Tapestry’s management team has done a very good job of positioning the company coming out of COVID and all of the hard work is beginning to show up in the numbers. JamesBrey/E+ via Getty Images

Generally speaking, we have historically tended to avoid retail and apparel due to how quickly and dramatically consumer tastes and habits can change. Since activists and private equity firms entered the space years ago and used many of their target companies in the industry to conduct financial engineering, we have stayed even further away. Loading these typically cyclical, and sometimes volatile, companies up with debt rather than carrying cash on the balance sheet to get through the tough times that inevitably arise adds a lot of risk to the equation and creates scenarios that we do not find attractive. However, in the last few years, we have managed to find some attractive names that have generated some decent returns. Many of those gains were the easy returns coming out of the COVID recovery, but we have also managed to find some attractive entry points for trading that occurred after that initial bounce.

One of those names is Tapestry (NYSE:TPR). Tapestry is a name that we have liked for quite a while with our base thesis broadly focused around the idea that this was a leveraged turnaround story (with two brands needing some TLC) that had a pretty solid balance sheet, a respectable dividend, as well as multiple avenues for creating shareholder value if the turnarounds took longer than expected or were not 100% effective (for instance, if Coach’s turnaround was successful but Kate Spade continued to languish, or vice versa). In short, unless the company ran into significant headwinds, it was “money good” because management would either turn it around or someone else would just buy shareholders out.

While the easy money has been made in this name, we believe that management has proven enough for us to believe that the stock should no longer be valued on the base case but rather should be looked at as a story with multiple tailwinds pushing it higher.

Turnaround Is Underway

The good news is that the turnaround is well underway, with both the Coach and Kate Spade brands bouncing back, which now has management talking less about the problems with the brands and more about where the brands can go in the next few years. Most promising, in our opinion, is that management believes that Kate Spade can be a $2 billion brand (in revenues) in the next few years. That is roughly double the size of current revenues, and although the margins are lower across the board (gross profit, operating income, etc.), we do think that margins will continue to increase as revenues rise and the management team is able to manage expenses.

China’s recent COVID outbreak may impact the company this quarter on the margin, as it accounts for about 20% of revenues as of the latest quarter. The company already expects to have some minor issues in Q3 from other items (supply chain, etc.) but feels like the business can make up the difference in Q4. We feel like any hiccups in China would just push consumers to delay purchases, not cancel what they desire.

Cash Generating Machine

Tapestry may not be in the ultra-luxury category or on par with the offerings from the European luxury houses, but it still generates a ton of cash by whatever measure an investor prefers. Earnings per share are strong, cash flow is abundant…simply put, the business generates enough cash for management to have more than enough to reinvest in the business and also have the luxury to fund a generous capital allocation plan that in our opinion is laying the groundwork for future share price gains.

Capital Allocation

While we have seen some talk of investors wishing that the company had increased the dividend, it appears to us that the company’s guidance of the $1/share for FY2022 is in-line with typical dividend policy. Many companies look to raise once per year, with a steady payout during their fiscal year, and one has to remember that Tapestry just reinstituted the dividend about 9 months ago. We think that management continuing to state that they want to grow the dividend (and at a faster rate than earnings growth!) in the future could indicate a willingness to do a dividend hike sooner rather than later (so maybe an announcement in the second half of calendar year 2022 which would be Q1 of 2023 for the company’s fiscal year).

Share repurchases are what we think can help keep a floor on the stock while also providing upside from current levels. We think that $30 is a level that can be viewed as a floor and that $40 is probably pretty close to fair value in the current fiscal year for the company. We would highlight for readers that management did increase their anticipated repurchases for fiscal year 2022 to $1.25 billion from $1 billion, and through six months, they have repurchased $750 million. This leaves $500 million left to repurchase this year, but with only $850 million remaining on the current share repurchase authorization, we think management will most likely be making an announcement in the next few months (potentially as late as November) announcing another incremental share repurchase program to provide additional capacity for FY2023.

What’s The Trade?

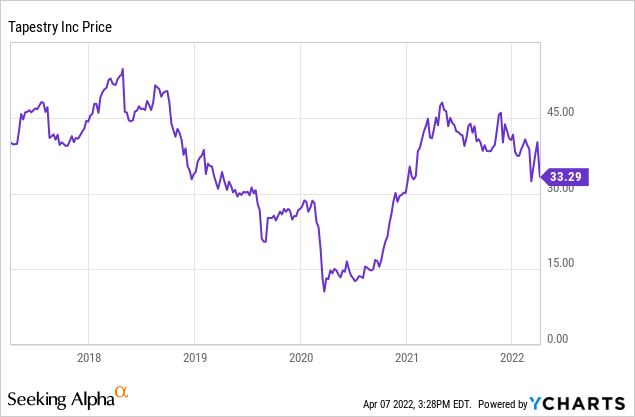

Tapestry is a name that we like long term, however, with the stock having once again fallen from the $40 neighborhood like a brick, we see a trading opportunity here with an attractive entry point. Due to the capital we already have tied up in the name and the market volatility due to recent geopolitical tensions, we wanted to minimize how much additional capital we would be putting at risk, so we created some options trades with different payoff scenarios. Over the last two days, we have put into place two trades.

The first was an outright bullish position whereby we purchased 10 TPR Apr 29, 2022, $35 Calls (this trade was near the close on Wednesday). The premiums seemed attractively priced and risking less than $900 instead of $33,500+ (which is the amount we would have had to spend to purchase 1,000 shares) for roughly the same upside over the defined period seemed like a no brainer. We would note, however, this first trade is most likely not going to be held until expiration day, as it is a trading position.

The other bullish trade we placed is a bit more complicated. First, we sold 2 TPR May 6, 2022, $33 Puts rather than purchasing 200 shares of Tapestry. We are perfectly happy to own those shares, but since we are bullish on the name and expect a decent bounce, we wanted to take the premiums from that covered put sale to then set up a corresponding call ladder by purchasing 1 TPR May 6, 2022, $34 Call, 1 TPR May 6, 2022, $35 Call and 2 TPR May 6, 2022, $36 Calls. This trade requires the stock to rebound strongly and for Tapestry stock to close at $37.50 by expiration day to perform roughly as well as owning the stock outright (because the premiums for the calls are paid for with the premiums from the put sale, we are treating those as sunk costs). Below is a table of the options used in the trade:

| Action | # of Contracts | Option | Option Type | Strike |

| Sell | 2 | TPR May 6, 2022 | Put | $ 33.00 |

| Buy | 1 | TPR May 6, 2022 | Call | $ 34.00 |

| Buy | 1 | TPR May 6, 2022 | Call | $ 35.00 |

| Buy | 2 | TPR May 6, 2022 | Call | $ 36.00 |

When the dust settled, we walked away with about $5 for setting the trade up. Certainly, nothing to get excited about, but we do like the “outs” on this trade. We either end up owning the stock for the same price we would have had to pay minus the $5 in net option premiums we banked, end up owning nothing if the stock closes between $33 and $34 by May 6th, or have the potential to make decent outsized profits if the stock closes above $37.50 (essentially the breakeven point). A close at any point between $34 and $37.50 would result in some gains, but would admittedly include the opportunity cost of positioning for such a strong rebound. We are comfortable with this as we like the risk/reward of the trade by essentially risking the same $6,600 in capital for $200 shares in order to potentially lock in gains that are 33% higher (if the stock reaches $40/share) by owning the option ladder we set up instead of the stock.

Be the first to comment