shaunl/E+ via Getty Images

Let´s look at what happens when a terrific business, enjoying favorable business conditions stumbles into a black-swan and critical unforced error. First, about the terrific business and the favorable conditions…

A Quick Overview Of The Business Model

I have covered EXPD in prior notes, here, and here. To summarize, the business model is very attractive because of the following characteristics:

- Phenomenal returns on equity with no debt employed.

- Long history of share buybacks and dividend growth (again, without using debt).

- Very low capital investment is needed.

- Consistent growth in all three businesses (ocean freight, airfreight and customs brokerage).

The moat around it has ensured a long period of above-normal returns on equity. During 2020 and 2021, the company benefited greatly from supply chain disruptions.

Expeditors Had A Terrific 2021

It is hard to overstate how good a year 2021 was for EXPD:

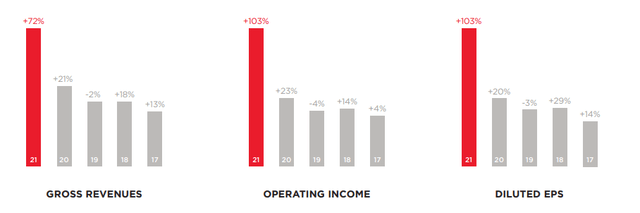

Annual Report 2021 (Expeditors)

With operating income and EPS more than doubling, and revenues jumping 72% from an already good 2020, one thing is clear: the supply chain pain is proving to be a magnificent tailwind. With these kinds of numbers you would expect the company to be trading at or near all-time valuation records, but that is not the case. And following is the reason.

Cyber Attack

All businesses are subject to risk. In this case, one of the worst things that can happen to a network operator happened to EXPD. There is near total reliance on IT systems for logistics and when these systems have to be shut down, everything comes to a halt. Given the well-documented strain in supply chains the timing could not be worse (I will not speculate as to the origin of the attack, but others might).

The first thing that comes to mind when one has a significant position in a business that is facing a critical risk is: Will they survive? Here is when having ample cash (over $1.7bln as of Dec 2021) and no debt comes in handy. The answer flows immediately from knowledge of the balance sheet: of course, they will survive. The next questions are equally important but less urgent…how long will this last? and, will customer goodwill be permanently impaired?

This is what happened. On February 20, the company disclosed being the target of a cyber-attack. Subsequent updates made it clear the scope was essentially firm-wide and that it would take several weeks to recover. As of today (six weeks from event), the latest update seems to indicate that most systems are back online but also that service issues still remain.

I expect a rough Q1 as a result, with potential spillover into Q2 as well. More importantly to long-term investors – and others may disagree with me – I do not expect a long-term damage to client relationships and earnings capacity.

This is because their competitive advantage extends beyond its IT – which will nevertheless get fully restored. The advantage includes its network of suppliers, built over decades, and its decentralized operating structure and culture, also built over decades. These advantages have proven difficult to replicate and the cyber event will not meaningfully damage either. Customers will be irked, of course, and a portion of them may be lost, but one year from now, few will remember the service interruption.

Because they will survive, they will also emerge stronger from this. We do not know what was the nature of the vulnerability or whether it could have been prevented. I have called it an “unforced error” because an owner expects this risk (amply identified in 10-Ks) to be mitigated to a very large extent. It was not, despite contingency plans working something failed here, and management shares in the responsibility. I have not read anything about potential insurance coverage either, maybe something to be addressed in the next earnings release.

Few good things come from events like this. One of those is that we get a chance to view management responses to big business problems. How honest and forthright were they? Too soon to say, this is what came out of the 10-K:

On February 20, 2022, management determined that the Company was the subject of a targeted cyber-attack. Upon discovering the incident, the Company shut down most of its operating systems globally to manage the safety of its overall global systems environment. The Company had limited ability to conduct operations during this time, including but not limited to arranging for shipments of freight or managing customs and distribution activities for our customers’ shipments. The situation is evolving and while the Company has partially resumed operations, at this time the Company is unable to estimate when it will resume full operations. The Company is incurring expenses relating to the cyber-attack to investigate and remediate this matter and expects to continue to incur expenses of this nature in the future. The Company expects that the impact of the shutdown and the ongoing impacts of the cyber-attack will have a material adverse impact on its business, revenues, expenses, results of operations, cash flows and reputation. At this early stage, the Company is unable to estimate the ultimate direct and indirect financial impacts of this cyber-attack.

So, before this news, my focus for Q1 release was going to be around the evolution of cash flow, as explained below. Now, I will look mainly for more clues on the impacts of the cyber event, as I am not sure how much revenues and working capital will be distorted by the mid-quarter system stoppage.

Evolution Of Free Cash Flow During 2022

Driven by the surge in revenues, accounts receivable have also increased materially from $2.0Bln in YE 2020 to $3.8Bln in YE 2021. This is roughly in line with increase in revenues and not unexpected. The company does provide financing to clients as a regular course of business, particularly paying customs duties and other charges on behalf of clients to be collected later. These credit extension decisions need to be disciplined and I will look for any signs of write-offs during Q1. The level of receivables is unprecedented, but so is the level of revenues and overall supply chain disruption. For now, this is something to monitor, not necessarily a negative development.

The level of increase in receivables has not been fully offset by an increase in accounts payable. Payables increased from $1.1Bln in 2020 to $2.0Bln in 2021, a total of $0.9Bln. Significantly lower and half of the $1.8Bln increase in receivables. As a result, despite revenues increasing by 72% year-on-year, operating cash flow increased only by 33%.

Unlike businesses that produce things, where revenue growth of this magnitude is only achieved by unit growth and therefore plant growth (capital investment); EXPD was able to grow with no incremental capital investment. A fabulous characteristic of asset-light businesses like it.

That does not mean that there was no investment. The investment shows up instead on working capital as noted above. However, unlike a new plant, working capital retains its value and may be recovered eventually by other means (i.e., factoring the receivables).

I expect the working capital position to stabilize and begin reverting through 2022, as revenues also settle at a more sustainable – and lower – level. It is important to confirm that AR balances remain healthy, in line with revenue levels and free of impairments. This will be a key item to monitor during the next couple of quarters.

Valuation

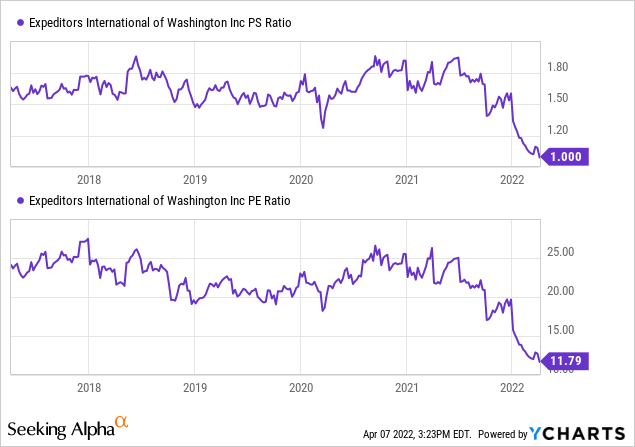

Everyone, including the company, is expecting a return to normal levels of business once supply chain constraints get resolved. Nobody can really tell when that will happen. In the meantime, the recent bump in earnings and sales has pushed valuation to historically low levels, including 1x sales and <12x P/E.

Forward earnings are expected to be about $7/share for this year and $6/share in 2023, down from $8.3/share in 2021.

Conclusion

So this is what happens when a terrific business, facing strong industry conditions stumbles on some critical (but solvable) problem… A window of opportunity to acquire attractively priced shares.

To be sure, Q1 may be far worse than anticipated, and expenses regarding future cyber protection may drag earnings for a while. Further volatility and downside are always possible. However, in the long term, two to three years from now, I am sure the focus will have returned to the terrific returns and moaty characteristics of the business, and having purchased such an earnings stream at below $100/share will look very wise indeed.

Be the first to comment