Alistair Berg

Published on the Value Lab 1/9/22

Corsair Gaming (NASDAQ:CRSR) had a terrible quarter. It was really bad. Any expected resilience in videogaming that you might have expected wasn’t there. But there are clear reasons why there’s such a bifurcation between sales of software in videogames versus sales in hardware and it all comes down to supply chain issues followed by a sudden glut. We think this is the worst the results will ever be, but even with a recovery we’re not such fans of this industry: it’s just too competitive and it’s all about brand value and popularity of those can be really short-lived.

The Here and Now: Q2

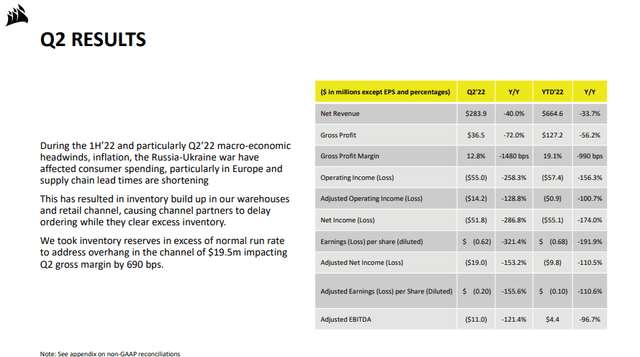

Q2 was an unmitigated mess. Sales fell meaningfully, COGS didn’t really, so gross margins collapsed. The operating expenses did not flex at all with sales declines as new products were being developed and the rest of the cost base was fixed. Operating leverage from topline declines worked harshly against the company’s profits this quarter.

But why did sales decline? Firstly, there was the issue of semiconductor shortages which has been a problem for about a year for the gaming hardware business. This slowed down turnover and made it hard to keep retailers satisfied with sufficient inventory. Lead times were really long for a while. But when that inventory finally came through we had a crash in consumer confidence, so now retailers are fully stocked and not turnover the bloated inventories fast enough.

There are some silver linings. This phenomenon where shortages become gluts has broadly hit the industry. The collapse in crypto prices similarly put GPUs back on the market, just as we worried about more than a year ago in our Nvidia (NVDA) coverage. Generally, PC hardware is getting cheaper which means that people who had held off on buying or upgrading their gaming PCs might be considering it now. There was demand destruction, and the reversal of that will come in clutch for results, and retailers are already seeing pickup on that front. Also the accelerated upgrade schedules through 2020 and 2021 are going to have less of a boom-bust effect on future results. So some reversion to the mean can be bet upon.

From a financial perspective, we just want to highlight a couple of things.

Highlights (Q2 2022 Pres)

Sales declines were massive at 40%, and operating leverage annihilated operating income. Admittedly, about 40% of the declines in operating income are from reserve effects. While non-cash, they are real effects. But they will certainly not be repeated as this level of bloated inventory won’t happen again. These echo effects from COVID-19 are not going to be repeated as people are not going to forgive the authorities for our inflation pains.

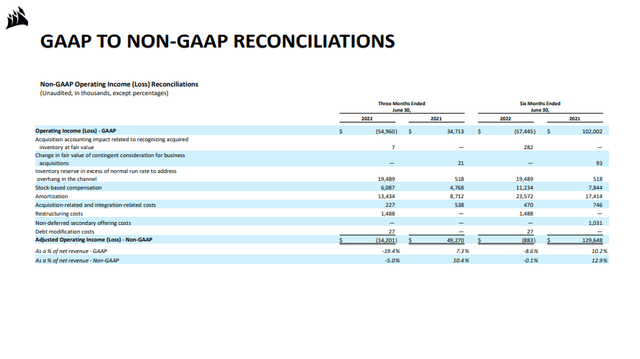

Reconciliations (Q2 2022 Pres)

The other effect we notice in the financials is that gross profit declines were not saved by COGS flex, which should be more variable. COGS declined about 30% while sales declined about 40%. This is because unit economics have deteriorated on account of input cost inflation. Altogether, not very nice.

Remarks

We think that there is going to be a reversion to the mean. This dismal performance is unlikely to be repeated.

Would we buy the dip? No. CRSR’s industry structure isn’t good. It’s gotten very competitive to sell peripherals, and anyone can build their own PC and there are plenty of local services that offer similar things, as well as ecommerce channels like Newegg (NEGG) which include it in their platforms. Altogether extremely competitive.

Moreover, CRSR relies on being pretty premium. Even their simpler peripherals are close in price to Logitech’s (LOGI) and Razer (OTCPK:RAZFF). They rely heavily on brand equity. The issue is that no company, except arguably Logitech, have been able to last long. Razer was the edgy leader in the early 2010s, inventing the concept of RGB you’ll never sleep again gaming peripherals with ridiculous product names to appear to angsty primarily teenage gamers, but they’ve actually not gone far in terms of market share since the IPO. Logitech has managed to succeed by offering great value products as well as more stylish expensive products too. CRSR is more focused on the premium end, and they could see a similar end to Razer very easily.

Also, with so many players in the peripheral industry, I’ve noticed even anecdotally that there’s barely any difference between a $40 gaming mouse and a $90 one except for style and maybe a bit on ergonomics. Headsets are a different story, but still. Polling rates go higher but who notices? Also high DPI gets way too high at some point, players need to be accurate especially with FPS games. With keyboards, it’s all about style. Pings are so low even with $32 keyboards that you really don’t need to spend $150 for a keyboard. You only do it because of that nice mechanical click or the brand name. Maybe for the style, maybe for the design. But ergonomics isn’t a patented concept, cheap can be extraordinarily good, just ask my 7 year of Logitech G203 mouse – nothing can beat it.

CRSR isn’t cheap enough considering all this either. On pretty fair estimates for 2023 for a 30% EBITDA decline from peak 2021 levels, the stock trades at about 10x EV/EBITDA. For a company with the industry structure it has, where positioning could erode in 3-4 years if they’re not careful, it looks fairly valued, not like a bargain.

Be the first to comment