Editor’s note: Seeking Alpha is proud to welcome Jia Wei Liu as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Natal-is/iStock via Getty Images

The Business

Crocs (NASDAQ:CROX) is an American company based in Colorado that manufactures and markets casual lifestyle footwear and accessories, with a vast majority of their products being made from their proprietary Croslite™ material, a molded footwear technology that delivers exceptional comfort. They have 3 key product lines, namely their Classic Clogs, Sandals, and Jibbitz, with a bulk of their revenue coming from their Clogs (~79%). Regionally, 70% of their Revenue comes from the Americas, while the remaining is split equally between EMEA and APAC (15% each). Low concentration of revenue outside of the Americas suggest an interesting opportunity for International Expansion, which has been highlighted by Management as one of their key strategies going forward.

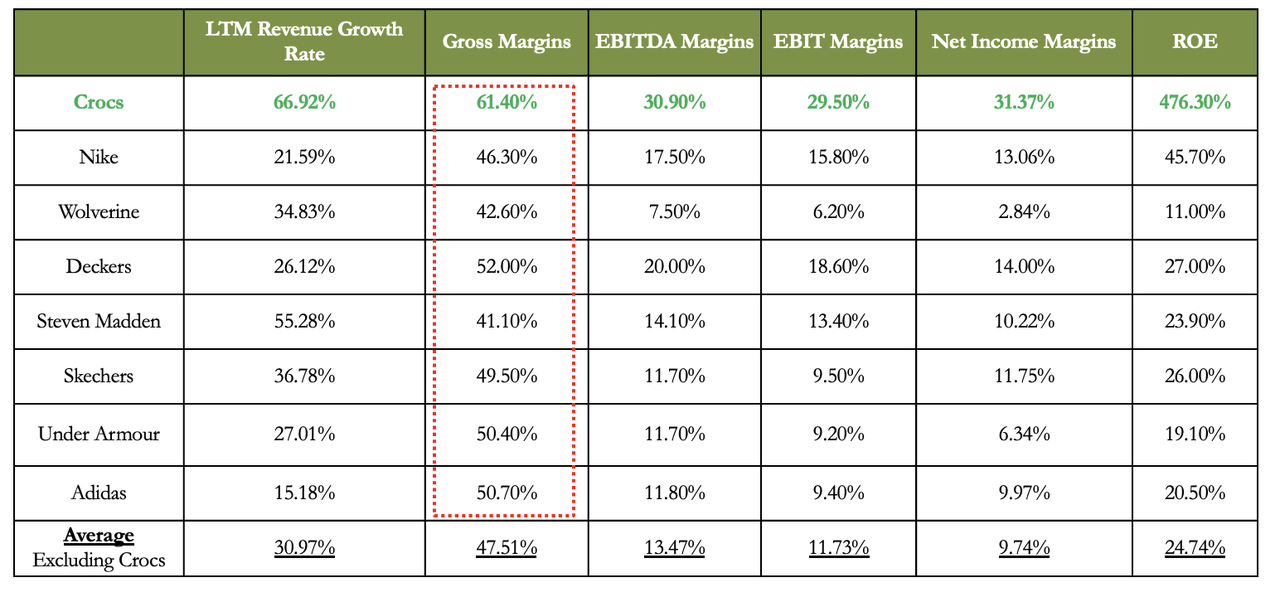

CROX has had exceptional financial performance over the past few years (2017-2021). Revenue has approximately doubled from $1.0B to $2.3B, representing a CAGR of 22.6%. Digital sales, which represents a higher margin category for CROX due to lower overhead costs, has also risen from 15.0% to almost 37.0%. Their margin performance has been incredibly stellar as well. Gross margins improved considerably from 50% to 61.4%, EBIT margins skyrocketed from 2.1% to 29.5%, while net income margins grew from 1.0% to 31.4%. For a footwear retailer, such numbers are not to be scoffed at. In fact, CROX’s margins are the best-in-class when compared to its competitors.

The Industry

CROX operates within a $393B global footwear market that is projected to grow at a 2.3% CAGR over the next five years. Of this massive market, it currently has a TAM of $163B, with $8B coming from the Clogs market, $30B coming from the Sandals Market, and $125B coming from the Casual Shoes market (following the HEYDUDE acquisition). This still presents a large untapped TAM opportunity of $230B which CROX could potentially tap into the future by introducing adjacent product lines. At its core, the global footwear market is a highly fragmented one, with competitors like Nike (NYSE:NKE), Adidas, Skechers (NYSE:SKX), Steven Madden (NASDAQ:SHOO), Deckers (NYSE:DECK), and Wolverine Worldwide (NYSE:WWW) fighting for a share of the market.

Reasons why I am bullish on CROX

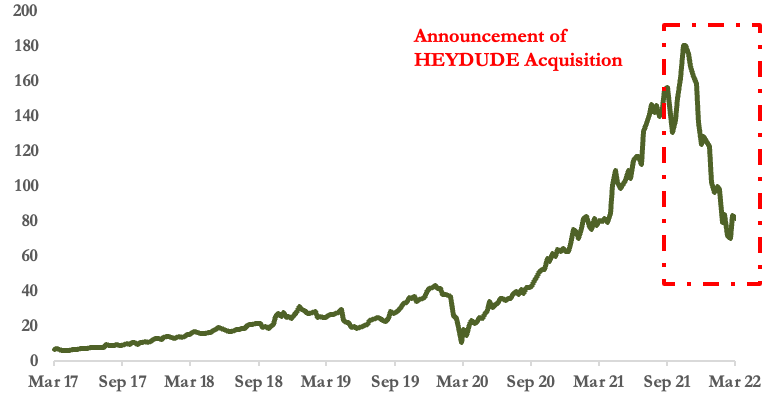

Reason 1: Market has oversold Post-Announcement of HEYDUDE Acquisition

In Dec 2021, CROX announced that it would be acquiring fast-growing Private Italian footwear company HEYDUDE for a purchase price of $2.5B which represents a 13x trailing EV/EBITDA multiple. This $2.5B would be financed with $2B in debt, $450M in shares (approx. 2.8m new shares issued) and a $50m draw of their revolving credit facility. HEYDUDE primarily sells shoes that look like contemporary modern shoes, while offering the comfort of slippers.

The market did not react favorably to this acquisition. Investors felt that the $2.5B purchase price was an overpayment for a relatively unknown footwear company that had only generated $570m in revenue in 2021. Moreover, they were wary of the high debt levels assumed by CROX as a result of the acquisition, where gross leverage increased from 0.9x to 2.9x. This caused the company to suspend its share repurchase program until gross leverage was able to fall below 2x, which investors did not like, as it meant that the company was no longer able to consistently create value for its shareholders. A combination of these factors led to investors selling off their shares in the company, causing share prices to tumble by over 58%.

CROX 5 Year Share Price Chart (Yahoo Finance)

In my perspective, I believe that the market has been overly pessimistic about this acquisition. Firstly, while many investors have never heard of HEYDUDE prior to the acquisition, the brand is actually significantly more popular than they think. In fact, based on a teen insight survey by Piper Sandler, HEYDUDE has actually been one of the fastest rising brands over the past two years, rising from the 54th Most Popular Footwear in 2019 to the 8th Most Popular in 2021. The reason as to why many investors have not heard about it is because they fall outside of HEYDUDE’s target audience, which have an average age of 16. Secondly, I strongly believe that this acquisition is a step in the right direction for CROX’s future. Given CROX’s market dominance and already high penetration in the $8B Clogs market, its entrance into the massive $125B casual shoes market through HEYDUDE presents an incredibly exciting growth runway for the company. Furthermore, introducing a new revenue stream allows CROX to reduce its reliance on its Clogs revenue, hence protecting it from external shocks to its Clogs’ demand. Finally, CROX’s high debt levels as a result of the acquisition is also not as worrying as it seems. Management has explicitly stated that they would be prioritizing deleveraging over the next few quarters, where they expect to hit 2x Gross Leverage by 2023. Given CROX’s strong free cash flow generating potential as well as a strong management team that has historically outperformed investors expectations (beat 18 out of last 20 earnings guidances), I am confident that management will be able to meet or even exceed their debt repayment targets. This would allow management to resume its much-loved share repurchase program and continue returning value to its shareholders, especially as management still has $1.1B in share repurchase authorization to conduct share buybacks. This overcorrection hence presents an opportune entry point for investors.

Reason 2: The Market has Greatly Underestimated the Viability of CROX’s Business

Another reason that caused the massive sell-off of CROX’s stock revolves around the market’s belief that CROX’s brand success was nothing more than the product of a Fad. At first glance, this view appears to be justified. Lockdown measures during the pandemic accelerated consumers’ desire for comfort, which was exactly what CROX offered. Moreover, CROX’s clogs were commonly found on the feet of healthcare workers, whose numbers hit all-time highs during the pandemic. This drove nearly triple-digit sales growth between 2020-2021 for their Classic Clogs, which was even named as the “Shoe of the Pandemic”. Furthermore, CROX seemed to be at the forefront of the trend towards “Meme Fashion” over the past few years. Its unique and albeit “ugly” products captured consumers’ hearts, propelling the Classic Clogs transformation from being named as one of the 50 worst inventions by TIME in 2010 to emerging as the 8th Most Wanted fashion item in the World in 2020 according to Lyst. As a result of these factors, CROX was able to enjoy significant revenue growth over the past few years. However, with such growth, there has been accompanying concerns about whether CROX would be able to sustain this growth as consumer tastes are inherently fickle and could shift away from CROX at any time, especially as pandemic restrictions ease.

However, I posit that CROX’s brand success was not merely the result of a fad, but due to thoughtful management strategy. This leads me to believe that CROX will continue to thrive over the near future as management continues to execute on their marketing strategy. To better understand this argument, we have to take a look at CROX’s troubled past. Back in the early 2000’s CROX took negative criticism regarding the “ugliness” of their products too seriously and went against their branding, choosing to redesign their Iconic Classic Clogs to look “better”. However, this was a massive misstep by the company, as this translated to even poorer demand for their products, causing them to incur a costly $400m loss. This was an expensive lesson for CROX, and as the years passed, the company started to lean into their unique identity as an “ugly” brand. In 2014, they invested $24.5m in restructuring their marketing strategy to focus on their Original Clogs. This move was further bolstered when Rees took over as the new CEO in 2017, where he doubled down on this approach, engaging in a slew of slightly controversial partnerships with notable brands and famous celebrities to emphasize on the unique “ugliness” of CROX’s products and to ultimately create shock value to spike interest from consumers. This has been deliberate on Rees’s part, where he has openly stated that “A collaboration needs to be controversial, but not too controversial”. Evidently, CROX’s incredible brand momentum over the past few years has not been an accident, but instead the result of deliberate management strategy. Moreover, based on excerpts from CROX’s most recent earnings call as well as their 2021 Annual Report, it is clear that management intends to carry on with this strategy over the near future by collaborating with an increasing number of brands and celebrities which gives me confidence that CROX will be able to maintain its strong brand momentum over the near future.

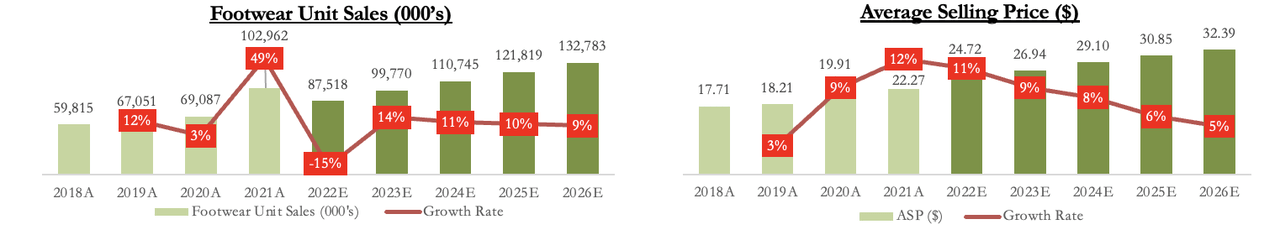

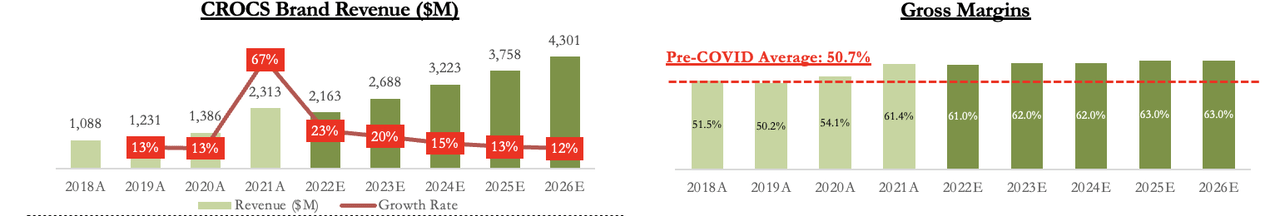

Quantitatively, I believe that this continued brand momentum will allow CROX to enjoy strong footwear sales even as they increase their average selling price through the forecast period.

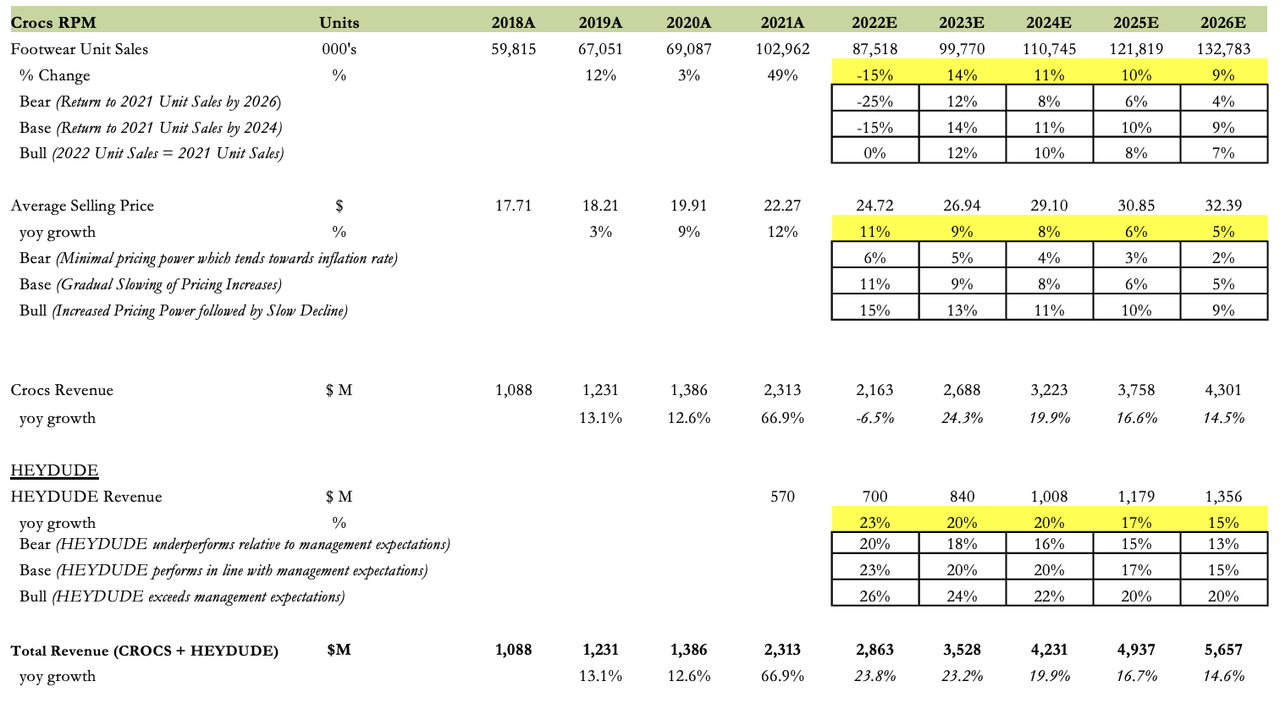

Internal Estimates

As a result, CROX will be able to enjoy sustained revenue growth and strong top-line margins.

Internal Estimates

Reason 3: CROX is an Exceptional Business that has been Grossly Undervalued by the Market

My final reason revolves around the fact that CROX continues to trade at discounted multiples despite the exceptional strength of its business compared to its competitors.

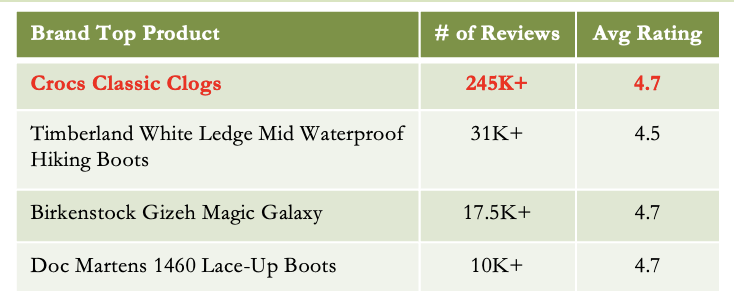

Firstly, CROX’s Classic Clogs is a winning product. When people think of CROX, the first thing that comes to their mind is its Clogs. Not many of CROX’s competitors has been able to develop a product that has essentially become synonymous with the brand itself. Even for companies that have done so, they have not been able to replicate the same level of popularity and love that CROX has been able to achieve, evident from the ratings it has received on Amazon.

Popularity of CROX’s Key Product vs Competitors ((Internal))

Secondly, CROX has unrivalled brand positioning. Unlike many of its competitors, CROX is more than just a product, it is a source of identity that people can associate themselves with. Their Mantra of “Come As You Are” encourages individuals to be comfortable and confident in their own skin, fostering the ideals of self-expression and individuality. CMO Heidi Cooley views this to be a core part of their brand’s identity, stating that “We’re one-of-a-kind. And what we recognized is that this is exactly what resonated with some of our fans. They too see themselves as one-of-a-kind”. This appeal to an individual’s sense of self is ultimately what creates such a loyal, cult-like fanbase for CROX, and such efforts have yet to be replicated by any of the company’s competitors.

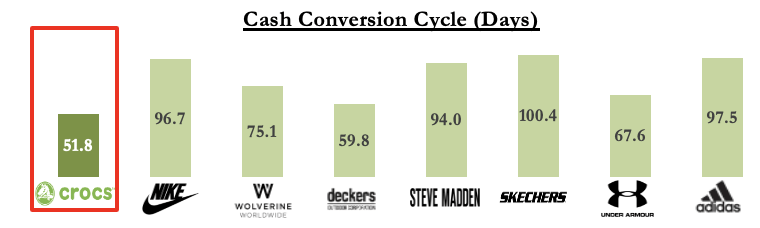

Thirdly, from an operational perspective, CROX is more efficient than its competitors. It’s industry-lowest cash conversion cycle implies that CROX has the fastest inventory-to-sales pipeline, implying high liquidity and strong demand for its products.

CapitalIQ

Finally, from a financial perspective, CROX outperforms all of its competitors in terms of all key financial metrics. I believe that a key source of their financial advantage comes from the simplicity of their products compared to their competitors. CROX’s Clogs are incredibly easy and cheap to manufacture compared to other footwear products like shoes, which have much more components that go into it. As a result, CROX is able to enjoy best-in-class gross margins that flows all the way down to their net income margins.

CapitalIQ

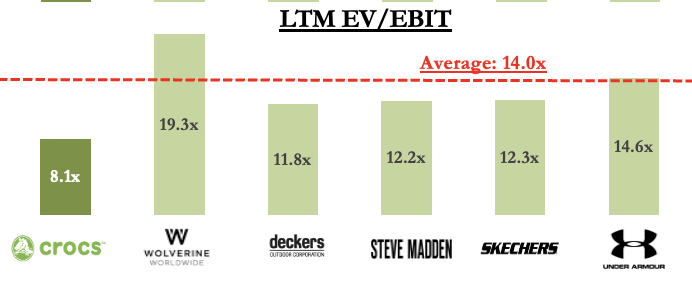

However, despite CROX’s apparent superiority over many of its competitors, it still continues to trade at discounted multiples which suggests a potential for multiple re-rating to at least industry averages.

CapitalIQ

Utilizing a back-of-the-envelope calculation based on the industry average EV/EBIT multiple of 14.0x and CROX’s 2021 EBIT of $682M, we arrive at an implied share price of $143.75, which translates to a 97.9% upside from current prices.

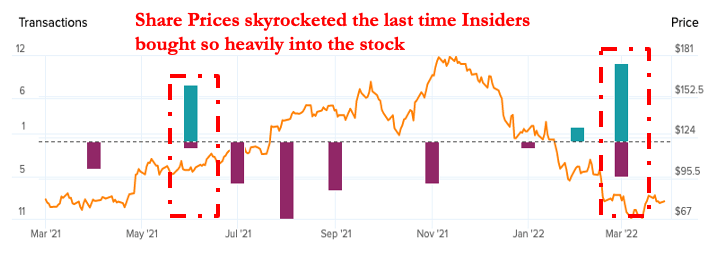

Bonus: Insiders have been loading up on CROX shares

TipRanks

As the icing on the cake, we can see that company insiders have been loading up on CROX shares, purchasing at an even higher volume than the previous spike in June of 2021. While history does not repeat, it certainly rhymes. The recent spike in insider buying suggests a potential inflection point in CROX’s share price. Coupled with the fact that insiders have to hold their shares for at least 6 months after purchase based on Section 16 of SEC’s insider trading policy, the spike in Insider Buying seems to strongly suggest that Insiders believe in the long-term potential of the company and that CROX is currently significantly undervalued by the market.

Valuation: Putting the reasons into numbers

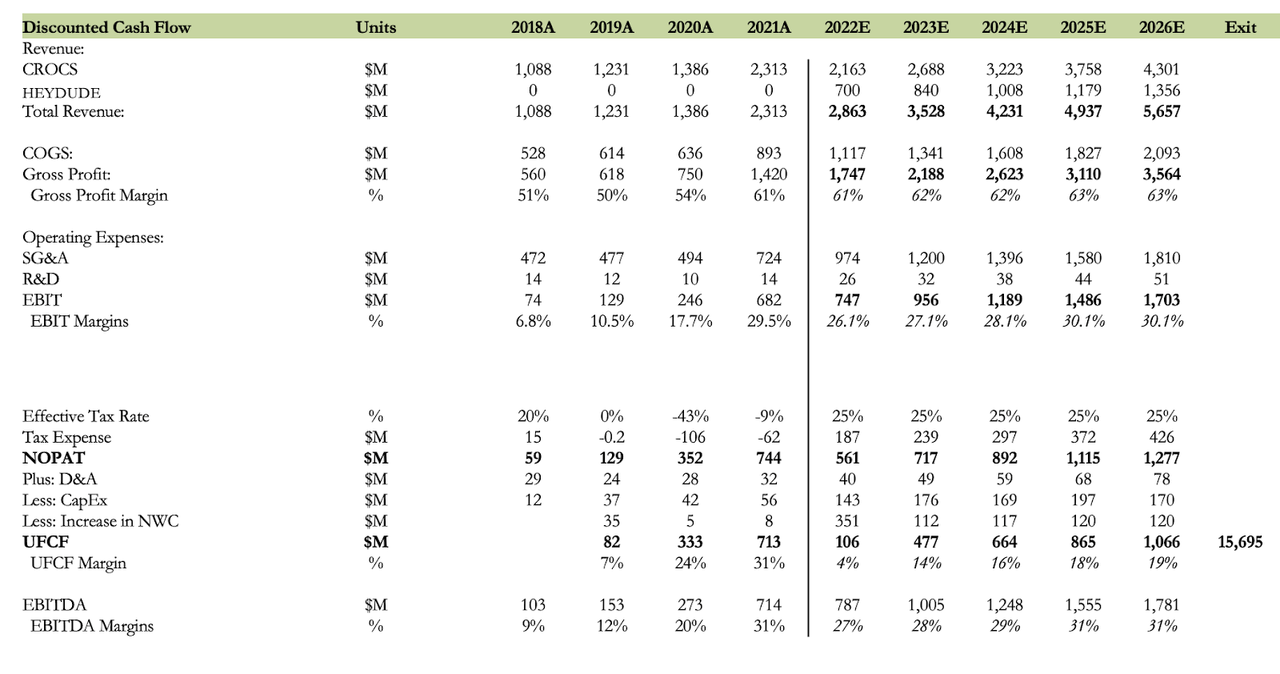

To value CROX, I carried out both a blended valuation by assigning equal weights to my Discounted Cash Flow and Comparable Company Analysis.

For my DCF, I utilized a WACC of 10.00% and assumed a realization of Reason 2 in my Revenue Projection Model.

Revenue Projection Model (Internal Estimates)

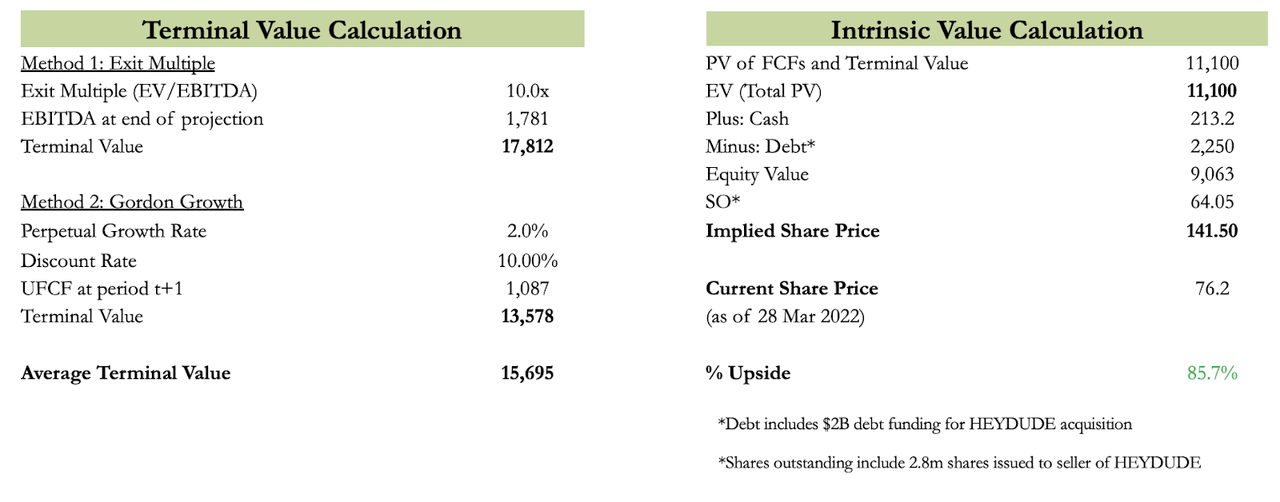

I used an Exit EV/EBITDA multiple of 10.0x and a conservative Perpetual Growth Rate of 2.0%.These assumptions helped me to arrive at a DCF Target Price of $141.50

Internal Estimates

Internal Estimates

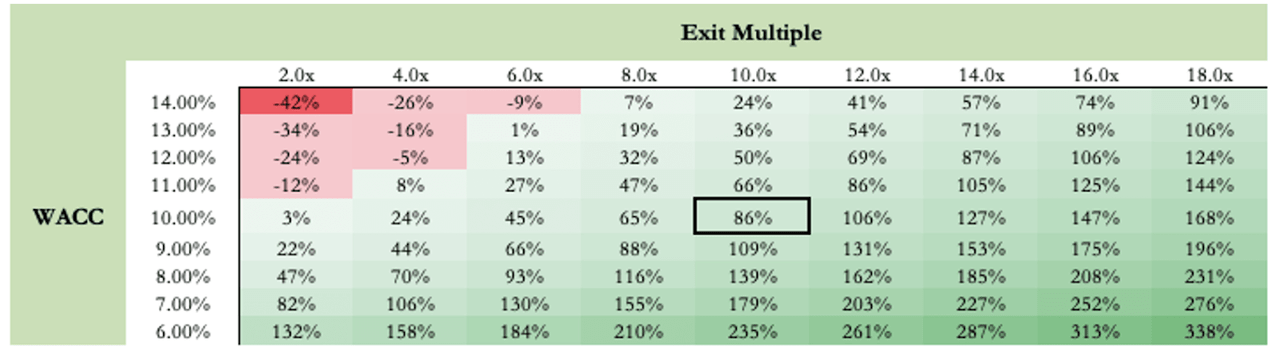

For sensitivity analysis, I chose to sensitize the WACC and the exit multiple as they were the biggest drivers of CROX’s share prices. From the sensitivity table, it can be seen that there is incredibly limited downside for CROX, which further bolsters the investment case for the company.

Internal Estimates

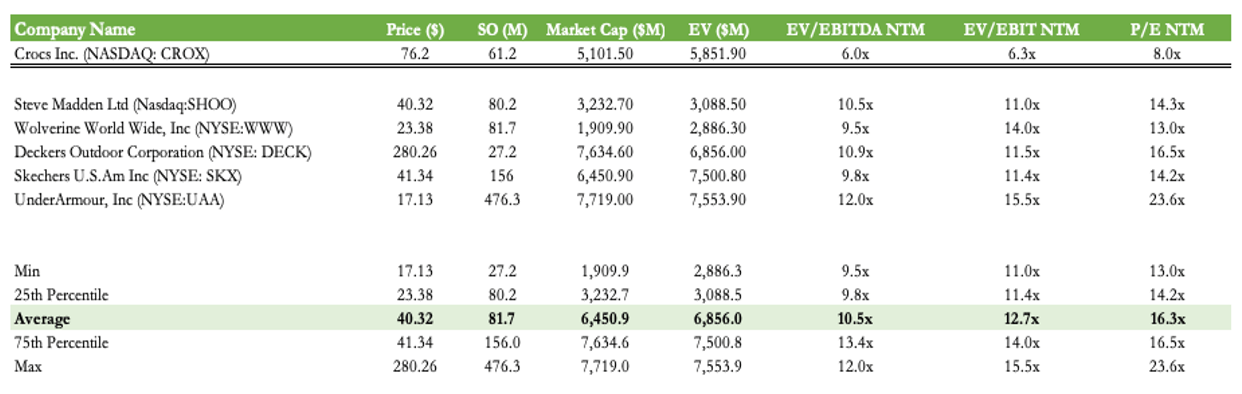

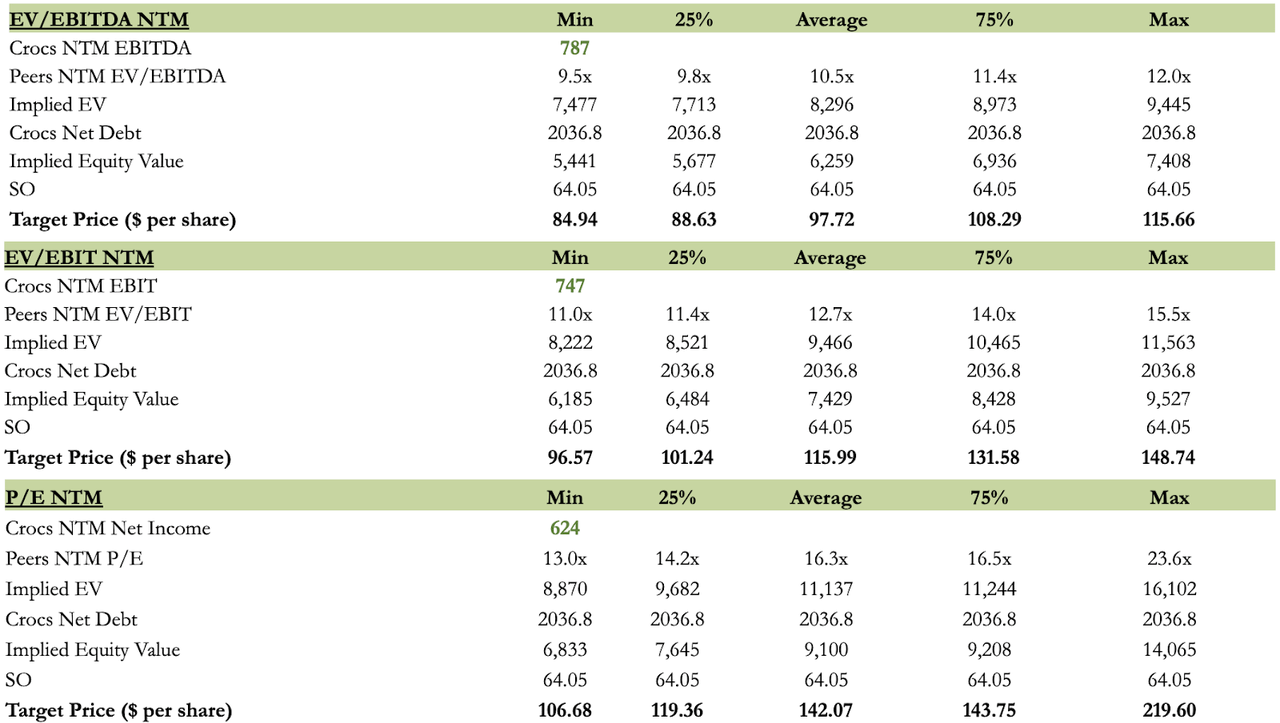

For my Comps, I mainly selected footwear companies in the United States that had a market cap of below $8B. I then proceeded to take the averages of their NTM EV/EBITDA, EV/EBIT and P/E multiples and applied them to CROX’s 2022E EBITDA, EBIT and net income respectively.

CapitalIQ

Internal Estimates

I arrived at 3 different values, which I took the average of, to arrive at my comps target price of $118.59.

Through the 50% weightage I placed on each valuation methodology, I arrived at an implied share price of $130.04, which represents a 70.7% upside.

Risks and Mitigants

The first investment risk centers around the possibility of there being a shift in consumer tastes away from CROX which would negatively impact the demand for CROX’s products. I believe that this does not pose a huge risk for CROX as CROX’s products are of extreme comfort and quality. Their incredibly well-loved Clogs product (4.7/5 stars out of 245k+ reviews on Amazon) will always have a place in the market. Moreover, management’s intention to continue to collaborate with brands and celebrities will play a huge role in ensuring that CROX’s name will stay at the forefront of consumers’ minds.

The second investment risk centers around the potential of the HEYDUDE acquisition failing, especially given the magnitude of the transaction value ($2.5B) relative to CROX’s current Market Cap (~$5B). While this is a legitimate concern, I believe that this acquisition is a well-thought out one by their strong management team. Management has been incredibly clear in terms of what they hope to achieve from this acquisition and the future direction they hope to take for the company. Ultimately, this boils down to the ability of management to execute and given their promising track record, I believe that they will continue to deliver.

For CROX, I believe that the over-pessimism regarding the acquisition has caused investors to overlook the inherent strength of CROX’s business as well as the viability of their business over the near future, resulting in suppressed valuations. Thus, I believe that the catalysts will revolve around helping investors to realize their misplaced judgment in the company’s prospects.

Catalysts

The first catalyst would be the upcoming earnings release on the 26th of April. Any signs of the company beating guidances or improving its performance will play a crucial role in helping restore the market’s confidence in CROX. The next catalyst would be quarterly reports over the next 1-2 years which would give the market greater transparency regarding the operations and financials of HEYDUDE as well as help them to actualize the acquisition synergies. The final catalyst would be the resumption of the share repurchases program, which is expected to happen by the end of 2023. This will further instill market confidence in CROX’s ability to generate consistent value for its shareholders. I expect all three catalysts to play out by the end of 2023, hence translating to an investment horizon of 1.5 Years.

Conclusion

CROX’s current pricing presents a great opportunity for investors looking for an undervalued business to invest in. Investors should not be too worried about short term fluctuations in the company’s share price and should hold the shares until the catalysts have been realized.

Be the first to comment