Damir Khabirov/iStock via Getty Images

Both Plains GP (NASDAQ:PAGP) and Enbridge (NYSE:ENB) are investment grade, high-yield midstream businesses. PAGP offers a higher dividend yield, but ENB has a higher credit rating.

In this article, we will compare them side by side and offer our take on which one is a better buy.

Plains Vs. Enbridge – Balance Sheet

Both PAGP (BBB- with a stable outlook) and ENB (BBB+ with a stable outlook) have investment grade credit ratings which implies they both have solid balance sheets.

PAGP’s primary focus since the COVID-19 crash has been fortifying its balance sheet. It has accomplished this with a three-pronged approach:

- It slashed its dividend aggressively in order to retain more cash flow for paying down debt.

- It has dramatically cut its capital expenditures in order to retain more cash flow for paying down debt.

- It has sold off non-core assets in order to retain more cash flow for paying down debt.

It has made impressive progress thanks to this initiative and management now forecasts that by year-end the company will achieve the middle end of their long-term target leverage ratio.

While PAGP’s balance sheet is certainly in greatly improved condition and the company is at little risk of financial distress as a result, ENB’s significantly superior credit rating gives it the edge in this area. The company has a very well laddered debt maturity profile, with large percentages of its outstanding debt not maturing until the 2030s, 2040s, 2050s, 2060s, and even 2080s. With the vast majority of its debt locked in at attractive fixed interest rates and plenty of current liquidity, ENB is positioned to compound capital at a low cost for decades to come. As a result, ENB is not only at little risk of financial distress, but also in great shape to generate wide spreads on its cost of capital through growth projects.

Plains Vs. Enbridge – Business Model

PAGP is primarily a bet on Permian Oil midstream infrastructure, as it derives roughly four-fifths of its EBITDA from that business. While so much geographic and commodity concentration can be construed as a negative by risk-averse investors, the positive is that its maniacal focus on this business has enabled the company to build one of the most competitively positioned midstream networks in the Permian Basin. In fact, some estimate that every barrel of oil produced in the Permian Basin touches PAGP’s infrastructure at least once. The remainder of its EBITDA comes from some NGL midstream assets in Western Canada.

Meanwhile, ENB sports vastly superior scale and diversification. It boasts some of the finest and largest midstream networks in the world, including:

- the United States’ second longest natural gas transmission pipeline network

- the largest natural gas distribution business in North America

- its crude oil pipeline network is the longest in North America

- a rapidly growing portfolio of renewable energy production assets (primarily wind and solar)

Finally, both businesses boast fairly stable cash flows thanks to most of their contracts being linked to commodity price resistant, take-or-pay terms with inflation-linked fee escalators. ENB is particularly well positioned for weathering a weak energy market given that 98% of its contracts are linked to such conservative terms and 95% of its cash flow stems from contracts with investment grade counterparties.

Overall, we once again give the edge to ENB here given its incredible scale and diversification and the strength of its counterparties.

Plains Vs. Enbridge – Dividend Safety

PAGP’s dividend coverage ratio is exceptionally strong. For 2022, analyst consensus estimates put it at 2.6x and analysts expect its 2023 coverage ratio on its forecasted 2022 dividend payout to be 2.9x.

Meanwhile, ENB’s dividend coverage ratio is not quite as strong, but is still very conservative at 1.56x in 2022 and 1.55x in 2023.

While we give the edge to PAGP here given its convincingly superior coverage ratio in both 2022 and 2023, neither business is at even a remote risk of cutting its dividend at present and it is also worth noting that ENB has grown its dividend every year for 27 years whereas PAGP significantly cut its dividend just two years ago.

Plains Vs. Enbridge – Track Record

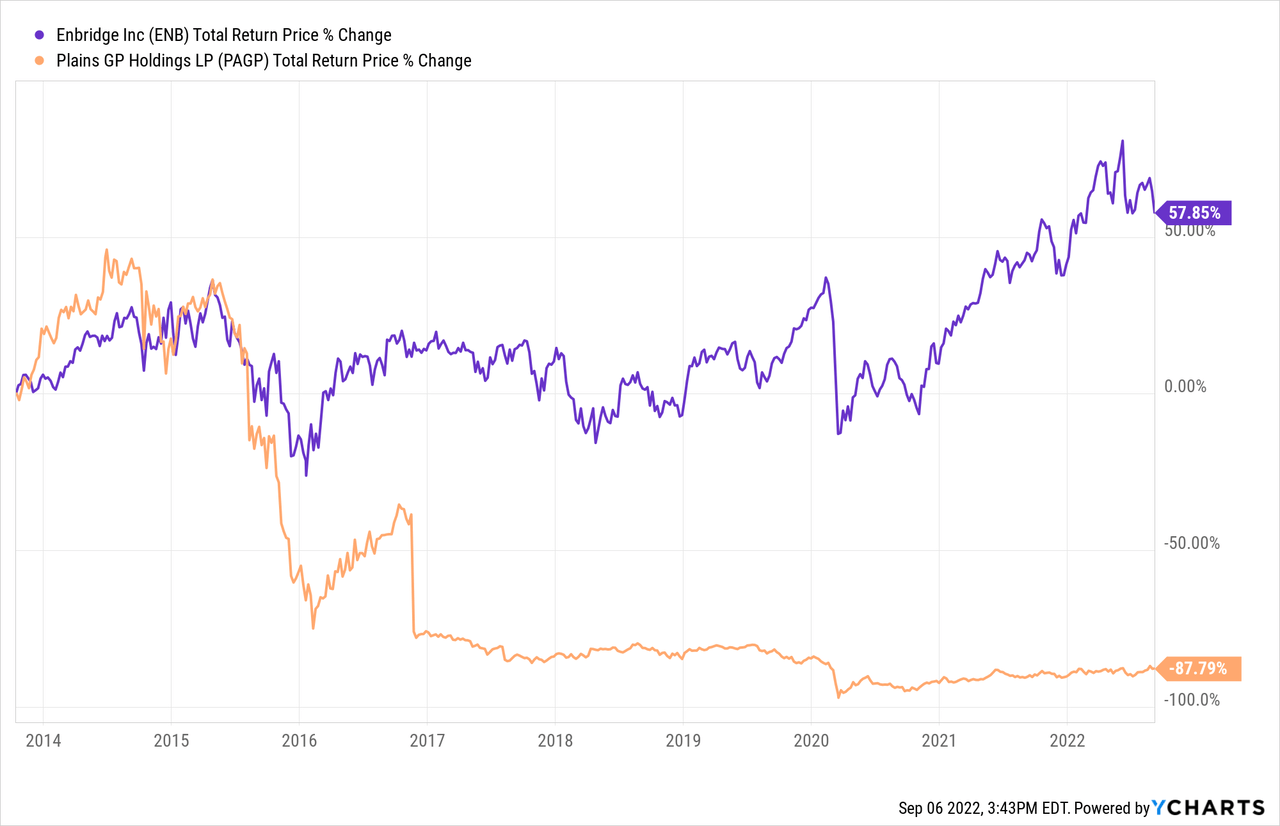

When it comes to track record, ENB total crushes PAGP with a very impressive track record compared to a very disappointing one for PAGP:

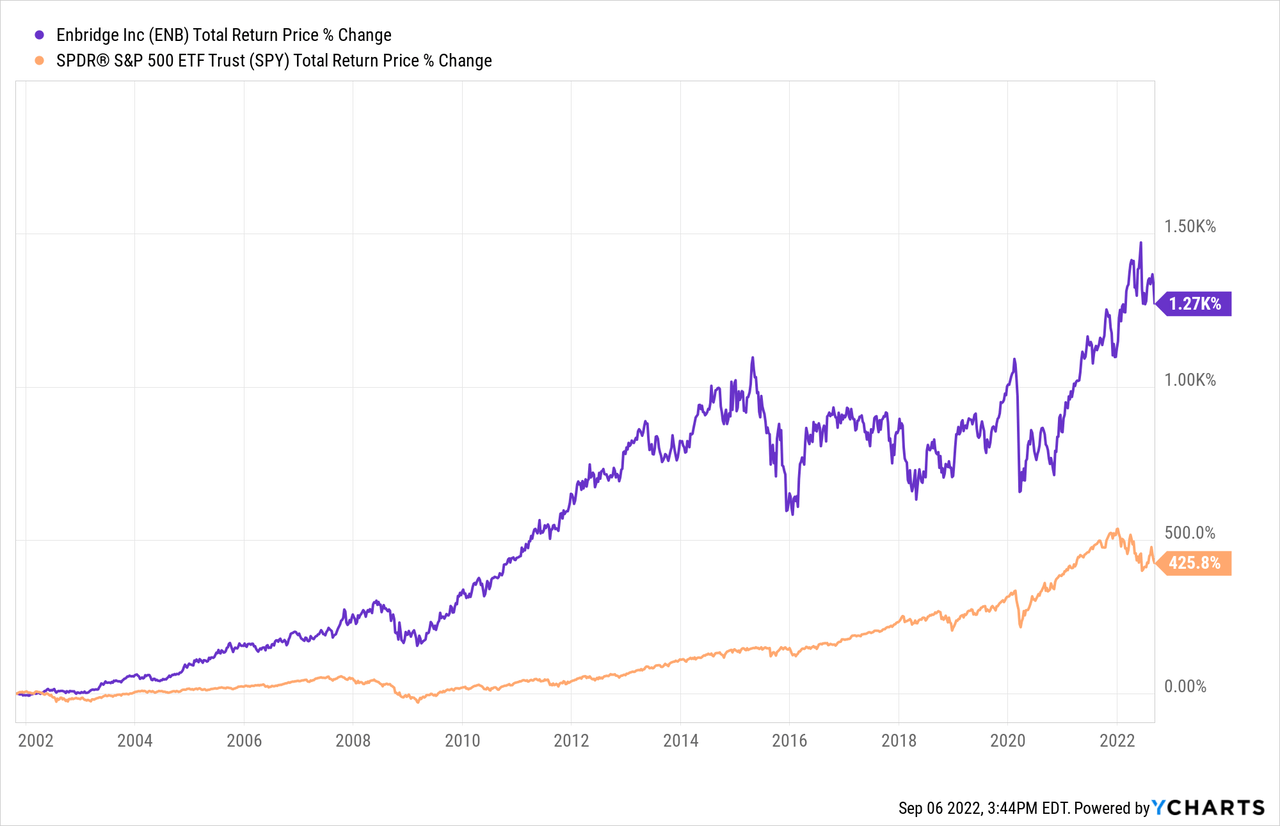

In fact, over the course of its full publicly traded existence, ENB has crushed the S&P 500 (SPY), reflecting its alpha-generating business model and superior management skill:

Plains Vs. Enbridge – Risks And Catalysts

ENB and PAGP both face very similar risks and catalysts given that they are in the same industry. Essentially, if energy – particularly oil – prices and demand were to remain suppressed over the course of several years, both businesses would begin to see meaningful and long-term declines to their cash flows given that their recontracting positioning would be weakened. On the other hand, if oil and energy prices and demand in general were to remain elevated for a prolonged period of time, they would both likely see cash flows meaningfully increase on a long-term basis due to an improved recontracting position.

PAGP’s risks and catalysts are more geographically concentrated than ENB’s however, given its focus on the Permian Basin. Furthermore, PAGP has shown a greater willingness and desire to sell off non-core assets, whereas ENB has positioned itself more as an acquirer and is also investing aggressively in renewable energy production.

As a result, while the Western Canadian NGL business is doing well for PAGP right now and is a nice diversifier for the company, it would not shock us if it eventually was sold as it is not part of their core Permian operations and could potentially fetch an attractive multiple if energy markets remain in a strong position moving forward. If PAGP were to then recycle that capital into accretive share repurchases, it could unlock meaningful value for shareholders.

Meanwhile, if renewable energy production continues to enjoy strong tailwinds and strong government incentives, ENB’s growth could outperform other midstream businesses. In addition, if valuations remain somewhat suppressed in the midstream sector, ENB could also benefit from its low cost of capital by consolidating smaller businesses and select assets via M&A.

Plains Vs. Enbridge – Valuation

When it comes to their relative valuations, PAGP looks clearly cheaper across each of the primary midstream valuation metrics. Its dividend yield is higher and its price to DCF is meaningfully cheaper, while its EV/EBITDA multiple is also significantly cheaper than ENB’s. As a result, we give a decisive win to PAGP here.

|

Valuation Metric |

PAGP |

ENB |

|

Dividend Yield |

7.3% |

6.6% |

|

Dividend Yield (5-Yr Avg) |

7.3% |

6.7% |

|

EV/EBITDA |

9.8x |

12.5x |

|

EV/EBITDA (5-Yr Avg) |

9.9x |

12.7x |

|

P/DCF (2022) |

5.3x |

7.6x |

|

P/DCF (2023) |

4.8x |

7.4x |

Investor Takeaway

This comparison really comes down to three major items for investors to consider:

1. ENB declares its dividends in Canadian Dollars and there are also Canadian Tax Withholdings to keep in mind for investors. PAGP is a U.S. based company that declares its dividends in U.S. Dollars. Both issue 1099 tax forms rather than the K-1s that many other midstream businesses issue. Note that PAGP also has an economic equivalent security (PAA) that trades at a slight discount to PAGP, but issues a K-1.

2. ENB is a safer, better diversified business that is investing in long-term growth projects both in its core midstream business as well as in its burgeoning renewable energy business. In contrast, PAGP has strong short-term growth potential as Permian Basin production ramps back up and the company rapidly grows its dividend in its quest to restore it to a level similar to where it was prior to its steep cut in 2020. Longer term, however, PAGP’s growth potential is much more muted, and it will be years before PAGP is able to strengthen its balance sheet enough to warrant a BBB+ credit rating like ENB currently commands.

3. PAGP is considerably cheaper than ENB and generates considerably more free cash flow and distributable cash flow per share than ENB does. As a result, it can pay out a significantly higher dividend and/or buy back more shares than ENB does. While ENB does have brighter long-term growth prospects, PAGP could potentially more than make up for this with its superior current cash flow.

Overall, if we could only own one midstream business, we would greatly prefer ENB to PAGP. However, given that we own a diversified portfolio of midstream businesses, we actually prefer PAGP over ENB given that it trades at a steep discount and is focused on the Permian Basin, giving it a strong competitive advantage in that region. We ultimately think that PAGP is better positioned to deliver alpha for investors over the next five years than ENB is, and rate PAA and PAGP as strong buys right now, whereas we rate ENB a Buy.

Be the first to comment