aluxum/E+ via Getty Images

For the type of company it is, Sisecam Resources LP (NYSE:SIRE) has been trading somewhat volatile over the last 15 months or so, starting to climb from a little over $13.00 per share on September 27, 2021, to a 52-week high of $23.99 on October 31, 2022, after it had its big quarter.

Since then, it has pulled back a little, but is trading at $21.50 as I write.

It’s latest earnings report was a big one, as demand from the domestic and international markets produced a favorable pricing environment that saw revenue and earnings soar in the quarter, even though sales volume was slightly down.

Looking ahead, as long as demand remains high, the company should be able to maintain high prices levels. But if sales volume starts to consistently show weakness, it could result in downward pressure on its prices.

That said, it’s hard to determine why sales volume went down a little. It could be from some smaller customers being priced out of the market because of demand from higher players that were willing and able to pay for product.

I’m not concerned about it at this time, but it’s worth watching in the quarters ahead to see if it’s an anomaly or a slow reversal in trend.

In this article we’ll look at its recent big quarter, what the company is thinking of in terms of risk reduction, and how things look going forward.

Some of the numbers

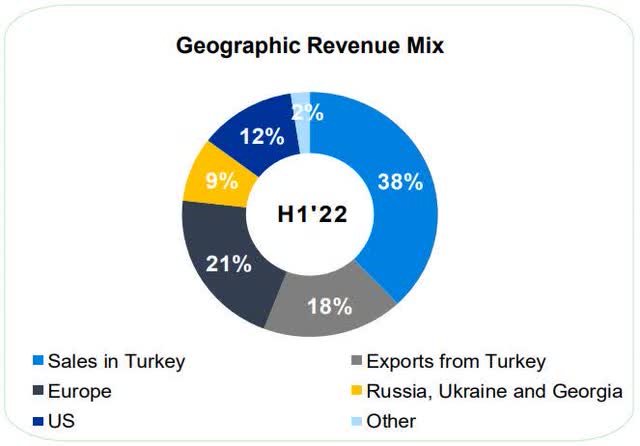

Revenue in the third quarter was $190.5 million, up 40.5 percent year-over-year, primarily from high domestic and international demand that allowed the company to raise prices at levels above rising input costs, especially in relationship to ocean freight inflation associated with supply chain constraints.

Revenue for the first nine months of 2022 was $543 million, compared to the $384 million in revenue generated in the first nine months of 2021.

Net income in the third quarter was $31.1 million, or $0.76 per unit, compared to net income of $15.4 million, or $0.36 per unit in the third quarter of 2021. Net income for the first nine months of 2022 was $94.1 million, or $2.30 per unit, compared to net income of $27.8 million, or $0.63 per unit in the first nine months of 2021.

Adjusted EBITDA in the quarter was $40.6 million, up 68.5 percent year-over-year, with adjusted EBITDA for the first nine months of 2022 of $120.1 million, a gain of 114.1 percent over the first nine months of 2021.

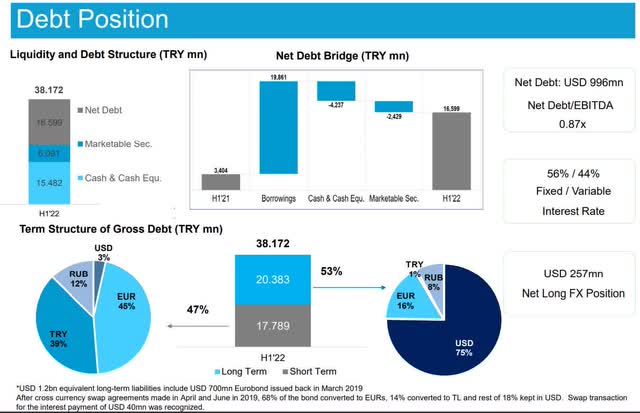

Cash and cash equivalents at the end of the quarter were $14.9 million.

Distributable cash flow in the quarter was $16.8 million, up 104.9 percent year-over-year. Distributable cash flow for the first nine months of 2022 was $48.1 million, up 204.4 percent from the first nine months of 2021.

The soda ash market

If you’re not familiar with Sisecam Resources LP, it participates in the business of mining trona ore which is then processed into soda ash, which is used in a wide variety of applications across a number of products.

While volume for soda ash in the quarter was down 4.6 percent from the third quarter of 2021, as shown above, demand drove the price up significantly in the reporting period.

Even though the volume of soda ash sold was slightly down by 1.5 percent year-over-year, domestic and international demand drove prices up.

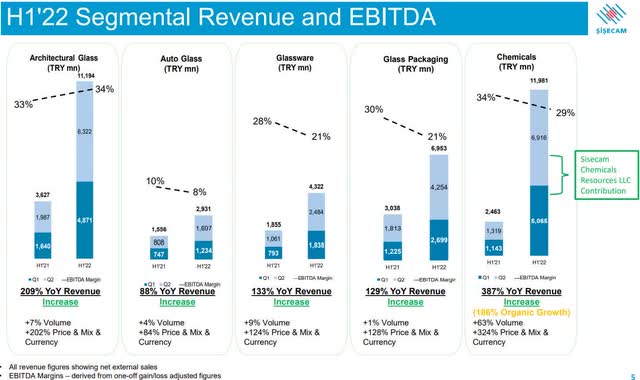

At first glance this may not make sense, but when looking at the geographic footprint of SIRE, it’s highly probable that demand from a specific market was down, while the remaining markets had high demand for soda ash. More than likely, it comes from the ongoing conflict between Russia and Ukraine, which accounted for about 9 percent of revenue in the first half of 2022.

Risk management

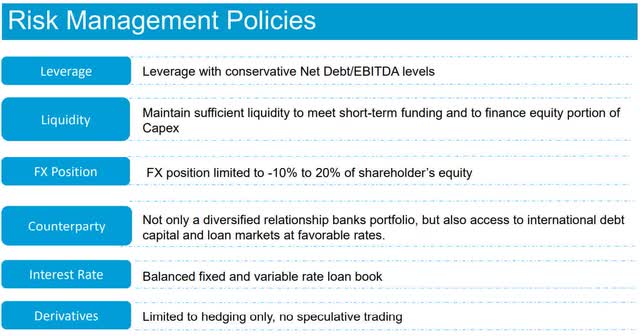

In light of the consistently strong performance of SIRE over the years, I think management, when considering the macro-economic risk it faces going forward, is now focusing more on risk control in the quarters ahead, considering it has the pieces in place to meet demand in the market.

Citing “higher interest rates, inflation, supply chain pressures and a possible recession,” the company taking steps to mitigate future risks by making its balance sheet a priority by incorporating a conservative capital structure that will allow the company to continue to meet future cash flow requirements.

Among the things it’s doing to that end are maintaining leverage at a conservative net debt/EBITDA level, limit derivative to hedging alone, have its Fx position be limited to no more than 20 percent of shareholder equity, and have enough liquidity in order to meet short-term funding and finance Capex.

Conclusion

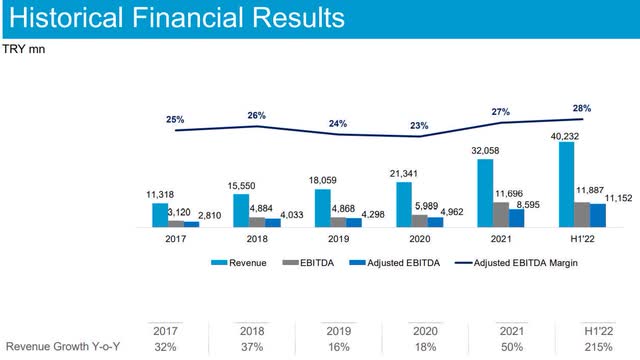

Over the last 5 years, SIRE has grown revenue, EBITDA and adjusted EBITDA on a steady and consistent basis, even though its share price corrected starting in February 2017, when it was trading at approximately $31.50 per share.

Since then, it took to April 2022 before it started hitting a bottom of about $9.50 per share before starting an upward run that led to its recent 52-week high of $23.99 per share.

My point in bringing that up is even though SIRE was improving its performance during that time, its share price didn’t immediately reflect it, and that included pre-COVID-19 effects, which of course brought it further down, starting in February 2022.

But since hitting that bottom of $9.50 per share or unit, it has more reflected the results in its share price.

Of course, this is a company that is invested in for the purpose of generating income, but the share price of the company will reflect its strength, over time, along with its ability to continue to distribute decent income to its unit holders.

Overall, I like SIRE, but its recent success and 9.98 yield could come under pressure in the quarters ahead if the economic headwinds continue or worsen.

The most important metric to watch will be the volume of soda ash versus the pricing power of SIRE. If it can continue to have strong demand in most of its geographies, it should be able to maintain and even grow its dividend. If soda ash volume continues to fall and pricing power comes under pressure, it’ll probably take some time to work it out if the economy stays weaker for longer than expected.

Coming off its huge quarter and with economic uncertainty growing as 2023 approaches, management understands that the most benefit it’ll probably provide for shareholders is to start mitigating risk that appears to lie ahead of it.

Be the first to comment