georgeclerk/iStock Unreleased via Getty Images

Amazon’s (NASDAQ:AMZN) stock has struggled in recent weeks and is now on its way below $3,000. The stock split news certainly lifted the shares initially, but that effect faded quickly. It seems clear that Amazon’s stock has one way to go over the next few months, which is lower.

The declines in Amazon have everything to do with the Fed’s plan to raise rates. It is leading investors to reprice risk assets.

Surging Real Yields

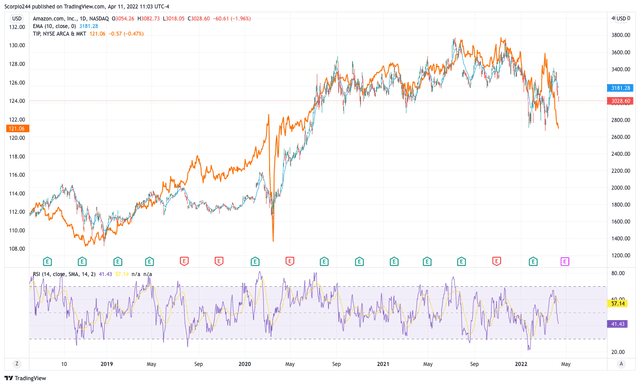

Amazon’s shares have been following real yields very closely, and where real yields go, Amazon is sure to follow. It is easy to see the relationship between Amazon and real yields by simply overlaying Amazon’s chart with the iShares TIPS Bond ETF (TIP) chart. The two have followed each other very closely since the winter of 2018.

The TIP ETF is a basket of Treasury Inflation-Protected Securities. When the TIP ETF rises, it indicates that real yields are falling, and when the TIP ETF is falling, it indicates that real yields are rising. It seems very clear that real yields should only continue to rise, which means the TIP ETF should continue to fall. The further the TIP ETF drops, the further Amazon’s stock falls, as the relationship is unlikely to change.

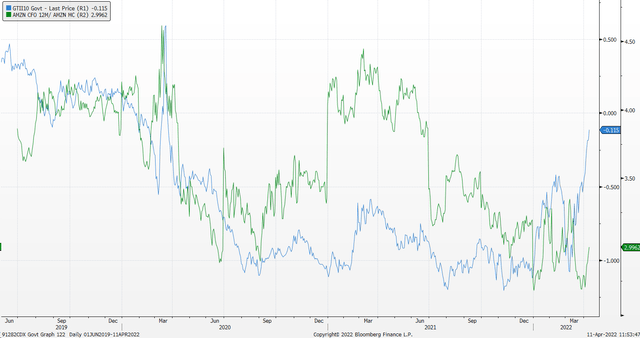

The ratio created by dividing the trailing twelve-month cash flow from operation (FFO) by Amazon’s market cap closely tracks changes in the 10-Year TIP rate. The general trend lower in this ratio is due to the free cash flow from operation over the trailing 12 months falling over the past few quarters.

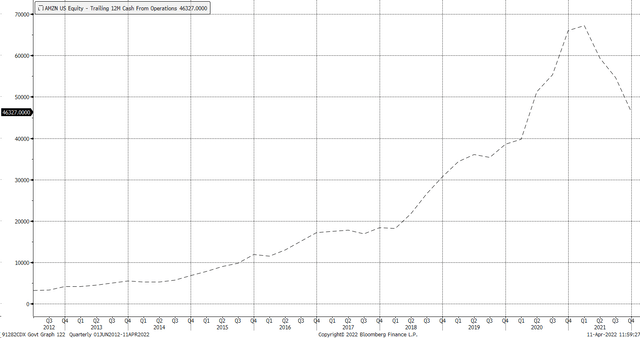

Free Cash Flow From Operation has struggled and has fallen sharply. It will be an essential metric when the company reports next quarter; if it continues to decline, it is only likely to put additional pressure on Amazon’s stock. If it can rise, it should help boost the shares. However, with real yields surging and the likelihood of those real yields rising even more in the coming months, one can assume that Amazon’s stock will suffer further losses. The pace of the stock’s decline will likely be determined by how effectively Amazon can manage its free cash flow. Still, the fundamentals are unlikely to change the overall downward path for Amazon as long as the Fed stays hawkish.

Again, the challenges of the stock have more to do with broader macro trends than fundamentals. The stocks losses and potential for future losses have more to do with a repricing of risk assets as investors weigh the value of future earnings and cash flow in a higher interest rates environment.

Technical Trends Breaking Down

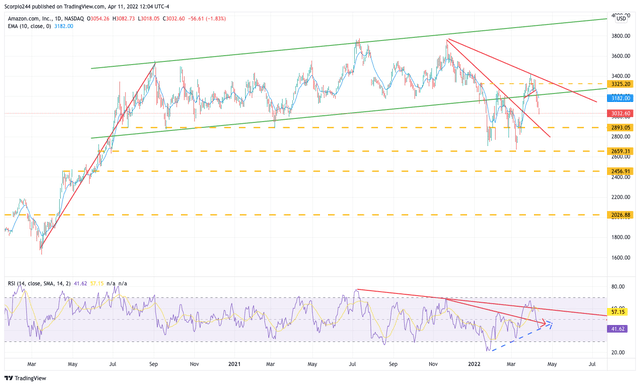

Right now, the technicals for Amazon are very weak, with the rising bearish flag pattern that started at the pandemic lows. Since breaking below the lower range of the trading channel at the start of 2022, the stock has been trending lower and appears to be on its way to $2,890. However, the stock isn’t likely to stop at $2,890, but is more likely to revisit the lows in early March at around $2,650.

The relative strength index is trending lower and in a long-term downtrend. The RSI is trending higher over the short-term, but it is more likely than not for the short-term RSI trend to be steam-rolled by the longer-term RSI bearish momentum.

The combination of bearish momentum and rising real yields will make life difficult for Amazon and its investors as shares fall further over the next few months.

Investing today is more complex than ever. With stocks rising and falling on very little news while doing the opposite of what seems logical. Reading the Markets helps readers cut through all the noise delivering stock ideas and market updates, looking for opportunities.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.

Be the first to comment