Chip Somodevilla

Investment Thesis

In my previous article, Meta Without the Verse, I outlined my doubts surrounding Meta Platforms, Inc.’s (NASDAQ:META) ability to successfully transition into a “metaverse” business. Not only will this transition require a monumental effort and tons of resources, but it would also reshape the way that our world interacts. Meta achieved this over a decade ago with Facebook, but I remain skeptical about its ability to achieve this again – and the question remains, how investable is Meta if its metaverse ambitions are unsuccessful?

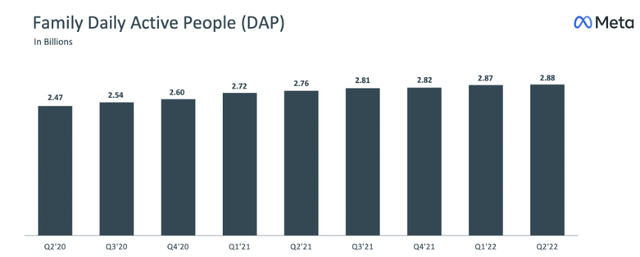

Meta’s core business revolves around its family of four apps: Facebook, Instagram, Messenger, and WhatsApp, which have a combined 2.88 billion daily active people – that is, ~36% of the world’s population use at least one of these apps on a daily basis. The company makes most of its money through advertising right now, with advertisers being able to showcase products across Meta’s Family of Apps to these 2.88 billion pairs of eyeballs.

There is a lot to like about Meta’s core business, but as the company has struggled to cope with recent iOS privacy changes, constant negative PR, and competition from the likes of TikTok, is the core business at risk of slowing down substantially?

I’ll take a look at Meta’s Q2 results to see whether I think this company could be a smart value play, or a simple value trap.

Earnings Overview

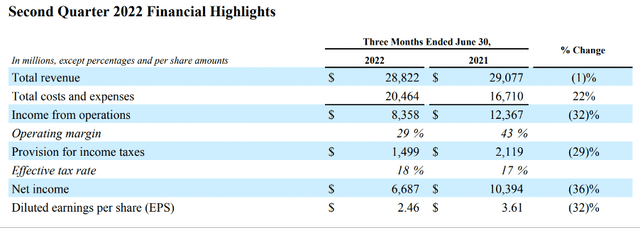

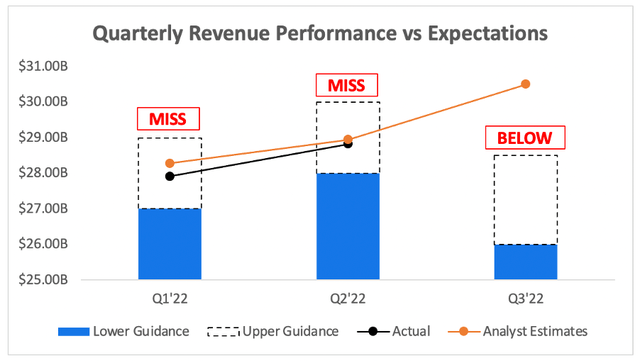

We’ll start by looking at revenue, and this was a pretty rough quarter with an even uglier outlook. Revenue came in at ~$28.82B (-1% YoY), slightly below the $29B midpoint of Meta’s guidance & below analysts’ estimates of $28.94B – so this was a miss, but not a major one. The most substantial issue weighing on shares of Meta right now relates to its Q3’22 guidance.

Management guided to Q3’22 revenue in the range of $26-28.5 billion, falling miles short of the $30.5B expect by analysts. When looking at YoY comparisons, this guide represents YoY “growth” rates between -2% and -10%; not exactly what investors want to see. This is made worse by the fact that Q3’21 should’ve been an easier YoY comparison, because Q3’21 was the first quarter impacted by Apple’s (AAPL) IDFA changes. CFO Dave Wehner spoke to this on the earnings call, but signaled that broader macro trends were offsetting this benefit:

As we headed into the back half of this year, we do get the benefit in our year-over-year growth rates from lapping the Apple iOS rollout, which happened — was largely complete by Q3 and Q4 of last year. So we’re getting the benefit of more favorable comps on the signals headwind. But that is being offset by the macro environment and the challenges we’re seeing there.

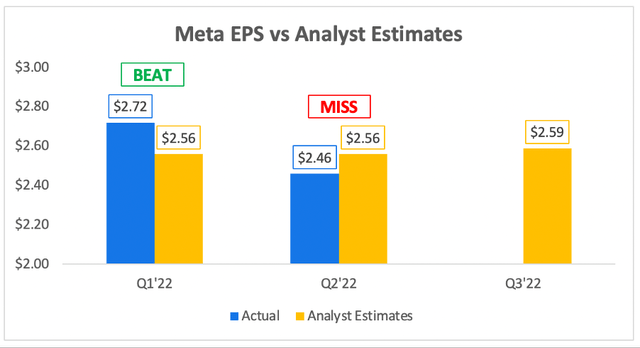

Meta completed a miserable trifecta of revenue miss, guidance miss, and an EPS miss. I am not personally too concerned by EPS misses, especially when a company doesn’t give its own guidance, but it is just another piece of negative news adding pressure to Meta’s shares.

In short, it was a pretty rubbish quarter from a financial point of view. One look at Meta’s ironically named Financial Highlights show that the only line item experiencing YoY growth was the growth in total costs and expenses – ouch.

Meta Q2’22 Earnings Press Release

But investing is forward looking – so while times might be tough now for Meta, what does the future hold?

“We Seem To Have Entered An Economic Downturn”

It’ll be no surprise to anyone who follows the market that Meta is feeling the impacts of an economic slowdown, and CEO Mark Zuckerberg highlighted this in the earnings call:

That said, we seem to have entered an economic downturn that will have a broad impact on the digital advertising business. It’s always hard to predict how deep or how long these cycles will be, but I’d say that the situation seems worse than it did a quarter ago.

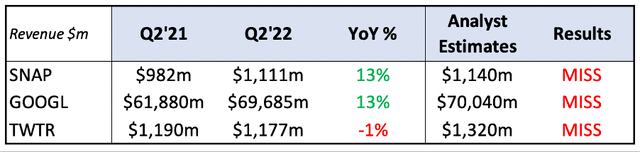

For me, the question is whether or not the issues faced by Meta are macroeconomic or Meta-economic – that is, are all digital advertising businesses feeling the heat? I think the answer is yes, but some are much more resilient than others – below is a snapshot of a few digital advertising businesses that have already reported:

Investing.com / SEC Filings / Excel

Sadly, we’re still early in results season; I’d love to compare results against the likes of Pinterest (PINS), The Trade Desk (TTD), and Roku (ROKU), but for now we’ll settle for Snap Inc. (SNAP), Alphabet (GOOG, GOOGL), and Twitter (TWTR).

The standout takeaway is that each company missed analyst estimates. I’m not surprised with Snap (it has a habit of missing) or Twitter (because of all the drama), but Alphabet missing estimates is more surprising.

But what is the difference between Alphabet and Meta? Well, Alphabet still grew revenues by 13% YoY, whereas Meta saw a 1% YoY decline followed by guidance at least a 2% YoY decline in revenue for Q3. I do think we’re entering more difficult economic times, but I also believe that Meta’s positioning is closer to the lower-quality businesses like Snap, rather than the more resilient companies such as Alphabet – although, Snap is still growing faster…

Slowing… Everything?

Alongside the slowdown in revenue comes the slowdown in the number of daily active people using Meta’s Family of Apps. Whilst there is no decline yet, Meta recorded one of its slowest-ever sequential growth rates in terms of DAP growth, which represented a 4% increase YoY. This should not be a surprise, since more than a third of the world’s population uses Meta on a daily basis, but it should highlight that future growth for this company will certainly not come from new users.

Meta Q2’22 Earnings Presentation

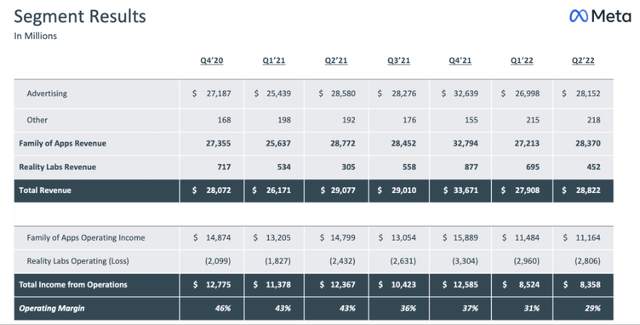

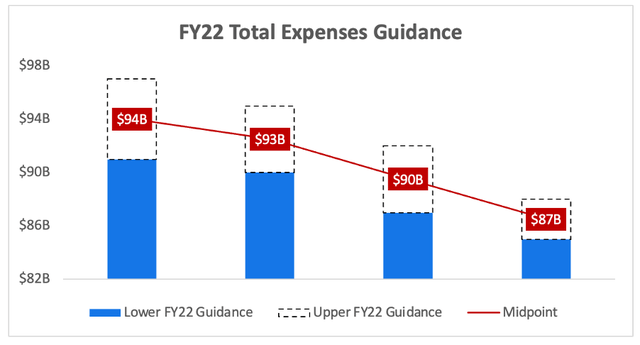

The company has also been cutting its outlook in terms of expenses for FY22 each quarter. According to CFO Wehner, this is a result of reduced hiring & reduced expense growth plans to account for the more challenging operating environment. Whilst it is positive to see this level of fiscal management, investors should at least raise an eyebrow and question what potential growth avenues Meta is closing off with these $7 billion in cost savings?

But What About The Metaverse?!

Meta’s core business is going through a tough time right now, which is understandable given the macroeconomic environment. Thankfully, ever since the name change to Meta, this is now a metaverse company, right?!

Well… no, it still isn’t. The idea of the metaverse remains a compelling idea, just like the idea of intergalactic space travel also remains a compelling idea.

In reality, the Ready Player One version of the metaverse is going to be decades away, and I do not foresee it becoming a substantial part of Meta’s business over the next few years. Just looking at the financial trends for Reality Labs, it’s clear that this remains a very small part of the business that continues to burn cash for fun.

Meta Q2’22 Earnings Presentation

Don’t get me wrong, I love to see companies exploring high-growth, potentially transformational new business ventures – just look at the success Amazon (AMZN) achieved with AWS, Alphabet achieved with YouTube, and even Meta itself achieved with WhatsApp.

My biggest issue with this company is the fact that it’s putting all its eggs into the metaverse basket, whilst its actual business continues to struggle. The name change to Meta may be seen as a decision taken to “better represent what the company is working toward,” but let’s face it: right now, it looks like a decision taken to avoid the negative PR associated with the Facebook brand and to give investors something shiny to look at whilst Meta attempts to resuscitate its core business.

Valuation

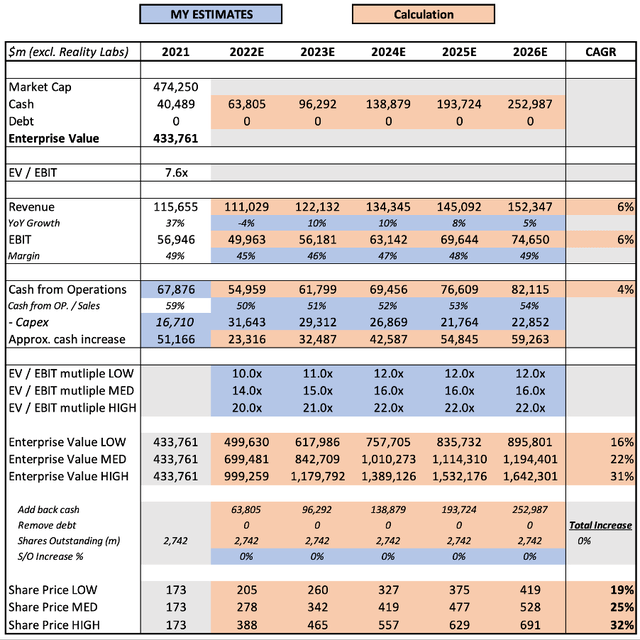

Meta’s shares have come crashing down in 2022, but the company does remain very financially resilient. I know it’s been touted as a value play, so how appealing does it look from a valuation point of view? In my previous article, I formed a valuation model excluding Reality Labs – I will do the same here, and call out any changes from my original model.

Well, I can see why it’s being looked at by the value investing community!

In terms of changes from my previous model, apart from updating the enterprise value details, I have also reduced the YoY revenue decline in 2022. I had assumed -10% in my previous model, which now appears to have been slightly too negative despite the forecasting slowdown in Q3’22, considering Meta has achieved positive YoY growth in H1.

Put all that together, and I can see Meta shares achieving a 25% CAGR through to 2026 in my mid-range scenario.

Bottom Line

This is one of the simplest conclusions that I’ll have to write.

If you believe that Meta’s core business will see a semi-decent level of success, and that it can execute on its metaverse ambitions, then the current share price looks like an incredible opportunity!

But if you believe that Meta’s best days are behind it, the competitive and regulatory headwinds will persist, and the metaverse is nothing more than a buzzword, then the current share price will look like the definition of a value trap.

I am extremely skeptical about the metaverse prospects, so I will focus just on the core business. Meta’s Family of Apps revenue and user growth is slowing, and it will take a while for investors to see whether or not this is just a blip on Meta’s path to success, or if it’s even the beginning of the end of this social media behemoth. Given this, I will remain on the sidelines with Meta and will continue to follow its progress – for better or for worse.

Be the first to comment