Sean Gallup/Getty Images News

Timing the Market subscribers had early access to this report.

International Business Machines (NYSE:IBM) reports its Q2 earnings soon.

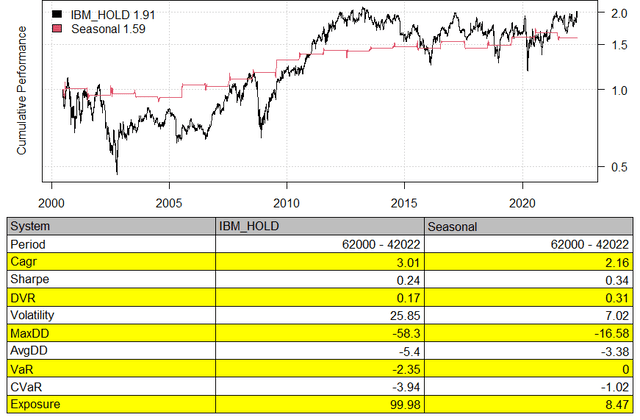

Several years back, I looked into the quarterly patterns in IBM to find that Q2 is pretty much random. Now, with six more years of data – and with honing in specifically on holding over Q2 earnings – I’ve rerun the test to find different results. Put simply, from a statistical and seasonal perspective, buying IBM before its Q2 earnings report pays off:

Even though we are holding over earnings, the max drawdown is 17%, which is only one-third as large as the buy-and-hold max drawdown, implying that holding over Q2 earnings – volatile as it may be – is actually relatively safe. The Sharpe ratio of this strategy concurs: At 42% higher than the Sharpe for buy-and-hold, simply holding IBM over Q2 earnings is a superior strategy from a risk/reward standpoint. Most interesting, however, is that Q2 earnings movements account for 65% of the upward trajectory of the stock.

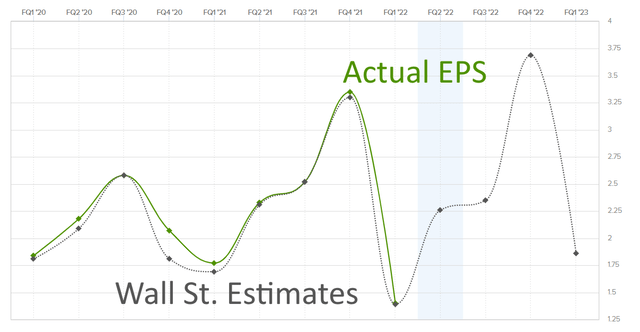

It is natural to ask why Q2 would be special here. Based on EPS patterns, IBM is a rather cyclical stock. FQ2 is when IBM returns to upward momentum in EPS, after a reliably seasonal drop in FQ1 EPS:

Q2’s EPS performance is an important piece of novel information with implications for IBM’s performance for the rest of the year. Notably, FQ2’s actual EPS tends to beat estimates and produce a significant surprise (read: stock reaction) 63% of the time, which not only helps explain the alpha produced by holding IBM over Q2 but is also a phenomenon that is reliably tradable.

Moreover, the risk/reward of this trade greatly favors the bulls. We saw above that the max drawdown of holding over Q2 is acceptable in respect to the max drawdown of buy-and-hold, but the reward, too, is bullish. The earnings movements for Q2 tend to be 85% larger for upward movements than downward movements.

Just the risk/reward of winning $1.85 for every $1.00 risk is enough to justify a trade if the probability of win is 50%. But recall that the probability of win is 63%, making this trade what we call a “phoenix” play in Timing the Market. That is, both the probability and risk/reward are in our favor, and this is the main reason I’m recommending this play.

Of course, it’s also good to know what’s going on with the company before diving into an earnings trade. We don’t want to get snagged by a one-off event, such as a sudden rise in expenses or a business restructuring.

As for IBM, perhaps the biggest happening is simply economic in nature. The economy is seemingly headed toward a recession, and Fed tightening is putting further pressure on corporate earnings. This isn’t necessarily bad for IBM, though, as the company is more of a recurring-revenue business – this is not a growth stock, and we will likely see some extra capital inflow into the stock as a defensive holding.

Arvind Krishna, CEO of IBM, stated in the last quarter’s earnings call that “demand for technology is going to sit at 4 points to 5 points above GDP. Even if GDP falls to flat or there’s a quick recession or if it’s a very slight recession, we see demand staying strong and continuing.” So, it appears that IBM is at least someone recession-proof. As the saying goes (for potential clients), “Nobody gets fired for buying IBM.”

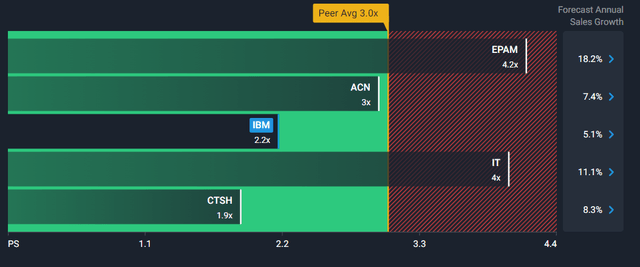

From a valuation perspective, IBM is slightly undervalued relative to its peers by several metrics, supporting the bullish thesis. For instance, IBM’s price-to-sales is about two-thirds that of the industry average:

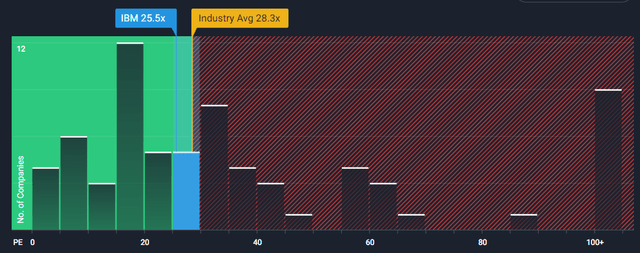

And its price-to-earnings is slightly below average:

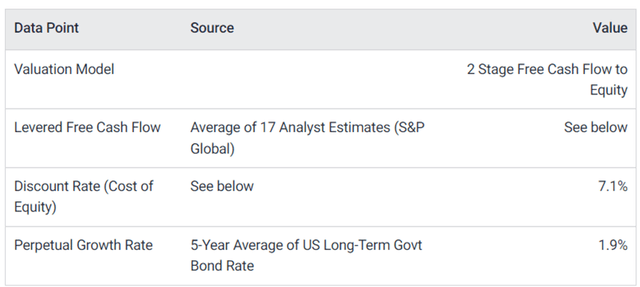

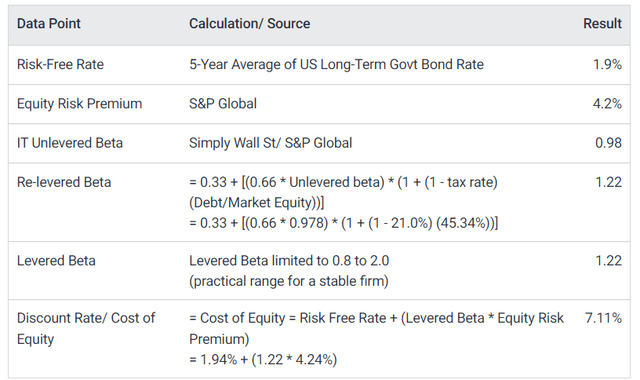

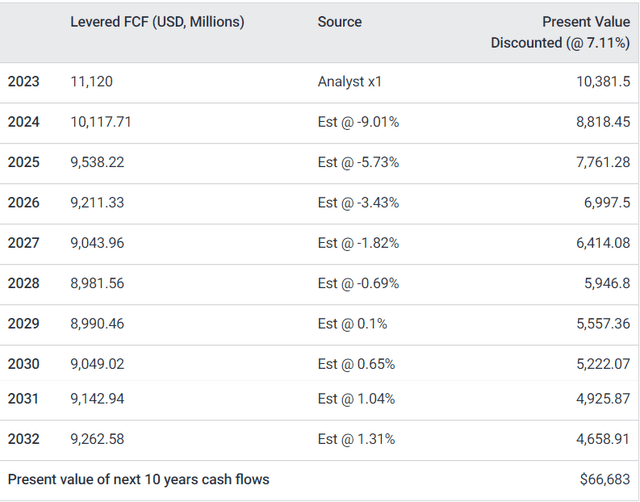

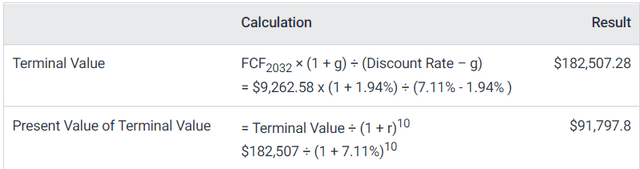

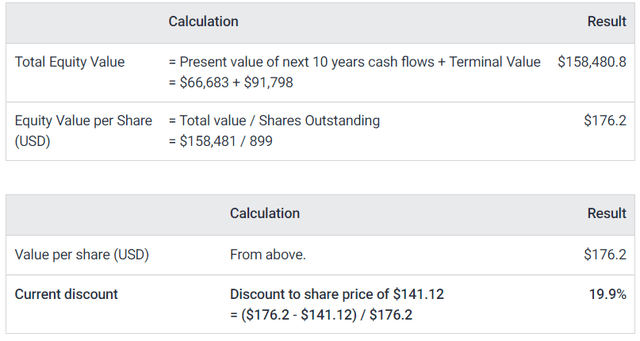

From an absolute valuation perspective, IBM has about 20% upside:

Overall, the data – including statistical, seasonal, macro, and valuation data – are highly supportive of a long position on IBM over Q2. Here is my trade idea:

- Buy Aug19 $140 call

- Sell Aug5 $155 call

The short calls are just to reduce the cost of the play; we reduce the cost by 14% by selling these short calls against the long call, at the detriment of capping our upside profit at $1500. However, we also get a positive theta from this, thereby profiting if IBM trends sideways due to the difference in time decay between the two options. Your max risk is merely the debit of the play, which is $535, at the time of writing.

Let me know if you have any questions.

Be the first to comment