Han Myung-Gu

Thesis

We turned bullish too early in our August article on EPR Properties (NYSE:EPR) as the Regal (OTCPK:CNNWQ) bankruptcy filing in September forced a further de-rating in EPR. We believe the de-rating is justified as the market needed to reflect significant risks relating to Regal’s rent base, which could impact a substantial portion of its ongoing rent and deferral payments.

However, management’s forward guidance in its recent Q3 earnings release suggests that the situation remains under control (for now), even though negotiations with Regal are still in the early stages.

However, with EPR’s valuation de-rated well below its 10Y mean, we believe the market has already reflected significant risks on Regal’s malaise. Therefore, investors adding at these levels, with an NTM dividend yield of 8.5%, could be well-rewarded if they could tolerate near-term downside volatility.

Maintain Buy with a medium-term price target (PT) of $45.

Management Remains Confident Of Its Guidance Range Despite Regal’s Troubles

EPR Properties posted an AFFO per share of $1.22 and an FFO per share of $1.16 in Q3. Notably, management revised its FFO per share guidance for FY22 from $4.50-$4.60 to $4.50-$4.68, upgrading the higher end of its guidance range. As such, the midpoint of its FFO per share guidance has improved to $4.59 from $4.55 previously.

Management’s confidence in its revised guidance emanated from Regal continuing to pay its rental and deferral payments in October and November, even though it missed rent payments in September. A better-than-expected Q3, on the whole, was also accretive to its revised guidance, which contemplated the missed rent payment from Regal.

As such, management was confident it could squeeze some additional payments from Regal through Q4, leading it to increase the higher end of its guidance range. CFO Mark Peterson articulated:

So the upside to our guidance now, since we are kind of dealing with post-quarter-end deferral payments, really becomes the Regal deferral for 1 month, which is $1.5 million for December and $0.5 million for the non-Regal customers for the month of December. And as I mentioned, there’s the September rent payment out there that in our midpoint of guidance, we don’t anticipate getting, but we could get a portion of that yet this year. So that contributes to the upside. (EPR Properties FQ3’22 earnings call)

We believe there remains significant uncertainty over the whole Regal situation. However, Regal made rent and deferral payments for October and November. Therefore, it seems reasonable for management to reflect higher confidence in recovering missed payments from September, when Regal first filed for bankruptcy protection.

Coupled with its well-battered valuation, the potential for mean-reversion seems attractive at the current levels.

Is EPR Stock A Buy, Sell, Or Hold?

Consequently, we are confident that management’s guidance has contemplated the near-term challenges for Regal. Notwithstanding, ongoing deferral payments remain uncertain as Regal accounted for $92M of EPR’s $123M deferred rent as of Q3.

Therefore, we urge investors to continue monitoring the Regal situation closely, even though we believe these challenges have been reflected in its valuation.

Moreover, the company also narrowed its investment guidance range to $400M (midpoint) from its previous guidance of $600M (midpoint). As such, the company’s revised outlook suggests Q4 investment spending of about $79M, below Q2’s $82M. As such, it implies investment spending of $161M in H2, well below H1’s $239M.

Management highlighted that it sees the need to be more prudent, given the surge in the cost of financing. Therefore, it could also impact the REIT’s ability to drive AFFO per share growth in the near term with elevated macro volatility and uncertainties.

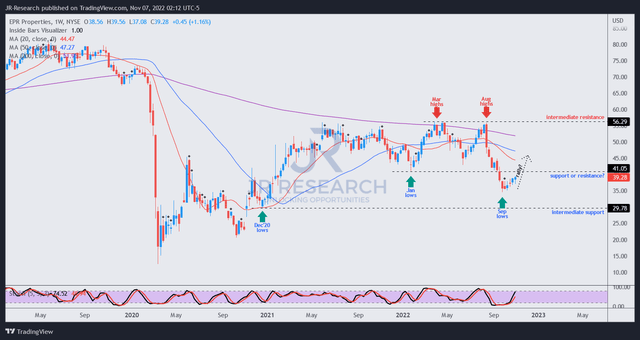

EPR price chart (weekly) (TradingView)

Notwithstanding, EPR last traded at an NTM AFFO per share multiple of 7.8x, well below its 10Y mean of 13.3x. Also, it’s well below its peers’ median of 14.1x. Hence, we believe significant damage has already been reflected in its valuation.

However, we must caution investors that EPR remains in a long-term downtrend and has also lost its medium-term bullish bias. Therefore, it’s clear that the market has de-rated it, and investors should not expect a retaking of its August highs anytime soon.

Still, we view the current levels as reasonable, with the mean reversion opportunity already underway.

Maintain Buy with a PT of $45.

Be the first to comment