sharrocks/iStock Unreleased via Getty Images

A rising tide often lifts all boats. From 2016 to 2020 investing was much less challenging for most investors than investing is today. Today investing is more challenging. Although there are many investment opportunities for all kinds of different investors who have different goals and needs, inflation had made investing more difficult across the board.

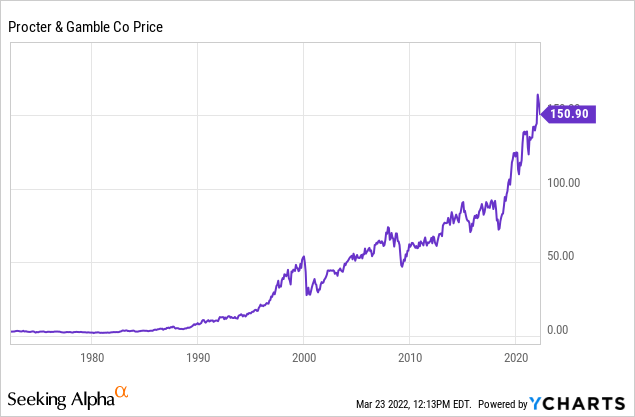

One stock that has been a very strong investment both during good and more challenging times is Procter & Gamble (NYSE:PG). Procter & Gamble, a retail giant company that needs no introduction to most, operates in five main segments: beauty, grooming, health care, fabric and home care, and baby, feminine, and family care. The company boasts such as brands as Old Spice, Head and Shoulders, Pantene, Tide, Charmin, Secret, and Oral-B.

The company’s three biggest division are home care, family care, and oral care. Home care is by far Procter & Gamble’s largest division being nearly 32% of annual revenues.

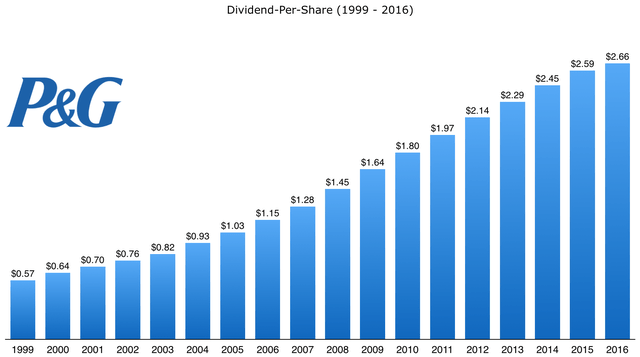

Procter & Gamble has been able to maintain impressive both in good times and bad, and the company has been one of the best performing stocks in the market for some time. The company also has a sixty-five-year history of raising the dividend, and this retail giant that is front and center on the list of dividend champions for good reason.

Just from 1999 to 2016, Procter & Gamble raised the company’s dividend from $.57 a share in 1999, to $2.66 a share in 2016. Today the dividend is $3.48 a share.

Procter & Gamble has been able to raise the dividend for 65 straight years, including in 2020 during the pandemic, well maintaining a conservative payout ratio and modest debt load. The payout ratio is right at 60%, which is not overly aggressive in the consumer staple industry, and the company’s net debt is just around 1x EBITA, or annual earnings.

Procter and Gamble’s organic growth and earnings held up very well both during the pandemic, and during the past year’s inflationary environment. Well many competitors such as Clorox (CLX) and Kimberly-Clark (KMB) have seen inflationary pressures have a significant impact these company’s margins and earnings, Procter and Gamble has been able to maintain impressive sales growth and strong margins even during these more challenging times.

The company’s recent earnings report highlighted how strong Procter & Gamble’s brands really are. This earnings report was very strong, and management issued very bullish guidance for the company’s core businesses as well as for shareholders. Despite a massive increase in operating costs primarily because of huge spikes in commodity costs, Procter & Gamble reported just a 1% drop in year-over-year revenues, and just 3% drop in year-over-year revenues adjusted for currency moves. Organic sales growth in the US was an impressive 4%, and the company also reported that on a two-year stack basis, organic sales in China were up 12%. This sales growth came without heavy discounting or promotions, which is why the company’s revenues held up so well despite extreme inflationary pressures. Procter & Gamble also issued very bullish guidance, with management guiding to 2-3% organic sales growth this year, and 3-6% earnings per share growth on an annual basis as well. The company’s core margin declined only 270 basis points, and core margins are still 3% higher than these levels were at just 12 years ago.

The company also discussed the intent to have ninety percent free cash flow productivity, with a plan to return nearly $17 billion to shareholders this year alone in dividends and buybacks. The company plans to pay $8 billion in dividends and to repurchase between $7 billion to $9 billion in shares this year. Share buybacks do nothing but add debt to the balance sheet when a share price is declining, but Procter & Gamble’s continued strong operating performance that has consistently driven strong stock performance has made the impressive buyback very accretive for shareholders. The buyback has also of course boosted the dividend as well.

This is why Procter & Gamble still looks cheap at 22x next year’s earnings estimates. This company has proven that the business is not cycles, and the brands have been strong enough for management to raise prices to offset margin pressure without losing any market share in the company’s core segments. The housing market has boomed over the last year, and Procter & Gamble is very well positioned to deliver a variety of strong products to new and existing homeowners. Well, many companies, such as Kimberly-Clark, have not been able raise prices to offset margin pressure because of intense competition, Procter & Gamble has been able to raise prices without losing market share. The company has not been able to completely offset margin pressure, but the strong brands this company boasts has enabled superior operating performance to most of the company’s peers.

Procter & Gamble should see high single digit growth when margin pressures eventually ease, and the company’s strong brands and impressive pricing power have shown that management has the tools to offset most inflationary pressures even in the current operating environment. Given the company’s cash flow, recession proof business model, and the impressive sales growth of this company, the stock is more than justified at trading at 25x next year’s earnings estimates, and those estimates should go up as the extreme inflationary pressure we are seeing from the Russia-Ukraine conflict ease. Procter & Gamble should be able to beat the fairly conservative 2023 earning’s estimates of $6.21 a share, and if the company trades at 25x the high end of next year’s earnings estimates of $6.61 a share, or $165 a share.

Inflation has separated the strong from the mediocre in the corporate world, and Procter & Gamble has proven that the company’s brands can withstand even the toughest operating environments. Management has skillfully used the company’s massive shareholder buybacks to increase earnings per share and dividend payouts, and if inflationary pressures ease even slightly, this company should see revenue acceleration that would likely offer shareholders even greater income and total returns. With Procter and Gamble having a realistic target of 90% cash flow, the company’s strong balance sheet and growing core businesses should be able to drive impressive income and total returns for years to come.

Be the first to comment