Massimo Giachetti

While I remain bearish on U.S. tech stocks and see significantly further declines in valuations as the bubble deflates, the ProShares UltraPro Short QQQ (NASDAQ:SQQQ) ETF is too risky and expensive and requires impeccable timing to generate positive returns. Since the Nasdaq 100 peaked in November 2021, it has seen a 30% decline in price, but over this period the SQQQ has risen by only 55% despite being 3x leveraged. From a longer-term perspective, USD1000 invested in the SQQQ 10 years ago would now be worth less than a dollar today. Unless we see a major collapse in the Nasdaq 100, the SQQQ is likely to cause significant losses over any holding period beyond the very short term.

The SQQQ ETF

The SQQQ is an extremely aggressive 3x leveraged ETF that seeks to allow investors to benefit from short term declines in the Nasdaq 100. The fund uses swaps on the NASDAQ-100 ETF (QQQ), swaps on the index itself, and futures to create the inverse exposure to the underlying market. Holding the fund for periods longer than a day opens the door to the effects of beta slippage, which largely explains why the ETF has lost almost all its value over the past decade. The fund’s high expense ratio of 0.95% adds to SQQQ’s decline over long periods of time. The ETF has seen a surge in inflows over the past few years, with assets under management rising to USD3.9bn, and daily volume averaging USD6.5bn.

A Nasdaq Bear Market Is No Guarantee Of SQQQ Upside

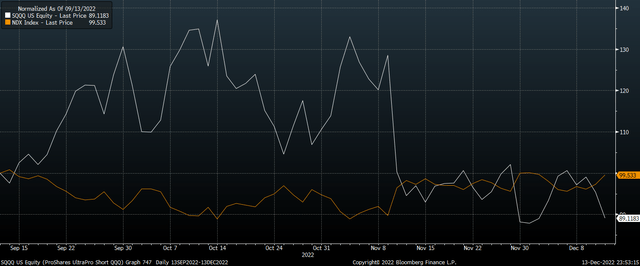

Over the past two years, the Nasdaq 100 is almost flat, but the SQQQ has declined by over 50%. The SQQQ is actually no higher than it was in July 2021 despite the NDX being down by almost 25%. It should be clear then that a bear market in the Nasdaq is absolutely no guarantee of positive returns on the SQQQ.

The fund’s prospectus notes that ‘ProShares’ returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period.’ However, the impact of the ETF’s high costs can even be seen over the course of any single day. For instance, the NDX is broadly flat since mid-October, yet the SQQQ is down by over 10%. This equates to more than 0.2% per trading day, which is significant.

SQQQ Vs NDX Rebased (Bloomberg)

Alternative Strategies For Betting On A Market Decline

Investors looking to profit from further declines in the NDX, or looking to hedge their long positions, are much better off selling call options or buying put options if they can. At the money NDX calls expiring on January 20 offer an option premium of almost 3.6%, meaning that call sellers will profit if the NDX remains below USD12,000 over this period.

For those looking to limit their downside risk in the event of a rally in the NDX, buying a put option could make sense. The January 20 at the money NDX put is selling for USD420, meaning that holders will profit on any declines in the NDX in excess of 3.6%. A long position in the SQQQ is likely to cost significantly more in funding costs.

Summary

The SQQQ is an extremely risky ETF that should be held for very short periods of time, if at all. The beta slippage caused by the leveraged nature of the ETF has seen SQQQ lose over 0.2% per day relative to what investors might expect based purely on price performance, meaning that holders will likely see their investment decline even in the short term in the absence of sharp NDX declines. Investors looking to benefit from further tech sector declines are much better placed selling call options or buying put options.

Be the first to comment