overall trend in the U.S. dollar/British pound relationship since the value of the dollar was allowed to float in 1971.

U.S. Dollar/British pound exchange rate (Federal Reserve)

The trend is much more pronounced once Paul Volcker and the Federal Reserve “broke the back” of inflation in the U.S. in the early 1980s.

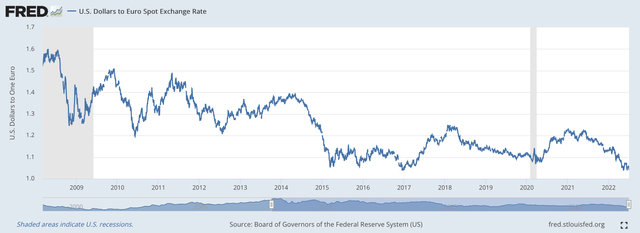

The Euro

The downward trend in the U.S. Dollar/Euro ratio has been even steadier, but only since early in 2008 and following the Great Depression.

U.S. Dollar/Euro Exchange Rate (Federal Reserve)

In both the case of the British pound and the Euro, the U.S. Dollar has become stronger since the ending of the Great Recession in 2009.

A lot has happened since the end of the Great Recession, with the U.S. economy rising relative to the economies of Great Britain and the European continent.

Just In 2022

But, there have been massive changes taking place in these economies just since the start of 2022 that are reflected in the charts.

The question that must be asked concerns the future direction of these economies.

Are the current weaknesses in Great Britain and the eurozone just a correction that will eventually reverse itself, with the pound and the Euro returning to previous levels?

Or, does the weakness in the pound and the Euro represent a re-balancing going on that will carry the value of the dollar into even stronger territory?

Chelsey Dulaney, writing in the Wall Street Journal, highlights the possibility in her headline that “Euro’s Woes Are Far From Over.”

In writing the article, she interviewed many traders and there are many who believe that parity between the dollar and the Euro will be reached and that the price of the Euro could even drop down to the $0.95 to $0.99 price range.

There was even a trader she talked with that suggested that the price of the Euro could even drop to as low as $0.90.

So much of the argument about the future value of the dollar rests on the outcome of the Ukraine crisis and how the energy supply situation evolves.

Energy

James Mackintosh, writing in the Wall Street Journal suggests that what happens in the energy area and how it is resolved will be a major factor in how the future shakes out.

Here, the European continent is begging for energy resources. The Ukrainian situation has just put Europe in an awful position with respect to the future availability of the energy it needs to remain in international competition as far as the economy is concerned.

The same is true of Great Britain.

Mr. Mackintosh reports that a major international shift has taken place in the energy strength exhibited by the United States relative to the position that England and the European continent are able to maintain.

How the Brits and the Europeans are able to resolve this dilemma, Mr. Mackintosh believes, is going to help determine whether or not the current situation is one of rebalancing or one that will produce a “correction” to return the dollar/Euro and dollar/pound back to where they were in 2021.

Central Bank Battle

But, this is not all.

Both Ms. Dulaney and Mr. Mackintosh pay attention to the fact that the central banks of each of these areas seem to be “out-of-sync” with one another with respect to where they are in terms of monetary policy.

The United States seems to be committed to a much tighter monetary policy to combat inflation than both the Bank of England and the European Central Bank.

This has been one of the major drivers of the strength of the U.S. dollar, and both authors appear to believe it will continue to be a point of difference in the future.

The main reason for the difference in policy effort has been how each central bank has interpreted the inflationary signals and how much pressure has been put on each of them to actually step up and fight the inflationary pressures.

But, there is another thing looming on the horizon.

This is the battle between the United States and China relative to which country will dominate the international monetary scene.

China is moving quickly into digital central banking and is planning to expand that into international operations.

The United States has recognized this threat over the past two years or so and responded in ways intended to maintain the strength of the U.S. dollar against the Chinese Yuan.

This battle is very, very important.

The U.S. must maintain a strong dollar through this period of competition.

In a real sense, I believe, the United States must keep its dollar strong, which means that the dollar must trade closer to parity with the Euro and the pound in the near future.

A strong dollar is in the national interest of the U.S. government.

Restructuring

So, in my mind, a restructuring must take place in the pricing of the major international currencies.

And, I believe that the leaders of the Federal Reserve must not lose sight of this goal.

This, to me, is the future!

Be the first to comment