Torsten Asmus

Background

Bonds can provide investors with a stream of fixed periodic interest payments and the eventual return of principal upon maturity. They play an important part in diversifying investment portfolios. 2022 was a tough year for bond funds primarily due to rising interest rates. Bonds lose price when interest rates rise. Investing in a bond ladder instead of most bond funds can minimize or eliminate portfolio losses due to rising interest rates.

A bond ladder is a portfolio of bond funds or individual bonds that mature at regular intervals and are held until they mature. Any price changes due to interest rate changes become noise that does not affect the ultimate return of the bond when it is eventually redeemed at par value. Proceeds from maturing bonds are reinvested in a new bond or bond fund that matures at a selected interval, typically one year, later than the longest bond or bond fund held.

Late 2022 Bond Ladder Analysis

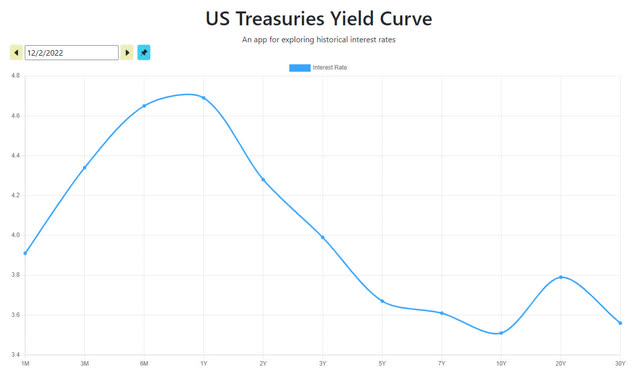

Current bond interest rates are the highest they have been in many years. The yield of U.S. Government Treasury Bonds versus their maturity is shown in the chart below. Yields at the short end are far more attractive than those at the long end. This makes a short-term bond ladder – one with bond maturities short enough that the bonds could be held to maturity – a ladder that could provide both good current yield and superior yield to maturity than a long-term bond ladder.

Treasury yield versus maturity (US Treasury Yield Curve)

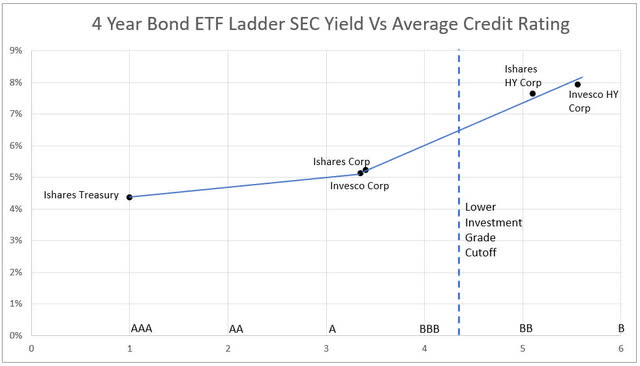

In addition to maturity length, bond yields are a function of the bond’s credit rating. Lower-quality bonds tend to offer a higher yield than higher-quality, higher credit rated bonds.

I constructed bond ladders composed of defined-term exchange-traded funds (“ETFs”) and compared those to bond ladders composed of individual bonds. I examined the impact of bond credit ratings on ladder yield. The bond ladders extended out to 4 years in length. Longer-dated bonds pick up little additional yield while increasing volatility due to fluctuating interest rates.

Exchange-Traded Bond Fund Ladders

Both iShares and Invesco offer defined-term bond funds. These are ETFs composed of bonds that all mature in a certain year.

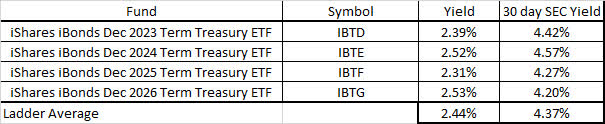

The highest quality bonds for a ladder would be US Treasury Bonds. They hold the highest credit rating – AAA. A four-year bond ladder composed of iShares defined-term Treasury Bond ETFs is shown below.

Four-year bond ladder composed of iShares defined-term treasury bond ETFs (iShares)

Yield is the current annualized payout of the bond fund and is distributed monthly by the ETFs. SEC yield is the annualized yield of the fund if held to maturity and accounts for current yield, principal changes of the bonds in the fund when held to maturity, and fund fees. The current yield was computed using the last three months of the fund’s distributions. SEC yield is from the bond fund website.

A four-year bond ladder composed of ETFs holding treasury bonds would provide an average annualized yield of just under 4.4% with virtually zero risk.

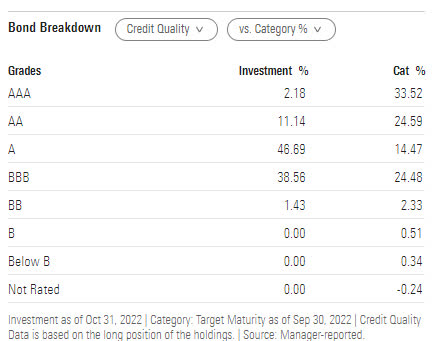

Corporate bonds offer higher yields than treasury bonds but come with lower credit ratings. The Invesco BulletShares 2023 Corp Bond ETF’s SEC yield is 4.83%, 0.41% higher than the iShares 2023 term treasury ETF. The Invesco ETF is composed of corporate bonds varying from AAA to BB rated. The credit grade composition of the ETF’s bonds is shown below.

Invesco 2023 term corporate bond ETF credit grades (Morningstar)

Assigning a grade of 1 to AAA, 2 to AA… 6 to B, the bond fund’s weighted average numerical score is 3.25 which corresponds to a weighted average credit rating of A-. A- rating indicates that the average of the bonds in the fund is the upper medium grade of investment-grade bonds. The average default rate for A- credit rating bonds between 1978 and 2008 was 0.14% per year which is a low probability of default. Further discussion of various credit ratings and default rates can be found here Bond Credit Rating.

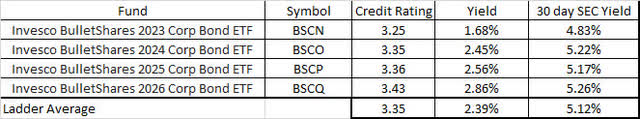

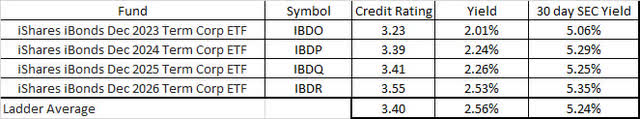

A four-year bond ladder composed of Invesco’s defined-term corporate bond fund ETFs is shown below.

Four-year bond ladder composed of Invesco’s defined-term corporate bond ETFs (Invesco, Morningstar)

A four-year bond ladder composed of iShares defined-term corporate bond fund ETFs is shown below.

Four-year bond ladder composed of iShares defined-term corporate bond ETFs (iShares, Morningstar)

The iShares corporate bond ETF ladder offers 0.12% higher SEC yield than the Invesco corporate bond ETF ladder with a slightly worse average credit rating than the Invesco ETF bond ladder.

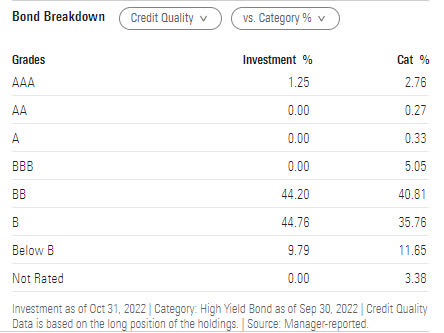

Both Invesco and iShares have defined-term high yield corporate bond ETFs. They offer higher yields than their corporate bond ETFs but with lower credit ratings. The Invesco BulletShares 2023 High Yield Corporate Bond ETF’s SEC yield is 7.19%, 2.36% higher than their 2023 term corporate bond ETF. The Invesco 2023 term high yield ETF is composed of corporate bonds varying from AAA to below B rated. The credit grade composition of the Invesco high yield bonds is shown below.

Invesco 2023 term high yield corporate bond ETF credit ratings (Morningstar)

The weighted average credit number is 5.59, which corresponds to an average credit grade of B+, which is between BB and B. A B+ rating indicates that the average credit rating of the bond holdings in their ETF fund is highly speculative non-investment grade bonds. The average default rate for B+ credit rating bonds between 1978 and 2008 was 1.22% per year. While this is much higher than the default rate of an ETF bond ladder composed of their corporate bonds, it must be noted that the fund is highly diversified with 89 holdings. With an average 1.22% default rate, the fund can expect on average about 1 bond to default per year.

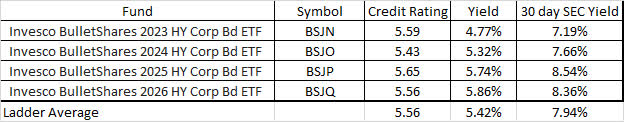

A four-year bond ladder composed of Invesco’s defined-term high yield corporate bond fund ETFs is shown below.

Four-year bond ladder composed of Invesco’s defined-term high yield corporate bond ETFs (Invesco, Morningstar)

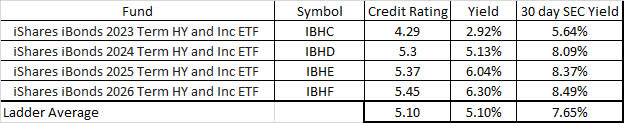

A four-year bond ladder composed of iShares defined-term high yield corporate bond fund ETFs is shown below.

Four-year bond ladder composed of iShares defined-term high yield corporate bond ETFs (iShares, Morningstar)

The iShares high yield corporate bond ETF ladder has 0.29% lower SEC yield than the Invesco corporate bond ETF ladder but with a better (BB average) credit rating than the Invesco bond ETFs.

The chart below plots each ETF ladder’s SEC yield versus the ladder’s average credit rating. BBB- bonds are the lowest-rated bonds that are considered investment grade and that line is shown on the chart.

ETF ladder SEC yield versus average credit rating (Author using vendor and Morningstar data)

Individual Bond Ladders

Another approach to a bond ladder is to directly own bonds. Holding individual bonds eliminates fees paid to bond fund managers. One should be able to cherry-pick the bond universe and select a single bond superior to the ETF’s aggregate. Holding individual bonds reduces bond diversification making a careful selection of an individual bond important.

The individual bonds presented below are from the offerings on the Vanguard website. Data is from the Vanguard website. I selected bonds with the highest Yield to Maturity with credit ratings equal to or better than the aggregate average of the ETF bond ladders above. In addition to credit ratings, Moody’s and S&P Global Ratings give credit outlooks for corporations – negative, stable, and positive. The corporate bonds selected were from companies with a stable or better credit outlook.

The highest quality bonds for an individual bond ladder would be US Treasury Bonds. The benefit of holding individual treasury bonds as opposed to a defined term ETF is one can exactly specify the maturity date and eliminate ETF fees. Diversification is not an issue as US government bonds are virtually default free. A four-year bond ladder composed of AAA-rated individual Treasury Bonds is shown below. The yield to maturity is almost identical to the term-defined treasury ETF ladder but with a higher current yield.

Four-year bond ladder composed of US Treasury bonds (Vanguard)

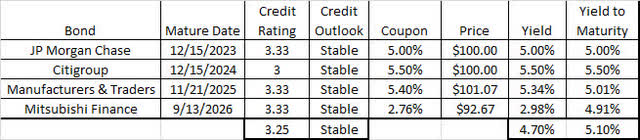

A four-year corporate bond ladder with an average credit rating equal to or better than the defined term corporate bond ETF ladder above is shown below. Credit rating and Yield to Maturity are about the same as the Invesco defined-term ETF corporate bond ladder with about twice the current yield.

Four-year bond ladder composed of investment grade company bonds (Vanguard)

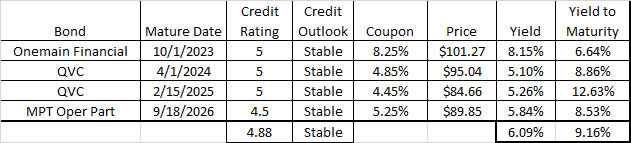

Looking at high yield bonds, a four-year high yield corporate bond ladder with an average credit rating better than the defined-term high yield corporate bond ETF ladder above is shown below.

Four-year bond ladder composed of individual high yield bonds (Vanguard)

All four companies have a stable credit outlook. The bond ladder’s aggregate credit rating, 4.88, is better than BB rating. BB-rated bonds had an average default rating of 0.81% from 1978 to 2008.

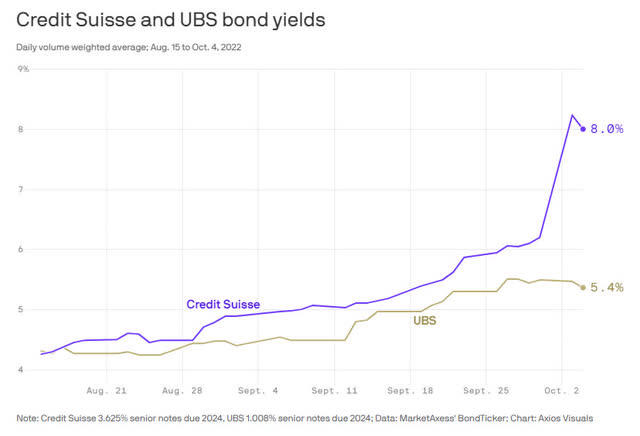

Currently, the best value in the upper medium grade of investment-grade bonds is Credit Suisse (CS) bonds. Credit Suisse is Switzerland’s 2nd largest bank. S&P Global Ratings and Moody’s recently downgraded Credit Suisse bonds one notch – from A to A- over concerns about execution risks to Credit Suisse’s recently announced restructuring plan. Both agencies stated Credit Suisse’s credit outlook is stable. The market reacted negatively to Credit Suisse’s recently announced restructuring and the price of their bonds sank driving up bond yields.

Credit Suisse recent bond yields (Axios)

From Axios: “Credit Suisse has a pretty strong capital position – but the markets are behaving as though it doesn’t.”

This might be an opportunity to pick up high credit-rated bonds with above current market yields.

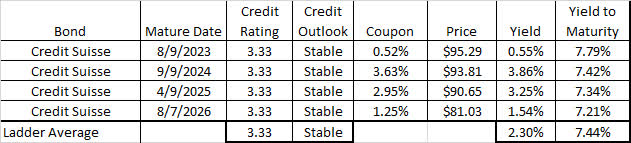

A four-year bond ladder composed of Credit Suisse bonds is shown below.

Four-year bond ladder composed of Credit Suisse bonds (Vanguard)

The ladder’s average yield to maturity is 1.65% higher than the iShares corporate ETF ladder. The ladders aggregate credit rating is A-.

Bond Ladder Summary

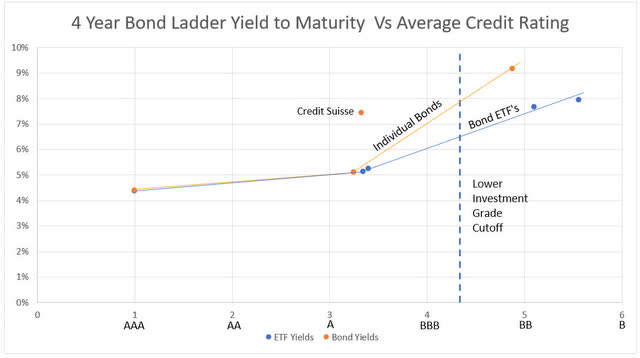

The chart below compares the SEC or Yield to Maturity of all the bond ladders discussed above against the bond ladder’s aggregate credit rating.

SEC or yield to maturity versus credit ratings for four-year bond ladders (Vanguard, Vendor website, Morningstar)

The safest bond ladder would be one composed of U.S. government treasury bonds. That would give an investor a 4.38% average yield to maturity. Substituting corporate bonds for Treasuries would increase the yield to maturity. The iShares defined term corporate bonds would yield 5.24%. The increase in yield (0.86%) is surprisingly small given the reduction in credit rating. Looking for higher yield, holding individual high yield bonds is superior to holding defined-term high yield ETF bonds.

As attractive as holding individual high yield bonds in a ladder is, I am concerned about the impact of a potential 2023 recession on those bonds. Now may not be the time to buy less than investment-grade high yield bonds. Instead of that, I will be looking to buy the Credit Suisse bonds as they offer about the same yield as the high yield ETF ladders while having substantially better credit ratings. An attractive strategy would be to hold both a Treasury bond ladder for risk-free investing plus the Credit Suisse bond ladder.

Be the first to comment