porcorex

It pays to buy into beaten down sectors that sport high dividend yields. There are plenty of high yield opportunities at present, with office REITs such as City Office REIT (CIO) and SL Green (SLG), as I recently highlighted here and here. Beyond offices, a number of healthcare REITs still remain undervalued, providing investors with high yield opportunities.

This brings me to Sabra Health Care REIT (NASDAQ:SBRA), which, at the current price of $12.53, trades well below its 52-week high of $16.60 and towards its low $11.44, pushing its dividend yield to 9.6%. This article highlights why SBRA current presents an attractive value proposition for income investors, so let’s get started.

Why SBRA?

Sabra Health Care is a self-managed REIT that focuses on owning and leasing SNF (skilled nursing facilities), senior housing communities, and specialty hospitals across the U.S. At present, Sabra’s investment portfolio includes 442 properties that are well diversified across 72 different relationships, with a long-weighted average remaining lease term of 8 years.

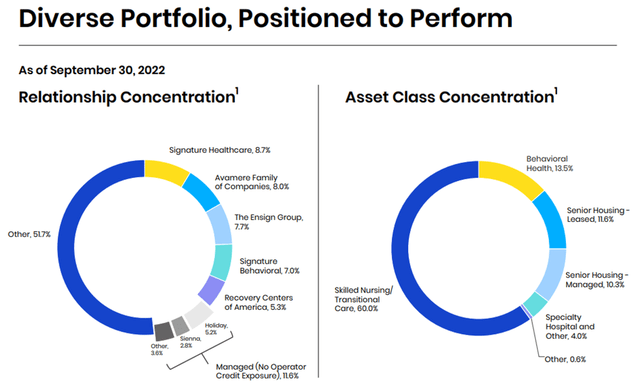

SBRA’s diversified mix of skilled nursing, senior housing, and other healthcare properties gives it diversification across both public and private pay models. As shown below, 60% of SBRA’s annualized cash NOI stems from skilled nursing, with much of the rest coming from senior housing (leased and managed), behavioral health, and specialty hospitals.

SBRA Portfolio Mix (Investor Presentation)

It’s not new news that SBRA and the rest of the healthcare REIT segment has seen challenges over the past 2 years, first with COVID lockdowns and subsequently with wage inflation and labor shortages as the labor market roared back. This resulted in certain tenants coming under pressure to cover rental payments.

However, SBRA is led by an experienced management team, including long-time CEO Rick Matros, and has been working through addressing tenant coverage issues. This includes the recent announcement of the 24 property portfolio transition from North American Health Care to two seasoned operators, Ensign and Avamere for a combined initial annual rent of $34.5 million.

As a result, both Ensign and Avamere will become two of SBRA’s largest relationships, with each representing 8% of Sabra’s annualized cash NOI. I view this as being a good move for the long-term viability of the properties, especially considering that the Ensign leased properties come with a corporate guarantee and Ensign is a large operator with a $5 billion market cap.

Notably, this transaction will strengthen portfolio EBITDARM to rent coverage to 1.83x (1.6x excluding provider relief funds). Moreover, SBRA maintains plenty of balance sheet flexibility, with a net debt to EBITDA ratio of 5.5x, and management expects to reduce leverage to 5.0x by the end of the year post disposition activities. Importantly for dividend investors, the $0.30 quarterly dividend is covered by $0.34 in AFFO per share generated during the third quarter.

Looking forward, I see potential for labor headwinds to ease, as inflation has shown signs of easing in recent months. Moreover, management is seeing normalization of labor, aided by encouraging occupancy gains, as noted during the recent conference call:

Moving on to the operating environment, labor continues to improve. It’s still tough, but occupancy is now improving as well as labor’s improved. I would note and remind everybody that our triple net occupancy is a quarter in arrears. And while occupancy was flat in the second quarter, as noted in the release, on the skill side, June through October, our occupancy increased 180 basis points, which we view directly as a function of labor getting better. And similarly for our AL portfolio that was up 190 basis points during that same timeframe, so June through October. Our senior housing lease portfolio also continues to improve and we had a nice bump in rent coverage there.

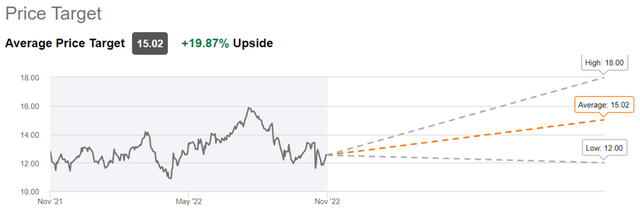

Lastly, I find SBRA to be rather cheap at the current price of $12.53 with a forward P/FFO of 8.4, sitting well below its normal P/FFO of 11.2. Analysts have a consensus Buy rating on SBRA with an average price target of $15, translating to a potential 29% total upside including dividends.

SBRA Price Target (Seeking Alpha)

Investor Takeaway

In summary, I view Sabra Health Care REIT as an attractive healthcare REIT with a well-diversified portfolio, experienced management team, and strong balance sheet flexibility. With the transition to Ensign and Avamere in place, SBRA should be able to weather the remaining labor headwinds, especially considering the recent occupancy gains in the portfolio. Finally, I find SBRA to be attractively valued and a good dividend income opportunity. Investors with an appetite for higher-yielding stocks should consider SBRA at current levels.

Be the first to comment