Oselote

By Alex Rosen

Summary

ETFS Physical Precious Metal Basket Trust ETF (NYSEARCA:GLTR) follows a basket of the spot prices of gold, silver, platinum and palladium. The fund is the first of its kind to hold the physical assets that underlie the price. The gold and silver are held in London, and the platinum and palladium are held either in Zurich or London. The fund NAV is based on London spot prices. YTD the fund is down 5.58%, and over the past ten years has returned -1.55%. We rate GLTR a Sell. We like the concept, but we are not comfortable with the execution, especially the breakdown of holdings by percentage.

Strategy

According to the fund prospectus, “the investment objective of the Trust is for the Shares to reflect the performance of the price of a basket of gold, silver, platinum and palladium bullion, less the expenses of the Trust’s operations. The Shares are designed for investors who want a cost effective and convenient way to invest in physically-backed precious metals”.

Proprietary ETF Grades

- Offense/Defense: Offense

- Segment: Commodities

- Sub-Segment: Precious Metals

- Correlation (vs. S&P 500): Moderate

- Expected Volatility (vs. S&P 500): Low

Holding Analysis

GLTR is not like a typical ETF that holds certain stocks based on sectors and regions. GLTR holds four precious metals in safes in London and Zurich. The safes are inspected twice a year to confirm the metals are still there. As of this writing the fund has the following holdings, Gold 1394.45 oz, Silver 51130.15 oz, Palladium, 278.85 oz, and Platinum 185.90 oz.

Because of the physical nature of this fund, it has a somewhat elevated expense ratio of .60%.

Strengths

How often can you call the fund manager and ask to see the assets? GLTR brings transparency to a whole new level. Several other funds carry physical gold or silver, but this is the first one to also carry Platinum and Palladium. Additionally, the fund does not lend against the assets, so it runs no risk there. Really, the only downside risk is an old-fashioned bank robbery.

Besides that very fun aspect of the fund, the real strength is that the fund focuses on assets that are not specifically tied to any one currency or country.

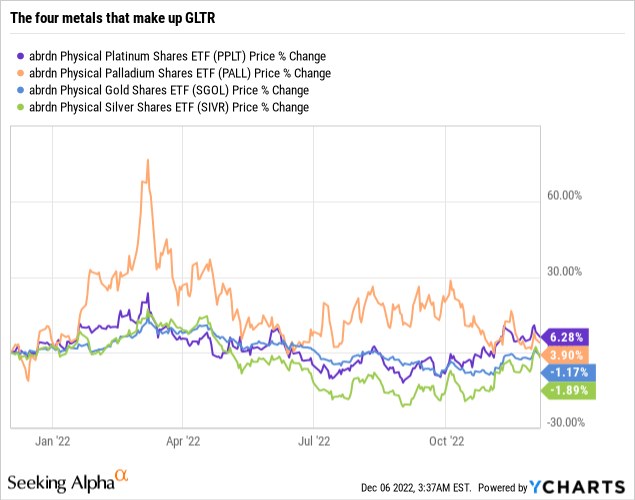

In fact these metals are often used in lieu of currencies. Think of it as the original crypto. With the exception of palladium, they all have been fairly consistent this year despite the market fluctuations.

Weaknesses

The fund’s transparency and extremely limited holding portfolio make it highly susceptible to even small fluctuations in the spot price of the metals, particularly gold. Significant daily shifts can be quite common. Further, a deeper analysis of the fund shows that 84% of the holdings by value are either gold (57%) or silver (27%), with platinum only accounting for 4% of the fund and palladium the remaining 12%. By physical commodity, the breakdown is gold 2.63%, platinum .35%, palladium .53%, and silver 96.49%. The only real benefit of this fund seems to be the physical holding aspect.

Opportunities

GLTR has the potential to be a very solid fund, but its heavily silver-based holdings really hamper upside growth. If GLTR were to rebalance to a more evenly distributed fund, we think it could really see some growth, especially with increased demand for gold, platinum and palladium in the tech and green sectors.

Threats

Because the fund is so heavily tilted towards gold and silver, the performance is really dependent on those two metals. There are many other funds that track gold and silver as well, so it really takes the sparkle off GLTR.

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Sell

- Long-Term Rating (next 12 months): Sell

Conclusions

ETF Quality Opinion

On one side the fund does exactly what it says: it holds physical gold, silver, platinum and palladium and trades based on the spot price of those metals.

Where we take issue is with the ratio of holdings. The fund is heavily weighted toward silver, and really just touches platinum and palladium. If the fund were evenly balanced with regard to weight or value, we would feel much more comfortable with GLTR.

ETF Investment Opinion

Investing in precious metals is a long-held practice. Holding multiple metals is a good idea: one falls, another one rises, they balance out. GLTR does not balance out. GLTR sinks like so many pieces of silver weighing it down. As a result, we recommend those holding GLTR to Sell, and those who are looking at it to not be dazzled by the shiny nature of the fund.

Be the first to comment