Dzmitry Dzemidovich

Introduction

In March 2022, I wrote a bearish article on SA about oilfield services provider Nine Energy Service (NYSE:NINE) in which I said that many retail investors were piling into nano and micro-cap oil stocks due to the Russia-Ukraine conflict and that the company looked overvalued. In my view, retail investors would eventually realize that the U.S. fracking sector needed to pick up for Nine Energy Service to benefit from high oil prices.

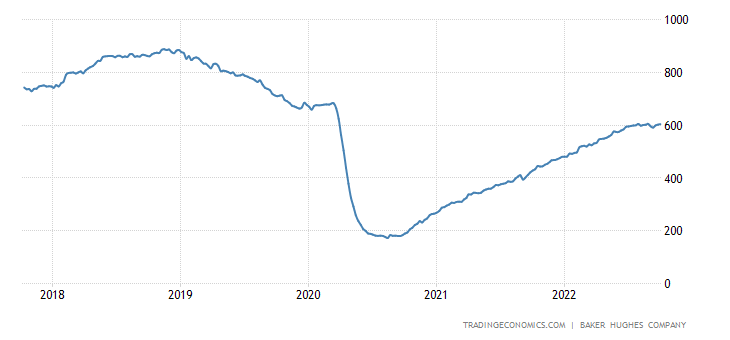

Well, the latest data from Baker Hughes shows that the crude oil rig count in the USA has surpassed 600 and I think this will allow Nine Energy to show a positive net income in its Q3 2022 financial report. The company’s restructuring process is progressing well, and it booked a net loss of just $1 million in Q2. Considering that the market valuation has declined to $116.5 million as of the time of writing, I’m now bullish on Nine Energy Service’s stock. Let’s review.

Overview of the recent developments

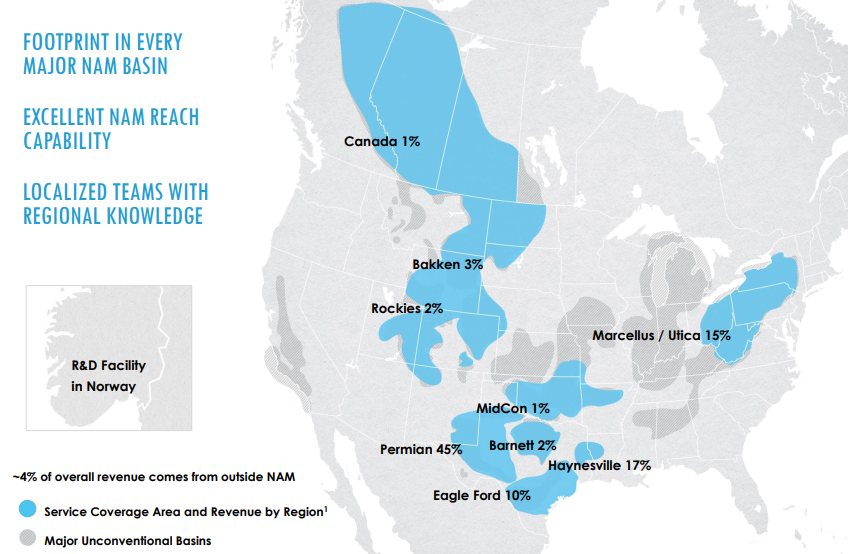

In case you haven’t read my first article about Nine Energy Service, here’s a short description of its business. The company is involved in the provision of completion services for unconventional wells and its focus is on the cementing and completion tools segments. The vast majority of its revenues come from the USA and its customers include Pioneer Natural Resources (NYSE: PXD), ConocoPhillips (NYSE: COP), and Chesapeake Energy (NASDAQ: CHK) among others.

Nine Energy Service

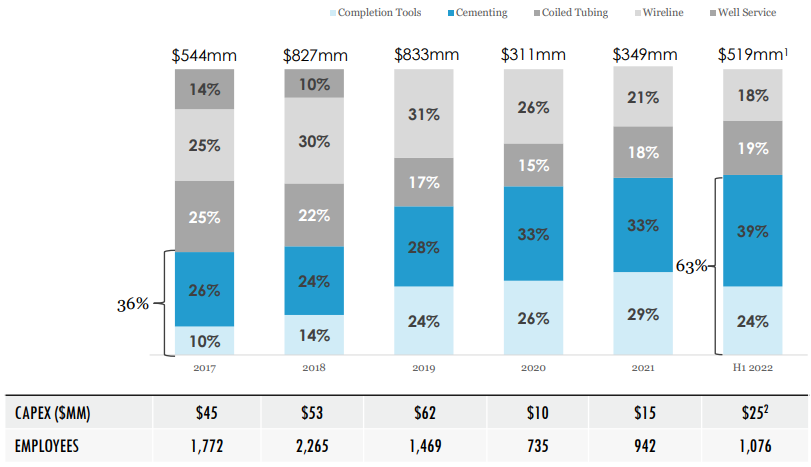

Nine Energy Service has an asset-light business model, and it has been moving away from coiled tubing, wireline, and well service solutions over the past few years with the objective of slashing CAPEX and labor costs.

Nine Energy Service

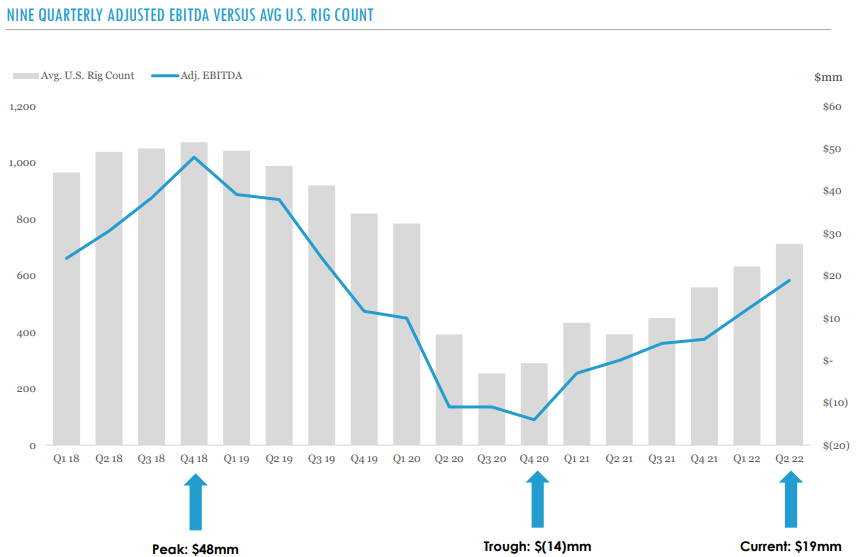

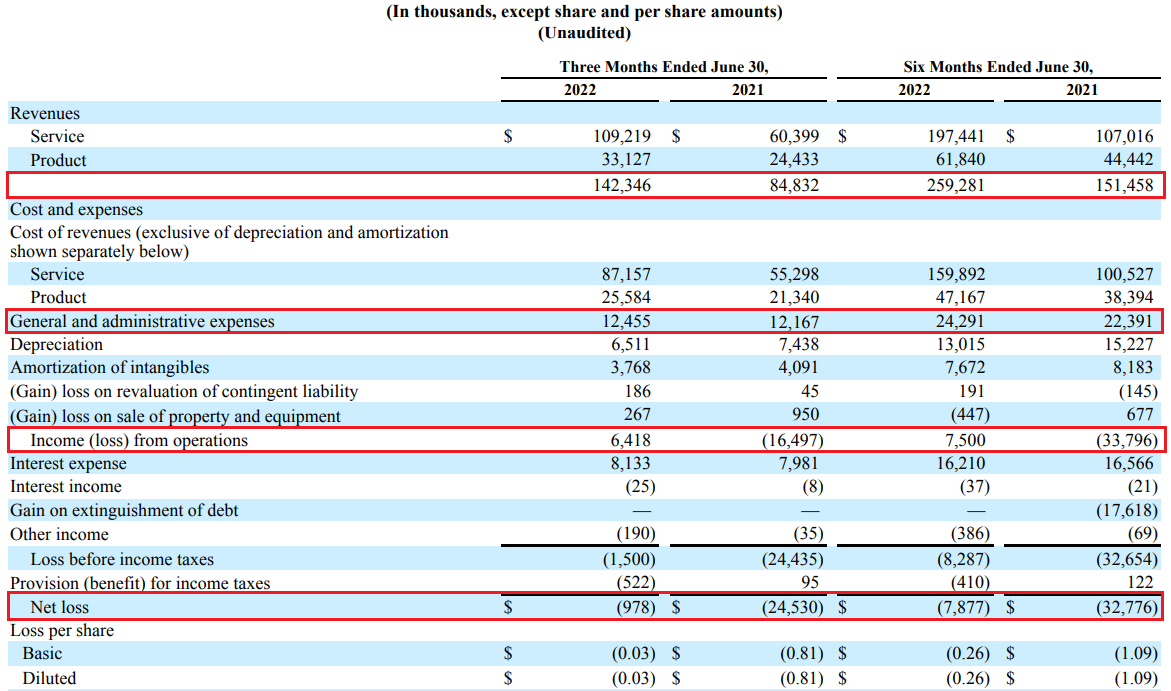

The financial performance of Nine Energy Service has historically been highly correlated with crude oil rig figures in the USA. Thanks to the restructuring efforts over the past years, the company’s Q2 2022 adjusted EBITDA has surpassed the levels from Q4 2019 despite the rig count being lower back then. However, the company booked a net loss of $1 million in Q2 2022 as interest expenses came in at $8.1 million.

Nine Energy Service

In addition, Nine Energy Service complained during its Q2 2022 earnings call about labor and supply bottlenecks. However, the company revealed that it’s continuing to implement net price increases, specifically in its cementing and coiled tubing service lines. Also, sales of its Stinger dissolvable plugs soared by 33% quarter on quarter which helped the completion tool division boost its revenues by 15% quarter on quarter.

With the war in Ukraine continuing longer than many experts expected, global oil prices have remained high for months now and this has driven the US crude oil rig count to 604 as of September 30.

Trading Economics

Nine Energy Service has been keeping general and administrative expenses at about $12 million for the past few quarters and I think the company is highly likely to post positive net income figures for Q3 2022 thanks to the price increases and the growing demand for its services as a result of higher drill count numbers. In my view, the net income for Q3 could be in the region of maybe $10 million.

Nine Energy Service

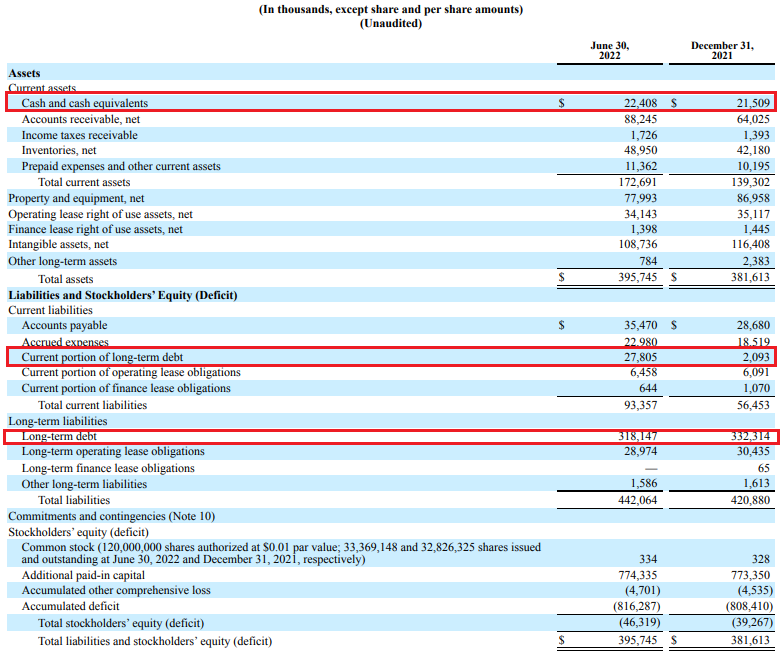

Turning our attention to the balance sheet, I think the situation looks concerning as net debt stood at $325.7 million as of the end of June. Free cash flow continues to be negative as higher revenues led to a significant increase in receivables in Q2. Nine Energy Service has $320.3 million 8.750% senior notes due October 2023 and it’s crucial to refinance this debt. In my view, there should be no liquidity issues in the near future. The company had $22.4 million in cash as of June and there was $52.1 million available under its 2018 ABL credit facility. CAPEX in H1 2022 was $6.1 million and the guidance for the full year is $20 million to $30 million.

Nine Energy Service

Nine Energy Service has an enterprise value of $436.8 million as of the time of writing, which seems low to me as this means the company is trading at an EV/EBITDA multiple of just below 5.8x based on annualized Q2 2022 results. With many analysts expecting oil prices to remain high for years to come as OPEC+ just announced the largest cut to production since the start of the COVID-19 pandemic, I think that Nine Energy Service should be trading at over 8x EV/EBITDA. Using annualized Q2 2022 figures, this translates into about $8.60 per share.

Turning our attention to the risks for the bull case, I think that there are two major ones. First, global oil prices could decline significantly if OPEC decides to increase production over the coming months or if the war in Ukraine comes to a conclusion in the near future and sanctions on Russia get lifted. Second, it’s possible that Nine Energy Service doesn’t manage to refinance its 2023 senior notes, and this could lead to a significant stock dilution if the company goes for a capital increase to raise the funds. This is more of a long-term risk though.

Investor takeaway

The US oil rig count is rising thanks to a prolonged period of high oil prices, and this has helped turn around the fortunes of Nine Energy Service. The company has significantly cut its CAPEX and headcount over the past four years and 2022 could be its best year since 2018 if oil prices remain high.

However, the refinancing of the 2023 senior notes remains a concern, and oil prices are likely to decline significantly if OPEC decides to increase production or sanctions on Russia are lifted. In view of this, I rate Nine Energy Service as a speculative buy.

Be the first to comment