jejim/iStock Editorial via Getty Images

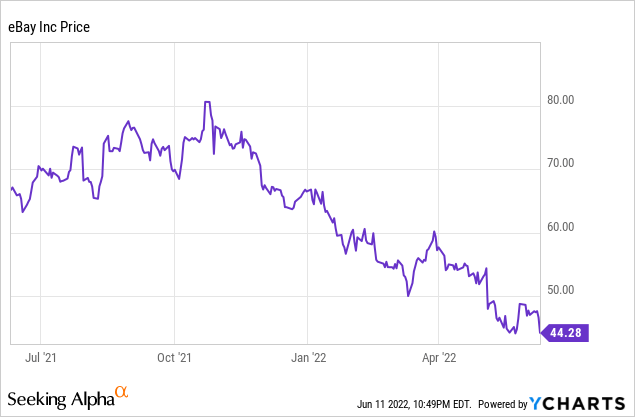

While in general I am supportive of a year-end rebound as my “base case” for where the stock market will land this year, and while I continue to encourage investors to position themselves into beaten-down tech stocks to take advantage of an upcoming rebound, I’m no longer quite so sure on eBay (NASDAQ:EBAY), the auction site and one-time Silicon Valley darling.

eBay had its golden moment of rushing back into relevance during the pandemic, when fierce e-commerce activity plus an obsession for all kinds of collectibles (including and especially Pokémon cards) drove activity on eBay to multi-year highs. eBay took advantage of its fervent recovery in activity to invest in other promising areas, including payments.

Yet now in 2022, the macro correction has reared its ugly head and eBay no longer looks like it’s on solid footing. Year to date, the stock has lost more than 30% of its value, with losses accelerating after eBay posted a weak Q1 earnings report in early May.

The bullish case for eBay no longer shines as brightly; eBay is a mixed bag of positives and negatives

In March, I cited eBay as an attractive value play that could be bought for its low P/E. At the time, the company was guiding to much better results (and a far more benign potential decline in 2022) than it is now. After having seen eBay’s Q1 results and its resulting guidance cut, however, I’m a lot more nervous about where this stock is headed over a 9-12 month horizon.

I’m reducing my opinion on eBay to neutral based on its degrading fundamentals. At this point, I do still see the value appeal to eBay, but that is mixed against a basket of new risks. I now see eBay as a fairly balanced bag of bullish and bearish factors.

In eBay’s favor are the following bull case drivers:

- Valuation could use a lift. At current share prices near $44, eBay trades at less than a <10x P/E versus Wall Street’s $4.31 pro forma EPS consensus for FY23 (data from Yahoo Finance). As long as eBay can get its revenue and earnings back out from negative y/y territory, I believe this valuation should normalize – but it may take some time.

- Focus on collectibles. eBay knows where its strength lies (i.e., where Amazon (AMZN) is not dominant). In the collectibles space, the company just expanded its Authorization Services. In addition, it launched eBay vault for buyers and sellers to store high-value goods. eBay’s conscientious alignment with the collectibles niche can be a great source of GMV growth going forward.

- New monetization strategies: eBay is leaning into both payments and advertising to support its marketplace-based revenue, which can help bolster both the top and bottom line going forward.

At the same time, however, risks have emerged:

- The return of brick and mortar stores seems to be impacting e-commerce much more than expected. eBay’s 2022 guidance cut is a reflection of much weaker macro trends than the company expected.

- Outside of collectibles and other niche categories like auto parts, eBay has no real “wow” factor anymore. Specialized, dedicated e-commerce stores like Chewy (CHWY) have taken over certain categories; and in any category that has no special niche leader, Amazon reigns supreme. It’s unclear whether eBay can continue growing on its collectibles push alone, let alone potentially shrink in the future.

In my view, it’s time to cut losses on eBay and retreat to the sidelines until either A) the company can show a path back to growing revenue and EPS, or B) the stock drops materially further to the point where eBay’s value angle is impossible to ignore.

Q1 download and guidance cut

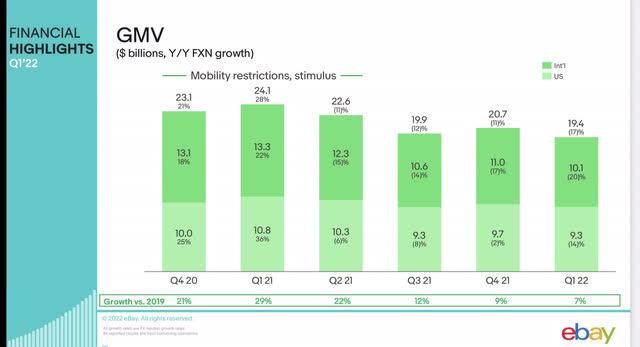

Let’s now go into more detail on what exactly ailed eBay in Q1. Take a look at the GMV (gross merchandise volume) trends below:

eBay GMV trends (eBay Q1 earnings deck)

eBay saw its gross merchandise volume fall by a stunning -17% y/y pace to just $19.4 billion. Now, that did come within the $19.1-$19.5 billion range that eBay had originally guided to, but what we don’t like to see is the fact that the three-year growth stack (compared to the pre-pandemic period) decelerated to just 7% growth over 2019 in Q1, versus 9% in Q4 and 12% in Q3. This does more to hammer home the narrative that a lot of eBay’s pandemic-era lifts were one-time in nature and fading fast.

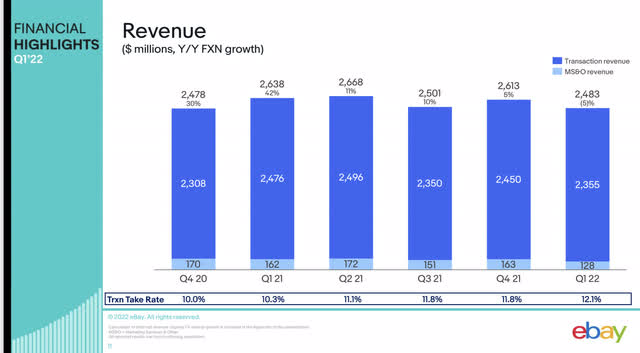

Unsurprisingly, GMV weakness translated into revenue declines as well. eBay’s Q1 revenue declined -5% y/y:

eBay revenue trends (eBay Q1 earnings deck)

The reason eBay was able to protect a revenue y/y higher than GMV was because A) transaction take rates swelled to 12.1%, versus 10.3% in the year-ago quarter (driven by higher fees), and B) additional monetization from the new revenue streams discussed earlier.

Jamie Iannone, the company’s CEO, issued some fairly dire commentary on the Q1 earnings call. While he highlighted strength in some categories like trading cards, he also mentioned that traffic and interest in e-commerce has dropped, which is a big red flag for the remainder of the year:

Given the challenges our customers are facing around the world, we are pleased with our performance to start the year. Since late February, when the war in Ukraine began, we have seen lower e-commerce traffic, inflation in gas prices and home energy costs and historically low consumer confidence, particularly in the U.K. and Germany. As we look forward to the rest of 2022, we find ourselves in the most dynamic macro environment I have seen since returning to eBay as CEO. We expect more near-term headwinds to e-commerce growth rates this year, and our revised guidance reflects our best year based on recent trends. Steve will go into more detail about our full year expectations later.

During these uncertain times, one thing that remains clear is that the tech-led reimagination is improving the underlying health of our business, and we are on track towards our long-term growth targets. One example is in focus categories. The investments in trust, user experience and marketing are driving higher customer satisfaction, leading to faster GMV growth. In Q1, excluding trading cards, focused category GMV grew 9 points faster than the rest of the platform. This growth is on top of last year’s stimulus-driven surge, which drove exceptional volume in many high ASP products.

Despite challenging year-over-year comps, trading cards remains one of our healthiest growth businesses. In the first half of 2021, we saw an unprecedented surge boosted by mobility restrictions and stimulus. Since that time, volume has remained elevated. And in Q1, GMV was more than double the size of pre-pandemic levels.“

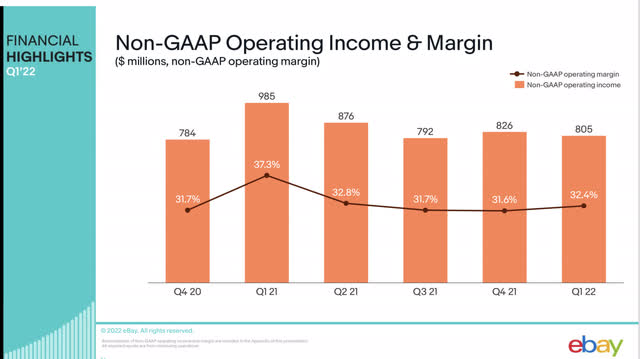

This top-line weakness also fed into weakened margins. On top of the revenue decline, eBay also saw cost of revenue jump by roughly five points as a percentage of revenue (driven by the increased mix of payments/advertising revenue versus marketplace services), while opex as a percentage of revenue also jumped by Q2-bps.

As a result, eBay’s pro forma operating income declined -18% y/y to $805 million, while pro forma operating margins also shed –490bps to 32.4%:

eBay operating income trends (eBay Q1 earnings deck)

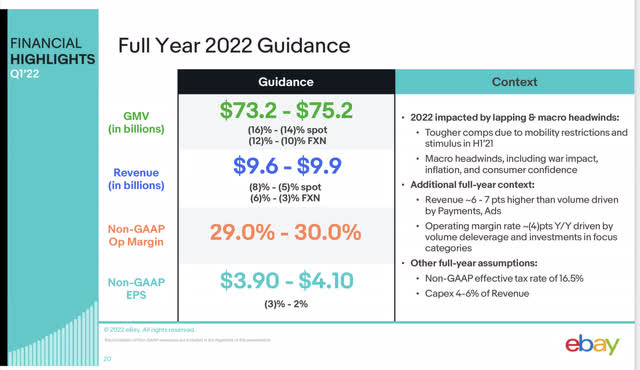

Adding insult to injury: eBay cut its guidance for the remainder of the year:

eBay guidance (eBay Q1 earnings deck)

The $9.6-$9.9 billion in revenue that the company is guiding to represents -6% to -3% y/y growth in constant currency, which is a deep cut versus a prior view of $10.3-$10.5 billion (0-3% y/y growth). eBay also slashed its pro forma EPS guidance to $3.90-$4.10, the midpoint of which is 7% lower than the prior $4.20-$4.30 outlook.

Key takeaways

Obviously, the eBay story isn’t looking so hot anymore. In my view, eBay is at risk of falling into “value trap” status, and I unfortunately don’t see many near-term catalysts that can help lift eBay out of its current doldrums, especially as the company’s outlook for Q2 specifically calls for GMV and revenue declines to be worse than in Q1. Steer clear here for the time being.

Be the first to comment