niphon

Investment Thesis

Jacobs Solutions (NYSE:J) is benefiting from strong demand in its end markets leading to an increased backlog level at the end of FY22. The company has a strong order pipeline across its segments due to projects from the U.S. IIJA funding, and cyber and intelligence, as well as other end markets. The company’s margin should benefit from the high margin project wins in the CMS segment and PA Consulting business as well as improvement in revenue mix.

Jacobs’s Q4 FY22 Earnings

Last month, Jacobs reported better-than-expected fourth-quarter FY22 financial results. The sales in the quarter increased 8% Y/Y to $3.88 bn (vs. the consensus estimate of $3.82 bn). The adjusted EPS increased 14% Y/Y to $1.80 (vs. the consensus estimate of $1.77). The revenue in the quarter benefitted from the Y/Y growth in the Critical Mission Solutions (CMS) and People & Places Solutions (PP&S) segments, partially offset by a sales decline in the PA Consulting business. The adjusted operating margin increased 80 bps Y/Y to 10.7% while lower G&A costs benefited the adjusted EPS in the quarter.

Revenue Outlook

In Q4 FY22, the backlog was up 5% Y/Y to $27.8 bn, but declined sequentially 0.8% due to the impact of negative currency translation. The book-to-bill ratio was 0.94x compared to 1.26x in Q4 FY21, as it is continuing to be impacted by the declining backlog from the burning of the Kennedy NASA project. The backlog in the Critical Mission Solutions segment was flat Y/Y at $10.6 bn whereas the backlog in the PP&S segment increased 8% Y/Y to $17 bn.

Looking forward, the strong demand along with robust growth opportunities in the order pipeline should drive Jacobs’ growth. The company has good visibility for its solutions business, with approximately 85% of CMS’s portfolio consisting of large enterprise contracts with durations greater than four years and 88% of the portfolio benefitting from federal-level government funding. The company also has a potential multi-billion dollar opportunity in its pipeline related to the U.S. Air Force’s large Integrated Support Contract (ISC 2.0). The CMS’ sales pipeline remains robust, with the next 24-month qualified new business at approximately $30 bn including $10 bn in source selection with an expanding margin profile. The company has also been awarded a new classified cyber win which was previously delayed due to Continuing Resolution. The PA Consulting business has been successful in winning a large award with the Ministry of Defense, U.K. which should benefit 2023. The pipeline in PA Consulting grew 52% Y/Y in Q4 FY22. The project pipeline in the PP&S segment is up 18% Y/Y due to the projects funded by the U.S. Infrastructure Investment and Jobs Act (IIJA).

Management has guided the FY23 revenue growth between mid-single digit and high single digit on a constant currency basis. The company is targeting double-digit revenue growth on a constant currency basis in the PA Consulting business and mid-single-digit growth for the CMS segment in 2023. I believe that given the strong backlog levels and healthy sales pipeline, the company should be able to meet its guidance and post good revenue growth in FY23.

Margins

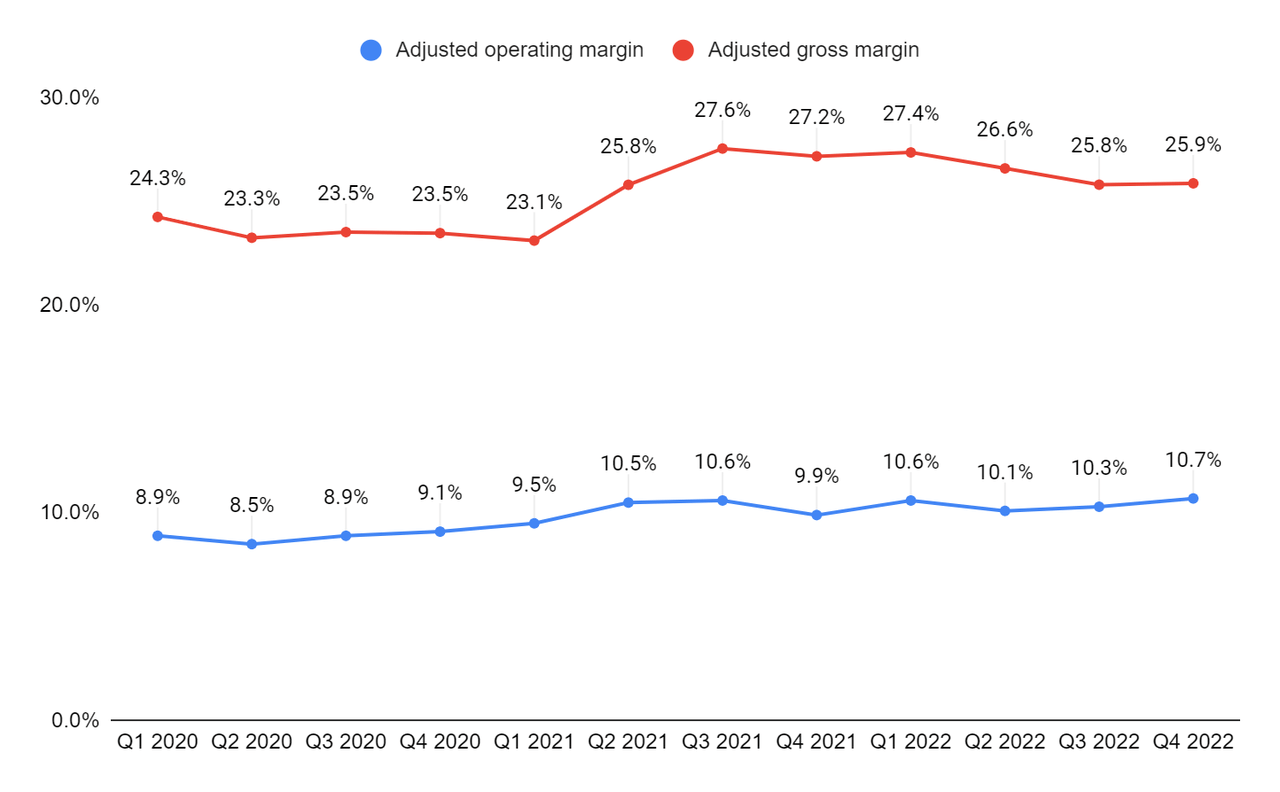

The adjusted gross margin in Q4 FY22 declined 130 bps Y/Y to 26% due to the newly ramped remediation contract in the CMS segment and investments in incremental employees in the PA Consulting business in advance of the large wins such as the U.K. Ministry of defense award. In Q4 FY22, the operating margins in the CMS segment declined 220 bps Y/Y to 6.9% due to the higher G&A in the cyber and intelligence businesses. The operating margin in the PP&S segment was up 275 bps Y/Y to 14.5% due to revenue growth and mix as well as lower labor costs. The adjusted operating margin in the PA Consulting business declined 490 bps Y/Y to 19.4% due to lower utilization and investments in pipeline pursuits.

Jacobs’s adjusted gross margin and adjusted operating margin (Company data, GS Analytics Research)

Looking forward, the adjusted gross margin should improve modestly in FY23 due to the higher margin cyber project wins in the CMS segment, the better backlog margin profile in the PP&S segment, and wins in the higher margin PA Consulting business. The adjusted operating margin should expand in FY23, driven by improvement in the adjusted gross margin and lower employee-related costs. The company hired employees in advance for large wins such as the U.K. Ministry of Defense award. As these projects ramp up in the coming months, the company’s employee-related costs as a percentage of revenue should decline.

Valuation & Conclusion

The stock is currently trading at 16.59x P/E FY23 consensus EPS estimate of $7.40 and 14.66x FY24 consensus EPS estimate of $8.37, which is lower than its five-year average forward P/E of 17.57x. The company is experiencing strong demand for its services and has robust backlog levels. The order pipeline also remains strong due to the U.S. IIJA funding as well as projects in data solutions. The company’s margins should benefit from the margin-accretive project wins and improving revenue mix with PA Consulting seeing good growth. Given attractive growth prospects and reasonable valuations, I have a buy rating on the stock.

Be the first to comment