Andy Feng

Margin of Safety

As a long-term, buy-and-hold investor, I want a margin of safety when I buy a bank stock. In this article, I highlight my criteria for determining a margin of safety for Citigroup Inc (NYSE:C).

Factor One: Tax-Loss Selling

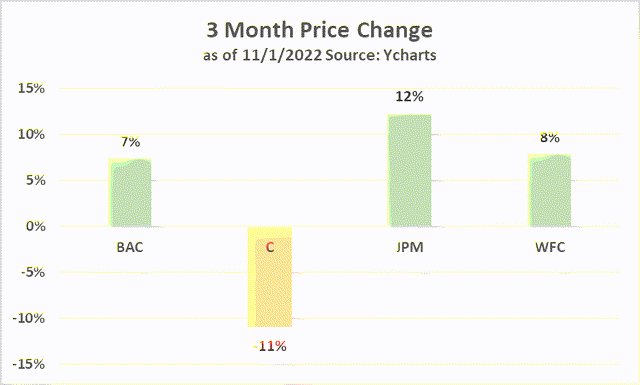

Citi shares are under tax-loss selling pressure between now and year-end. Check out these five charts.

Over the past 90 days Citi shares are down compared to big bank peers whose shares have moved up.

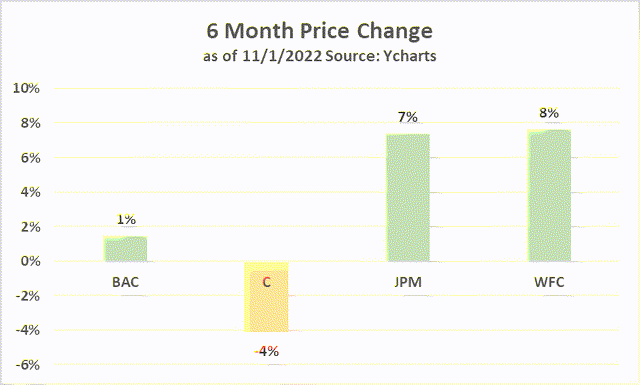

The same is true over the past six months.

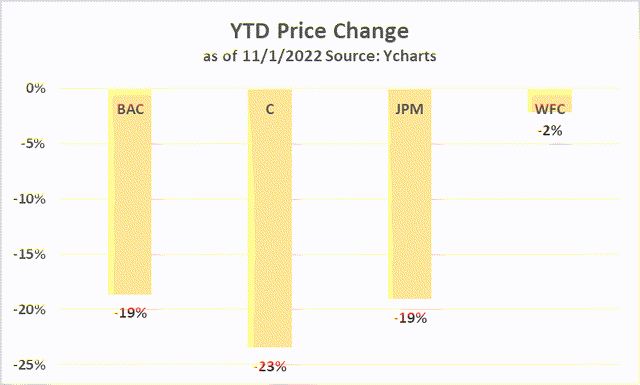

Year-to-date, all the big banks are down, though as the next chart shows, Citi’s price has fallen the most.

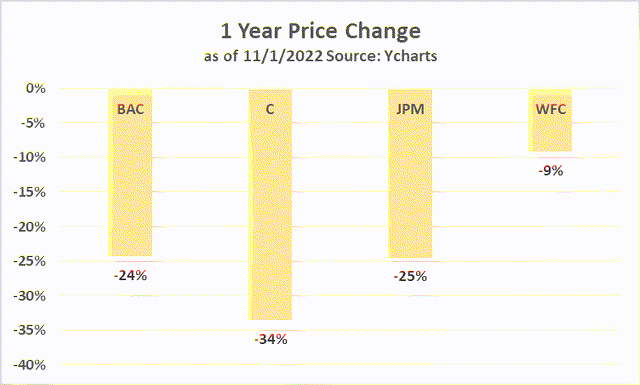

Go back a year and the story looks even worse than year-to-date performance.

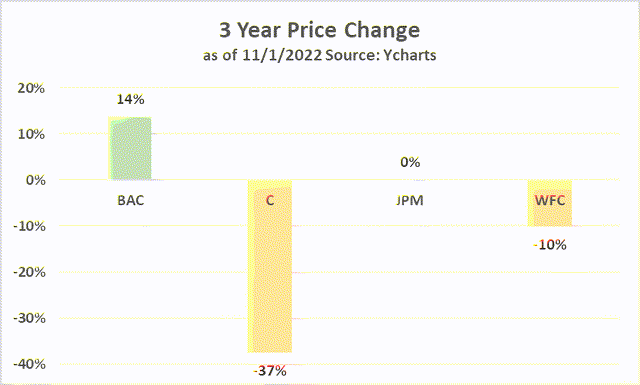

Patient Citi investors who have held shares since November 2019 are down 37%.

Implication: Short-term tax-loss selling needs to and will occur. Selling pressure should ease as we move into 2023.

Factor Two: Stock Buybacks

CEO Jane Fraser had this to say about buybacks during the bank’s recent earnings call:

“Turning to Capital, we returned $1 billion to our shareholders through common dividends during the quarter, while buybacks continue to be on hold. We will keep evaluating that decision on a quarterly basis, as due to increasing regulatory requirements we build our CET1 ratio to 13% or so by mid next year and that includes a management buffer of 100 basis points. We ended the quarter at a CET1 ratio of 12.2%, as we actively managed our RWA usage throughout our lines of business.

When an analyst pressed CFO Mark Mason as to the timing of when buybacks may resume, here is how he responded:

“With that said, we are going to take it quarter-by-quarter, as I think you have heard us say and evaluate what buyback decisions and capital actions make the most sense in light of the environment that we are managing through. We are clearly managing through an uncertain environment.“

Implications:

1) Investors do not know when buybacks will resume.

2) Citi is one of the few big banks not buying back shares.

3) CFO Mason’s comment about “managing through an uncertain environment” is also an apt description of how investors feel about investing in Citi today.

4) See the next factor; my view is that buybacks will not resume at Citi without regulatory ok, just as we saw with Wells Fargo (WFC).

Factor Three: Need an “All-Clear” Sign from Regulators

As a career banker with significant experience dealing with bank regulators during difficult times, my gravest concern about Citi today is its apparent inability to resolve regulatory concerns.

The Federal Reserve and OCC, the bank’s two primary regulators, issued a “Consent Order” in September 2020. Anyone without direct experience operating under a “Consent Order” has no idea just how much work, money, and TIME are required to remedy risk and control failures.

There is strong evidence that Citi is NOT on track to resolve the Consent Order any time soon.

I found the September 14 Wall Street Journal article, “Federal Reserve Wants Citigroup to Move Faster to Fix Problems with Its Risk Systems,” distressing but not altogether surprising given the degree of difficulty in from of Citi’s management and board.

The WSJ article is a must-read for Citi investors. Here is the first paragraph from the article:

“Regulators are frustrated with the progress Citigroup Inc. has made in the two years since they reprimanded the bank for problems with the systems it has in place to prevent costly mistakes, according to people familiar with the matter.”

There are significant implications associated with this article’s revelations.

Implications:

1) Regulators are not satisfied with Citi’s progress, and therefore, Citi’s expense numbers are impossible to forecast since regulators will require Citi to spend money on risk and control issues until the bank gets it right.

2) Rest assured that Citi’s regulatory issues extend beyond US shores; having personal experience working with bank regulators in Asia and Europe, it is a certainty that Citi faces enormous regulatory scrutiny and burdens outside the US.

3) The lack of meaningful progress two years after receiving a Consent Order is not a vote of confidence for the bank’s CEO; as bank investors witnessed in recent years with European banks, and Wells Fargo & Co, management is given a limited window for fixing deep-rooted risk and control failures.

4) When a bank is forced to focus on regulatory issues and spend unlimited sums resolving a Consent Order, revenue is at risk as capital spending on revenue projects is cut and management attention is directed away from customers and onto regulators.

5) As I wrote in September 2020 about Citi’s Consent Order, Citi investors are wise to study Wells Fargo and U. S. Bancorp (USB) to appreciate how much and how long it takes for large banks to remedy Consent Orders: Think years, not months.

Factor Four: Insider Buying

Not everyone agrees with me here, but I am a big believer that an investor does not know when a distressed corporation’s stock price has reached near-bottom until we see insiders step up and make meaningful purchases.

We saw this at JPMorgan Chase & Co (JPM) in February 2016 when Jamie Dimon acquired $25 million in JPM shares. We also saw this phenomenon at Wells Fargo in March 2020 when CEO Charlie Scharf bought $5 million in WFC shares.

Citi bulls should be scratching their heads wondering why Citi CEO Fraser or other insiders remain on the sidelines not buying so-called “cheap” Citi shares.

Here is a chart showing Citi insider activity over the past two years. Note that there have been no buyers. Sellers sold between May 2021 and February 2022 at prices ranging between $68.56 and $74.56.

Insider Buying and Selling (Openinsider.com)

Reasons for Optimism

Investors intent on holding Citi shares can rest on two factors that may be reasons for optimism:

1) Eroding Analyst Confidence in Citi.

2) Purchase of Citi Shares by Berkshire Hathaway Inc. (BRK.A) (BRK.B).

Let me address both factors.

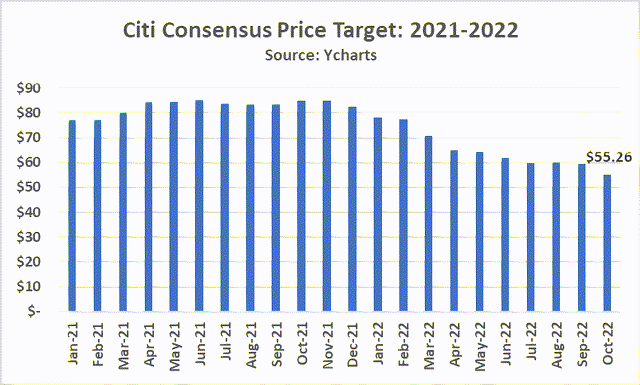

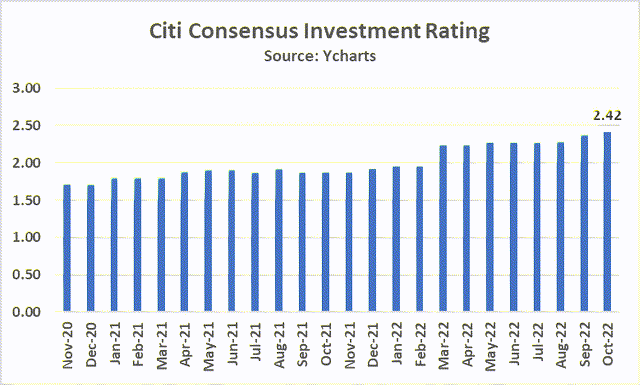

This next chart shows the consensus one-year out price target for Citi since January 2021. The good news is that Citi analysts keep driving down their price targets. As I wrote and warned in September 2020, “Heartbreak Citi: Analysts Too Bullish,” one of the biggest hurdles facing Citi investors was the unreasonable confidence and expectations of the analyst community.

This next chart shows that Citi analysts today are less bullish on Citi than at any time during the past two years. The contrarian in me sees this as a positive sign.

The second possible reason for optimism that Citi is priced for acquisition and accumulation is the news out earlier this year that Warren Buffett’s Berkshire Hathaway had made a major investment in Citi.

Citi share price jumped 7% on the May 17 news of Buffett’s first quarter investment. Citi investors should be heartened to see the world’s greatest investor become a big shareholder.

Optimism Check

While flagging analyst confidence and Berkshire’s decision to buy Citi may be viewed as reasons for optimism in Citi shares, here are two offsetting observations.

Seeking Alpha Writers

While the analyst community’s expectations for Citi are now lower than any time over the past two years, the same cannot be said of the Seeking Alpha community that follows Citi.

In fact, to the contrary, it appears Seeking Alpha writers are extremely bullish.

Over the past 60 days, there have been 11 Very Bullish and 5 Bullish Citi calls by Seeking Alpha writers. There have been no Holds or Sells. This works out to a composite Strong Buy of 1.31, a score even better than the 1.45 composite Strong Buy score from 70 Seeking Alpha Citi article writers in 2022.

Berkshire Hathaway

As much as I respect Warren Buffett, in fact, I am a long-time investor, I will say that I am completely baffled by Buffett’s approach to bank investing since early 2020. To that point, I wrote a lengthy article for Seeking Alpha in February 2021 entitled, “Respectfully, Mr. Buffett, What Were You Thinking?”

In the article I posed the question: How could Berkshire Hathaway sell massive positions in JPMorgan Chase and The PNC Financial Services Group, Inc (PNC) at the height of Covid worries and the low point in bank stock prices in 2020? These are unquestionably two of the finest, safest, best managed banks in the world.

Then in Q1 2021 Berkshire buys Citi and pays somewhere on the order of $62 to $68 a share. By my calculation, those shares have lost about 29%.

Final Observations

I need to see a margin of safety from Citi before I pick up shares that are clearly cheap by all traditional measures of value.

Nothing has changed since my December 30, 2021, article, “Citi Bear: Consent Order + Buyback Pause + Revenue Fall + Write-Downs = 3+ Year Fix.“

Take that back: One thing has changed.

When I wrote the article, I expected Citi to be investment-ready for this cautious buy-and-hold bank investor in the second half of 2024. My timetable is now 2025.

I am avoiding Citi shares, but I would not short the bank at today’s price.

Among big banks, my current favorite is Bank of America Corporation (BAC), both Common shares and Preferred (BAC.PL). My September 2022 article on BAC highlights my reasons.

While I expect Citi shares to go up between now and then, I see Bank of America shares, as well as those of certain smaller banks, going up as well over the next three years but with less noise and volatility than Citi.

Caveat

Every investor needs to do their own homework before investing. My risk profile as a long-term buy-and-hold investor is probably not your risk profile. Investors and potential investors in Citi are well-served to read a variety of opinions.

Be the first to comment