ablokhin

Introduction

Five Below (NASDAQ:FIVE) reported its Q2 earnings this week. This article aims to answer two questions: “Were the Q2 earnings good?” and “Is the long-term thesis intact?“

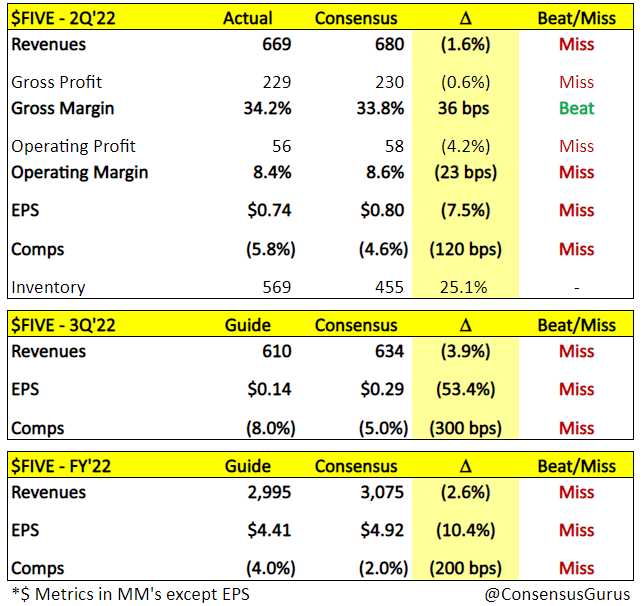

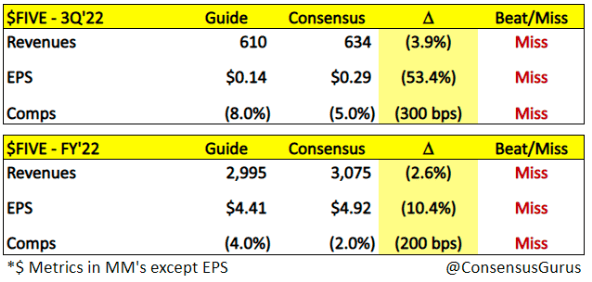

Simply put, the answer to the first question is a resounding no. This is pretty evident if we look at how the company fared against the estimates:

Consensus Gurus

It was pretty much a miss across the board in Q2 but also in Q3 and FY guidance. The table above is not enough to answer the second question, so we must dig a bit deeper. We can also learn more by listening to management’s comments.

So, without further ado, let’s get started.

The numbers

Five Below reported bad numbers in Q2, especially in the top line. On the bottom line, the company again demonstrated excellent cost control. This shows it’s a master in controlling profitability. Before digging into the top and bottom lines, let’s review the headline results.

The headline numbers

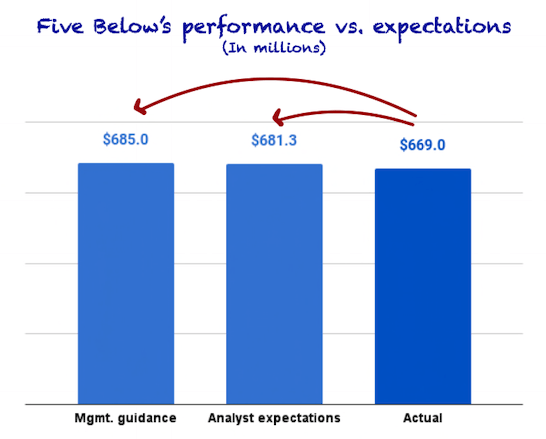

Q2 sales came in at $669 million, up 3.5% year over year. This number met neither analysts’ nor management’s expectations:

Made by Best Anchor Stocks

As in Q1, the good news was on the bottom line. Despite the lower sales, the company managed to fall inside its guidance, although it missed analysts’ estimates:

Made by Best Anchor Stocks

The divergence between sales and earnings demonstrated once again that Five Below can control its costs in most environments and protect margins, all despite operating in the value retail space where flexibility is limited. This is especially important when times are tough, as an essential part of any long-term holding is its ability to weather challenging periods.

There’s no denying, however, that the headline numbers were not great. Beats on the top and bottom lines would’ve been better, but we must focus on the long term and be prepared to face challenging periods because they will inevitably come. Maybe they are already here.

The top-line drivers: comparable sales and new stores

Five Below has two main drivers of its top line: comparable sales and new store openings. Comparable sales refer to the increase or decrease in sales from stores that were already open in the comparable period. So, for example, comparable sales for Q2 2022 will be a calculation using only the changes in sales from those stores that were already open during Q2 2021. New store openings are pretty much self-explanatory.

Last quarter, sales came in lower than expectations because comparable sales came in softer (store openings came in line), but this quarter it was a combination of both.

Comparable sales come in lower than expectations again

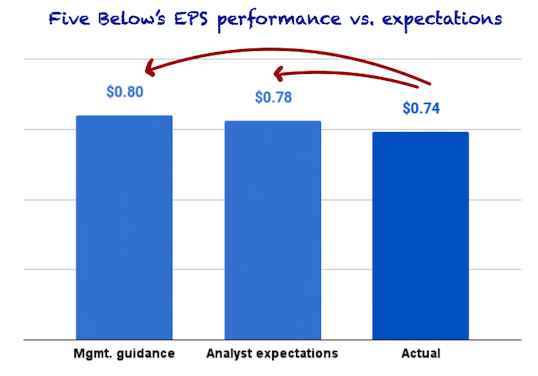

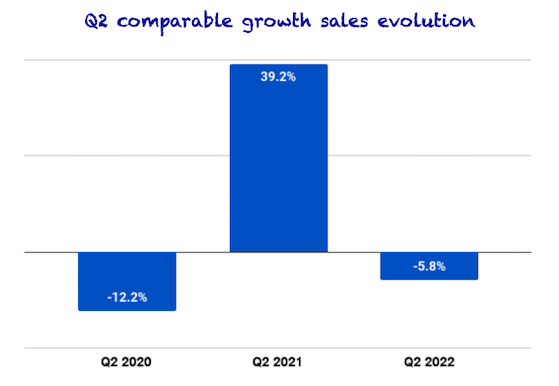

Comparable sales decreased 5.8% year over year, failing to meet analysts’ and management’s expectations:

Made by Best Anchor Stocks

Comparable sales also have two underlying growth drivers: average ticket and number of transactions. Average ticket decreased by 4.3%, and transactions decreased by 1.7%.

When it comes to Five Below, we prefer the average ticket price to be responsible for the decrease in same store sales. Our reasoning is that the company is more in control of average ticket than traffic, because of initiatives like Five Beyond, which has items of more than $5. Seeing the number of transactions decrease might mean that traffic is plummeting, which would be worse for Five Below than its customers temporarily spending less. If the customer is in the store, management has more flexibility to lead them to spend more.

It’s also important to zoom out when analyzing comparable sales. Last year, government incentives created a huge pull forward in comparable sales for Five Below, and unlapping these comps amidst macro weakness is not ideal. It’s also true that last year’s comps faced easy comps during the pandemic year:

Made by Best Anchor Stocks

The result of these unusual times is that it’s complicated to make sense of these volatile numbers. For this reason, zooming out can help us understand the long-term trend. On a three-year basis, comparable sales increased 15%, a 4.7% CAGR. This is much more in line with the long-term expectations, and it’s what we should really focus on. Rarely does growth come in a straight line, especially amidst unprecedented events.

New store openings come out below expectations

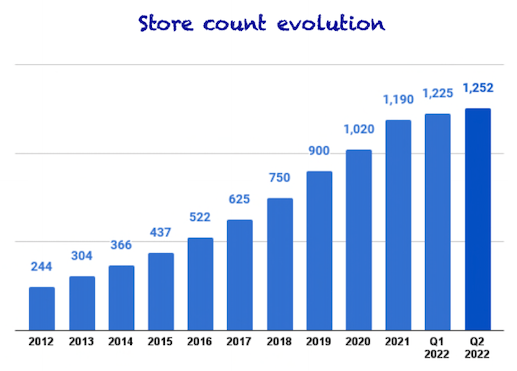

While last quarter management opened precisely what they expected to open, they fell slightly short this quarter. Five Below opened 27 new stores, falling below its expectations of 30 stores.

These stores were opened across 18 states and helped the company end the quarter with 1,252 stores:

Made by Best Anchor Stocks

The total number of stores last quarter plus the Q2 openings shows us that Five Below didn’t close a single store, which it has rarely done throughout its history, unlike other retailers.

Of course, we don’t know when these stores were opened during the quarter, so it’s difficult to quantify their impact on this quarter’s sales. For example, if almost all stores were opened towards the end of the quarter, their impact would be deferred to Q3.

What we do know is that new store productivity (‘NSP’) is coming slightly below pre-pandemic levels. NSP is the ratio between the sales added for each square foot added. So, for example, if this ratio is 100%, each new square foot adds a similar level of sales. This was the case for Five Below before the pandemic, but this has come down to 80% on an adjusted basis. Of course, this worried some analysts who asked about cannibalization. Management argued that cannibalization is not the cause of the reduced productivity, but rather a focus on existing stores due to supply chain shortages:

There is a couple of things going on there, especially post-pandemic where we pulled back on grand opening marketing and inventory levels and things like that where the supply chain got really tight we favored existing stores versus new stores. So that probably drove that reduction in productivity versus what we saw in pre-pandemic periods.

I think you mentioned cannibalization, that’s been relatively consistent from our calculations, we did increase over the last couple of years and we called that out, we expected that closer to about 100 basis points, that’s embedded in our guide.

Source: Ken Bull (Five Below CFO) during the Q2 earnings call

As Five Below grows its store base, cannibalization will undoubtedly appear to some level, but the company has demonstrated a remarkable ability to densify markets without too much cannibalization. You also have to consider that densification is a tailwind for the supply chain, marketing, and brand recognition.

Digging into profitability

While many retailers continue to see margins contract, Five Below continued to show excellent cost control. We believe management should get all the credit here, as managing margins is not easy amidst an inflationary environment for a company with “pre-established” price points in most stores.

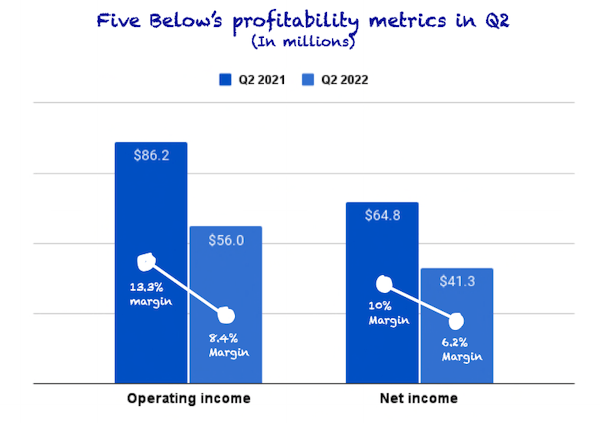

Cost control was a tailwind for margins, but they inevitably contracted due to the slow increase in sales compared to 2021:

Made by Best Anchor Stocks

The massive pull forward of demand in 2021 helped the company expand its margins as fixed costs were distributed across a larger sales base (leverage). However, now the company is seeing the opposite effect (deleverage) as increased costs related to more stores and additional investments are distributed across a similar sales base.

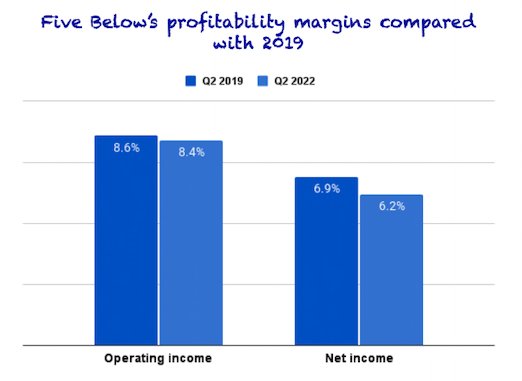

In fact, if we compare Q2 2022 margins to the 2019 period, we can see how they are much more comparable than against 2021:

Made by Best Anchor Stocks

It’s remarkable to see how margins are almost the same considering the inflation levels in both periods. This is just another data point that shows that leverage and cost control are indeed working.

Inventories also played an important role this quarter, but we’ll go over them when we talk about the qualitative highlights.

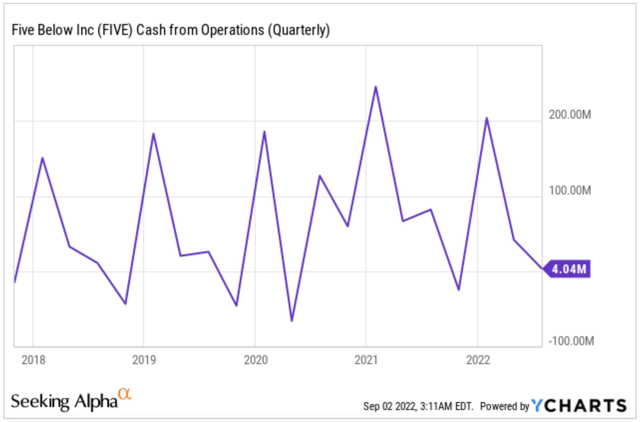

Solid cash flow and balance sheet

The best thing about the release was probably the continued strength of the company’s balance sheet, which will allow it to play offense.

Operating cash flow came in at $4 million, a significant decrease from the comparable quarter last year. However, we have to take into account that last year’s seasonality was muted due to the incentive payments by the government, so this quarter was basically just a return to normal in terms of seasonality:

Regarding the balance sheet, Five Below reported $272 million in cash and short-term investments and no debt. The company does have “debt” related to leases, but it’s not financial debt, so management doesn’t count it.

Five Below’s numbers for Q2 were bad, period. This said, as long-term investors, our focus should be on trying to understand how short-term setbacks impact the long-term thesis. For this, we have to look at the qualitative highlights.

Qualitative highlights

The cause of the worse-than-expected results

Results being below expectations were partly caused by the macro environment, but also by management’s over-optimism embedded in their expectations. Headwinds are now expected to last longer throughout the year:

Taken together, with the macro environment lapping last year’s robust sales and trends was more difficult than we had expected. As we shared with you at our Investor Day in March, we expected 2022 to be a very unique year for us given many of these factors I just outlined. While we do see some specific positive emerging drivers for our Q4 performance, we do not see all the headwinds, we just mentioned dissipating in the near-term. As a result, we have reduced our sales and earnings outlook by nearly 3% and 13%, respectively for the year.

Source: Joel Anderson (Five Below CEO) during the Q2 earnings call

There’s no denying that 2022 is proving to be a special year, so we can’t blame management for being unable to predict macro. As long-term investors, we don’t believe macro trends can be easily predicted, and this is no different for CEOs.

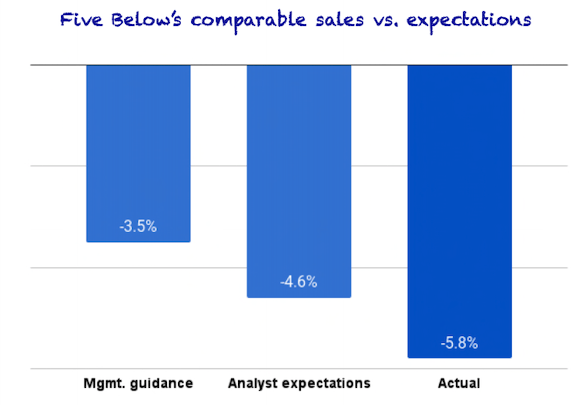

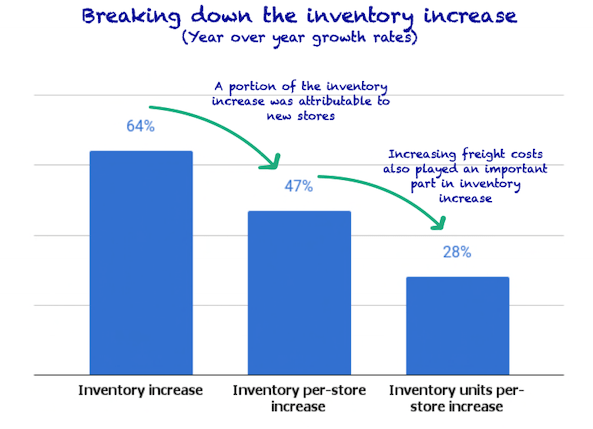

What happened to inventories?

Inventories are currently the focus metric across the retail industry. The rationale is that as demand decreases and the supply chain eases, many companies will build up too much inventory, leading to markdowns and discounted merchandise.

Five Below’s inventories were up 64% year over year. While this number is undoubtedly high, it needs some context. First, Five Below suffered some inventory shortages last year during the holiday period, and management doesn’t want to repeat the same mistake. For this reason, they have been ramping up inventory which they expect to wind down during the back half of the year:

We expect significantly improved in-stocks this year and for our average per-store inventory levels and year-over-year comparisons to moderate significantly as we move through the back half of this year.

Source: Ken Bull (Five Below CFO) during the Q2 earnings call

Additionally, we have to consider that the company is continuously opening new stores, so obviously, this creates an increase in inventory that isn’t necessarily related to slower demand.

In this quarter, the average inventory on a per-store basis was up 47% year over year, which is significantly lower than the 64% overall increase. This 47%, however, is not entirely related to units, as higher freight costs are embedded in it. Average total units on a per store basis were up 28% year over year, which is obviously not low but it’s something we should not consider worrying about amidst the current environment and especially since it’s a part of management’s strategy:

You are seeing a high number at the end of the second quarter, but that is because we’ve advanced deliveries because we wanted to make sure we got out ahead of any supply chain disruption so our point was that we’d rather have it in our distribution center than somewhere else, so we really push that.

Source: Joel Anderson (Five Below CEO) during the Q2 earnings call

Made by Best Anchor Stocks

The moral of the story is that context always matters, and no two inventory increases are created alike.

Playing offense during tough times

Five Below is undoubtedly not going through its best period performance-wise. Still, the company is well positioned to take advantage of an adverse macro environment thanks to its value proposition and solid balance sheet.

Management still believes that value will play an important role in an inflationary and recessionary environment, and the company should see customers shifting to their stores. This will be especially true when the season changes customer behavior from the “wants” to the “needs”:

As you get into the fourth quarter though, as you know, that becomes our needs quarter as opposed to, right now, we’re living mostly in the wants business. We did call out how our needs categories outperformed. But our whole box becomes a needs as people think about the holiday and they think about needing to fulfill Christmas gifts and Hanukkah and celebrating the holidays with their families. We become more of a go-to.

Source: Joel Anderson (Five Below CEO) during the Q2 earnings call

While this explanation makes total sense, we still need to see if it ends up playing out.

However, there’s a more tangible benefit from a down period right now, which revolves around real estate. Management is seeing increased opportunities in real estate thanks to the uncertain macro environment, which is leading other retailers to close stores:

I’m not going to give up all my sources, but publicly I think even several hours ago Bed, Bath and Beyond just announced 150 closures. So for the last decade, retailers have ebbed and flowed and we really haven’t seen that dislocation in the last two years like we have in the past. So a significant part of our growth strategy is not about greenfield and I think the dislocation retailers will help us only accelerate and that’s what we’re starting to see, and hence why we’ve actually started to give you some insight into 2023, which is probably the earliest we’ve ever done some of that.

Source: Joel Anderson (Five Below CEO) during the Q2 earnings call

More real estate opportunities have several implications for Five Below. On the one hand, better leasing terms and, on the other hand, more locations are available to ramp up store openings, which is precisely what the company plans to do.

There’s yet another permanent benefit from tough times for Five Below. As management is working to become more cost-efficient, the organization is becoming better optimized, and margins should improve once the skies are clear:

It’s also true that sales expose things and I think, in some ways, it’s helped to make us a leaner organization. Ken commented on a lot of costs we’ve taken out of the business and those will benefit us as we go into ’23, start to open over 200 stores, it really will leverage your fixed cost significantly.

Source: Joel Anderson (Five Below CEO) during the Q2 earnings call

Challenging times typically translate into opportunities for counter-cyclical management teams and also help improve the efficiency of the business. We think both of these are in play for Five Below.

Focused on growth

Despite the challenging environment, management is not cutting on growth and expects to ramp up store openings and remodels. Next quarter, management expects to open 45 new stores, a 66% increase compared to the previous quarter. It also plans to remodel 250 stores to the Five Beyond model this year, which should help with sales growth (thanks to higher ticket size) and margins. Of course, this expansion plan is backed by management’s confidence in the long-term potential of Five Below.

The highlight, however, was store growth guidance for next year:

Next year’s new store openings represent a significant milestone of over 200 for the first time.

Source: Joel Anderson (Five Below CEO) during the Q2 earnings call

This might have been the reason for the good market reaction despite the poor results.

The accelerated pace of store openings is especially appealing since operating leverage might kick in sooner than expected. With the Indiana distribution center already open, management doesn’t expect new DC openings for the next couple of years:

As it relates to our distribution infrastructure, we are very excited to have officially opened our Indiana shipping center this summer to further gain efficiencies and speed to our stores and ultimately our customers. As a reminder, this DC completes our Five Node network and provides us capability to service approximately 90% of our stores within one day. We are now taking a pause from opening DCs for a couple of years.

Source: Joel Anderson (Five Below CEO) during the Q2 earnings call

Growth will not be limited to store openings and remodels, as the company is also investing in new experience initiatives such as BOPUS:

For e-comm, we enhanced our offering by rolling out BOPUS to over 100 stores in July and we’ll complete our chain wide rollout by the end of this September. BOPUS allows our customers to shop Five Below when, where, and how they like furthering our goal becoming an omnichannel retailer. This is yet another example of the ongoing implementation of our long-term vision to connect with our customers and deliver an even better experience for them.

Source: Joel Anderson (Five Below CEO) during the Q2 earnings call

We are eagerly waiting for the day management announces the launch of a loyalty program.

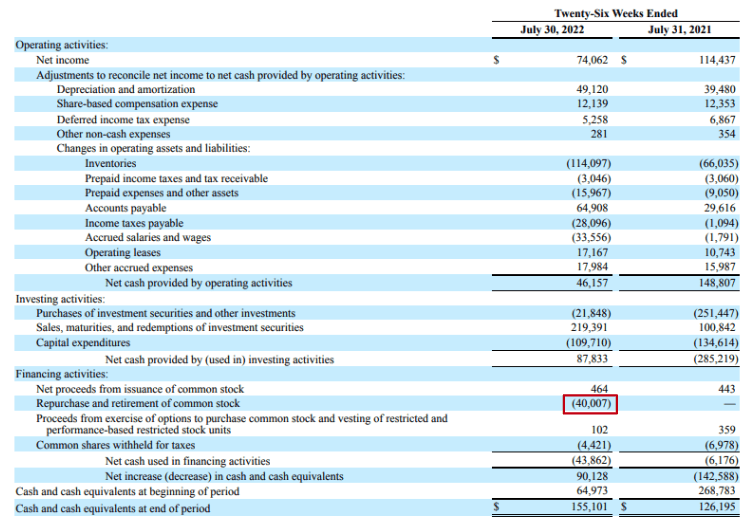

What about buybacks?

Last quarter we talked about how management was ramping up buybacks. This quarter, though, management did not say anything about them. Looking at the 8-K, it looks like management has paused buybacks, as the amount for the first six months is equal to the amount spent in repurchases in Q1:

Five Below 8K

Seeing the stock price weakness and the stock not being expensive (in our opinion), we would’ve liked seeing continued buybacks. Still, we completely understand that priorities have shifted to execute on growth thanks to the opportunities the current environment is giving. Sometimes, it’s all a matter of opportunity cost.

The impact of pOpshelf

The last thing we wanted to talk about is pOpshelf, Dollar General’s store concept that is technically trying to copy Five Below’s value proposition. Joel Anderson argued that pOpshelf is not that comparable to Five Below and that, up to now, the company does not see any negative impact from it:

No it doesn’t change our outlook at all. I’m very much aware of pOpshelf like any other retail, in competition in other retailers all the time. You specifically asked about the merch assortment, I’ll tell you, to me, it is feels much more like a home goods and it does a Five Below and it caters to a different age segment than we do. So the fact that we now have some stores in our same centers and we haven’t seen any impact at all.

Source: Joel Anderson (Five Below CEO) during the Q2 earnings call

Guidance

Guidance was not a bright spot either, as management reduced again its FY 2022 guidance and the third quarter’s guidance was weak. It was basically a miss on all fronts. Here’s a summary:

Consensus Gurus

We will not spend too much time on this, as many of the headwinds that impacted Q2 will also impact Q3. However, management expects these headwinds to ease as they go into Q4, which is why you see that the full-year guide came closer to expectations than Q3.

The most important thing about guidance is that, despite the challenges and the recent sluggish performance, management doesn’t see any reason to cut their long-term growth targets: its triple-double vision.

As far as the long-term goes, you put a unique aside we are still very confident in our long-term store growth opportunity. The teams are working and really accomplished a lot to maintain our Triple-Double, and at this point in time, we don’t see any reason to be backing off of our long-term strategy.

Source: Joel Anderson (Five Below CEO) during the Q2 earnings call

We believe in management’s optimism because we don’t think there’s any reason not to, and also because insiders have recently been buying. The latter is just anecdotal, but always a good sign.

All in all, guidance was not good, although it wasn’t something too worrying either if you really focus on the long term. Could there be rough times ahead? Sure, but we are convinced that Five Below has what it takes to come out stronger from a down period.

Conclusion

All in all, it wasn’t a good quarter for Five Below. However, after assessing it in depth, we believe the long-term thesis is intact, and that’s what we care about.

In the meantime, keep growing!

Be the first to comment