Pekic

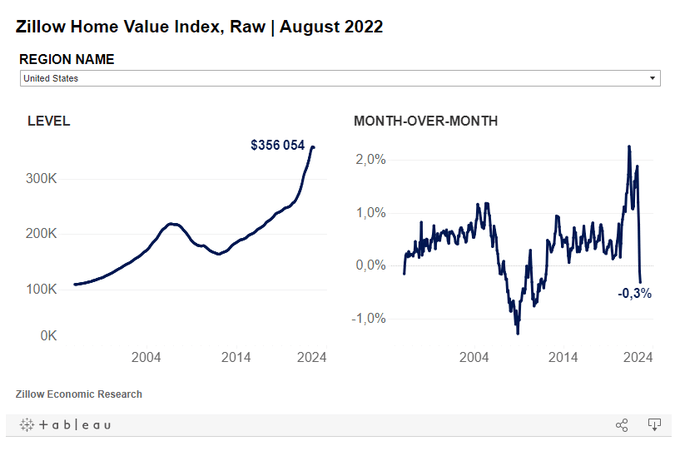

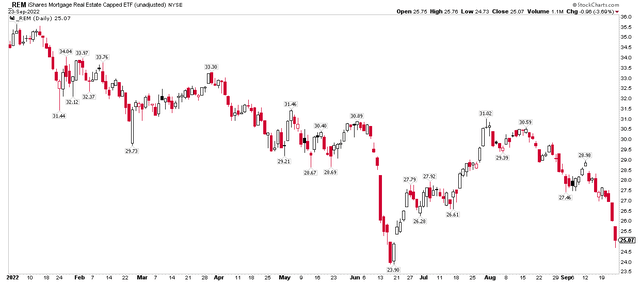

Mortgage REITs, like the rest of the broader market, are threatening the June lows. The iShares Mortgage Real Estate Capped ETF (REM) is down about 20% from its early August rebound high as surging interest rates pressure the space. Unsettling for the real estate and mortgage markets are no doubt extremely high borrowing rates, at 6.7% as of last Friday, and now falling home prices, according to Zillow (Z).

One small-cap REIT that has solid expected earnings and dividend growth now looks like a decent value.

Mortgage REITS Threaten the June Low

Home Prices Now Falling: Zillow

Zillow

Mortgage Rates Jump Near 7%

Mortgage News Daily

According to Bank of America Global Research, Hannon Armstrong (NYSE:HASI) is a specialty finance company based in MD that provides capital and advisory services to companies in the renewable energy (wind/solar), energy efficiency, and sustainable infra markets. The company’s $3 billion portfolio of 200+ transactions include 50% behind-the-meter assets such as energy efficiency, distributed solar, and storage, 45% of GC (grid-connected) assets such as wind and solar, and 5% of other sustainable infrastructure investments.

The Maryland-based $2.8 billion market cap Mortgage Real Estate Investment Trusts industry company stock within the Financials sector trades at a high 31.9 trailing 12-month price-to-earnings ratio and pays a high 4.7% dividend yield, according to The Wall Street Journal.

Competition remains tight for HASI’s operations which could hurt returns looking ahead. On the bullish side, new partnerships the firm is crafting may brighten the future prospects for deals – that’s key given the current maturity wall of its portfolio. Perhaps the big macro risk is what’s happening with interest rates with its asset/liability mix.

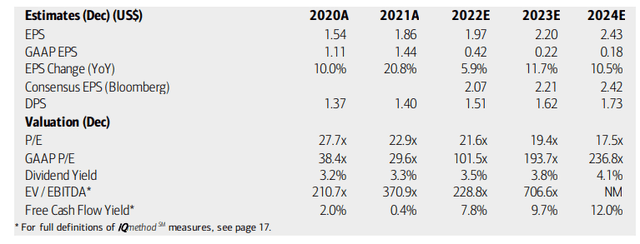

On valuation, BofA sees earnings rising this year and accelerating into 2024. Dividends should thus increase nicely in the coming quarters. The Bloomberg consensus forecast shows about the same EPS growth. Still, its operating P/E ratio remains high but has pulled back hard since BofA’s last update – about 17x using last Friday’s closing price, declining to under 14x by 2024. Free cash flow is high continue paying out nice dividends.

HASI Earnings, Dividends, And Valuation Forecasts

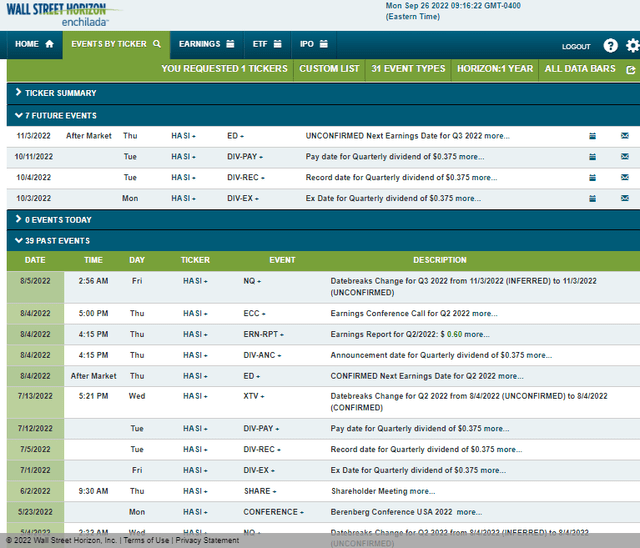

Looking ahead, Wall Street Horizon’s corporate event data show a dividend ex-date of October 3. Hannon’s Q3 earnings date is also unconfirmed for Thursday, November 3 after market close.

Corporate Event Calendar

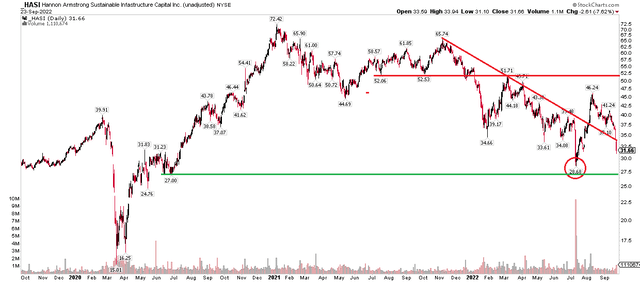

The Technical Take

HASI’s stock price has dropped by more than half of its early 2021 peak. The low $50s was a critical spot, and when shares broke that support, a swift move to the mid-$30s came about. The stock then rebounded to what had been support but failed at its new resistance during the first quarter of this year.

Another major drop culminated in a huge volume spike in July when HASI fell under $30. That’s a key spot here with the stock in the low $30s. Buying in the upper-$20s, which has confluence with a pullback low in the summer of 2020, could make sense with a stop.

HASI Shares Dipping to Support

The Bottom Line

Hannon Armstrong is looking like a better buy now with a lower valuation and still-solid earnings and dividend growth. The chart shows some support in the upper-$20s, too. I think it has turned into a solid value play.

Be the first to comment