naphtalina/iStock via Getty Images

Semiconductor and electronic assembly solutions provider, Kulicke and Soffa Industries (NASDAQ:KLIC), has been one of the best performing stocks of the last five years. It has grown profitably across a decade, building itself into a resilient firm. With the end of the semiconductor bubble, the company’s revenues have meaningfully declined. However, the capital exit that will arise as a result of inflation and weakening demand, will benefit the strong firms like Kulicke and Soffa, who will be able to go the distance.

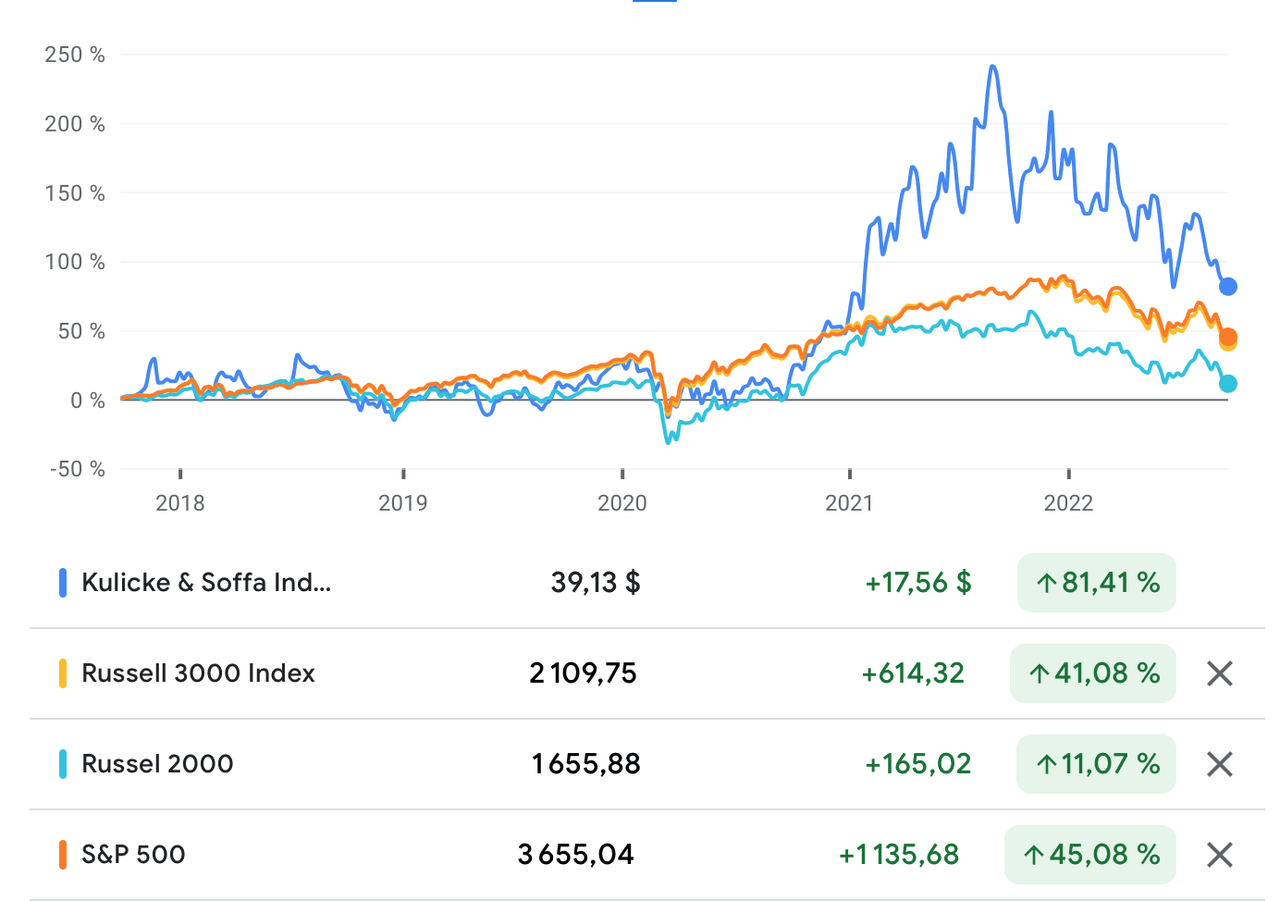

Kulicke and Soffa has been one of the stars of the now-finished bull market. In the last five years, the company has shot past the general market, at time of writing, the stock has returned an 81.41% over the last five years, compared to 41.08% for the Russell 3000, 11.07% for the Russell 2000, and 45.08% for the S&P 500.

Source: Google Finance

Year-to-date, the company is down 41.14%, while the Russell 3000 is down 24.78%, the Russell 2000 is down 27.14%, and the S&P 500 is down 23.8%. After years of being a stock market darling, the company is getting battered on the stock market.

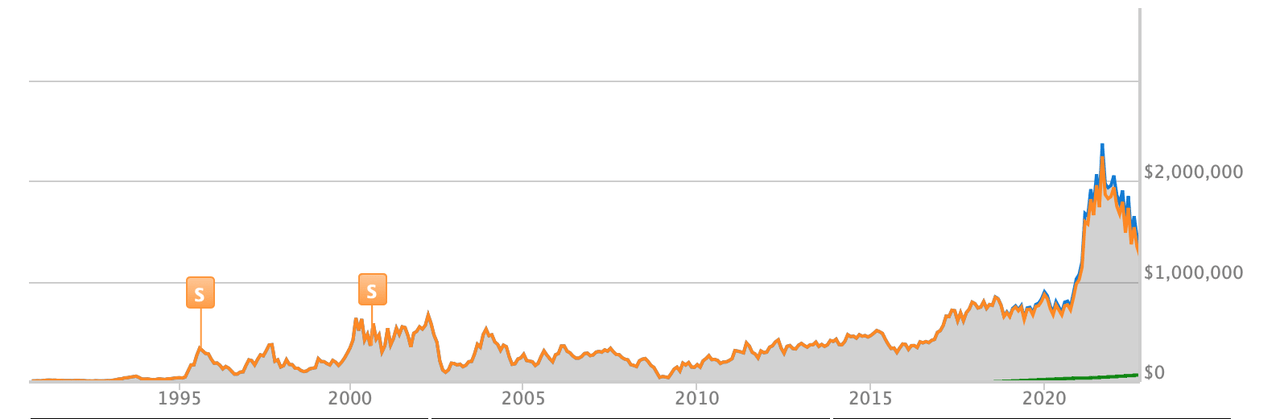

Taking the long view, it can be argued that Kulicke and Soffa has been, overall, a great investment for its shareholders. Since listing in 1990, the company has gained a total shareholder return (TSR) of over 13,316%.

Source: Kulicke & Soffa

Kulicke and Soffa’s Business

Founded in 1951, Kulicke and Soffa provides semiconductor and electronic assembly solutions. The company operates through two business segments: capital equipment and the aftermarket products and services (APS) segments.

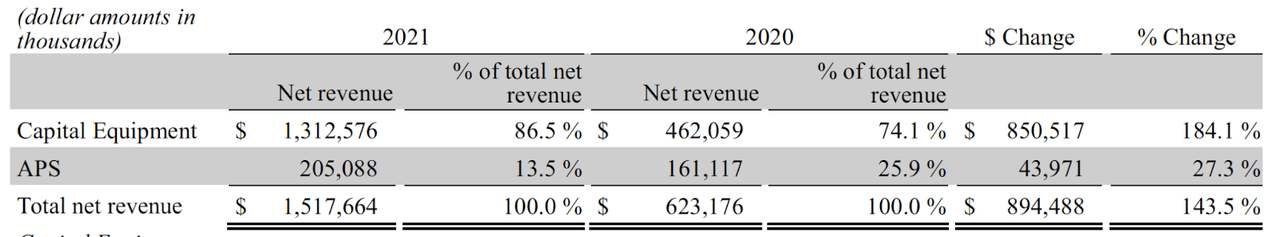

As of 2021, capital equipment accounted for 86.5% of the company’s revenue.

Source: 2021 Annual Report

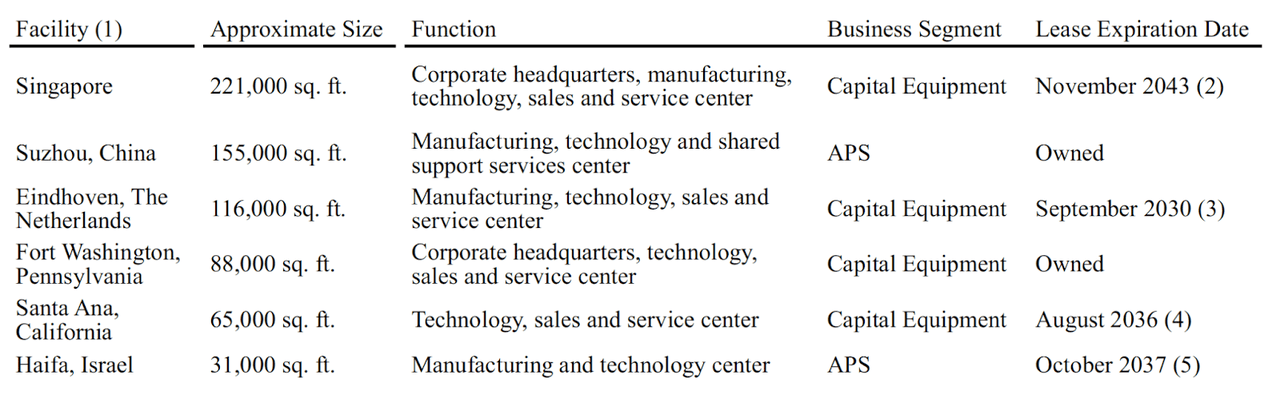

The capital equipment segment operates out of Singapore, the Netherlands, the United States and Israel, while the APS segment operates out of China.

Source: 2021 Annual Report

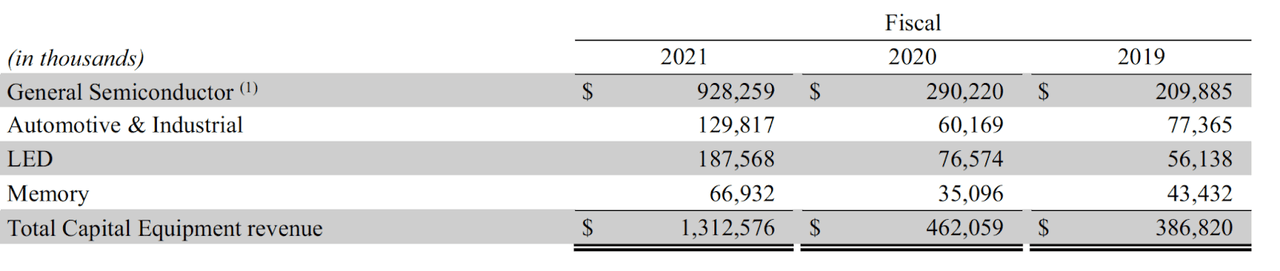

Capital equipment serves four end markets: general semiconductor, which in 2021, accounted for 70.7% of capital equipment revenue; automotive & industrial, which accounted for 9.8% of capital equipment revenue; LED, which accounted for nearly 14.3% of capital equipment revenue; and memory, which accounted for about 5.2% of capital equipment revenue.

Source: 2021 Annual Report

Growth with Profitability

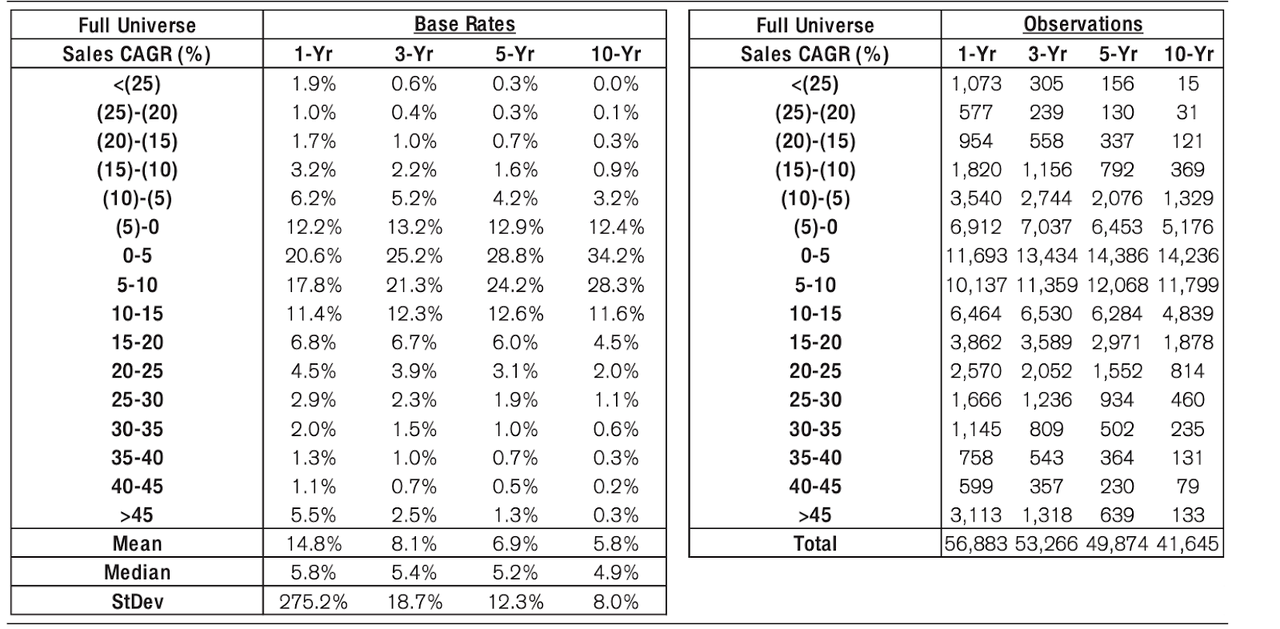

Kulicke and Soffa grew revenue from over $791 million in 2012, to nearly $1.52 billion in 2021, for a 10-year revenue compound annual growth rate (CAGR) of 6.73%. This is a fairly normal level of growth, which places the company among 28.3% of companies which achieved similar rates of growth between 1950 and 2015, according to Credit Suisse’s The Base Rate Book. In the trailing twelve months (TTM), revenue was $1.7 billion.

Source: Credit Suisse

Gross profitability has always been high. According to research by Robert Novy-Marx, 0.33 and above is ideal. Kulicke and Soffa’s gross profitability in 2012 was 0.45, rising to nearly 0.52 in 2021. In the TTM period, gross profitability is 0.52.

The company’s operating profit margin was 22.7% in 2012, rising slightly to 27.2 in 2021. According to Aswath Damodaran’s data, the semiconductor industry has an average operating profit margin of 25.55%. Industrials as a whole have an average operating margin of 11%, according to The Base Rate Book. In the TTM period, operating profit margin is 32.7%.

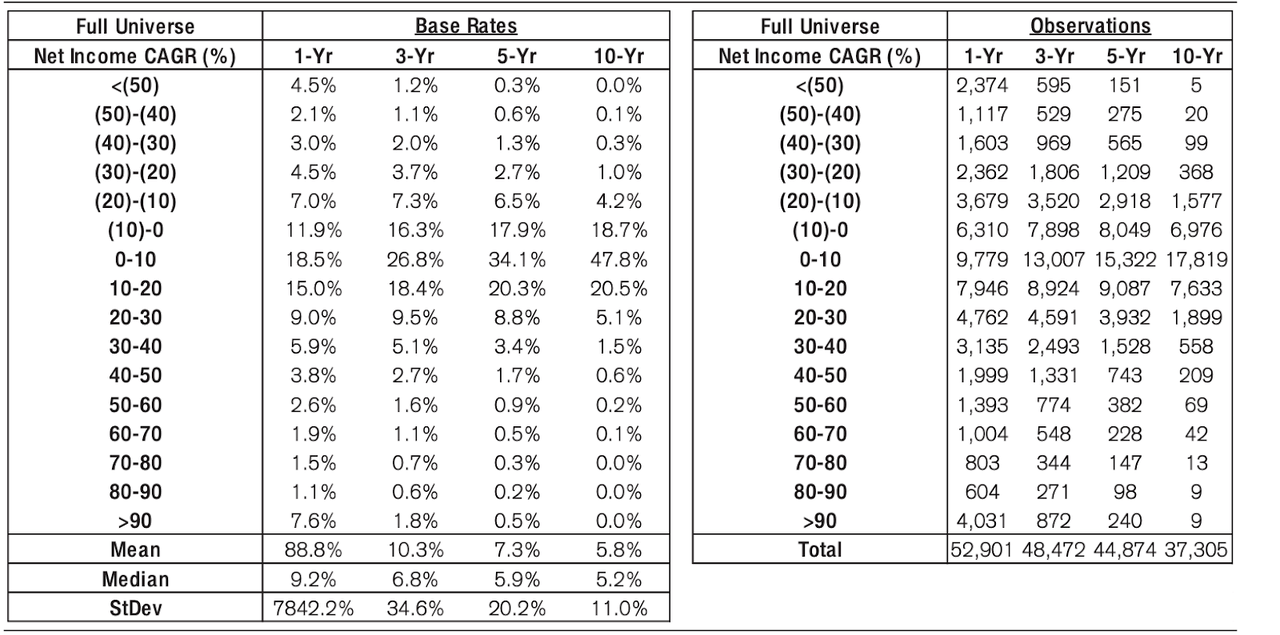

Kulicke and Soffa’s net income has grown from $160.58 million in 2012, to $367.16 million in 2021, for a 10-year CAGR of 8.62%. This puts the company among 47.8% if businesses.

Source: Credit Suisse

Kulicke and Soffa’s return on invested capital (ROIC) declined steadily across the decade, from 106.1% in 2012, to a low of 6.9% in 2019, before recovering and ending the decade with a ROIC of 61.2% in 2021. ROIC in the TTM period is 68.8%.

That pattern is repeated with its history of free cash flows (FCF), with FCF declining from $$175.75 million in 2012, to a low of 54.44 million in 2019, before recovering and ending the decade with FCF of $277.55 million in 2021. In the TTM period, FCF is over $380 million.

Kulicke and Soffa Could Win in a Tough Economy

Semiconductors may be high-tech, but they are, fundamentally, just commodities, and as such, markets follow Kaldor’s cobweb model, meaning that there is a time lag between production decisions and future returns. This leads to an inverse relationship between asset growth (at the industry and company level) and future returns. For observers of the semiconductor market, talk about increasing capex to meet booming demand, should have been a signal of trouble ahead. Production decisions in boom times invariably overstate the size of future demand, because even the best estimates do not take due consideration of market volatility.

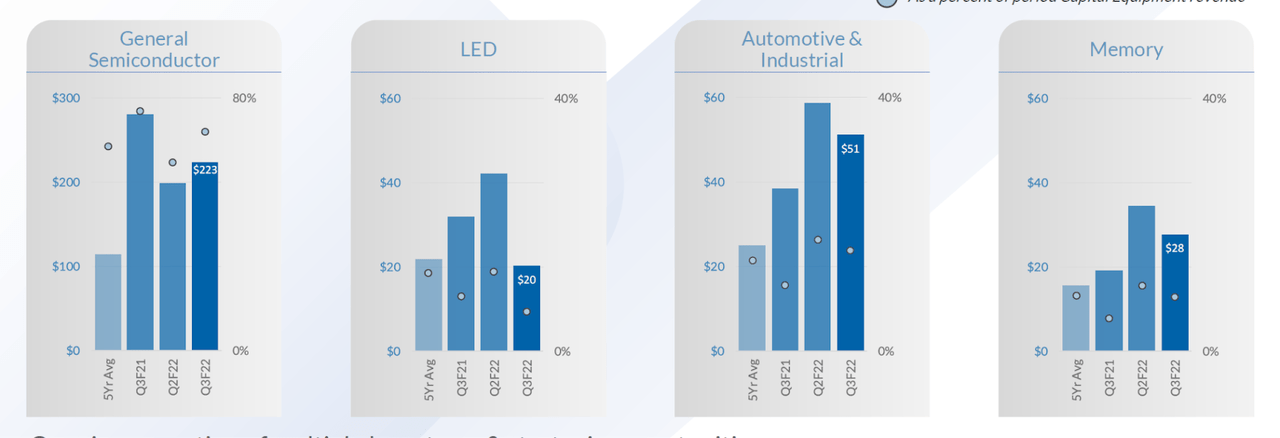

This explains why, with inflation biting, semiconductor companies have seen their numbers go off a cliff in 2021. Companies such as NVIDIA (NVDA) and the Taiwan Semiconductor Manufacturing Company (TSM) have taken a beating, because managers could not resist the wider forces that compelled them to increase capital expenditure thanks to the temptations of the pandemic boom. The company has seen Q3 2022 revenue from the general semiconductor sub-segment decline to 80% of Q3 2021 revenue. Similarly, revenue in the LED sub-segment is lower than for the same period in 2021. The automotive & industrial and memory sub-segments, have, however, seen growth in the last quarter.

Source: Q3 2022 Earnings Presentation

However, the company’s ability to grow profitably and, crucially, to remain profitable in a declining market, puts it in a strong position to steer through a downturn. What we should expect to see is industry wide consolidation over the coming years, as businesses attempt to cope with the mistakes of the boom era and clean out excess inventory. In that period, the strong businesses will be able to eat up the weaker ones, and as capital exits the market, profitability will grow. With its strong financial position, Kulicke and Soffa should be one of the winners in that process of capital destruction.

Valuation

With FCF of $380 million in the TTM period, and an enterprise value of over 22.8%. This compares favorably with the FCF yield of the 2,000 largest businesses in the United States. New Constructs calculates that FCF yield at just 1.5%.

Conclusion

Kulicke and Soffa has been one of the best performing companies in the market over the last few years. However, 2021 has been a horrific year for the semiconductor industry, and this has had a meaningful impact on the company’s business. Nevertheless, the company has built itself into a strong, profitable firm, and it will be able to see out this crisis. With capital exiting the market, profitability will improve, to the benefit of Kulicke and Soffa. With a FCF yield of 22.8%, investors can likely expect rich returns in the future.

Be the first to comment