Fly_dragonfly/iStock via Getty Images

2022 has been a volatile year, with domestic equity and bond indices both sustaining significant declines. If there is a continuing flight to safety, the Dogs of the Dow are likely to outperform the broader market, and may be sensible allocations on continued weakness.

The basic Dogs of the Dow theory presumes that investing in the 10 Dow Industrial components that enter each calendar year with the highest yields is a prudent allocating strategy. The theorists note that these components should all be relatively strong companies, and that their high yields indicate that they could possibly appreciate to a higher price and also pay out the above-average dividend.

Here, I am focusing on the three dogs that have the highest current yields, though their ranking could change based upon market performance. All ten dogs do offer yields above three percent, but the highest yielding dogs are paying out around or over five percent annually.

The highest yielding Dow Dog is Verizon (VZ) which currently sports a dividend of about 5.2 percent. Verizon potentially bottomed several weeks ago, when it had a capitulatory drop following its reporting of earnings and providing reduced guidance for the rest of 2022. The drop took it from around $55 to $45 in about two weeks before finally rebounding.

Verizon daily candlestick chart (Finviz)

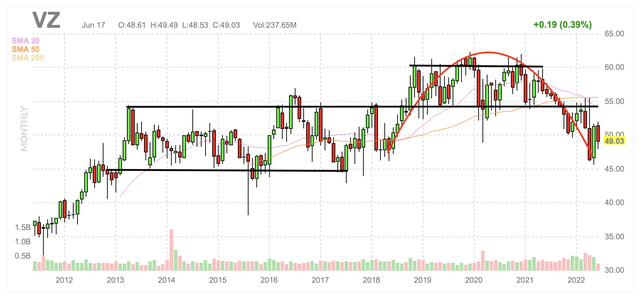

Verizon’s low P/E and well covered dividend are desirable characteristics in this apparent bear market. Further, there appears to be substantial and long-term support for the equity in the mid $40s. This has held over the last decade.

Verizon monthly candlestick chart (Finviz with added black and red marking by Zvi Bar)

It seems reasonably likely that Verizon will be continue to have strong support in the mid-$40s in the event such pricing is tested in the near term. Verizon currently has a price to earnings ratio of about 9, and a market capitalization of about $205 billion.

The second highest yielding Dog of the Dow is Dow (DOW), which yields about 5.1 percent. Dow’s core business is highly sensitive to oil and gas prices.

Dow daily candlestick (Finviz)

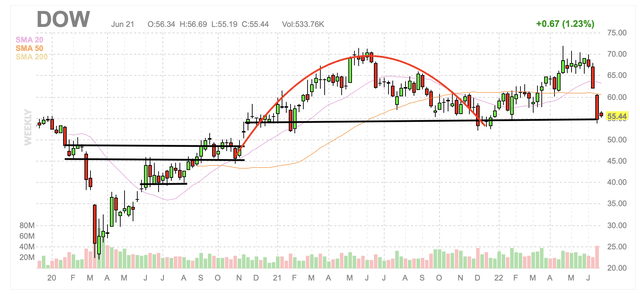

This significant drop so far in June has taken DOW from the high $60s to the mid $50s. This level is also roughly in line with where DOW bottomed in late 2021. Nonetheless, DOW appears susceptible to another leg down upon further global weakness, a guidance revision, or the possible further spiking of hydrocarbons. As a result, I am waiting for DOW to test the $40s here.

Dow weekly candlestick chart (Finviz with red and black markings by Zvi Bar)

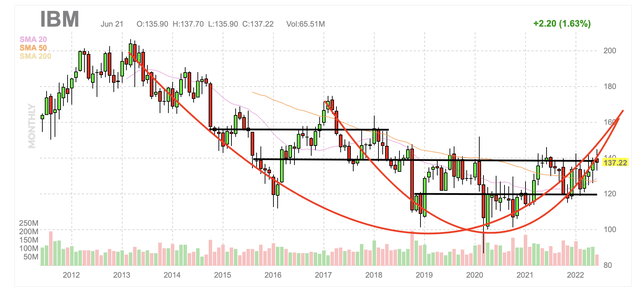

The next highest yielding Dog of the Dow is International Business Machines (IBM), which actually looks like it may be ready to break out. IBM has been in a long term downtrend, but the company reoriented itself last year with a spinoff of Kyndryl (KD), which holds IBM’s legacy infrastructure services business. Since doing so, IBM has responded well, and now appears poised to test multiyear resistance.

IBM weekly candlestick chart (Finviz)

The remaining IBM is now far more growth oriented, but also still packing a substantial dividend of about 4.9 percent. If this turn around can continue, it appears as though IBM may have the momentum to break into a higher trading range between about $140 and $160.

IBM monthly candlestick chart (Finviz with red and black markings by Zvi Bar)

IBM currently has a P/E of about 13.8. It is possible that the company will have to reduce guidance in the second half of the year, but this is not certain.

Conclusion

It appears as though all of the above mentioned equities could decline with the broader market in the case of a significant market sell-off. It is also reasonably likely that they would outperform the market on that leg lower. Beyond relative valuations, their dividends should be highly supportive here. Moreover, it seems like Verizon recently made a capitulatory bottom on the reporting of weaker guidance, and that IBM may have finally pulled itself out of a multi-year sell off.

On the other side, DOW looks like it has the potential to sustain another move down, and possibly test the mid-$40s. As for VZ and IBM, these equities look like they could benefit from a continuing flight to quality. I am looking for IBM to break through $140 and hold it on a weekly and/or monthly close before I allocate there, but such an occurrence looks close.

Be the first to comment