pxel66/iStock via Getty Images

Our daily report on the SPY (NYSEARCA:SPY) included our Sell Alert that we sent to subscribers on Wednesday and it was triggered late Thursday as the SPY crashed through $404 before the close. Even though we had set up this alert, we were surprised when it went off on Thursday, before the actual CPI announcement on Friday. It was apparent Thursday afternoon that the SPY was anticipating bad news, from the CPI report, that would take the market down. That’s exactly what happened on Friday. The selloff Thursday afternoon was dramatic, climaxing with the break below the $404 level. That triggered our automatic Sell Signal Alert. The CPI crash actually happened on Thursday and continued on Friday. So now what?

Bear Market Continues

Obviously, the bear market continues and we are looking for a retest of the recent lows. The hopes that this was the bear market bottom have now evaporated. The $390 base case, that some have, is now history and the bear is looking for a new bottom. As we have published in our previous article, our best case scenario for the SPY was ~$385 and our worst case was ~$331. We set the likely case at ~$369. That’s our next, short term target for a technical bounce.

Technical bounces during bear markets can be quite strong and we were looking for such a bounce. We did not get it and that is bearish. The bottom fishers are not buying into this market yet. Consider that they are always too early in their buying. They create the bottom by buying early and halting the further drop in the market. Even after they start buying, there is a lengthy bottoming process often described as either a saucer or “W” shaped bottom. This bear market has yet to even start the bottoming process. The failure of this technical bounce, and its short life span, tells us that.

Future Market Bottom

Another indicator that the market has hit bottom is an enormous, high volume, selloff that finally exhausts all the sellers, who are late to throwing in the towel on this bear market. Usually the inexperienced investors wait for the very bottom to panic-sell their Index holdings and the bottom fishers are there waiting to buy. All that is still ahead of us.

The consumers will begin to feel the pressures of this SPY stool tipping over here. The SPY is a leading indicator of what is waiting down the road for consumers. They are beginning to feel the pinch of high prices and higher interest rates. As this torture is ramped up and folks feel less wealthy, due to losses in their 401k, you will see consumers cutting their spending and cutting demand. That leads to a recession. That is what this leading indicator, the SPY bear market, is telling us, but it is only dawning on the consumer. I doubt if many consumers will cut back on spending for their summer vacation plans. They will pay the high gasoline prices this year. Cutting expenses happens next year after the market bottom is in place. My guess is the bull will reappear before the next presidential election.

Watching The Stool Tip

Our daily SPY report was watching the SPY trapped in the $408 to $417 trading range. Trading that range was easy money, but it was also a bearish trap, because the technical bounce was struggling to move higher. Now we know the CPI fear was probably creeping into the SPY. It culminated on Thursday afternoon when it crashed below $404, our preset sell signal. The technical bounce was aborted and hopes for a more robust technical bounce we’re smashed.

Bad news hit the red hot Energy sector. It was extremely overbought and looking for any excuse to go back and test the uptrend support. No surprise here when it happened. It could not have happened at a worse time, because the technical bounce was already struggling. Now the market leader was hit.

At this point, it would not have taken much more pressure to tip the stool over. Instead of a light push, the CPI smashed it over, starting early on Thursday and watching it dive on Friday. It was not pretty. It was not unexpected. The market was worried all week about the CPI announcement on Friday, but somehow the SPY found out about it on Thursday afternoon.

Here are the daily charts that we were watching and writing about each day for our subscribers. We did not predict the fall. We are not in the prediction business. The signals tell us what is happening. Our Sell Signal alert at $404 on Thursday afternoon told us what would happen on Friday. The SPY told us. The big sellers on Thursday afternoon told us.

Monday’s Beginning

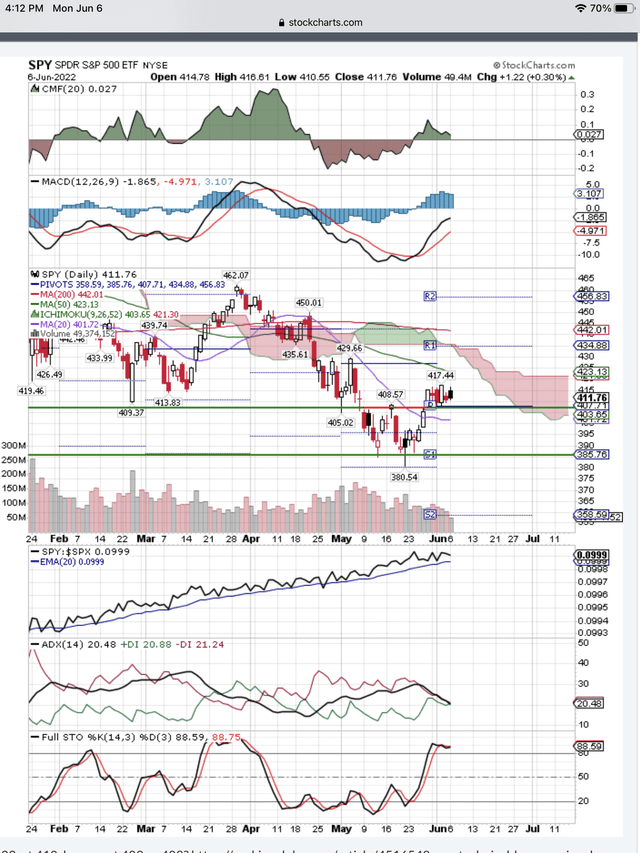

The week started off nicely and here is the chart and our comments on Monday:

Monday June 6th SPY (StockCharts.com)

You can see all the signals are showing Demand and the bottom signal, Full Stochastic, is showing overbought Demand. Price is trying to reach the 50-day, bear market downtrend at $423, but struggling. Here is what I wrote to subscribers when I sent them this chart on Monday:

If this technical bounce continues for at least a couple of more weeks, as I expect, price will keep testing 416 to 420. Either the buyers exhaust the sellers at these levels and we move on to 428, OR the buyers are exhausted, the technical bounce ends and down the SPY goes to retest the bottom at 385. I don’t expect that bottom to hold and I expect the SPY to continue lower looking for a bottom.

So you can see that I was surprised when the SPY stool fell over on Thursday.

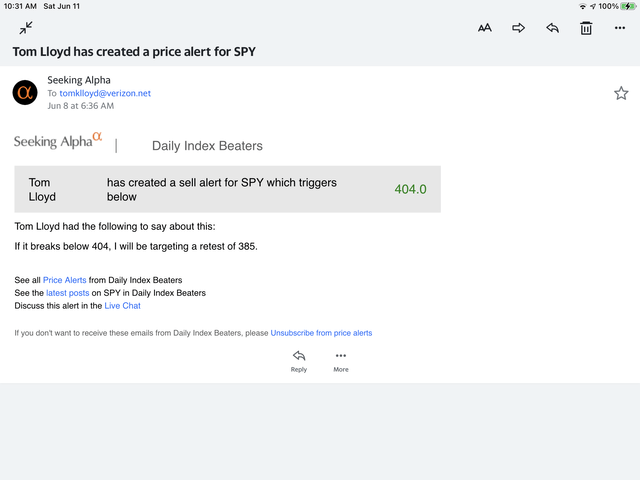

Wednesday’s Sell Alert, Chart and Comment

Here is a copy of the Sell Alert that we sent out via Seeking Alpha on Wednesday:

Wednesday’s $404 Sell Alert Sent To Subs (SeekingAlpha)

We were surprised when this Sell Alert was triggered on Thursday going into the close.

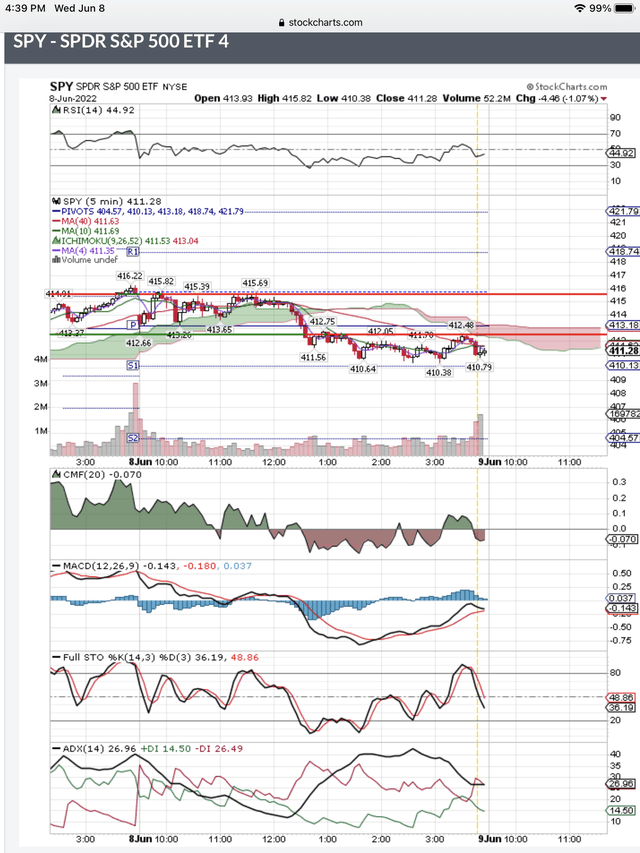

Here is Wednesday’s 5-minute chart and you can see the SPY is having a tough time with resistance at $415-$416.

Wednesday’s SPY Stopped By Resistance (StockCharts.com)

We wrote the following to go with this chart and Sell Alert:

Naturally, a negative surprise could occur at anytime. So I have setup a sell alert if price breaks below 404. If this happens, my target is a retest of 385. I expect this will happen when this buy cycle is over.

You can see that this Sell Signal alert proved to be very timely, even though I could not predict when it would be triggered.

Thursday Disaster Strikes

Here is Friday morning’s 5-minute chart and you can see the big selloff starting in the afternoon Thursday and triggering our SPY $404 Sell Signal before the close. Also you can see Friday’s opening gap down because of the bad CPI news announced on Friday.

SPY Selloff On Thursday and Frida (StockCharts.com)

Here is some of what we wrote to our subscribers on Thursday evening:

Traders like to be flat for the weekend. Looks like they started early and want to be flat going into the CPI number tomorrow, or they want to be short. We had our Sell signal alert set at 404 and that alert was triggered this afternoon as the SPY smashed below it going into the close.

Conclusion

The big, technical bounce never moved past first base. Bad news during the week stalled it. Fear of the CPI number on Friday held the SPY in check. Then on Thursday the SPY realized the CPI was going to be bad news. The selloff started in the afternoon, triggering our preset Sell Signal at $404 around 3:30 p.m. The CPI crash continued on Friday, leaving us with a bear market that continues down, looking for a bottom. We are leaning towards our worst case scenario of a bear market bottom ~$331. The market is dropping and looking for support for the next technical bounce. We think that is below $385. We report on the SPY everyday after the close. Stay tuned!

Be the first to comment