DNY59

Until very recently I Bonds were a hidden niche of the financial world. The first time I wrote about them, on September 13, 2021, I couldn’t even find a suitable image. Instead I chose a picture of a nice lady with a dog. My wife likes to point out that a lot of successful commercials include a dog, and that first article actually got quite a few readers and many comments asking for further details. I responded to all of the comments as I will with this article.

Why had so many otherwise well-informed and savvy investors never heard of I Bonds? One reason is that nobody has a vested interest in telling you about them. Most financial advisors don’t mention them, or didn’t until about a year ago perhaps because a professional advisor can’t make a nickel from selling them to you. Buying I Bonds is something you have to do for yourself. It isn’t hard, but it takes a little effort. You open an account at the TreasuryDirect website and learn to work with it. Being a content person I hate to have to deal with website systems to do anything. I often screw up on-line purchases and occasionally have to call upon SA editors to help me with tasks an eight-year old could do. If I managed to figure out the way to buy I Bonds, you can do it too.

What finally put I Bonds on the investment map? The simple answer is the high inflation which began to appear in the spring of 2021. Yes, it shocks me too that it ramped up so recently as the economy began to recover from the pandemic lock down. Suddenly investors became interested in inflation protection. As the inflation numbers soared I Bonds began to be mentioned in mainstream financial media as one of the ways to defend against it.

Inflation is a scourge. It has the unique ability to sneak up on investors without being noticed and wreck the purchasing power of their portfolios. In a famous 1977 Fortune article entitled “How Inflation Swindles The Average Investor”, Warren Buffett articulates with his usual eloquence how inflation is the one thing that quietly erodes value in every portfolio. It’s not just what it does to your personal dollars but the ways it damages the performance of most holdings in your portfolio. For the decade between 2011 and 2020 inflation has actually been quite tame – an average of about 1.9% annually, the lowest rate for any significant period since the 1930s (see this table). We should celebrate, right? Unfortunately, there’s this fact that you should think about: that tame 1.9% inflation rate still knocked about 21% off the value of a dollar over the past ten years.

Despite reassurance from the Federal Reserve the current burst of inflation has not proven to be transitory. It has risen to more than 9% on a year over year basis and at this moment has appeared to level off around that number. Until something changes radically, I Bonds are likely to be the best super-safe asset to counter inflation. With two months of inflation numbers yet to drop the odds are pretty high that the one year forward I Bond return will be around 8%.

What Are I Bonds And How Do They Work?

Series I Bonds are a form of US Treasury Savings Bond which produces returns adjusted for inflation – thus the I in their name. Like ordinary EE Savings Bonds, I Bonds are backed by the full faith and credit of the US government and are effectively risk-free. Savings bonds have been around since 1935. Under a temporary name change to War Bonds, US Savings Bonds helped fund World War II. They have also contributed greatly to funding education. I Bonds were initiated by the US Treasury in 1998 to provide average retail investors with a vehicle to offset inflation. By their terms they do exactly that. I Bonds are the one part of your portfolio which is guaranteed to hold its value in terms of purchasing power.

I Bonds produce returns with two components. The first is a fixed rate which provides the “real” return – real meaning adjusted for inflation. For new purchases this rate resets semiannually on May 1 and November 1, or the next business day if the first day of the month happens to fall on a holiday. Once you purchase an I Bond the “real” rate in force at that time continues for 30 years until the bond matures or until the owner chooses to redeem it. The second component of I Bond return is the inflation rate as represented by the Urban Consumer Price Index (CPI-U). The Urban CPI is used by the government for important measures such as resets of Social Security payments.

The inflation rate used for I Bonds is reset semiannually at the same time the fixed rate is reset, on May 1 and November 1. The return of I Bonds you already own compounds automatically every six months and the accrued value of your I Bond is updated. The return is not sent to you but reinvested on the TreasuryDirect site. You yourself do not have to do anything with I Bonds you already own. As for taxation the default choice on the TreasuryDirect site is to defer taxes until they are redeemed or reach maturity. For paper I Bonds it is up to you to report income year by year or do nothing and defer. As with all income from Treasury bonds, I Bonds are exempt from state and local taxes.

I’ll repeat here for the purpose of clarity that the fixed rate doesn’t change for bonds you already own but remains in place for up to 30 years. The inflation rate is updated six months after the date of initial purchase. It is then updated every six months going forward. If this seems complicated, TreasuryDirect was kind enough to provide the below table:

When Will My I Bond Change Rates?

| Month purchased and issued | New rates take effect |

|---|---|

| January | January 1 and July 1 |

| February | February 1 and August 1 |

| March | March 1 and September 1 |

| April | April 1 and October 1 |

| May | May 1 and November 1 |

| June | June 1 and December 1 |

| July | July 1 and January 1 |

| August | August 1 and February 1 |

| September | September 1 and March 1 |

| October | October 1 and April 1 |

| November | November 1 and May 1 |

| December |

December 1 and June 1 |

I Bonds Are Uniquely Flexible

You can currently buy up to $10,000 annually of electronic I Bonds in a TreasuryDirect account. That’s $10,000 per Social Security Number. You can buy the same amount for your spouse and each of your children. You can also request that up to $5000 of your Federal income tax refund be received in the form of a paper I Bond which will be mailed to you whenever the IRS gets around to sending refunds. Later in this article I will briefly discuss the Gift Box, which can serve as another way to add to I Bond purchases in a given year.

The fact that you may choose to defer taxes on I Bonds until maturity or redemption is an important feature. This may be helpful if you or your heir (whom you designate with each purchase) expect to have lower taxable income at some point in the future. Under some circumstances I Bonds are tax free when used for educational purposes – read the fine print, though. They cannot be used if purchased by individuals under the age of 24 although there is a mildly complicated way of achieving the result for younger children or grandchildren using standard education savings accounts. You can read about it in detail by googling Harry at The Finance Buff and clicking I Bonds. Use in financing education is one of the few areas where the rules for I Bonds differ somewhat from the rules for EE Bonds.

One of the most important but seldom mentioned qualities of I Bonds is that they are not only an excellent inflation hedge but can serve as a hedge against deflation as well. How could that be? The reason is that the inflation component of the composite return never dips below zero. The fixed return earned for a six-month period may dip for bonds with a positive fixed rate if inflation is negative for a full six months, but the current zero rate takes this off the board for bonds you buy right now. The most that return can drop in the event of deflation over a six month period is the amount of the fixed (“real”) return over that period.

There has been only one six month period of deflation in the history of I Bonds and in recent years the fixed rate has been minimal. With the current and recent fixed rate of zero the combined value will never drop. In the event of a deflationary period the accrued value of the I Bond would simply freeze at its highest level. When inflation returns, as it always has, the total value of the account begins to compound again from the highest level it has reached. To understand the benefit of freezing the value of an I Bond, bear in mind that in a deflationary period a given amount of money buys more goods.

I Bonds are an investment for calculating nitpickers like me, so I would feel remiss if I failed to mention their most nitpicking advantage. An I Bond purchased at any time in a month is treated as if purchased on the first day of that month. Therefore if you are transferring funds from elsewhere, you may wait until the last day of the month and capture that month’s full return. That means that in effect your first eleven months will produce the income from twelve months, about an 8% extra return. As in all dealings with government entities don’t cut it too close. Reader comments have reported unhappy outcomes when a purchase didn’t get processed until the following month.

When Can I Bonds Be Redeemed?

I Bonds are probably the most flexible investment available. This is because their duration is any date you choose from one year to their maturity date of 30 years. You cannot redeem your I Bond during the first year, but after that you can choose any moment you wish if for any reason you want to redeem your I Bond for cash. You can use them as a place to park cash for the short to intermediate term or leave them in place and continue to have an assured long-term hedge against inflation. I have never redeemed an I Bond.

For the first five years the price paid for redeeming a bond is giving up one quarter (3 months) of returns. Questions in reader comments to earlier articles prompt me to mention that the returns shown in calculators reflect these rules. For the first five years returns are reported in calculations without the last three months to reflect the fact the returns of the last three months would not be included if the I Bond were redeemed at that time.

After five years of owning an I Bond the forfeiting of one quarter’s returns no longer applies. There are, by the way, no commissions or other costs involved in buying or selling I Bonds. Paper bonds – now available only as part of your tax refund – can be bought at price intervals from $50 to $10,000 while electronic bonds may be bought in penny increments starting at $25. You could, for example, buy an I Bond with a face value $25.23.

What Are The Present Return Prospects For I Bonds?

The one-year forward prospects for I Bonds are exceptional at this moment. Until November 1, 2022, the guaranteed “real” return is zero. The inflation-based six month return for I Bonds bought before November 1 will be 4.81% (an annualized 9.62%, the headline number which many readers will remember). If buying now the first six month return will be that 4.81% through March 2023 when it will be replaced by the new rate to be announced on November1. It’s too early to know what that rate will be but for the four months through July it has been 3.05% (6.1% annualized). We will get the August number in a couple of weeks and the September number in the middle of October. Whether that adds to the 3.05% (or subtracts) remains anybody’s guess. Whatever the rate set November 1 turns out to be, it will be added to the current 4.81% to give the rate for the next year. The chances are high that it will continue to be attractive.

Don’t forget that the permanently fixed “real” rate will also be reset on November 1. For the first time in several years there is a fairly good chance that it will rise above zero by a meaningful amount. The fixed rate is set by the Treasury and is derived from market rates. The Treasury has never explained the exact process although close observers of I Bond fixed rates generally believe that it is linked to the 5-Year Treasury Note (which is not inflation adjusted). Market observers have occasionally been surprised by the number.

Since the current period of ultra low rates came into being at the depths of the 2008-2009 financial crisis, the fixed rate has most frequently been zero. There were a few six-month periods when higher Treasury rates prompted the Treasury to raise the fixed component to 0.10 or 0.20. During the brief cycle of rate increases in 2018-2019 the fixed rate was set at 0.30 on November 1, 2018, and 0.50 on May 1, 2019 (surprising some observers), before falling back to zero within a year as the 5-year Treasury yield fell sharply. With the yield on the 5-year having risen sharply in 2022 to 3.40% (as I write this line) it would not be surprising if the Treasury raised the fixed rate for I Bonds by 0.20% or more.

Under normal circumstances a generous increase in the fixed (“real”) rate might suggest waiting to buy after November 1. I will look at this closely as November 1 approaches, but my inclination would be to buy before November 1 and take advantage of the all time record 4.81% return for the first six months. You will have another opportunity to take advantage of a higher fixed rate next year before the May 1, 2023, reset.

How Do I Bonds Compare With TIPS And Ordinary Treasuries?

I Bonds and TIPS are similar in many ways. Both Treasury securities pay a fixed rate as well as an adjustment for inflation. A TIPS ETF or fund is often included in model portfolios. A 15% TIPS allocation was the amount proposed in the model put forward by the legendary Yale endowment guru the late David Swensen. That being said, TIPS have produced dismal returns for most of a decade until this year. What rescued them from often negative returns was the rise in interest rates as the Fed began to attack inflation by raising rates at all maturities. This had the effect of pulling the negative coupon rates of TIPS into positive territory.

I try to use the term TIPS as infrequently as possible because it is actually singular – Treasury Inflation Protected Security – but it sounds plural and is also commonly used as the plural by others and myself. A TIPS shares the core characteristics of I Bonds – a fixed rate combined with the inflation rate – but beyond that similarity there are important differences. The one great advantage of TIPS is that you can buy a lot of them. You can buy all you want at the monthly Treasury auctions, and you can also buy them on the open market. The advantages of TIPS pretty much end there.

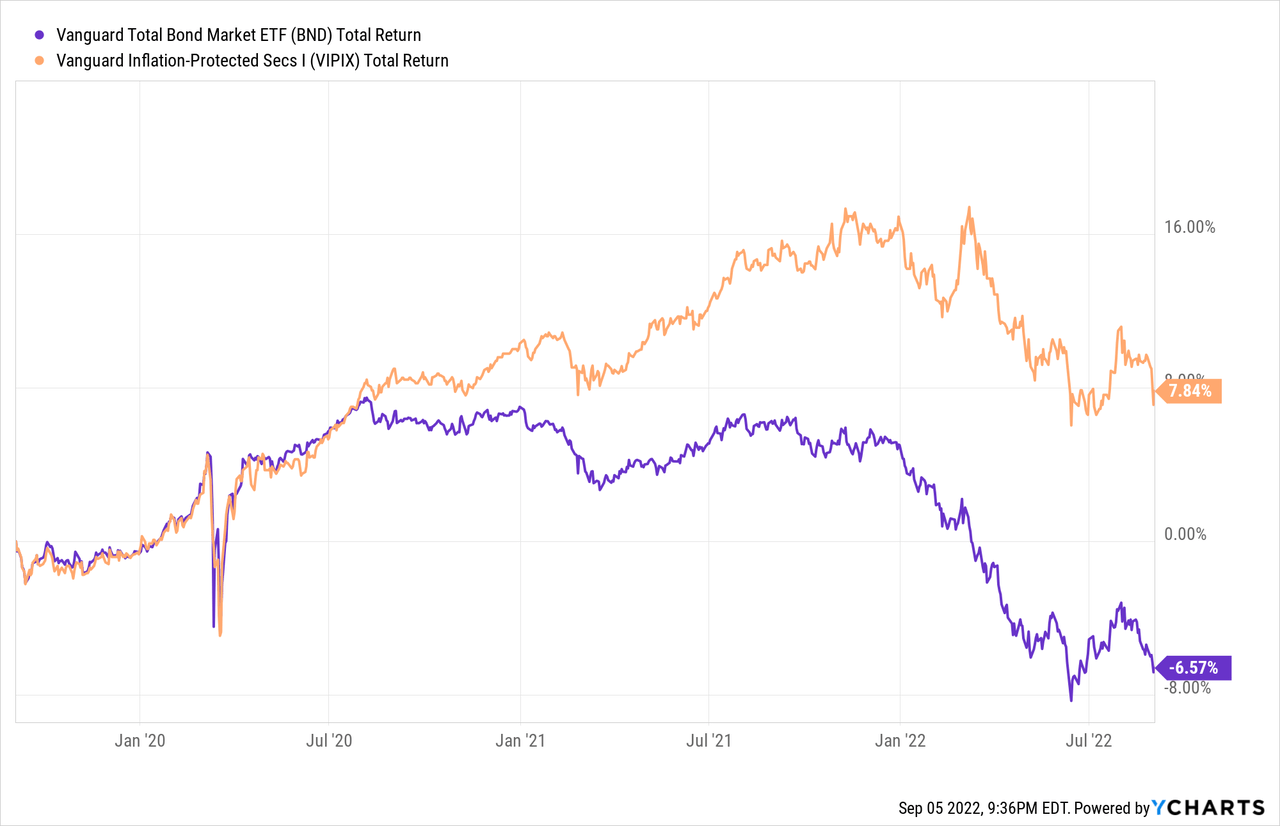

Unlike I Bonds, TIPS trade every day on the open market. This daily fluctuation is very much not an advantage to the holder. Unless you are a trader confident that you can time things in the market, the primary effect of trading is that rates may go in the wrong direction to the extent that a price decline due to higher rates overpowers the income for a given period so that you are stuck with a loss. That won’t matter to investors who are holding to maturity. If you need to sell, however, you will do so at a loss. Here’s a chart showing the Vanguard Inflation-Protected Securities Fund (VIPIX) compared to the Vanguard Total Bond Market ETF (BND). Notice the way that the same rising interest rates which dragged down the Total Bond Fund also acted as a drag on the price of Inflation-Protected Fund:

What you see in the above chart is that the TIPS price element falls along with the ordinary Treasury Bond ETF, just not quite as much. It’s a tug of war between two opposing forces, the downward tug as rising rates drag down all bond prices and the upward tug as the TIPS ETF is supported by monthly increases due to high and rising inflation. With I Bonds you know at any moment what amount you would receive if redeeming your bond for cash.

Another disadvantage to a TIPS is that the amount of value added as the inflation component does not compound as it does with I Bonds. The accrued inflation component is also subject to being dragged down if the inflation rate goes negative. In short, TIPS do not fully share the deflation protection provided by I Bonds. At the present zero fixed rate the I Bond inflation component and total value freeze in the case of deflation.

A final disadvantage of TIPS is that the income from the inflation component of a TIPS is subject to a phantom tax every year unless it is held in a tax-advantaged account. The word “phantom” is a usage meaning that you must pay tax on the income annually despite the fact that you do not receive it. Over the long term this produces a bit of a drag on TIPS returns and may be inconvenient to an income investor. I Bonds give you the opportunity to avoid this problem by electing to defer taxes until maturity. To compensate for these several disadvantages the real return fixed component of TIPS has historically been 50-75 basis points higher than the fixed return of I Bonds. This is about what it is at present.

When it comes to Treasuries and other safe investments which are not inflation-protected, investors must make a judgment call as to whether the yield on ordinary Treasuries is more or less favorable than the yield on inflation adjusted Treasuries. At current inflation levels both I Bonds and TIPS beat the yield on ordinary Treasuries or vehicles like CDs. Complicating this decision is the fact that inflation and interest rates are linked but usually with a time lag. If inflation subsides this should be followed over time by a decline in interest rates. Just to establish a base line for your thinking, over the decade of suppressed rates following the 2008-2009 financial crisis the modest 1.9% average inflation exceeded the average return on most safe fixed income.

The table below compares the current (and recent) I Bond fixed rate with the current coupon yield of TIPS and ordinary (non inflation-adjusted) Treasuries. The TIPS yield on September 13, 2022, is included because it shows how the TIPS yield has flipped to positive from deeply negative in less than a year. This shift has made TIPS more competitive with I Bonds.

| NAME | I BOND RATE | TIPS YIELD | TIPS YIELD 9/13/21 | ORDINARY TREASURY YIELD |

|---|---|---|---|---|

|

5 Year |

0.00 | +.85% | -1.83% | +3..40 |

|

10 Year |

0.00 | +.86% | -1.05% | +3.29 |

|

30 Year |

0.00 | +1.10% | -.34% | +3.45 |

Using The Gift Box To Buy When The Inflation Rate Is High

The primary advantage of TIPS is that you can easily buy them on a large scale while I Bonds can ordinarily be bought only in the annual $10K amount plus the $5K amount you can add as part of your tax refund. There is, however, one way to add to the amount you buy in a particular year.

A reader comment to a previous article prompted me to look at the Gift Box more closely. While the Gift Box cannot work to buy more I Bonds for a given Social Security Number in a given calendar year it can enable you to buy more in a year when the inflation component is high. To move the I Bond from the Gift Box into your account will then require foregoing your annual purchase in a future year. You and your wife or husband, for example, can exchange Gifts and thus double the amount you buy in a given calendar year. The rule is that you must ultimately deliver the gift to a particular individual with a Social Security Number and an established account. If the individual has already purchased $10K in a given year the Gift delivery will not be allowed. If the Gift has already been delivered in a particular year, the individual will not be allowed to buy another $10K. Sorry. That effort to double up won’t work.

There are a couple of workarounds including buying in a revocable trust or in one’s personal business. I had initially been tempted to dismiss these approaches but they can also work. The easier approach is to create a trust. I won’t go into detail here because both are complex and laborious and need to be set up well in advance. You can google The Financial Buff who answers the trust question by walking you through it.

As for the simpler strategy using Gifts, you can do it today once you understand how it works. There is a paired solution that works well, however. That’s a reciprocal arrangement between yourself and your partner. The wife-husband partnership is frequently used, or appears to be from previous reader comments, but you partner with anyone who has an account in place. As an example I partnered this year with a stepson who had additional cash he wished to put into I Bonds. We may pair up again in October when the inflation component starting November 1 will be clear. He has plenty of years to wait for a low inflation year to have the I Bonds delivered. At age 77 I hope to be able to have the Gift delivered sooner.

The premise for this strategy is to add I Bonds during a period in which inflation rates are unusually high and Deliver them in a future year when return prospects are lower. Harry at The Finance Buff wrote cogently about I Bond Gifting in this piece all readers interested in using the Gift Box should read it and pay close attention to the details it provides.

Bottom Line: I Bonds Provide Insurance Against Inflation

The number one goal of most investors is – or should be – to put money aside for future use and invest it in such a way that it will retain its purchasing power. Many investors aspire to do better than that, and under normal market conditions, it is often possible to do that with stocks and sometimes with bonds. Stocks and bonds other than Treasuries come with risks, however, and investors should never forget that their first goal – the one that must be achieved – is to preserve the purchasing power required to meet one’s future needs. It’s for this reason that inflation protected investments have an important place in most portfolios. The primary such investments with absolute safety are I Bonds and TIPS.

I have been buying I Bonds since 2000 when the real rate was 3.6%. Even better, at that time you could buy up to $30,000 in I Bonds per year per Social Security number. I realized that I had been a little slow on the uptake during the first two years I Bonds existed and jumped all over the opportunity. There were several years of around 3.5% inflation in the early 2000s when those first I Bonds returned 7% or more. It helps to get a high return right out of the gate because it establishes a base upon which future returns compound. The present return on those original two years of I Bond purchases is currently above 13%. Even though the inflation rate gradually declined over the past two decades until spring 2021 the overall rate earned on those first I Bonds has been over 6% compounded from 2000 to the present so that my initial 2000 investment of $30,000 is now worth about $100,000. In risk adjusted terms those I Bonds bought in 2000 were unquestionably the best risk-adjusted investment I ever made. Unfortunately they will mature and run off the books in October 2030 when I will be 86.

The Treasury came to its senses after a few years and realized that they were being way too generous. They realized that they had set both the real rate and the amount an individual could invest way too high. They moved toward lower real rates and limited the amount an individual could buy to that $10,000 electronic plus $5000 via tax refund. There were times when I considered stopping my annual purchases, but the more I thought about it the clearer it seemed to me that I Bonds continued to be a very good deal even at the zero rate.

You don’t need to worry about missing those first days of I Bonds. After 2030 my I Bond portfolio will look a lot more like those of young investors who are starting annual purchases of I Bonds right now. I kept buying every year on the terms still in effect today. Those who buy I Bonds his October will likely get a great running start because the first year will create a fantastic base upon which future returns will compound. I fully expect that for those buying before November 1 the one year combined will be around 8%. Going forward I Bonds will continue to match inflation whether it is low or high. They will likely continue to beat all short-term returns available in short-term Treasuries and CDs. The best way for investors to think about I Bonds is as an insurance policy. They insure your future against the scourge of inflation. They provide freedom from worry about a particularly pernicious risk. Even at the current zero real rate of return, I Bonds achieve exactly that goal.

This is a recommendation that does not require warnings or disclaimers as I Bonds are risk-free, but I do have a suggestion. Like most government entities TreasuryDirect is swamped because of being short of staff (heaven help you if you have business with the IRS). It’s a good idea to give yourself a few days leeway for any action with which you might need to call the number for help on the TreasuryDirect site so if you want to buy before November 1 you might do so with a few days left in October. In mid-October I will write a follow-up article with up-to-date analysis of the factors involved in deciding whether to buy before or after November 1. By then the inflation component will be known and it will be a little easier to forecast the likely fixed rate. Until then readers should begin to familiarize themselves thoroughly with the terms of I Bonds and decide if they work for you. If you have questions, include them in a comment to this article and I pledge to get back to you faster than any government agency will.

Be the first to comment