Olemedia

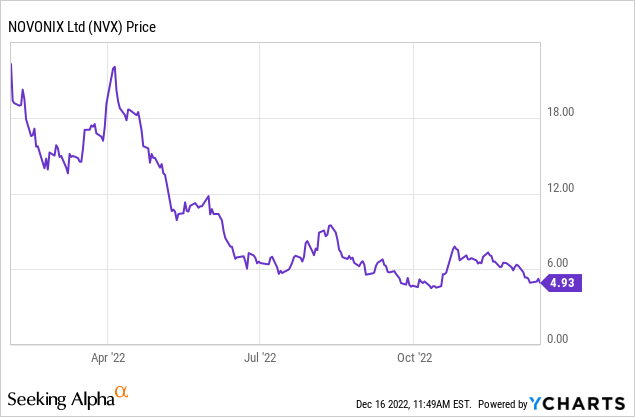

Novonix (NASDAQ:NVX) is a speculative growth company that specializes in producing synthetic graphic for use in making anodes in lithium-ion batteries for the EV market. I say “speculative growth” because the company is not turning a profit yet and faces capital expenditures in order to build up its infrastructure and supply-chains. So far, this thesis hasn’t worked out so well for investors: since going public back in February, the stock has fallen more than 75% (see below). However, that might be an opportunity for investors considering that Novonix is supported by the U.S. Department of Energy as well as Phillips 66 (PSX), which has a 16% stake in the company.

Investment Thesis

We all know that the global EV market is growing by leaps-n-bounds. We also know that the Biden administration’s Infrastructure Act and IRA Act (which I prefer to call what it really is: a “Clean-Tech Act”) are supportive of building out the clean-tech and EV supply-chains here in America as opposed to rolling-over and letting the Chinese dominate the sector (and the good paying manufacturing jobs that go with them).

Indeed, anode & cathode materials to build lithium-ion batteries are critical technology for the U.S. to source here at home. Although lithium gets all the press and is the best-known component of lithium-ion batteries, there is far more graphite than lithium in a battery. Further, battery anodes require specialty coated spherical graphite at over 99.9% purity.

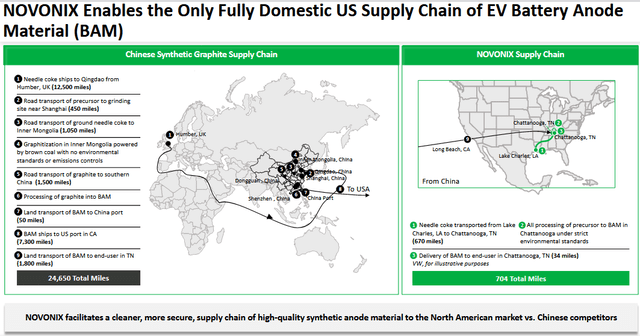

Enter Novonix – which in October received a $160 million grant from the U.S. Department of Energy to expand domestic production of high-performance, synthetic graphite anode materials. NVX plans to expand synthetic graphite production to 40,000 tonnes per annum by 2025. In January, one of the U.S.’s leading refiners, Phillips 66, took a 16% stake in the company and will be supplying needle coke from its Lake Charles refinery to NVX’s plant in Chattanooga, TN. This is the only domestic U.S. EV battery anode supply chain:

The graphic above was taken from Novonix’s OTC Markets Conference Presentation in November.

Phillips 66 Takes A Stake

Phillips 66 subscribed for 77,962,578 ordinary shares of Novonix for a total purchase price of $150 million, or an average of $1.92/share. That was good enough for a 16% stake in the company.

On its Q4 FY conference call last year, current PSX CEO Mark Lashier said:

Our Emerging Energy Group is advancing opportunities in renewable fuels, batteries, carbon capture and hydrogen. We recently signed a technical development agreement with NOVONIX to accelerate the development of next-generation materials for the U.S. battery supply chain. We own a 16% stake in the company, extending our presence in the battery value chain.

In January, at a presentation at the Goldman Sachs Clean Energy Conference, PSX’s then CEO Greg Garland said:

You’ve seen our investments in batteries around Novonix … We’ve participated in that value chain for a number of years. We produce, especially material that is used to produce synthetic graphite, and we’ve got great demand. And we’ve got lots of opportunities to partner with producers that want to make synthetic graphite, both in Europe and in North America, as those value chains want to localize. So they’re not dependent on the supply chain all the way back to China to produce lithium ion batteries in Europe and North America. So we’re partnering with NOVONIX to have a very low-carbon path to synthetic graphite to sport lithium ion batteries.

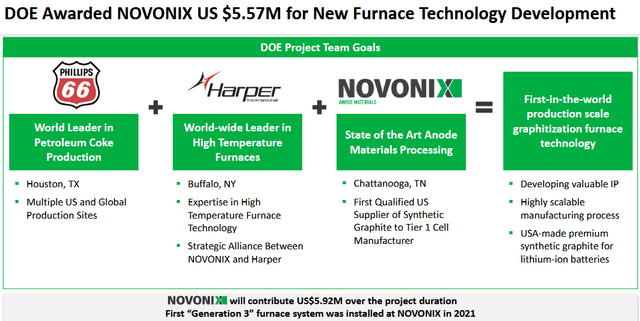

Back in January, Novonix also received a $5.57 million DOE award to develop advanced manufacturing graphitization furnace technology at production scale – the first of its kind in the world:

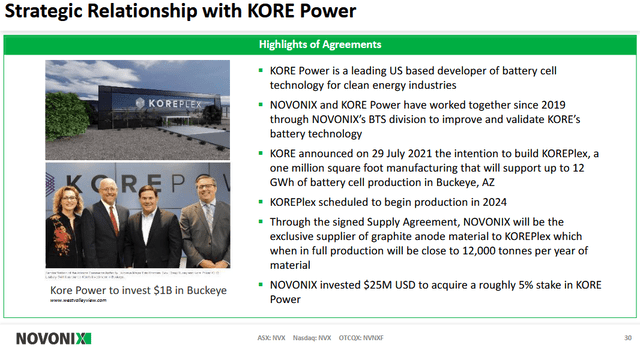

Novonix also has a key strategic investment & supply agreement with KORE Power, a leading domestic developer of battery cell technology. Part of this agreement was Novonix’s $25 million investment for a ~5% stake in KORE:

Note that the KOREPlex facility is scheduled to begin production in 2024, and that NVX will be the exclusive provider of graphic anode material – which is expected to be close to 12,000 tonnes per year.

Risks

Through PSX, Novonix has locked up supply of specialty coke in order to manufacture its synthetic graphite material, which it expects to be supplying in high-volume to KOREPlex starting in 2024.

However, that’s still more than a year away. Meantime, NVX is burning through cash: as of the latest quarter ending in September, the company had only $2.8 million in revenue (for the quarter and YTD) while burning through $19.2 million of cash. The good news is that, at quarter’s end, the company had $181.8 million in cash and only $36 million of long-term debt. That being the case, and with combined support from the DOE and Phillips 66, Novonix appears to have more than enough cash to invest in the business and see it through until it brings its facilities up-to-scale and revenue begins to ramp-up as it supplies its partners with synthetic graphite.

According to Research & Markets, the top-5 synthetic graphite producers have a greater than 75% market share: Shanshan Technology, Shenzhen Sinuo Industrial Development Co. Ltd, BTR New Energy Materials Inc., Jiangxi Zichen Technology Co. Ltd, and Hitachi Chemical Co. Ltd. These are big and major competitors. However, none of these are making synthetic graphite here is made in the USA, and that is what makes NVX unique.

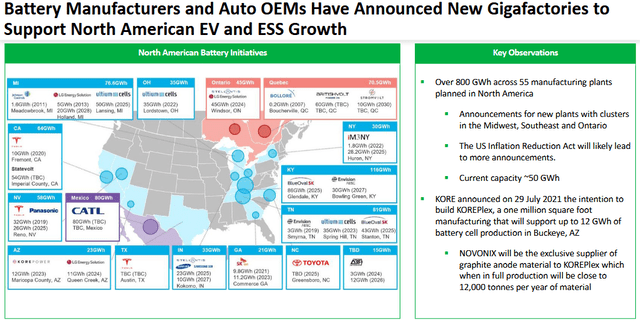

For investors, the opportunity is huge. That’s because the Clean-Tech Act is already working, and domestic and North American supply-chains activity for domestic EV battery manufacturing is flourishing:

As noted earlier, having a totally domestic supply-chain cuts down on shipping distance from China. More importantly, it is also a more secure supply and the components will qualify for the government’s “made in USA” battery component incentives.

Summary & Conclusion

Novonix is a speculative growth type investment and is not for the weak of heart. That’s because the company is still burning cash, not profitable, and has little current revenue. However, it would appear that NVX’s proprietary technology is both unique and will be in high demand going forward. I say that because not only is the DOE investing in the company, but so is private sector company Phillips 66, which will be supply a key material in NVX’s manufacturing process. And, the company has already lined-up an exclusive supply agreement with KORE Power. That being the case, I wouldn’t bet against NVX going forward, and rate the company a “Speculative BUY” for those investors who like to allocate a portion of their portfolio toward high risk/reward companies. Such an investor will need to be patient, as an investment in NVX may not pay off for another 12-18 months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment