pixdeluxe/E+ via Getty Images

Love it or hate it, we live in a world dominated by technology and data. Given how much data exists today, it should be no surprise that there are a large number of companies dedicated to providing various services related to it. One such player is a company called Jack Henry & Associates (NASDAQ:JKHY). Though the name may sound like some law firm or a consulting enterprise, the company actually focuses on providing information processing solutions for its customers. Examples include the processing of transactions, the automation of business processes, and the management of information for thousands of financial institutions and other corporate entities that the company counts as its clients. Although current economic conditions may not seem all that great, the company continues to post promising revenue, profit figures, and cash flow metrics. Having said that, shares are far from cheap and, I would argue, are close to being overvalued. Because of this, I have decided to rate the enterprise a ‘hold’ at this time, reflecting my belief that shares should generate returns that more or less match the broader market moving forward.

A promising trend

My first time writing about Jack Henry & Associates was back in early June of this year. In that article, I talked about how impressed I was by the job of management in growing the enterprise over the prior few years. I felt as though that growth looked set to continue moving forward, for both the company’s top and bottom lines. Ultimately, I felt as though the company was a high-quality player in its space. But with this quality came a rather lofty price that, at least for me, was a bridge too far to consider. Because of this, I ended up rating the enterprise a ‘hold’. Since then, the company has performed more or less along the lines of what I would have anticipated. While the S&P 500 is down 7.1%, shares of the business have generated a loss for investors of only 5%.

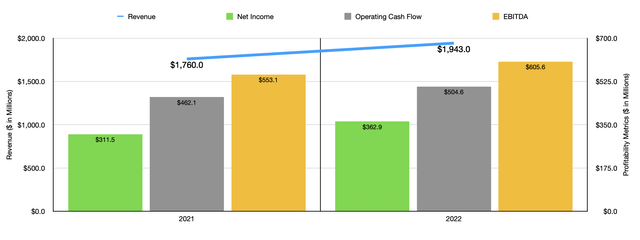

What’s really interesting is that, despite broader economic conditions, the company continues to post robust financial results. Consider revenue for starters. During the 2022 fiscal year in its entirety, the company generated revenue of $1.94 billion. That compares to the $1.76 billion generated in 2021. According to management, this increase was driven largely by growth in private and public cloud, card processing, remittance, implementation, and transaction and digital revenue activities. Overall services and support revenue for the company expanded by roughly 10% from $1.05 billion to $1.16 billion. The growth under the processing revenue category was even greater at 11%, with sales climbing from $710 million to $786.5 million. Profitability for the company also improved. Net income expanded from $311.5 million in 2021 to $362.9 million in 2022. Operating cash flow also increased, climbing from $462.1 million to $504.6 million, while EBITDA expanded from $553.1 million to $605.6 million.

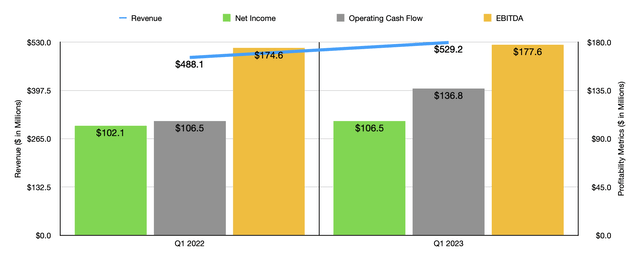

But the company’s growth did not stop at the end of its 2022 fiscal year. In the first quarter of its 2023 fiscal year, the company generated sales of $529.2 million. That represents an increase of 8.4% over the $488.1 million generated the same time one year earlier. The greatest growth for the company came from its processing operations, with sales jumping by 10% from $190.6 million to $209.1 million. This increase, management said, was driven largely by higher card processing and digital revenue charges. Naturally, profits followed sales higher. Net income of $106.5 million beat out the $102.1 million reported one year earlier. Operating cash flow expanded from $106.5 million to $136.8 million, while EBITDA inched up from $174.6 million to $177.6 million.

So far, things are looking quite positive for the company and its shareholders. And interestingly enough, despite broader economic concerns, management does not seem to have any issue with what the near-term future looks like. At present, they are forecasting revenue for 2023 of between $2.09 billion and $2.10 billion. At the midpoint, that would translate to a 7.8% increase over what the company generated in 2022. Earnings per share, meanwhile, are forecasted to be between $4.90 and $4.94. Assuming the company’s share count remains unchanged, that would result in profits falling slightly to $359.8 million. But at the end of the day, the disparity between this and the $362.9 million the company generated in 2022 is virtually insignificant.

Unfortunately, management did not provide any guidance when it came to other profitability metrics. If we were to annualize results experienced so far in 2023, we would get modest increases for both operating cash flow and EBITDA. But as a conservative investor, I would prefer to be more cautious in my evaluation of the firm. So instead, I decided to assume that these metrics would decrease at the same rate that net profits are forecasted to decrease by. Following this approach, I calculated operating cash flow for the company of $500.3 million and EBITDA of $600.4 million.

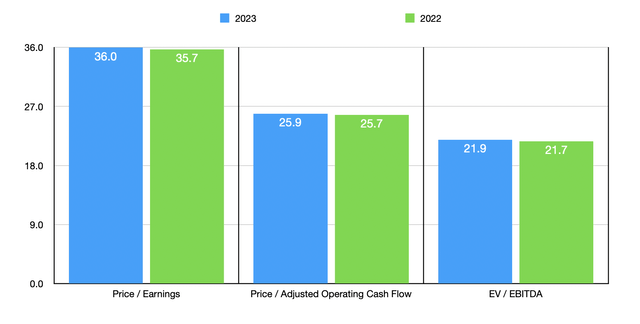

Based on these figures, the company should be trading at a forward price-to-earnings multiple of 36. The price to operating cash flow multiple is still high but comes in a bit lower at 25.9. And the EV to EBITDA multiple of the company should be around 21.9. As you can see in the chart above, this pricing does make the company look a bit more expensive than if we were to use the 2022 data. As part of my analysis, I also decided to compare the enterprise to five similar firms. As you can see in the table below, four of the five companies in any given valuation category are cheaper than our prospect. This makes it expensive relative to similar firms.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Jack Henry & Associates | 36.0 | 25.9 | 21.9 |

| PayPal Holdings (PYPL) | 35.2 | 12.6 | 17.3 |

| SS&C Technologies Holdings (SSNC) | 19.4 | 10.8 | 10.9 |

| Broadridge Financial Solutions (BR) | 30.3 | 42.3 | 18.4 |

| DLocal (DLO) | 38.7 | 18.2 | 25.5 |

| Concentrix Corporation (CNXC) | 14.4 | 11.8 | 9.2 |

Takeaway

My ideal scenario when it comes to investing is to buy a high-quality company at an attractive price. Though certainly uncommon, these kinds of opportunities do come about a few times a year. In my opinion, Jack Henry & Associates definitely fits the bill when it comes to high-quality businesses. The space in which it operates is also promising. Having said that, shares do not look cheap enough at this time for me to seriously consider. Instead, I feel as though there are better opportunities that can be had. And because of that, I think that my ‘hold’ rating is still appropriate at this time, even though shares are tiptoeing near the line of being overvalued.

Be the first to comment