Jean-Luc Ichard

Shares of Microsoft (NASDAQ:MSFT) have continued to trend down after the release of fiscal fourth quarter results despite the software company presenting strong top line growth in its intelligent Cloud business. Because shares of Microsoft have revalued 29% lower so far in 2022, the firm’s free cash flow has become too cheap. While there are challenges to Microsoft’s growth prospects, especially in the PC market which is showing signs of growing weakness, Microsoft is one of the most profitable businesses in the world regarding free cash flow. For that reason, I believe that Microsoft will be able to withstand growing market volatility and, sooner or later, revalue to the upside!

PC market weakness remains a risk in the short term

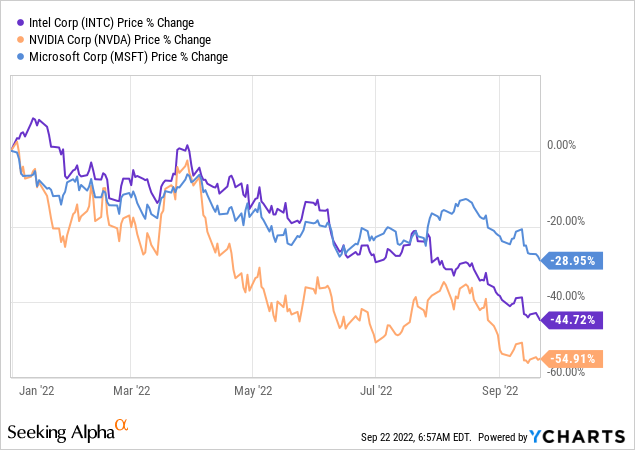

From Intel (INTC) to Nvidia (NVDA) and Microsoft, technology companies with exposure to the PC market have not done well in 2022. Intel, Nvidia and Microsoft have all bled market value this year as PC shipments weakened after the pandemic and inventory buildups threaten to make the supply situation even worse. Microsoft obviously would be hurt by an accelerating down-turn in the PC market, but I believe two factors speak for Microsoft despite the potential for growing revenue headwinds.

YCharts

Microsoft’s free cash flow has become too cheap

The first factor is that Microsoft’s valuation has become compellingly cheap in September as the software company’s shares fell to a new 1-year low.

Microsoft generated a massive $17.8B in free cash flow in FQ4’22 which translated to a free cash flow margin of 34.2%. In the last twelve months Microsoft generated a total of $65.1B in free cash flow… which translates to an average free cash flow of $16.3B a quarter or $5.4B each month!

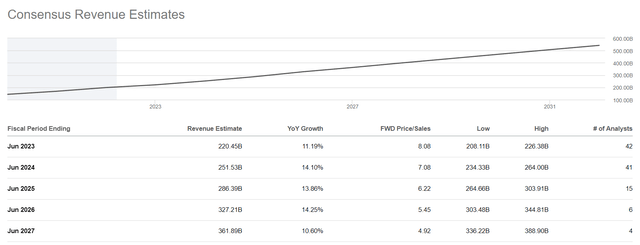

Assuming that Microsoft can sustain its current free cash flow margin of ~33%, and working with estimated revenues of $251.5B in FY 2024, then the software company could be earning up to $83.0B in free cash flow in the next fiscal year. As of right now, Microsoft has a market cap of approximately $1.78T which means the assumptions laid out here result in a price-to-free-cash-flow ratio of 22 X. This multiple may be high for the average company that has no moat and no significant market share… but Microsoft has both and the company is one of the free cash flow-strongest companies in the world. Microsoft is also expected to see healthy top line growth this year and next year: the revenue assumption implies 11% year over growth in FY 2023 and 14% in FY 2024.

Seeking Alpha: Microsoft Revenue Estimates

Stock buybacks

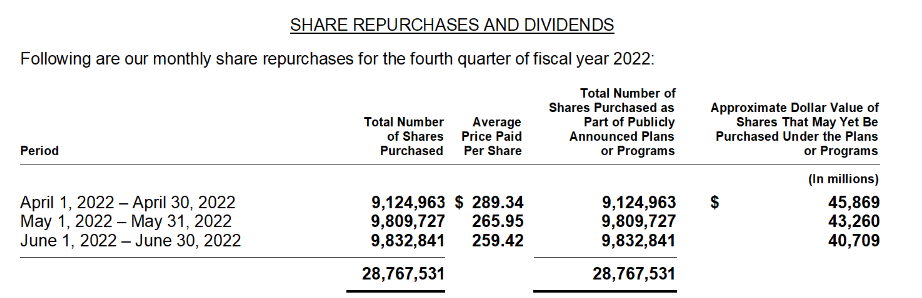

The second factor that could make a big difference for Microsoft relates to stock buybacks. In the fourth-quarter, Microsoft spent $12.4B on repurchases and dividends. Additionally, Microsoft just raised its dividend by 9.7% to $0.68 per-share, bringing the dividend yield to 1.1%.

Few investors will consider a 1% dividend yield as a key reason to buy Microsoft, but the volume of stock buybacks could be a deciding factor. Microsoft is repurchasing shares aggressively: in FQ4’22, Microsoft repurchased between 9 and 10M shares each month which cost Microsoft a total of $7.8B… which calculates to 44% of Microsoft’s free cash flow in FQ4’22.

Microsoft: FQ4’22 Stock Buyback

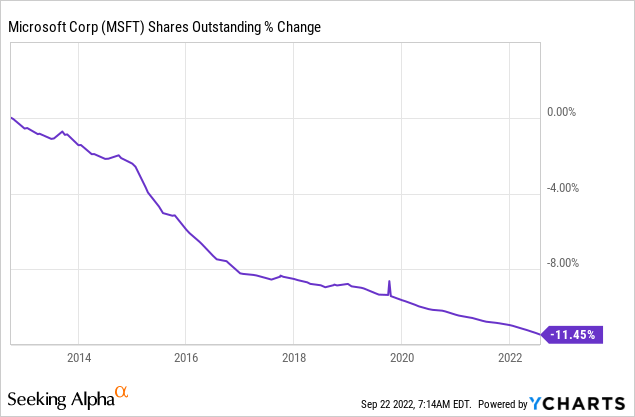

Microsoft has repurchased shares regularly, but Microsoft’s weak stock performance could result in the announcement of a major stock buyback. The firm’s share count has decreased about 11% in the last ten years. Since Microsoft is no stranger to stock buybacks, a new major repurchase initiative could make a real difference for Microsoft’s beaten-down shares.

YCharts

Valuation

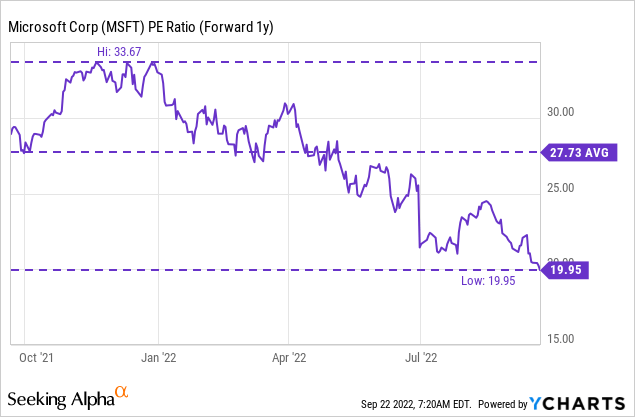

Microsoft is not only cheap based off of free cash flow, but also based off of earnings. The software company is expected to generated EPS of $11.98 in FY 2024, implying 18% year over year growth. Based off of FY 2024 estimates, Microsoft trades at a P-E ratio of 20X… which is at the very bottom of Microsoft’s 1-year P-E ratio range and well below the average P-E ratio of 27.7X. Since Microsoft’s shares are trading at such a low valuation factor, a major stock buyback would make sense for the company.

YCharts

Risks with Microsoft

Although Microsoft has said that it sees double-digit revenue and operating income growth for the current fiscal year, the slowdown in the PC market represents a fundamental challenge to Microsoft’s outlook in FY 2023. I have recently voiced my concern that the PC market may be primed for a continual slowdown in the third-quarter, largely because of soft demand for consumer electronics as well as higher inventory levels for PC and laptop manufacturers. A down-grade in Microsoft’s outlook for the fourth-quarter may be one of the bigger short term risks that the firm and the stock are facing. What would change my mind about Microsoft is if the software company announced a major change in its short term revenue outlook or if it saw a fundamental slowdown in its core Cloud business that is a key driver of Microsoft’s top line growth.

Final thoughts

The more Microsoft’s shares drop, the more I feel I am getting a really good deal: the lower the price, the higher the free cash flow value the stock represents. The outlook for Microsoft’s top line growth is still pretty robust and the software company has considerable potential to deploy free cash flow for stock buybacks. A major stock buyback could result in a revaluation of Microsoft’s prospects and push the stock into a new up-leg!

Be the first to comment