NicoElNino

Vanguard Total Stock Market ETF (NYSEARCA:VTI) is down over 20% from the highs it set late last year. While it is possible that the markets will continue to decline in the second half of 2022, current pricing appears to provide a strong long-term risk/reward opportunity.

VTI is the exchange-traded fund (“ETF”) version of the largest equity mutual fund in terms of assets under management, the Vanguard Total Stock Market Index Fund Admiral Shares Inst (VTSAX), and is also the third largest equity ETF. The fund tracks the performance of the CRSP U.S. Total Market Index that essentially represents all stocks traded on both the New York Stock Exchange and the Nasdaq Stock Market. Due to VTI’s broad structure and low fee, it is a reasonable choice for dollar cost averaging over long periods of time.

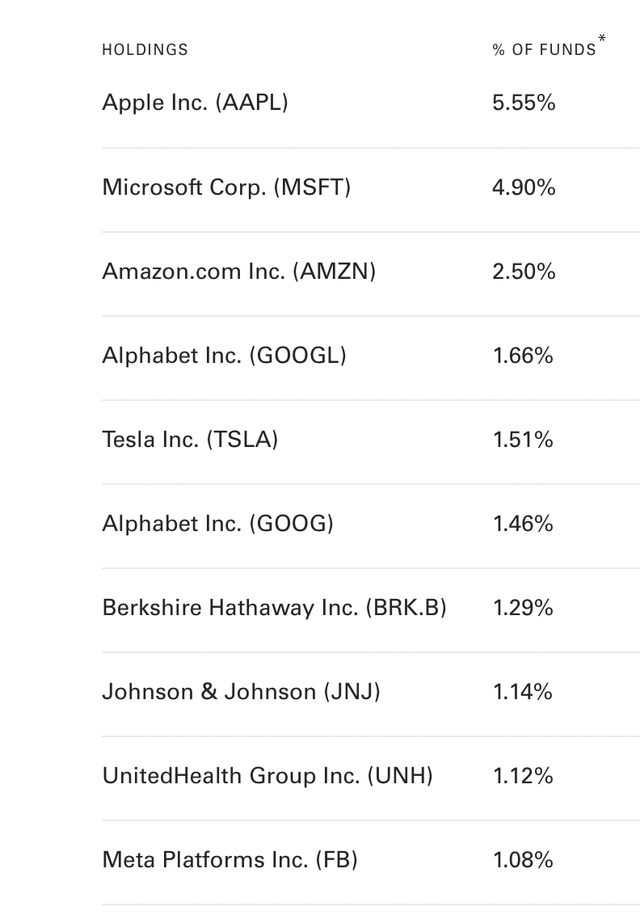

VTI is composed of over 3,600 companies, but about 80% of VTI’s weighting is within the S&P 500, and the top holdings are usually the same, due to market weighting. The last equity to make it into the top ten holdings of VTI without also being in the S&P 500 was Tesla (TSLA) back in 2020.

VTI top 10 holdings (Vanguard)

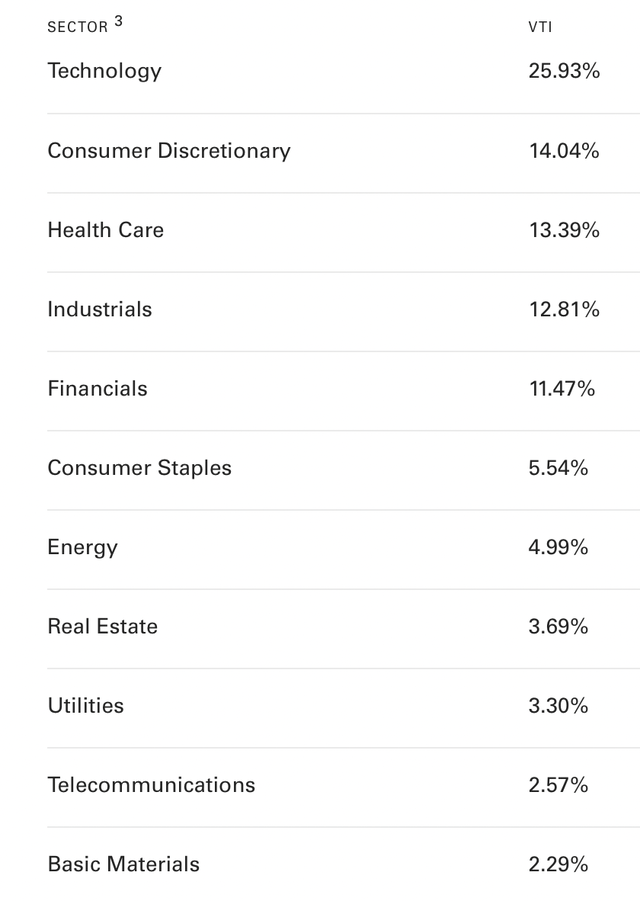

Much like the broader market, VTI often suffers from excessive concentration in popular sectors and stocks. This is a risk, but it is only in proportion to the market itself. VTI is currently most heavily concentrated in the technology sector, which makes up over 25% of the fund. This is actually down from the start of the year, when around 30% of VTI was in the technology sector. Similarly, consumer discretionary is now 14% of the fund, but was around 16% at the end of 2021. In that same time, energy increased from around 2.8% up to nearly 5% of the fund.

VTI sector exposure (Vanguard)

VTI is essentially guaranteed to not beat the market, but to be the market. As a result, VTI allocators do not seek outperformance, but rather market performance based on the presumption that equities as an asset class are likely to appreciate over time, and that a fund like VTI will closely track that movement. VTI might not be the best choice, but it is almost certain to not be the worst.

The market experienced a dramatic and broad drawdown in the first half of 2022, and it may continue this quarter. Nonetheless, this now appears to be setting up as a reasonable time to dollar cost average into long-term equity exposure. Highly volatile drawdowns like the one the market is currently experiencing are almost always good long-term opportunities.

VTI daily candlestick chart (Finviz)

VTI has been in a sustained downtrend, but it may end up breaking out of that downtrend here. The broad market ETF appeared to fund strong support last month in the low $180s, and this level appears likely to be supportive going forward. As a result, shorter term investors could consider that as a stop loss point.

Conclusion

VTI is one of the most reasonable ways to accumulate diversified equity exposure within a single fund. The market is currently in a sustained downtrend, and mid-term election years often bottom in the fall. As a result, the current market appears to set up as an opportunity to accumulate VTI as a long-term holding.

VTI is down around 20% so far this year. Even though it is possible that VTI has not yet bottomed, I believe it has reasonably strong support at current levels. Moreover, there appears to be substantial support about 5% below current levels, in the low $180s.

Be the first to comment