Nicholas Smith/iStock Editorial via Getty Images

John Deere (NYSE:DE) is a company that has been around the block, or the field I should say, a few times. The company has been around for over 185 years, meaning they have been through every economic cycle you could imagine and then some.

In today’s article, we are not going to spend so much time on what the company has done in the past, but rather focus on what the company can do moving forward and the opportunity they have in front of them with the technology advancements they are working on rolling out.

As the company puts it,

John Deere is uniquely positioned to deliver both economic and sustainable value for our customers through advanced technology and solutions.”

The Primary Competition

As many of you are probably aware, John Deere is a leader in manufacturing heavy machinery and equipment within the industrial and agriculture space. John Deere and Caterpillar (CAT) are the two primary competitors within the space.

The two companies trade very similar to one another currently, as CAT trades at a market cap of $102.7 billion and DE trades at a market cap of $98.6 billion.

As it currently stands, the two companies look very similar, but that is certainly not the case over the past few years. DE has made major headway in the space, meanwhile CAT has fallen on tougher times. Over the past five years, shares of DE have climbed over 155%, nearly doubling Caterpillar’s 80% return over the same period.

CAT has much more reliance on sales outside the US than that of Deere. North America sales for DE account for over 55%, while CAT sales within the US account for only 43%.

A Growing Opportunity Ahead

When you think of a disruptor, you are going to think of a company like Tesla (TSLA) that has transformed the automotive space or a company like Amazon (AMZN) which has disrupted the retail space among other areas.

The company you are least likely to think of is probably John Deere. When thinking of John Deere, you think big, strong, diesel tractors plowing in a field. Well you would not be wrong there, but they are also a disruptor within the farming industry.

In fact, John Deere actually has a Chief Technology Officer. Jahmy Hindman is Deere’s CTO, who in an interview last year explained how the company “employs more software engineers than mechanical engineers now.” That was something very surprising to me when thinking of a company like Deere.

Mr. Hindman was hired in 2020 to focus on the company’s technology enhancements, focused around connectivity, software, data platforms, applications, and even self-driving. Yes, you heard right, self-driving tractors.

The company is pursuing a smart industrial strategy to revolutionize the agricultural sector, as described on their investor relations site:

John Deere will deliver intelligent, connected machines and applications that will revolutionize production systems in agriculture and construction to unlock customer economic value across the lifecycle in ways that are sustainable for all.”

Inserting self-driving technology into tractors can be a game changer for farmers. Although the cost will be high, the long-term gains could be huge for not only Deere but the farmers who purchase these. This new software will allow farmers to hook up a trailer behind a tractor and even start the machine and begin farming, all from a smartphone device.

Similar to that of a Tesla vehicle, the driverless tractors are equipped with multiple cameras providing a 360-degree image. With the use of the images filtered through computer algorithms, the tractor is able to alter course if needed.

Deere is expected to deliver its first driverless tractors later this year. The opportunity is robust for Deere as farmers become comfortable with the technology once it is in action.

Tech Crunch

Risks

The company has a lot going for it and is especially trading at an attractive valuation, which we will look at in a second, but it goes without saying that risks do still lurk. Even for a company the size of Deere.

Farmers are getting hit particularly hard as the costs of fertilizer, staffing costs, and other material costs have skyrocketed over the past year. All this can put pressure on a company like Deere. Do farmers have the additional capital to spend on a brand-new machine right now? That is the question they are asking themselves.

In addition to higher costs, consumer spending is poised to take a hit as well, with the economy heading towards a possible recession. However, someone like DE should not be as impacted as others because the need for their machinery is a necessity. People need food, thus have a need for agriculture, which has a need for agriculture products like Deere offers.

I think an interesting sector to keep an eye on will be housing. Deere has a sizable forestry segment, and a dip in lumber prices and/or demand could be something to keep an eye on. Construction and forestry make up roughly 25% of Deere’s revenues.

Investor Takeaway

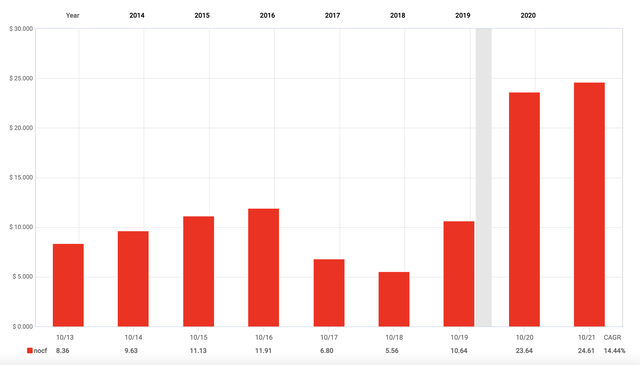

John Deere has been a great stock to own over the past few years, but it is also making a name for itself in the dividend community. Over the past few years, Deere has increased the dividend over 10% per year.

Strong cash flows have fueled the growing dividend over the past few years.

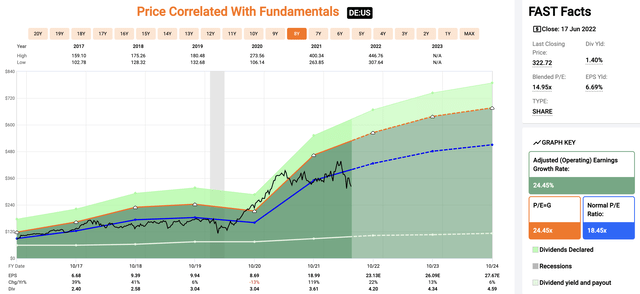

Currently, shares of DE have a dividend yield of 1.4%, which is roughly the highest levels we have seen this year.

According to FAST Graphs, analysts are expecting 2023 adjusted EPS to come in at $26.09. On a forward-looking basis, shares of DE trade at a forward P/E multiple of 12.4x. Looking at the FAST Graphs chart below, you can see that over the past five years, shares have traded closer to 18.45x, suggesting shares are extremely undervalued currently.

The upside potential with the driverless technology along with a dividend growth track record that is gaining steam makes an investment in shares of DE look quite intriguing.

Look forward to hearing your thoughts on DE in the comments below.

Be the first to comment