Justin Sullivan/Getty Images News

By The Valuentum Team

The tech giant Oracle Corporation (NYSE:ORCL) offers investors a nice income growth story as the firm is a great cash flow generator with a resilient business model, though a dividend growth story that comes with several downside risks. Oracle’s growth ambitions are laser focused on the lucrative cloud computing space which are supported by secular tailwinds, though its legacy operations are contending with secular declines in demand, which is why this strategic pivot is so important for the company.

Oracle’s balance sheet has become bloated in recent fiscal years due to its M&A activity and enormous share buyback programs. We like Oracle’s dividend growth potential, but caution that management needs to repair the firm’s balance sheet strength. Shares of ORCL yield ~1.7% as of this writing.

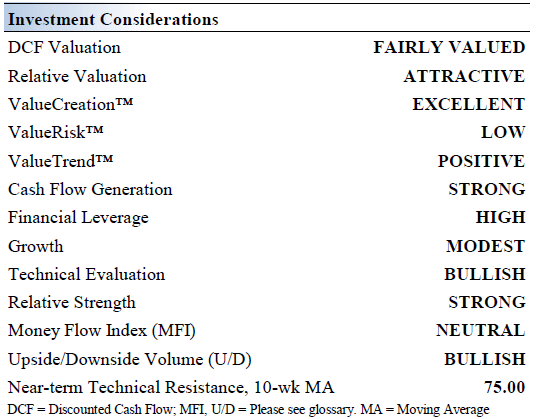

Oracle’s Key Investment Considerations

Image Source: Valuentum

Oracle is shifting the complexity from IT, moving it out of the enterprise by engineering hardware and software to work together—in the cloud and in the data center. Its Oracle Autonomous Database offering is growing at a robust pace. The company has three businesses, ‘Cloud and License,’ ‘Hardware,’ and ‘Services.’ Oracle was founded in 1977 and believes it is now well on its way to becoming the leading provider in the enterprise SaaS market, and it continues to plow money into R&D, showcasing its dedication to innovation.

Management expects overall top-line growth to accelerate moving forward as its cloud business becomes a larger portion of its total revenue. Competition remains fierce, but the firm is confident in its technology leadership, and the market is large enough for many winners. Its Fusion ERP and NetSuite ERP customer base continues to swell higher.

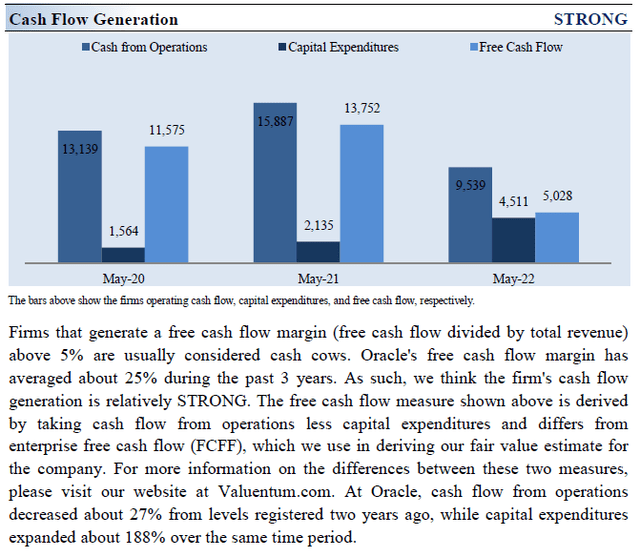

Oracle is incredibly shareholder friendly, seen through its sizable dividend increases and share buyback programs in recent fiscal years. The company is a stellar free cash flow generator (defined as net operating cash flow less capital expenditures) as its annual free cash flows averaged ~$10.1 billion from fiscal 2020-2022 (please note Oracle’s fiscal year ends in May). Oracle’s dividend payout speaks to its confidence in the free cash flow generating prowess of its business. Its run-rate dividend obligations stood at $3.5 billion in fiscal 2022.

However, its massive share buyback programs and past M&A activity have significantly weakened its balance sheet. In fiscal 2022, Oracle spent $16.2 billion buying back its stock and cumulatively spent $56.4 billion from fiscal 2020-2022. At the end of its fiscal 2022, Oracle had $21.9 billion in cash, cash equivalents, and current marketable investments on hand versus $3.7 billion in short-term debt and $72.1 billion in long-term debt, equal to a net debt load of just under $54.0 billion.

Additionally, at the start of Oracle’s fiscal 2023, the firm acquired the health care tech firm Cerner through an all-cash deal with an equity value of ~$28.3 billion (the deal closed in June 2022). While Oracle’s management team is scaling back share repurchases in response to the company’s ever-growing net debt load, it will take some time for the firm to repair its balance sheet strength. There is a lot to like about Oracle given its stellar cash flow generating abilities and improving growth outlook, though we caution that its single biggest downside risk is its bloated balance sheet.

Earnings Update and Guidance

On June 13, Oracle reported fourth quarter earnings for fiscal 2022 (period ended May 31, 2022) that beat both consensus top- and bottom-line estimates. The company also issued out favorable guidance for fiscal 2023 during its latest earnings call.

In the fiscal fourth quarter, Oracle’s GAAP revenues grew by 5% year-over-year and were up 10% on a constant currency basis. The firm noted that on a constant currency basis, its cloud revenue grew by 22% year-over-year with infrastructure cloud revenue up 39%, Fusion ERP cloud revenue up 23%, and NetSuite ERP cloud revenue up 30% last fiscal quarter. Please note its sales growth performance on these fronts was modestly lower when not adjusting for foreign currency headwinds (the strong US dollar seen of late has weighed quite negatively on the revenue performance of large domestic enterprises with substantial international sales).

As an aside, Oracle suspended its business in Russia shortly after the Russian invasion of Ukraine in February 2022. That represents a near term headwind for Oracle, though we appreciate the firm taking a stand on this issue.

Oracle is in the process of scaling up its faster growing cloud-oriented operations and its operating expenses are growing accordingly. Operating expenses advanced 10% year-over-year in the fiscal fourth quarter (up 12% on a constant currency basis) which led to its GAAP operating income declining by 1%, though its non-GAAP operating income was up 6% on a constant currency basis. The firm’s GAAP diluted EPS came in at $1.16 last fiscal quarter, down 21% year-over-year (and down 14% on a constant currency basis) as a decline in its net income was offset somewhat by a 7% drop in its diluted outstanding weighted average share count.

Here is what management had to say regarding Oracle’s recent performance and near term outlook during the firm’s fiscal fourth quarter earnings call:

Now to the guidance. We feel very optimistic about our business momentum. And we also recognize that there is increasing macro uncertainty right now. In addition, since we ceased operations in Russia in March and made other adjustments in the region, we have factored out around $100 million per quarter from guidance that we used to receive from these customers. Taking all that into account, I do expect our cloud business, which grew 22% this year, will organically grow more than 30% in constant currency in FY ’23.

Cloud service and license support will also see growth acceleration and could well see double-digit organic growth. As I said earlier, our fundamental principle is to grow EPS while accelerating cloud revenue growth. Given our increasing confidence in organic revenue growth, we will continue to prudently invest back in the business and you can already see the returns in our performance.

Revenue growth accelerated from 2% in FY ’21 to 7% this year. Clearly, there’s strong demand for our cloud services, and we intend to capitalize it — to capitalize on it. As such, I expect our CapEx spend will be higher in FY ’23 to meet the demand. We expect to add another 6 regions in fiscal 2023 in addition to the 38 cloud regions across 20 countries that we have already serving our customers. — Safra Catz, CEO of Oracle

When Oracle reports its first quarter earnings report for fiscal 2023 on September 12, it is essential to monitor the pace of its cloud-related revenue growth. Additionally, we are looking out for any commentary regarding integrating Cerner’s operations into Oracle’s, as that large deal effectively represented Oracle’s way of establishing a foothold in the health care tech space. Execution on these fronts will be key.

Oracle’s Economic Profit Analysis

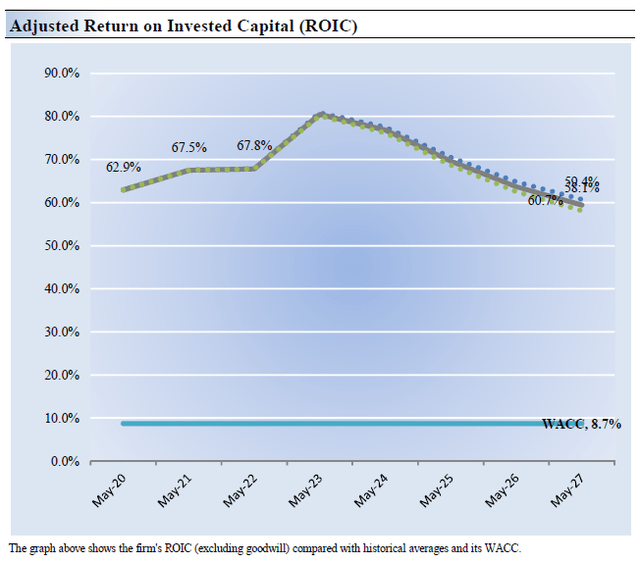

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital [‘ROIC’] with its weighted average cost of capital [‘WACC’]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Oracle’s 3-year historical return on invested capital (without goodwill) is 66.1%, which is above the estimate of its cost of capital of 8.7%.

In the chart down below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate.

Oracle’s Cash Flow Valuation Analysis

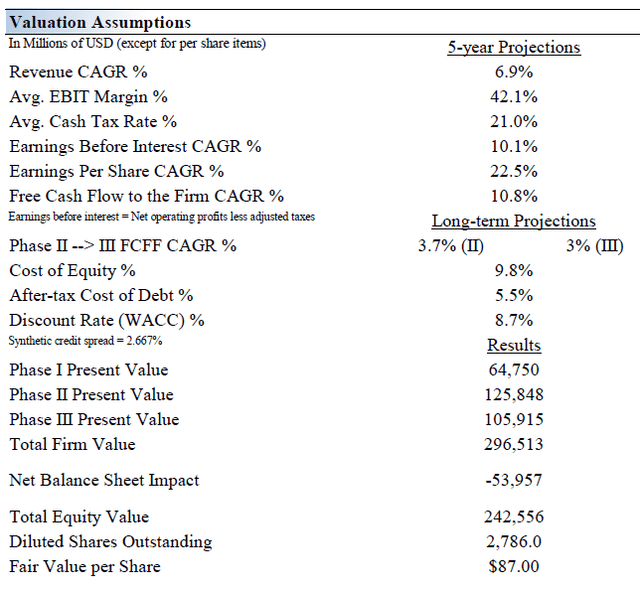

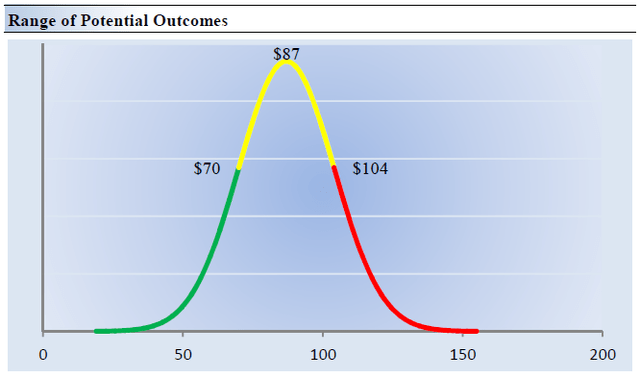

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows, net of balance sheet considerations. We think Oracle is worth $87 per share with a fair value range of $70.00 – $104.00. Shares of ORCL are trading near the low end of our fair value estimate range as of this writing.

The near-term operating forecasts used in our enterprise cash flow model, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 6.9% during the next five years, a pace that is higher than the firm’s 3-year historical compound annual growth rate of 2.4%.

Our valuation model reflects a 5-year projected average operating margin of 42.1%, which is above Oracle’s trailing 3-year average. Beyond Year 5, we assume free cash flow will grow at an annual rate of 3.7% for the next 15 years and 3% in perpetuity. For Oracle, we use a 8.7% weighted average cost of capital to discount future free cash flows.

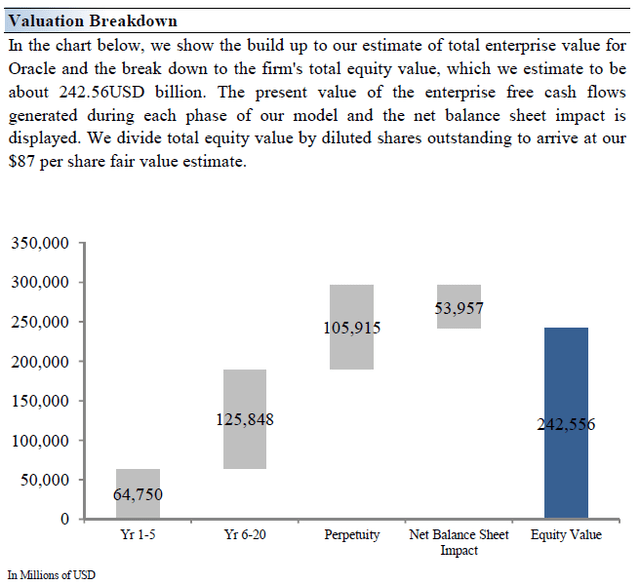

Image Source: Valuentum Image Source: Valuentum

Oracle’s Margin of Safety Analysis

Although we estimate Oracle’s fair value at about $87 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

In the graphic up above, we show this probable range of fair values for Oracle. We think the firm is attractive below $70 per share (the green line), but quite expensive above $104 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Dividend Analysis

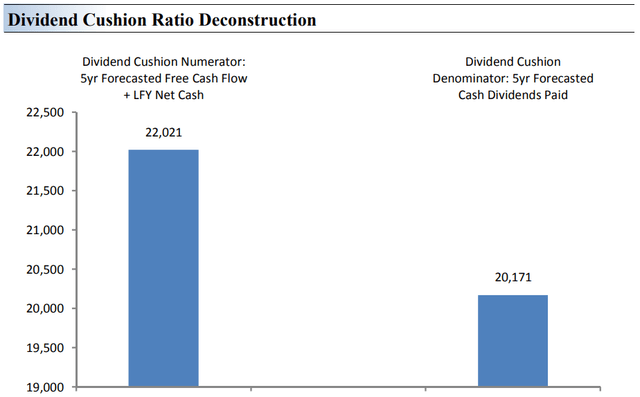

Dividend Cushion Ratio Evaluation (Image Source: Valuentum)

The Dividend Cushion Ratio Deconstruction, shown in the image above, reveals the numerator and denominator of the Dividend Cushion ratio. At the core, the larger the numerator, or the healthier a company’s balance sheet and future free cash flow generation, relative to the denominator, or a company’s cash dividend obligations, the more durable the dividend. In the context of the Dividend Cushion ratio, Oracle’s numerator is larger than its denominator, suggesting strong dividend coverage in the future.

The Dividend Cushion Ratio Deconstruction image puts sources of free cash in the context of financial obligations next to expected cash dividend payments over the next 5 years on a side-by-side comparison. Because the Dividend Cushion ratio and many of its components are forward-looking, our dividend evaluation may change upon subsequent updates as future forecasts are altered to reflect new information.

Concluding Thoughts

Oracle has an attractive business model that drives dependable recurring revenue streams. Management is incredibly shareholder friendly, returning gobs of cash back to investors via share repurchases and meaningful per share dividend increases. Its cloud-oriented operations have started to gain some real traction, and we’re expecting that increased visibility and strong free cash flow generation will lead to robust dividend growth going forward.

In recent fiscal years, Oracle raised its capital expenditure expectations in a big way, albeit off a low base, to fund the expansion of its cloud operations. Competing capital allocation priorities such as share repurchases and M&A activity, weigh negatively on its dividend growth potential as does its large net debt load. Nevertheless, we like the growth in Oracle’s dividend we have seen in recent fiscal years. The firm had ample cash-like assets on hand at the end of fiscal 2022 to meet its near term funding needs. Oracle’s dividend growth trajectory remains promising.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment