Pgiam/E+ via Getty Images

Earth First Investments 7

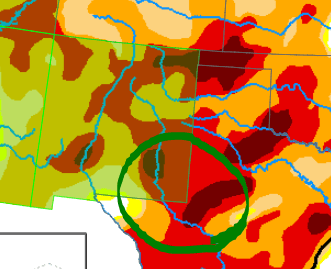

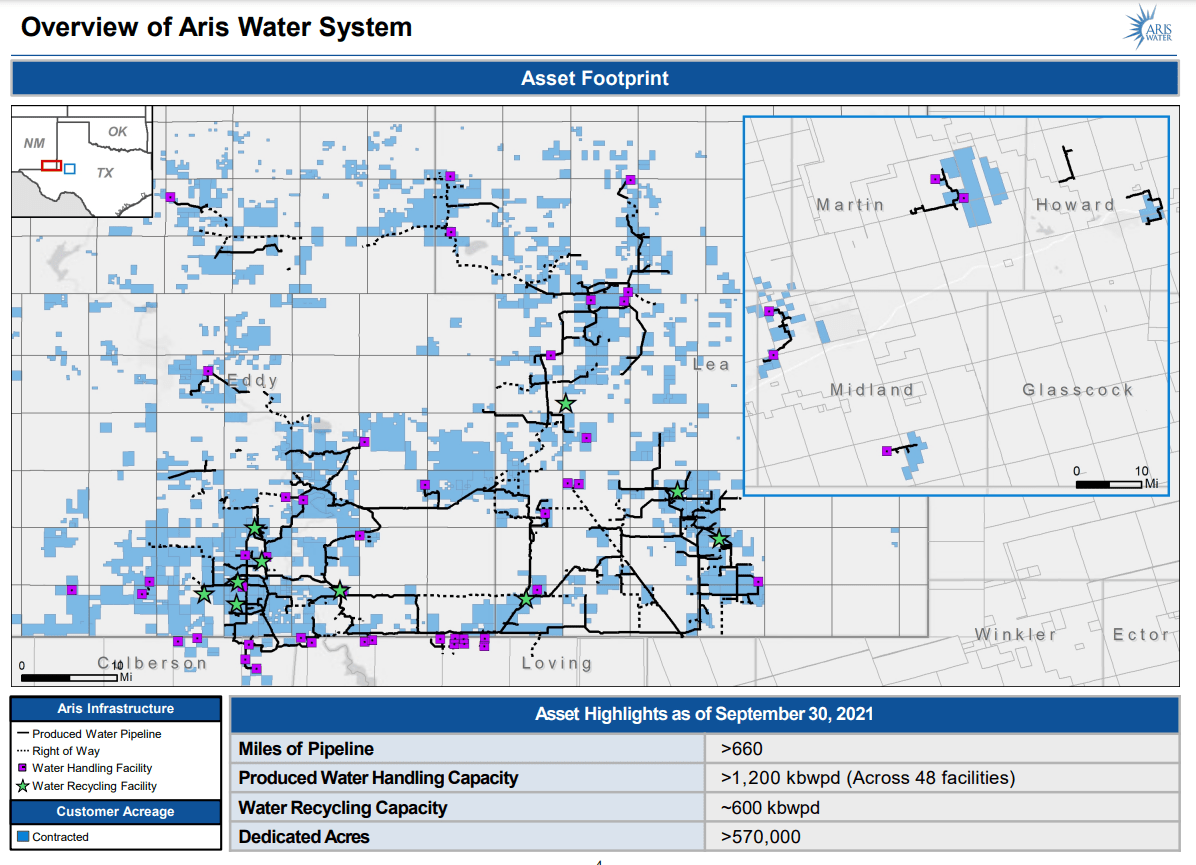

Water is a key component of operations in oil and gas drilling, and is also withdrawn from hydrocarbon deposits. As such, Aris Water Solutions (NYSE:ARIS) was created in 2019 to form one of the first consolidated and independent operators of water recycling technologies in the Permian Basin, one of the top oil and gas producing regions in the US. The water recycling services reduce the need to draw on local water supplies, and cleans up any waste water that may result. The region is dry, and currently under extreme drought conditions, adding to the dire need for these services.

Drought Monitor

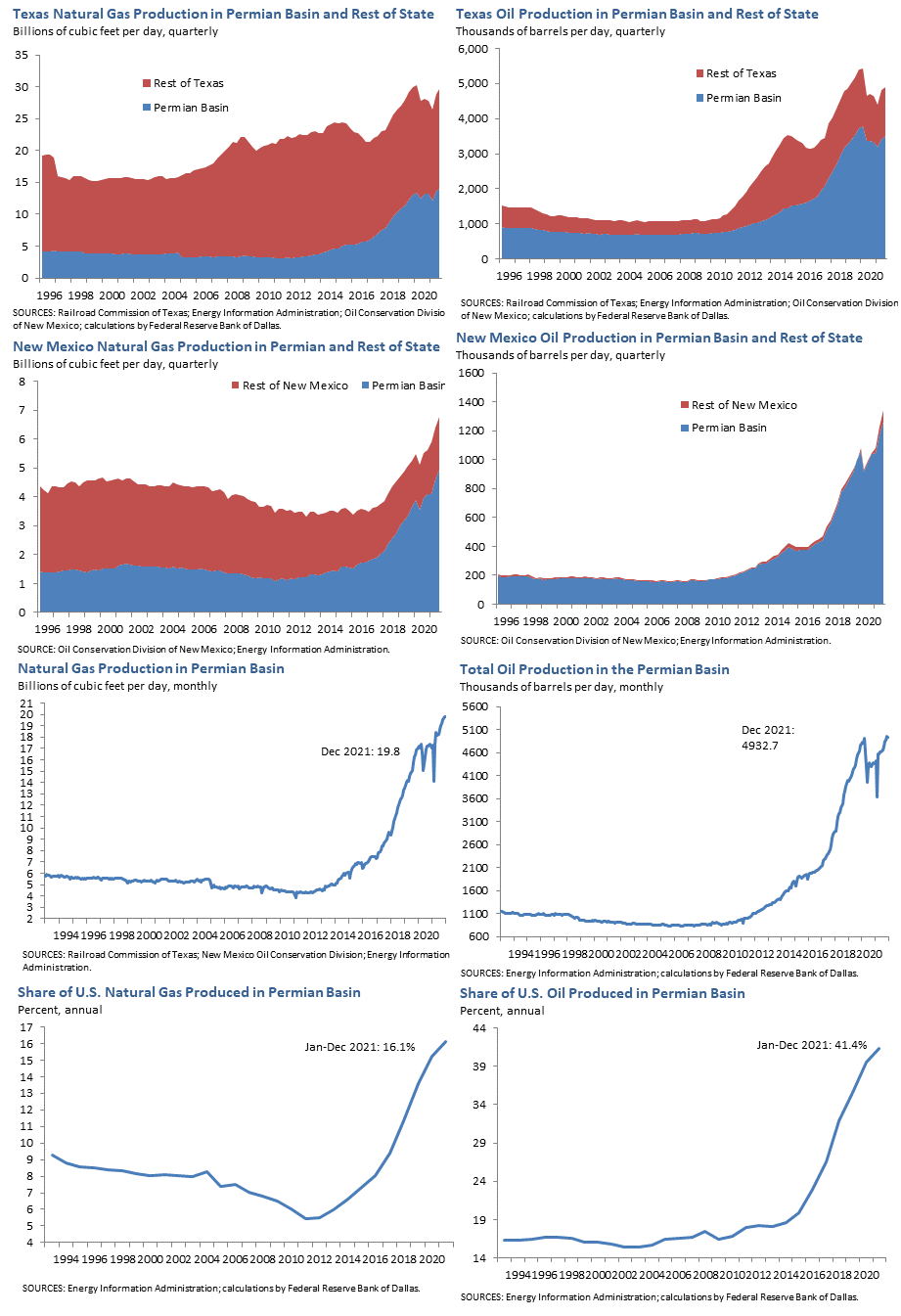

As the US reduces dependence on foreign oil and gas imports, production in the region is set to increase significantly, and Aris can leverage new ESG scrutiny on the industry to grow. Due to their current rate of growth, I expect that their services are seen as a favorable expenditure in regards to both sustainability goals, and cheap operational water supply. Therefore, as long as fossil fuels remain necessary, and drilling develops in the region, Aris will see stable revenue growth. Avenues for growth into the future may be for alternative fuel production, especially as green H2 production requires water as a feedstock.

Growth Outlook

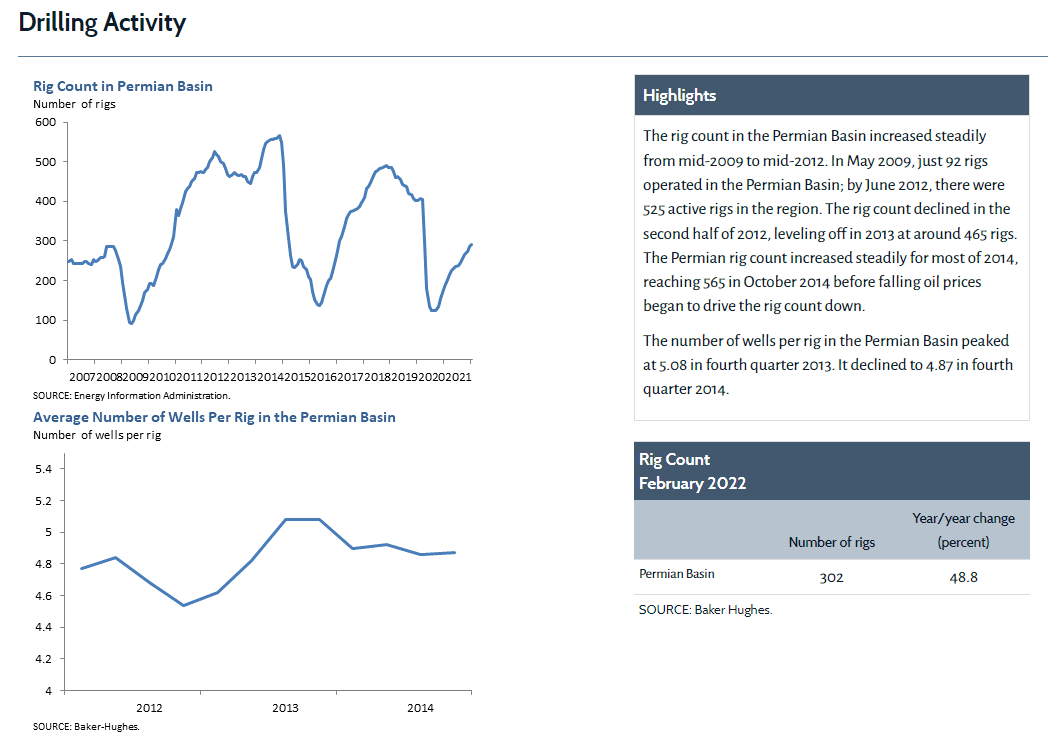

While production is heavily affected by macroeconomic effects on oil and gas supply and demand, the region is currently in an upward trend. While overall fossil fuel use should trend down due to the detrimental effects of greenhouse gasses, alternative fuel processes remain in early commercialization. Additionally, hydrocarbons have utility in nearly every industry, especially plastics, and any meaningful commercialization of non-fossil-fuel based plastics is at least 10 years away. There is also the realization that imported crude is negatively impacted by geopolitical risk and volatile prices, and a lack of sustainability transparency, it is necessary to increase US oil and gas production to be more self-sufficient. As such, Permian Basin production has increased at a fast rate since pandemic lows, and I expect peak levels to reach higher than in 2018-2019 and 2010-2014 levels (approximately 500-600 rigs).

Dallas Fed

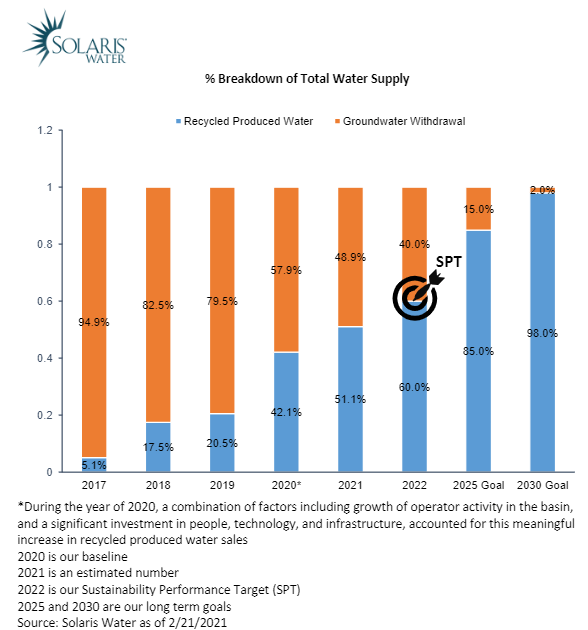

As rig development increases, production increases, and an amazing amount of new production in the region has supported the growth of revenues for Aris. While the company was originally selling groundwater based water supplies, the proportion of recycled water has increased significantly to 60% for 2022. With goals for less than 5% groundwater sales for 2030, the company has invested significantly over the past few years to develop their network. This includes a partnership with Texas Pacific Land (TPL) in order to develop services together with operators on TPL lands in Texas. This will be important in expanding Aris’ network in Texas, which is less developed than in NM.

‘We are pleased to further develop our long-standing and productive relationship with Aris, a premier water infrastructure and solutions provider for upstream operators across the Delaware Basin,’ said Tyler Glover, CEO of TPL. ‘Having Aris develop additional strategic infrastructure on TPL’s surface acreage will further expand and enhance our ability to serve operators and customers. By working with Aris, we will drive more water volumes onto TPL’s surface acreage and facilitate further operator development on our oil and gas royalty acreage.’

Aris Dallas Fed

Financial Overview

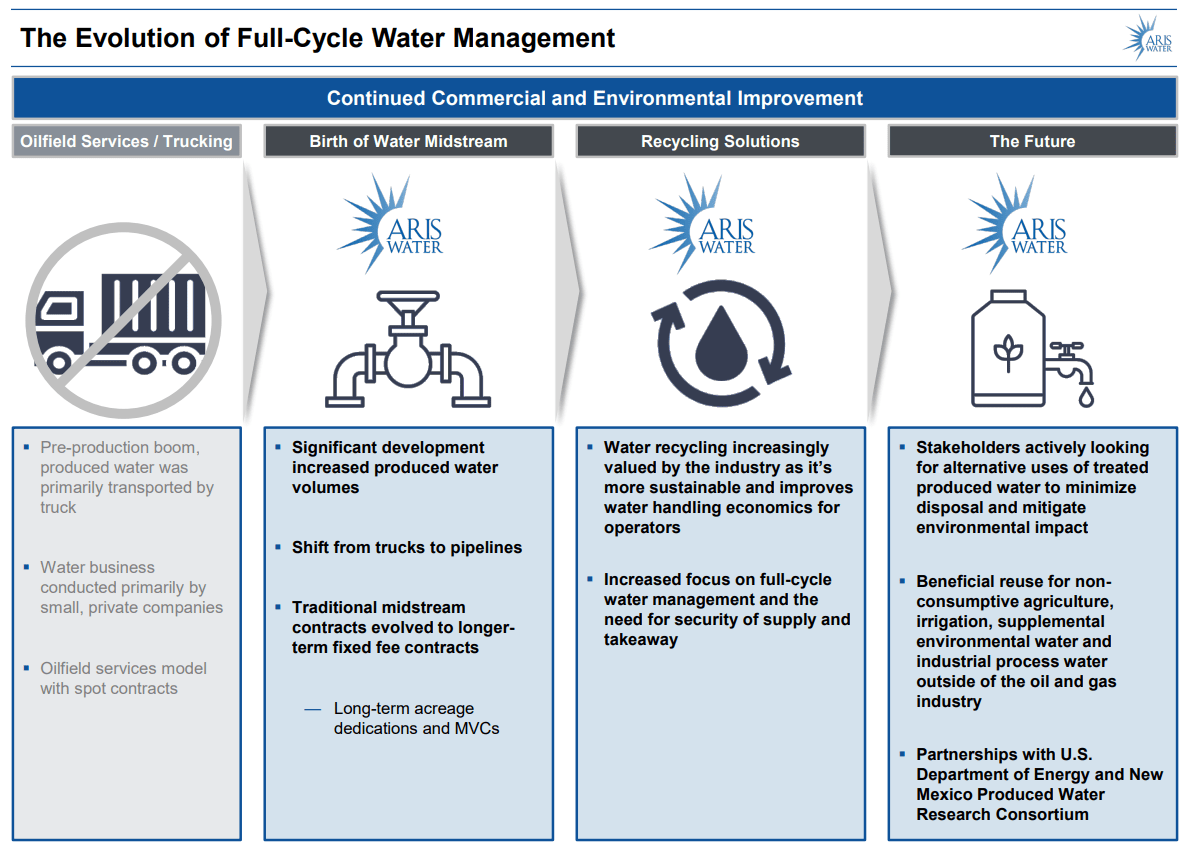

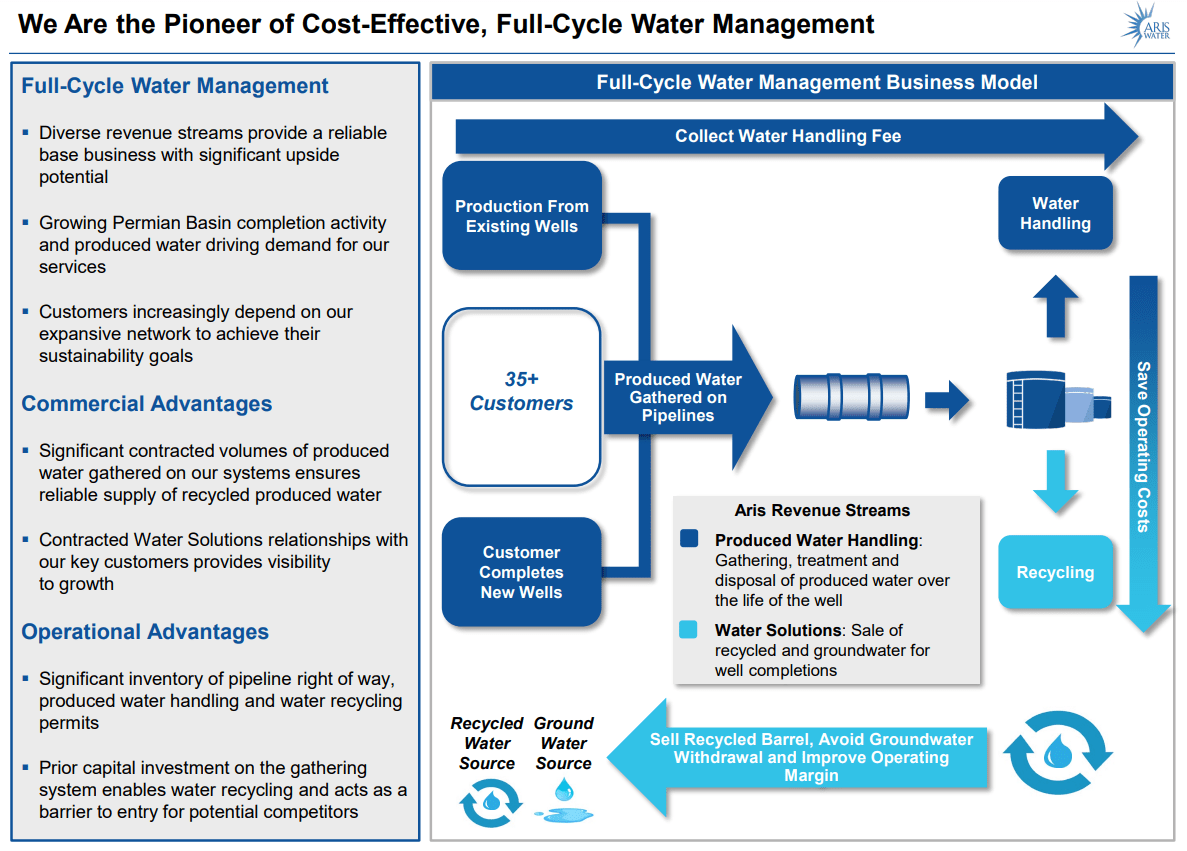

The Aris platform revolves around a series of pipelines and water handling and recycling facilities. The company develops the logistics for potential clients in order to both receive water and then resell it later on. By using pipelines rather than tanker trucks, the company can establish long-term contracts, reduce operating costs, and expand at a faster rate. Emissions are also reduced, with the exact impact increasing with capacity. To date, the company has recycled more than 2 billion barrels of water, and this has saved over 4 million tanker truck trips as a result.

Aris Aris Aris

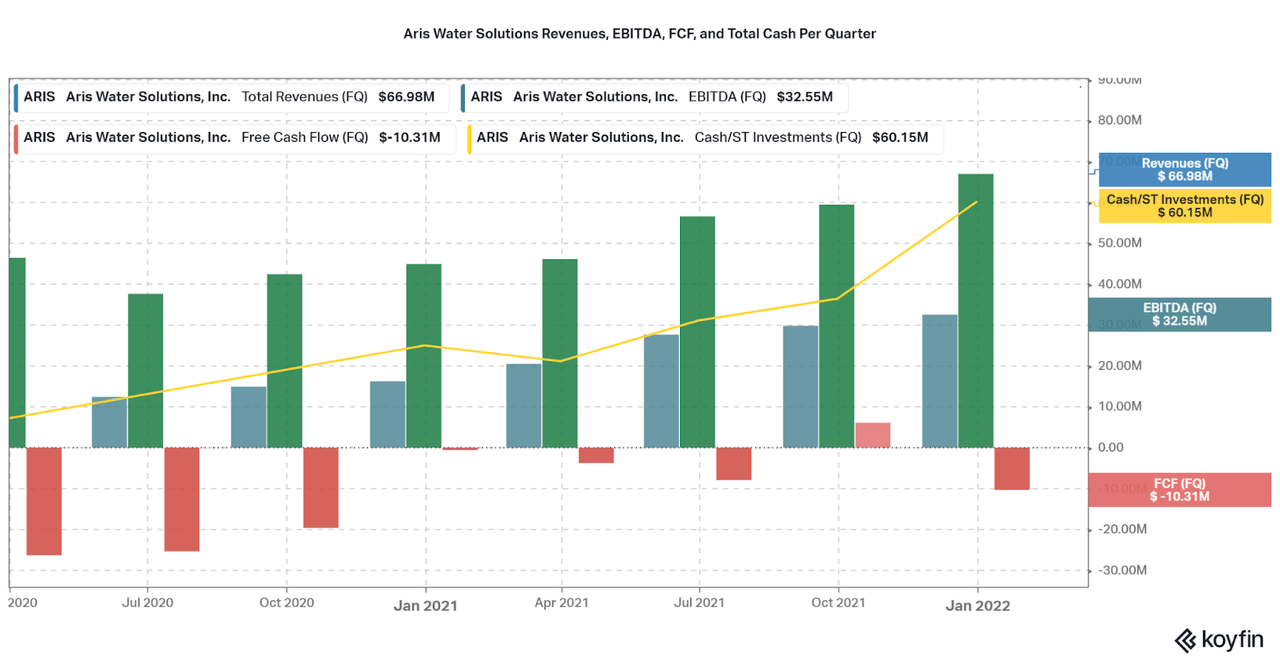

As a result of their popular and well-developed platform, revenues have risen at a steady clip over the past few years. Unfortunately, there is limited historical visibility for their financial performance as the company is quite young, but as I show below, they have already established a stable financial company. Revenue growth is above 5% per quarter, or 20% per year over the past 2 years, even including a decline thanks to the pandemic. However, the company fared better than most in the industry thanks to the organic growth potential. Also, EBITDA growth has been increasing at a faster rate, with 15% increases per quarter on average, or a triple in 2 years. I find the stability and scalability of revenue and EBITDA to be a favorable image, and should be a case study for other early stage sustainability companies.

At the same time, the company has established a growth oriented balance sheet. While current leverage is quite high, the ratio of debt to cash is already decreasing. As of Dec 2021, the company had $392 million in Total Debt and $62 million in cash. Free cash flows have remained negative as the company invests in growth, but I believe a shift to stable, profitable growth should be established within the next year or so. Thanks to the current high development cycle for the Permian Basin, I would assume there is little short-term risk to Aris’ financials over the next year or so.

Koyfin

Thanks to the unique platform of Aris, I find the financials support the investment case. I am not alone in this assumption, as the price is up 26% since IPO in fall 2021. At a current market cap of slightly less than $1 billion. The current price to sales is 1.65x, with forward P/E estimates at ~17.5-18.0 if the price remains at these levels (TTM GAAP P/E is 362). Uncertainty on FCF and net income margins is preventing meaningful share price appreciation, but I find the growth rate can support a higher valuation. However, due to the fact that there are no peers as most water recycling is either small business or performed in house, we cannot compare and contrast the current valuation to determine over or under valuation. Below, I list a table of possible five and ten-year share price CAGRs at a range of growth rates and valuations as reference. Looks quite enticing at current valuations if you ask me.

|

Growth Rate |

Five Year CAGR (%) |

10 Year CAGR (%) |

|

Low (10% at a 1.5 price to sales) |

8.5 |

9.3 |

|

Mid (15% at a 2.0 p/s) |

20.7 |

17.6 |

|

High (20% at a 2.5 p/s) |

31.2 |

25.5 |

Conclusion

While some will find too much risk in the early nature of the company, I find that the financials, state of the market, sustainable platform, and valuation all support a bullish case. The most important facts to follow are the state of the Permian Basin (politics may play a part), a reduction (or stasis) in leverage, and EPS growth quarter after quarter. Also, while I believe cyclicality will be reduced to Aris’ small size, it is an angle to consider for long horizon investors. Also, the company will need to increase the number of customers, as concentration is heavily skewed towards ConocoPhillips (COP), but favorable relationships in the industry should support diversification down the road (acquisition target??). Recurring investments will take the most advantage of cyclicality, but limits the times one will feel comfortable selling their shares if needed. I hope this article planted the seed of curiosity for your own due diligence in starting a position in Aris Water Solutions.

Thanks for reading and let me know your thoughts in the comments.

Be the first to comment