yacobchuk/iStock via Getty Images

This is my first look at Evofem (NASDAQ:EVFM). When I did my initial overview of the company, I was startled by its sparse liquidity. I decided to investigate to check its viability as an ongoing concern.

This article reflects my findings.

Evofem maintains cash resources putting it at risk

During Evofem’s Q1, 2022 earnings call (the “Call”) CFO File gave a quick rundown on its cash resources. He reported that as of the close of Q1, it had 2.8 million in cash and cash equivalents and 4.2 million in restricted cash. It had raised $10 million in unsecured debt offerings and ~$5.4 million on its equity line of credit.

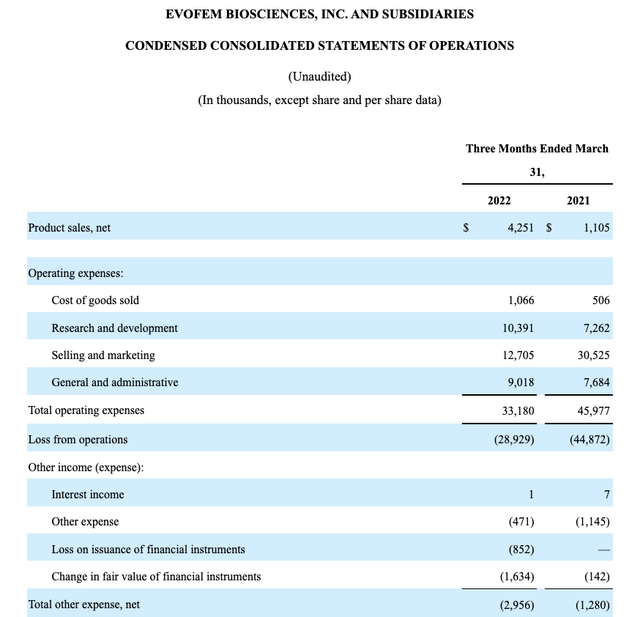

A balance of $2.8 million for a company with a quarterly operating profile as shown below is a flashing red flag mandating cautionary attention:

Evofem Q1, 2022 10-Q excerpt (seekingalpha.com)

Its unrestricted cash and equivalents of $2.8 million are wholly inadequate for a company that generates ~$10 million in monthly losses. No, insolvency proceedings knocking shares down to a de minimus price are not inevitable; nor, unfortunately are they unimaginable.

The SEC requires US based companies to report their true skinny in their 10-Q/K filings on a quarterly basis. One section that is particularly helpful can be found under the liquidity discussion contained in item 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

In Evofem’s case this invaluable information resides beneath the heading “Liquidity and Capital Resources” in its Q1, 2022 10-Q (p. 32). A review of this section reveals management disclosures as follows:

- short term liquidity resources are sufficient;

- over the next 12 months it will need to raise additional capital;

- uncertainties associated with such necessity raise “substantial doubt about our ability to continue as a going concern”.

Certainly Evofem is not the only small biotech with such daunting disclosures. In and of itself they are no basis for panic; they do however warrant attention. Other tidbits from Evofem’s 10-Q advise us that substantially all its assets are encumbered by the “Baker Brothers Note”.

Turning to its balance sheet (10-Q, p. 3), we find that the Baker Brothers notes make ~$86 million of an aggregate of “current liabilities” totaling >$154 million. Inquiring further, these notes are part of a series of financings, obtuse to all but the cleverest of Philadelphia lawyers; they are described in detail at pp. 14-15 of the 10-Q.

Evofem carries a market cap of ~$34 million as I write (at close of market on 07/05/2022). Substantially all of its assets are mortgaged to secure obligations valued (by Monte Carlos simulation 10-Q, p. 20) at ~$86 million. Various of its financings include covenants, including:

…covenants requiring us to maintain the listing of shares of our common stock on the Nasdaq Capital Market and, assuming no further amendment of Current Note terms and failure to achieve the Qualified Financing Threshold or the Clinical Trial Milestone (as discussed above), to achieve cumulative net sales of Phexxi of at least $100.0 million by June 30, 2022. Further, we may not have sufficient cash to make required payments under the terms of the Current Notes, and, should this occur, holders of the Current Notes have rights senior to holders of common stock to make claims on our assets (10-Q. p. 40).

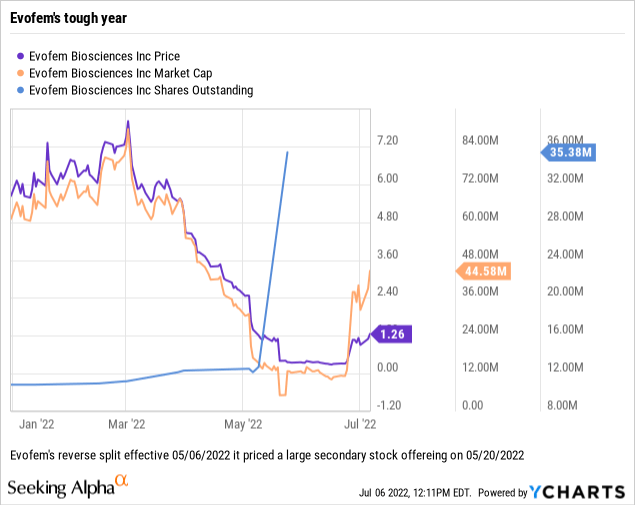

Evofem’s shares have suffered as it has struggled

Evofem’s share trajectory has been a struggle in futility. During its short life as a public company it has engineered two reverse splits. The first was on 01/18/2018; it was a 1 for 6 reverse split, cutting each pre-split holding down by a factor of 6. Shareholders who owned 600 shares pre-split saw their holdings cut to 100.

A scant ~3.5 years later on 05/06/2022, Evofem took another bite out of shareholders share count, this second time with a 1 for 15 reverse split. Under this latest reverse split, shareholders who had owned 1,500 shares on 05/05/2022, were cut back to a share count of 100 shares.

Stock splits are irrelevant in one sense. Visualize a birthday sheet cake. If you buy half of this cake, it may be cut in any number of pieces. That is what is going on in stock splits, your percentage ownership in a company overall is being redivided into different size pieces. In a regular split, it is cut into more pieces so you have more smaller slices of cake. In a reverse split it is cut into fewer pieces. No matter the number of pieces, your overall percentage of the cake remains the same.

Why bother you might ask. The reasons may differ. I think of Citigroup’s (C) 10-for-1 reverse stock split in 2011. Before the split Citigroup was trading at ~$4.50; after the split >$40. The reverse split enabled Citigroup to get its price >$5 where institutional investors were able to own it.

Evofem’s reverse splits were for an entirely different reasons. According to its 2018 10-K (p. F-7) its first reverse split was:

…to effect a six-for-one reverse stock split of its common stock, or the Reverse Split, cause the Company not to be governed by Section 203 of the Delaware General Corporation Law, or the DGCL, and change its name from “Neothetics, Inc.” to “Evofem Biosciences, Inc.” The name change and the Reverse Split were both effected on January 17, 2018. Shares of the Company’s common stock commenced trading on The Nasdaq Capital Market under the new name and ticker symbol “EVFM” as of market open on January 18, 2018.

Its 2022 reverse split was to help boost Evofem’s price above $1.00 to keep it from NASDAQ delisting. The chart below, which reflects share prices adjusted for the split shows Evofem’s price action over this year to date along with its market cap and shares outstanding..

The second reverse split looks to have been inadequate. Perhaps a 1 for 45 reverse split would have given more of a margin for error towards the objective of keeping the price above $1.00.

Evofem gets a price and volume boost from Roe v. Wade

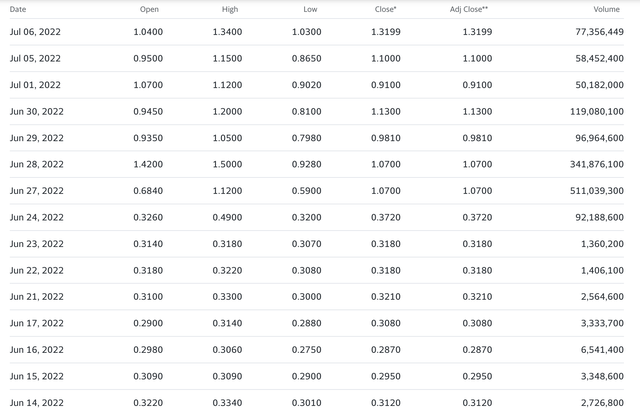

Despite its 1 for 15 reverse split, Evofem did not manage to raise its price above $1.00 over the time period shown below until June 27. 2022.

The listings below provide a granular view of Evofem’s price and volume action for the last several weeks. Note that its volume and price exploded following the 06/24/2022 overturning of Roe v. Wade:

Evofem’s recent weekly prices and volumes (1 for 15 reverse split)

Checking Seeking Alpha’s news feed shows the 06/28/2022 report below:

Evofem adds 36% on collaboration for birth control method

- Following a twofold rise in value yesterday, Evofem Biosciences (NASDAQ:EVFM) is trading ~36% higher in the pre-market Tuesday after the commercial-stage pharma announced an agreement with one of the largest pharmacy benefit managers for its Phexxi birth control method.

- The deal is aimed at widening access for Phexxi, an FDA-approved contraceptive vaginal gel, the company said.

It is not likely that this deal explains the astronomical jump in Evofem’s share volume from its range of 1-3 million to >500 million on 6/27/2022. That is some whopping big volume increase of >16,566%.

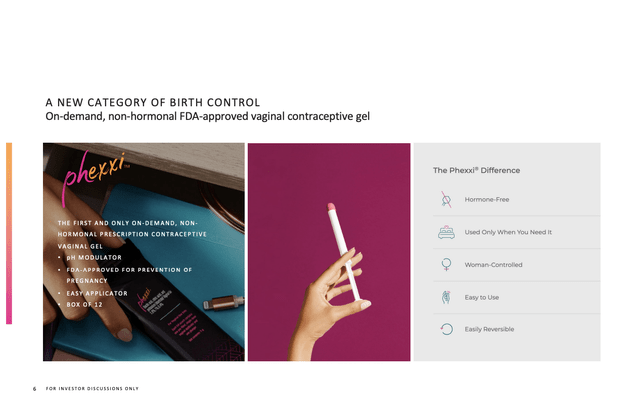

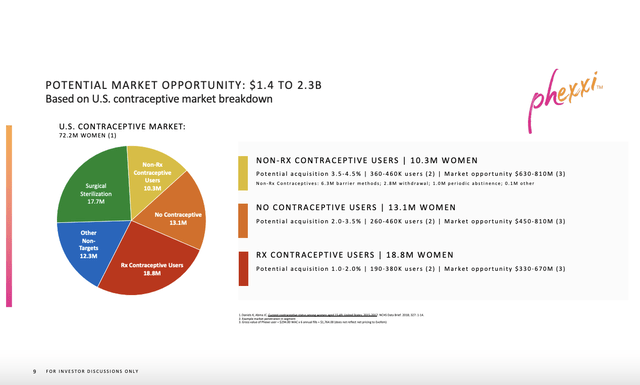

It seems that CEO Pelletier’s message tying potential success for Phexxi, Evofem’s FDA approved vaginal contraceptive gel, to the Roe v. Wade decision is gaining traction. Evofem’s presentation slide below describes the product:

Evofem 06/2022 presentation slide (EVFM_CORP-PRESENTATION)

Evofem pegs it as a potential blockbuster:

Evofem 06/2022 presentation slide (EVFM_CORP-PRESENTATION)

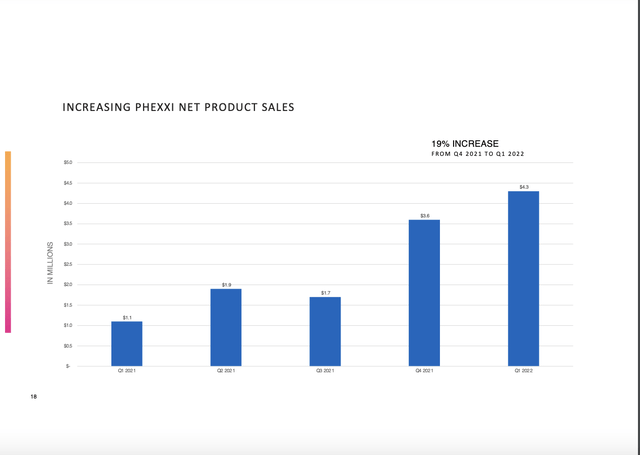

Its quarterly revenues to date offer little support for such a future, as shown by its slide below:

Evofem 06/2022 presentation slide (EVFM_CORP-PRESENTATION)

With Phexxi aggregate sales to date at <$15 million its covenant referenced above requiring $100 million in aggregate Phexxi sales by 06/30/2022 will require modification to prevent default.

Conclusion

Evofem is a unique stock. It has severe financial challenges. Normally I would shy far, far away. However, it has shown that it can surprise to the upside. Of course, a few exceptional price/volume prints do not a solid investment make.

It will be fascinating to watch this stock as the culture wars rage. GLTA.

Be the first to comment