Eoneren/iStock via Getty Images

Bakkt Holdings, Inc. (NYSE:BKKT) is investing in a target market that grows at a CAGR of 26%. Banks are already using the company’s platform, and management reports tons of cash to invest in new marketing campaigns. Assuming conservative future sales growth and EBITDA margin figures, the implied valuation is significantly larger than the current price mark. Even taking into account the potential risks and the current concentration of clients, I don’t believe that the stock price could fall significantly from its current mark.

Bakkt

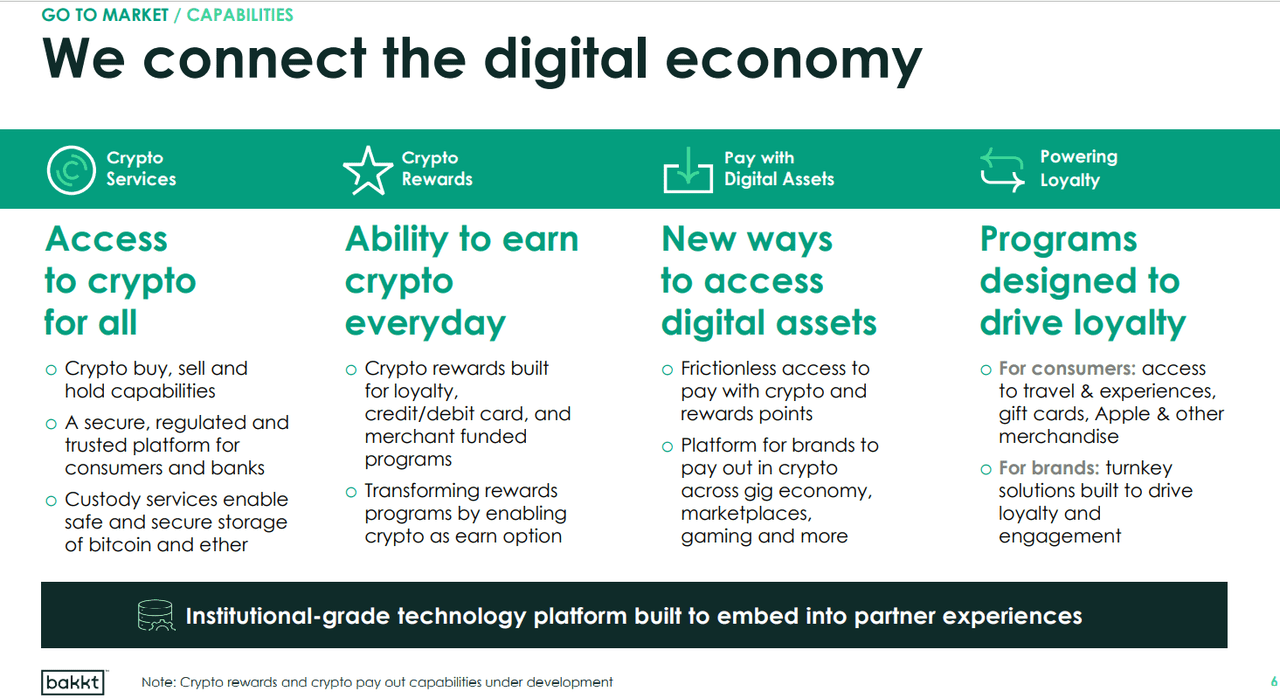

Founded in 2018, Bakkt intends to connect the digital economy through a platform offering crypto assets, loyalty and rewards, and payments.

4Q21 Bakkt Earnings Presentation

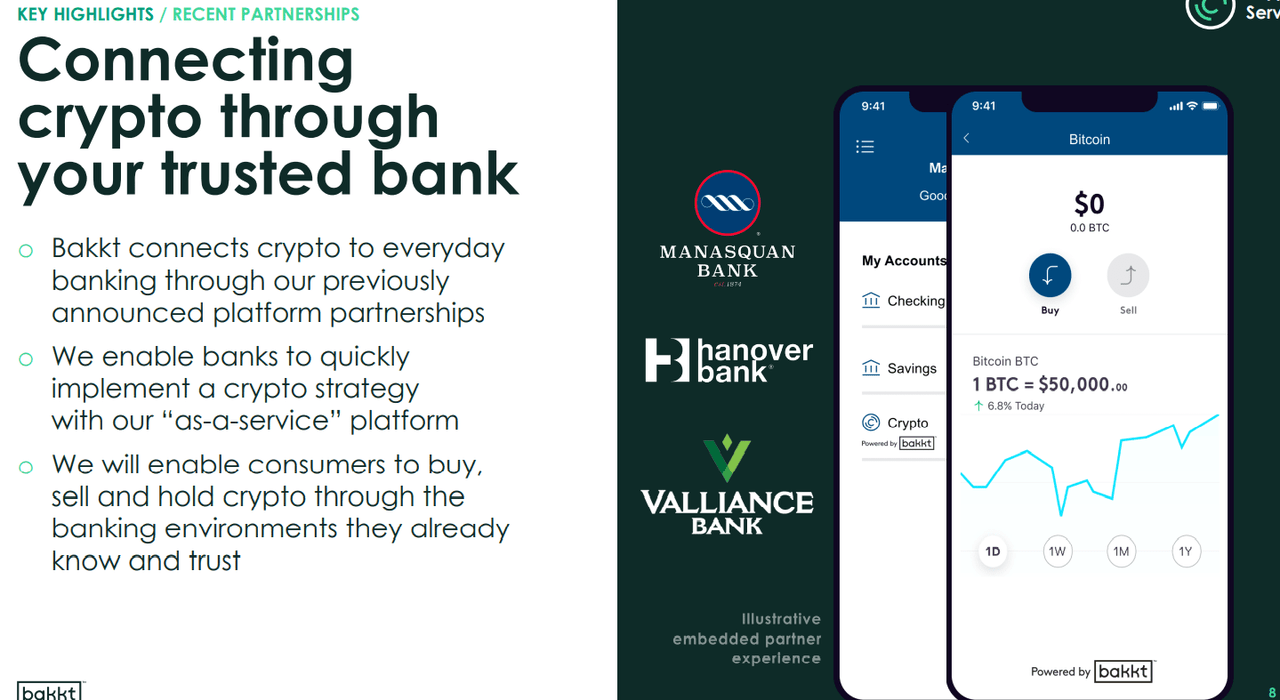

The company has already reported that several banks are already using the company’s platform. In my view, if other banks also decide to use Bakkt’s platform, both the company’s reputation in the finance industry and sales growth will trend north.

4Q21 Bakkt Earnings Presentation

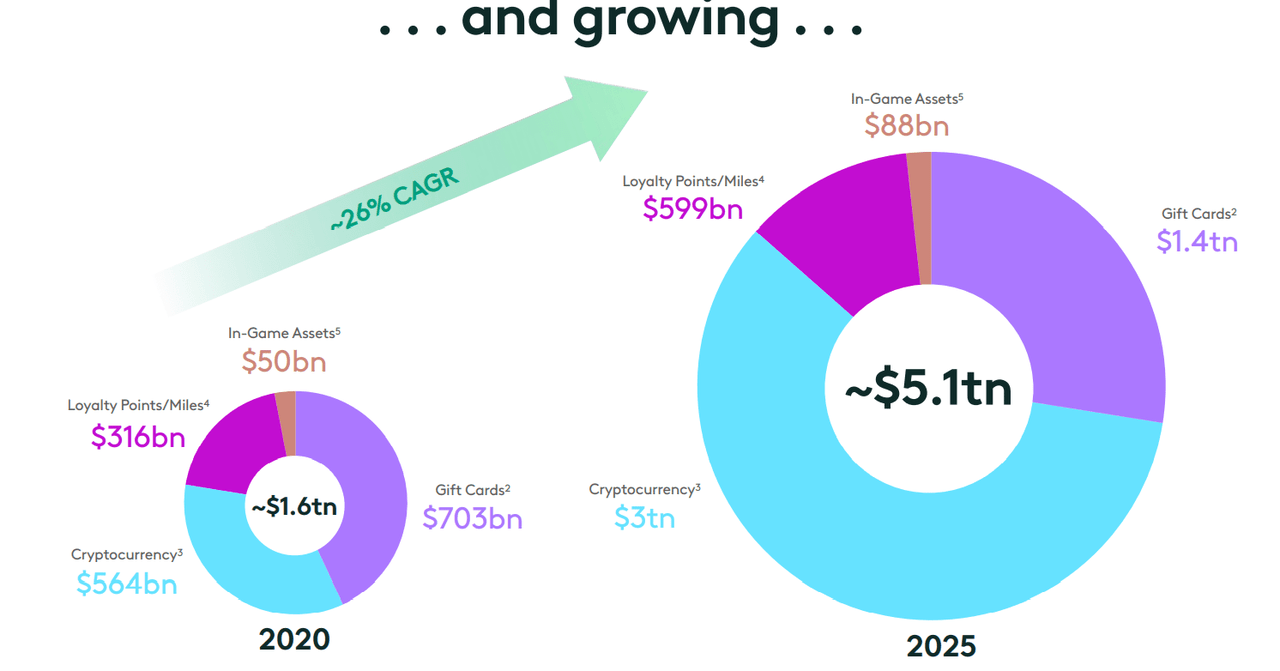

It is quite remarkable that Bakkt claims to be investing in a market that grows at a CAGR of 26%. The company’s target market is expected to grow from $1.6 trillion in 2020 to $5.1 trillion in 2025.

Investors Day

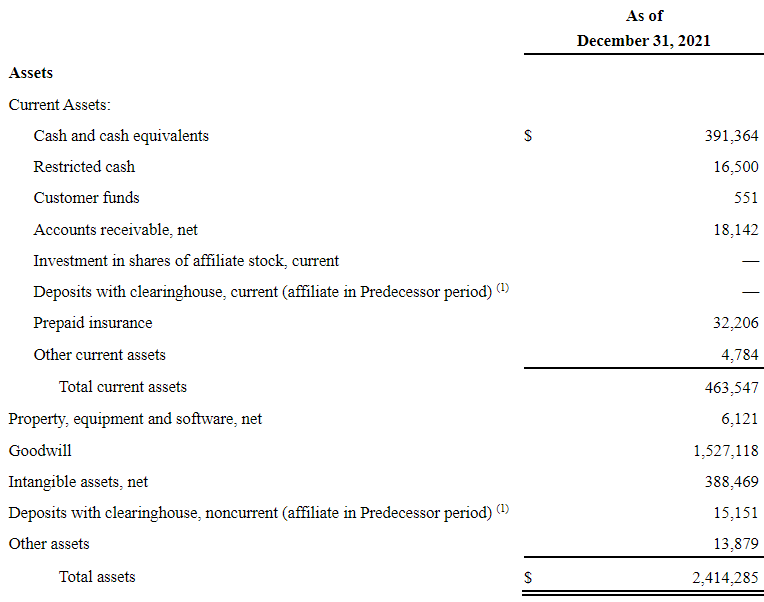

Balance Sheet: Bakkt Has Tons Of Cash And Marketing Campaigns

As of December 31, 2021, Bakkt reports $391 million in cash with total assets worth $2.4 billion. The balance sheet shows goodwill worth $1.527 billion, which represents a large part of the total amount of assets. With this in mind, the goodwill impairment risk may be very relevant in Bakkt.

10-k

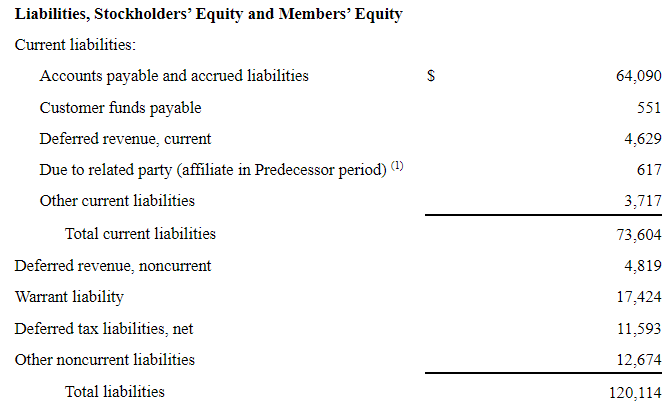

The list of obligations appears very small, so most financial advisors may not be afraid. The most relevant are warrant liability worth $17 million, and deferred tax liabilities worth $11 billion.

10-k

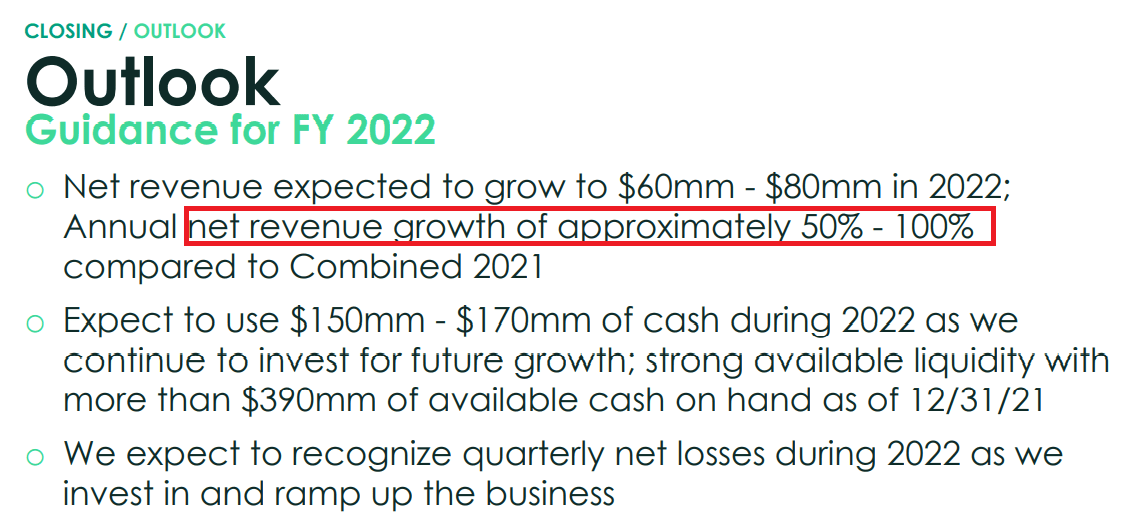

Guidance For The Year 2022 Includes 50%-100% Sales Growth

With Bakkt expecting to deliver sales growth of 50%-100% y/y and using $150 million to 170 million, I believe that it is a great time to assess Bakkt. Let’s note that the Bakkt has enough liquidity to operate in 2022 and perhaps in 2023. I assumed cash burn rate of $150 million per year.

4Q21 Bakkt Earnings Presentation

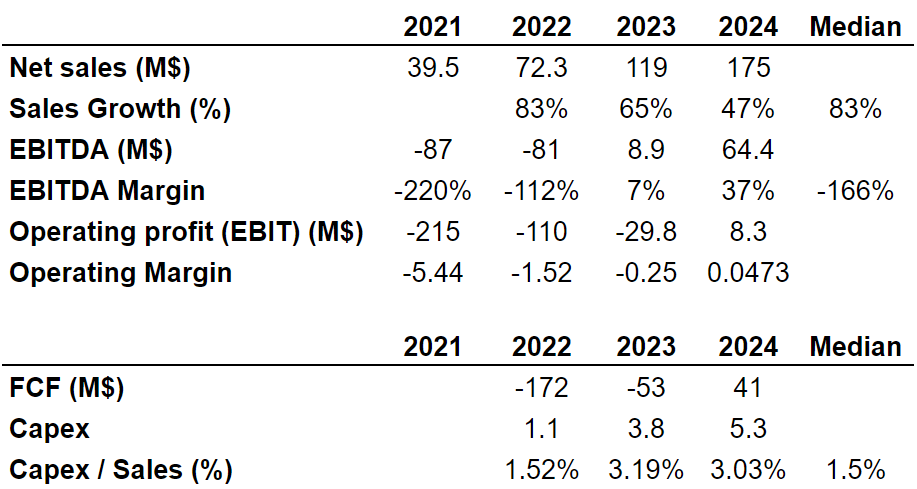

Analysts don’t seem as optimistic as management, or they didn’t have time to review the most recent guidance by Bakkt. They believe that the median sales growth from 2022 to 2024 is equal to 83%. It is very interesting that estimates include positive EBIT for the first time in 2024. Besides, they are also expecting free cash flow of $41 million in 2024. I invite investors to review the numbers of other analysts because my numbers are not far from those of other analysts.

marketscreener.com

More Partners, More Products, And Sufficient Market Campaigns Imply A Valuation Of $11.8

If Bakkt signs a sufficient number of new partnerships in the next decade, the number of clients will likely increase. As a result, Bakkt may enjoy economies of scale, which could lead to an eventual increase in the free cash flow. Let’s note that signing new partnerships is among the company’s strategies:

We are focused on continuing to build strong partner relationships. Acquiring customers through our partners is an efficient and scalable way to grow our business. Our goal is to provide these partners opportunities to leverage our capabilities either through their existing environment or by leveraging our platform. Source: 10-k

Bakkt also expects to launch a significant number of marketing campaigns, which will likely increase the target market to over 100 million users. In my view, if new campaigns continue to push the company’s name in google trends, brand awareness will likely help push revenue up:

We are focused on activating our existing partnerships and will launch joint marketing campaigns with our partners to engage with their customers. Our recently announced partnerships provide us with an addressable market of well over 100 million users, who we will focus on bringing onto our platform. Source: 10-k

Close to 43% of the total headcount works in product design. So, under this scenario, I would also expect Bakkt’s product offering to increase as management mentioned in the last annual report. With more products and more clients, most likely more partners may be willing to collaborate or work with Bakkt:

We aim to increase the breadth and depth of our product offering in order to increase its appeal to partners and consumers.

As of December 28, 2021, we had a total of 765 employees, which included 579 full-time employees, all of whom are located in the United States. Approximately 43% of our workforce is dedicated to engineering, design, or product roles. Source: 10-k

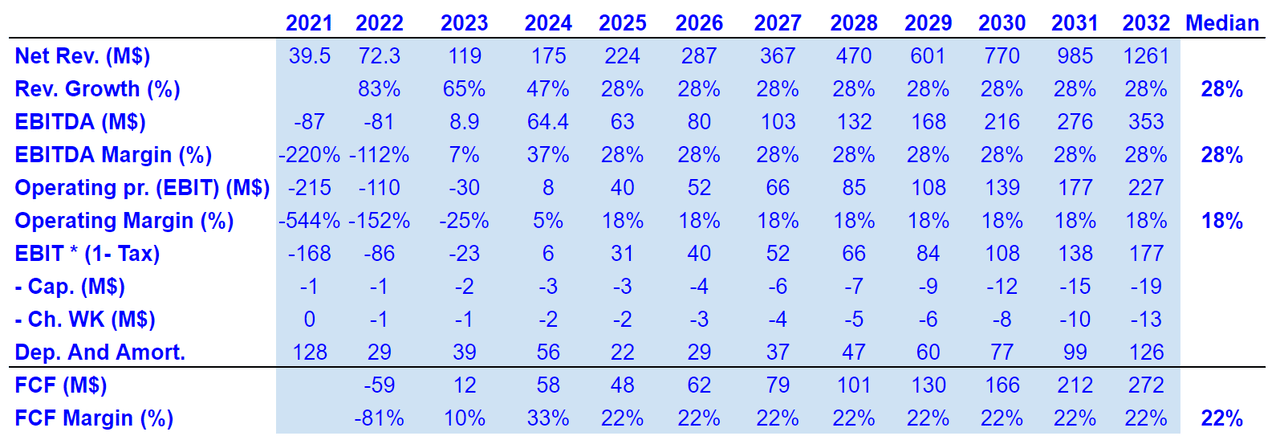

Under the best case scenario, I assumed that Bakkt will be able to report revenue growth of 28% y/y, which is approximately the growth of the global crypto asset management:

The global crypto asset management market size was valued at $0.67 billion in 2020, and is projected to reach $9.36 billion by 2030, growing at a CAGR of 30.2% from 2021 to 2030. Source: Crypto Asset Management Market Size

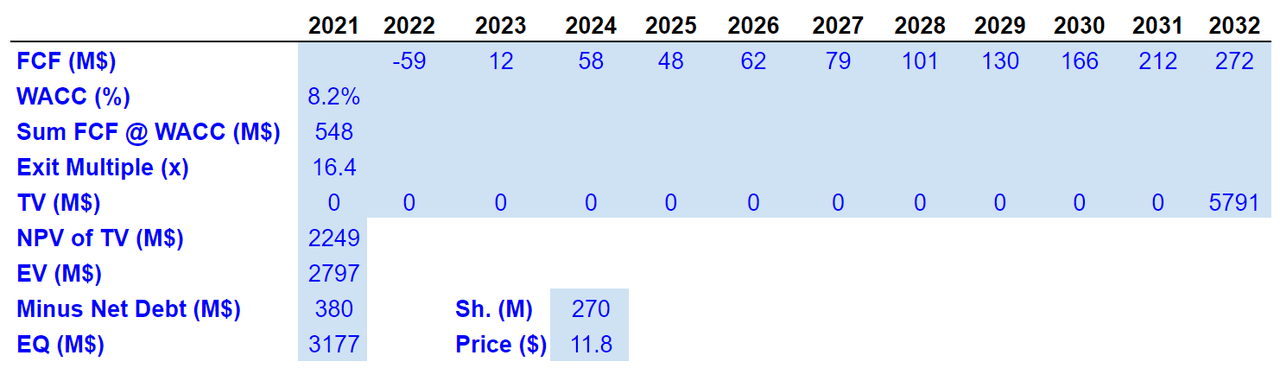

If we also assume an effective tax of 22%, 2032 free cash flow will be equal to $272 million. The free cash flow margin also stands at 22% from 2025 to 2032.

YC

Using a weighted average cost of capital of 8.2% and a stream of free cash flow that grows from $12 million to $272 million, the sum stands at $548 million. I also believe that with sales growth of 28% y/y, the exit multiple could stand at 16.4x. With these figures, the enterprise value would stand at close to $22 billion. Finally, including a class V common stock, and assuming a share count of 270 million, the stock price would be $11.8:

As of March 25, 2022, we had 57,164,488 shares of Class A Common Stock, 206,003,270 shares of Class V Common Stock issued and outstanding held of record by 18 holders, and 7,140,929 Public Warrants issued and outstanding, each exercisable for one share of Class A Common Stock, held of record by 1 holder. There is no public market for our Class V Common Stock. Source: 10-k

YC

Declining Sales Growth And EBITDA Margin Of 32% Would Imply A Valuation Of $8.07

In the last annual report, Bakkt noted a certain concentration of customers. If management cannot increase the number of clients, the risk of losing one or more clients is substantial. The decline in revenue could be substantial. Under this case scenario, I assumed that in the next decade, Bakkt would lose a few small customers:

For the periods from October 15, 2021 through December 31, 2021 and January 1, 2021 through October 14, 2021, and the year ended December 31, 2020, four, three, and two customers represented approximately 59%, 55%, and 65%, respectively, of total revenue.

The loss of any such enterprise or loyalty partner would materially and adversely affect our business, financial condition, results of operations and future prospects. Source: 10-k

I would also expect that Bakkt will suffer from a certain increase in the regulation regarding cryptocurrency exchanges, privacy, and data protection. As a result, management will have to invest a bit more to deal with new regulations, which would lower Bakkt’s EBITDA margin and free cash flow margins:

Regulatory authorities around the world are considering numerous legislative and regulatory proposals concerning privacy, data protection and cybersecurity. In addition, the interpretation and application of these laws and regulations in the United States and elsewhere are often uncertain and in a state of flux. Source: 10-k

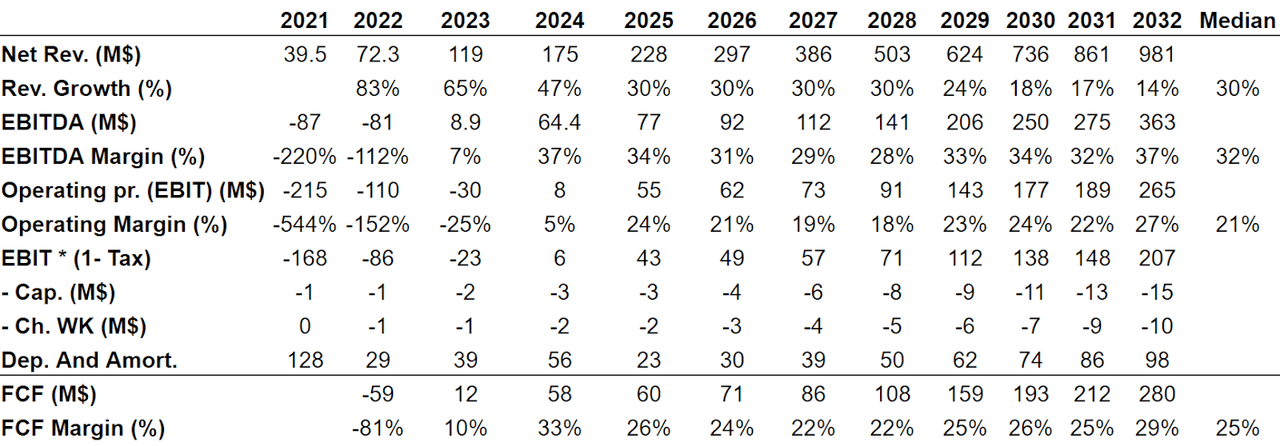

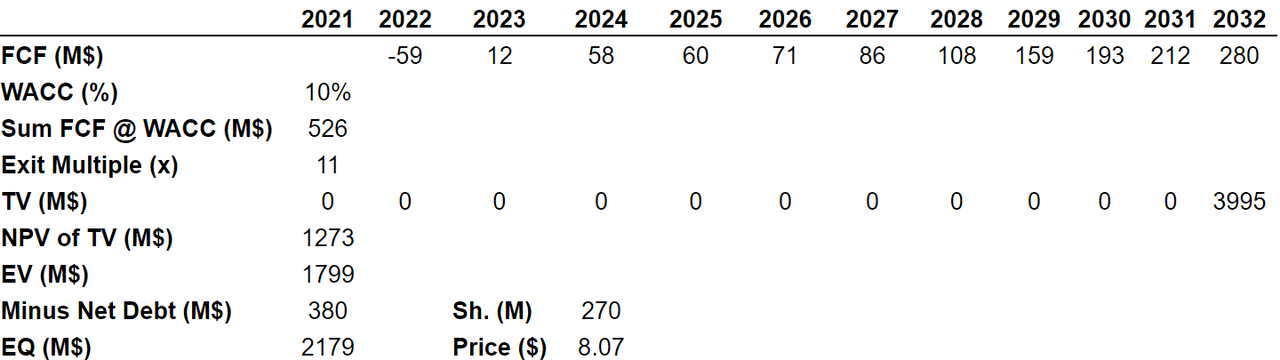

Under a conservative view, I believe that we could expect sales growth to decline from close to 30% in 2025 to almost 15% in 2032. I also assumed a median EBITDA of 32%, and growing capital expenditures. Finally, the results include 2032 free cash flow close to $275 million and a free cash flow/Sales ratio of 25%.

YC

If we sum the free cash flow from 2022 to 2032 with a weighted average cost of capital of 10%, the result is equal to almost $525 million. Also, with an EV/EBITDA multiple of 10.5x, the terminal value should be equal to $1.27 billion, and the implied price would be $8.07.

YC

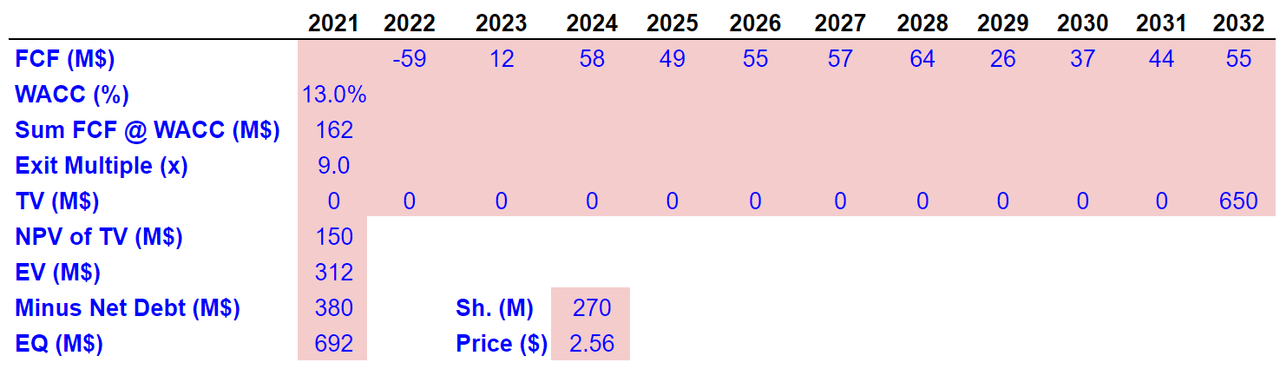

Under The Worst Case Scenario, Which Appears A Bit Unlikely, My Implied Price Is $2.5

Under the worst case scenario, management will likely not sign sufficient partnerships. The company may also have to invest a large amount of money to be accepted by large partners, which will likely lead to a drastic decrease in profitability:

Any substantial delay in the inclusion of additional partners and digital assets may have an adverse effect on our business, financial condition and results of operations. Also, there can be no assurance that we will receive the necessary regulatory approvals or support from partners to launch features as planned or that we will operate as anticipated. Source: 10-k

I also assumed that management will not be able to adapt to new changes in the cryptocurrency industry, which is evolving rapidly. As a result, competitors will obtain market share from Bakkt, and sales growth will not be as large as expected:

Our success will depend on our ability to develop and incorporate new technologies and adapt to technological changes and evolving industry standards; if we are unable to do so in a timely or cost-effective manner, our business could be harmed. Source: 10-k

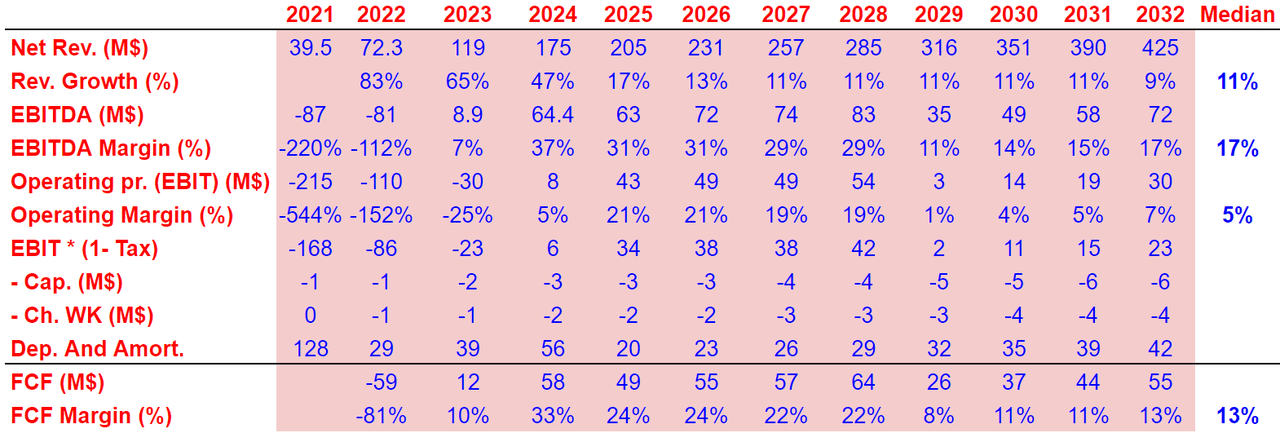

In this case scenario, I included sales growth between 17% and 11%, and also assumed a median EBITDA margin of 17%. With capital expenditures increasing from $1 million to $6 million and 2032 D&A of $42 million, the free cash flow margin would stand at close to 13%.

YC

Now, with a weighted average cost of capital of 13% and an exit multiple of 9x, which appears very conservative, the enterprise value would be close to $311 million, and the equity valuation should be around $691 million. In sum, I obtained a stock price of $2.5, which I believe would be the lowest valuation that I could imagine for Bakkt.

YC

My Takeaway

Bakkt does enjoy a target market that grows at the double digit. Banks already trust the company’s platform, and the balance sheet shows plenty of cash to invest in new market campaigns. In my view, if Bakkt grows as expected, and new partners are added, future free cash flow will likely justify a large valuation. I don’t believe that investors had time to review the expectations of analysts and the guidance given by management. My DCF model indicates that the valuation could even reach $11.8 per share in the near future.

Be the first to comment